Lately I’ve been reflecting on loser stocks and have been wondering if there’s any reason to keep hoping that they might turnaround and go for a decent rise higher.

Of course, I’ve surveyed what the analysts think, as it’s their job to assess the outlook for companies, but I’ve tried to build into my analysis sensible reasons why a stock is out of favour and whether it’s likely that circumstances will change for it.

- Tyro: wind of change

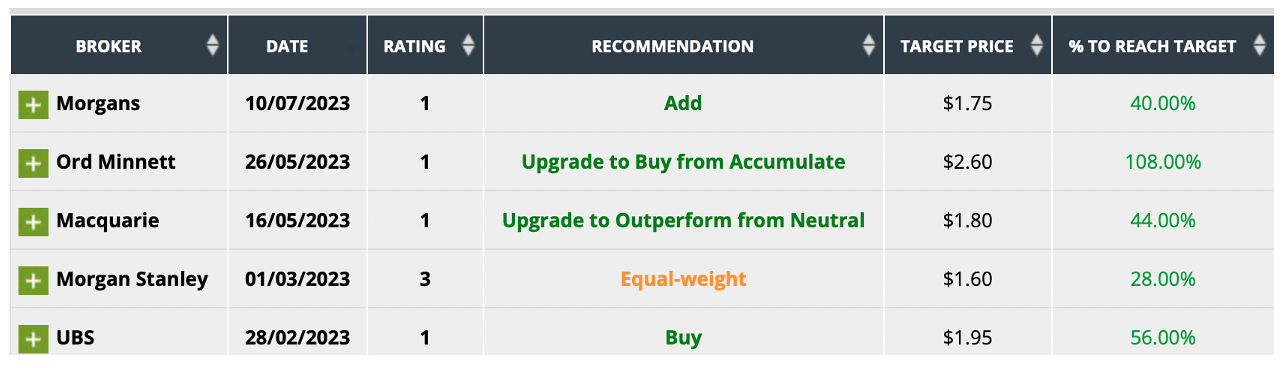

An easy one to assess is Tyro (TYR). The consensus view says there’s 55% upside, but, even better, five out of five analysts on FNArena really like the company, as the table below shows.

What’s best to like about this company is that there has been a takeover offer of $1.60, which the board rejected, and the current share price is $1.25, while in late July it was $1.40.

Clearly, the Ord Minnett team is on board with the company. I suspect they’ve always thought that not only has Tyro suffered the negative effects of the sell offs of tech and payments companies as interest rates rose, but also they operate in the retail/discretionary consumption space, which hasn’t been helped by 12 rate rises.

It’s not a big stretch to believe that Tyro will benefit from eventual rate cuts in 2024.

This has been a loser stock for me but I’m making it a keeper and I’ve reduced my overall holding price by buying more at lower prices.

- Zip: how deep is their love?

One stock that has been in the big loser category for me has been Zip Money. I have a small holding here, but it too has had the impact of rate rises and the increased competition from other Buy Now Pay Later (BNPL) businesses coming in to eat their lunch. Afterpay is in the same boat. Also, there are new government regulations that won’t help profits.

Interest rate cuts and a possible takeover might be a plus for the company that recently appointed a new CEO Cynthia Scott, who formerly ran Zip Australia.

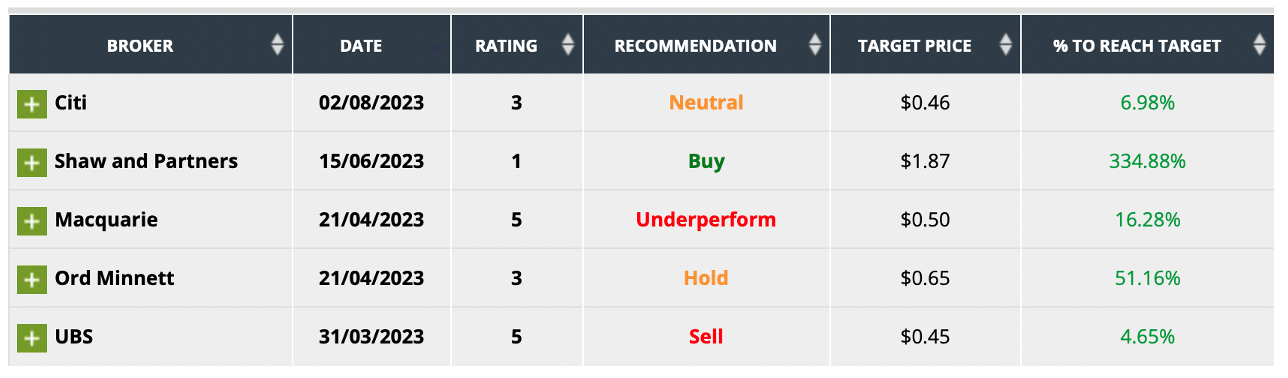

On the plus side, five out five analysts like the company as the table below shows.

