“Of the big 4 banks, CBA is the highest quality business. It may seem like the most expensive, but investors in the long run have been rewarded for holding CBA over the other three banks,” Michael said.

“The other three major banks are about to go ex-dividend, and it can be tempting to buy these for the dividend.

“However, CBA is looking the strongest here on the chart and is likely to provide a higher return beyond the short term.