The team at Shaw and Partners looks ‘zipped’ out of their mind seeing a 334.88% upside. Given its low share price now, it must be tempting to take a punt on this stock if you have zero exposure to Zip. That said, this is a gutsy/speculative play.

- A2 Milk: stayin’ alive

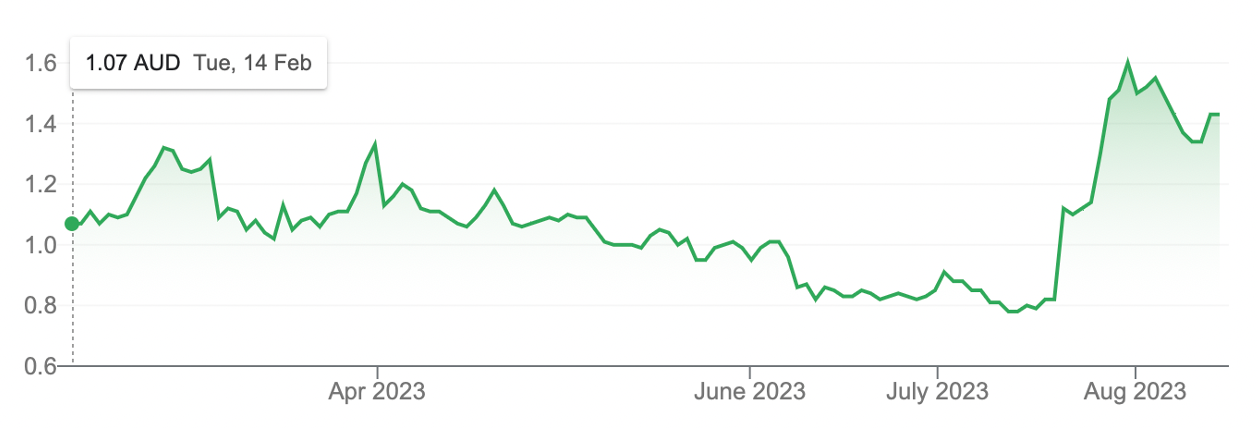

Another loser with a potential positive outlook is A2Milk (A2M), which could be helped by a recent decision of Beijing to permit group travel back into Australia. This used to account for 30% of the total leisure Chinese tourists coming to Oz and could reignite these travellers’ old ways of loading up their suitcases with A2M’s products for resale when they arrive back home.

The average expected share price rise works out to be 17%. Five out of six analysts still like the company. The most enthusiastic is Ord Minnett where the future share price guess/forecast is 46% higher, while Morgans think a 22% better price is likely. Bell Potter says a 15.6% higher price is on the cards.

I’ll stick with A2M.

- EML: for whom the bell tolls

We now get to the losers, which have few reasons for investors to keep the faith with, or for speculators to risk much of their hard-earned money on these stocks.

EML has been in more trouble that Donald Trump! The believers who once were there in numbers have deserted the company. UBS tips a 13% fall, while Ord Minnett sees a 2.5% rise. None of the experts can see a turnaround for the company any time soon.

EML is a long shot punt!

- Nuix: alone

Another perennial disappointment is Nuix. This company has lost so many friends that only one brokerage cares to cover the company and that’s Morgan Stanley, which hits the business with a 13.6% downgrade in stock price.

The only positive I see is a recent bounce-back in its share price, which could say inside traders know more than us ahead of reporting.

- Appen (APX): Aussie tech disaster of 2023!

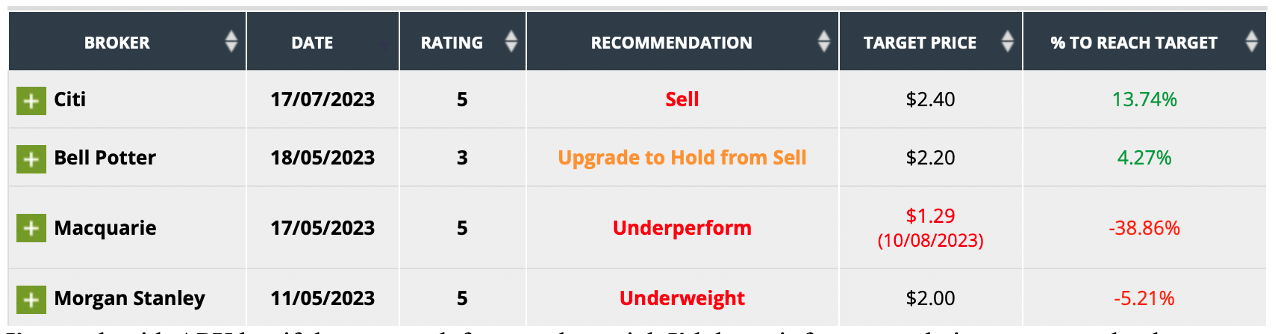

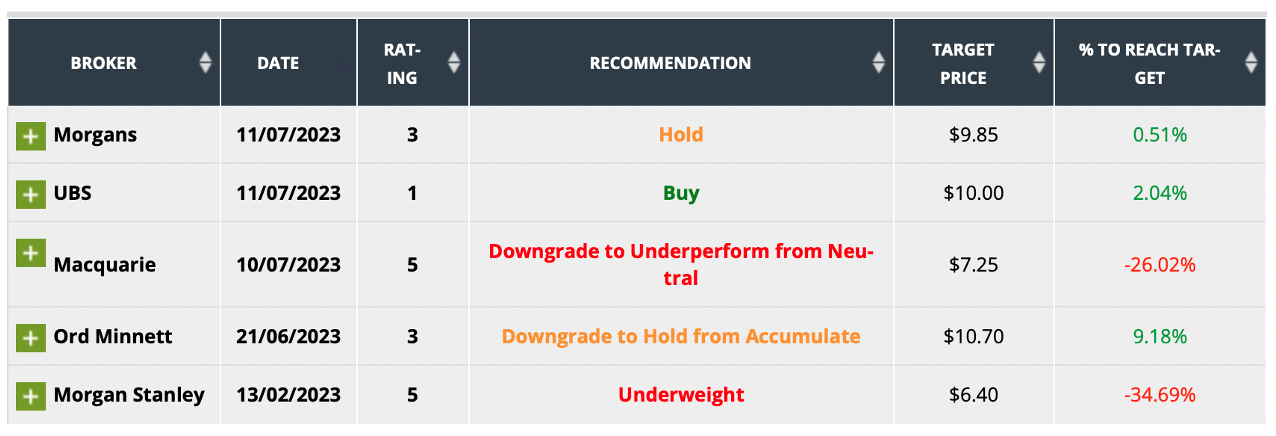

Those holding out for a tech company turnaround for Appen (APX) will be waiting a long time. The table below shows the challenges ahead for the business, with the consensus price guess being a negative 6.5%.

I’m stuck with APX but if the amount left was substantial, I’d dump it for a speculative company that has more potential upside.

- Magellan Financial Group (MFG): tragedy

One of the great losers of the past 12 months has been Magellan Financial Group (MFG). Despite some of its funds doing well, the exodus of advisers and the related fall in the funds under management has really hurt this company’s bottom line, its brand and its share price. The consensus says to expect a 10% fall in its share price and the table below says it all!

If MFG stages a comeback, it will be on par with what Lazarus once pulled off coming back from the dead!

I do believe MFG’s share price will improve but it will take a lot of time.

- Mesoblast: jive talkin’

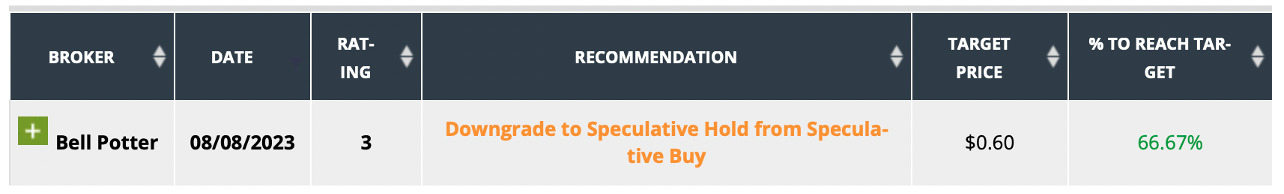

The final disappointing company is Mesoblast, which has one analyst watching this pest of a company. Bell Potter says MSB is a “speculative hold from speculative buy” after another obstacle from the US drug regulator.

Mark Twain once defined a mine as “…a hole in the ground and its owner is a liar.” My experience with. Biotech companies leads me to say a biotech company is a good idea owned by well-meaning, unreliable optimist. Buy MSB if you love risk plays!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances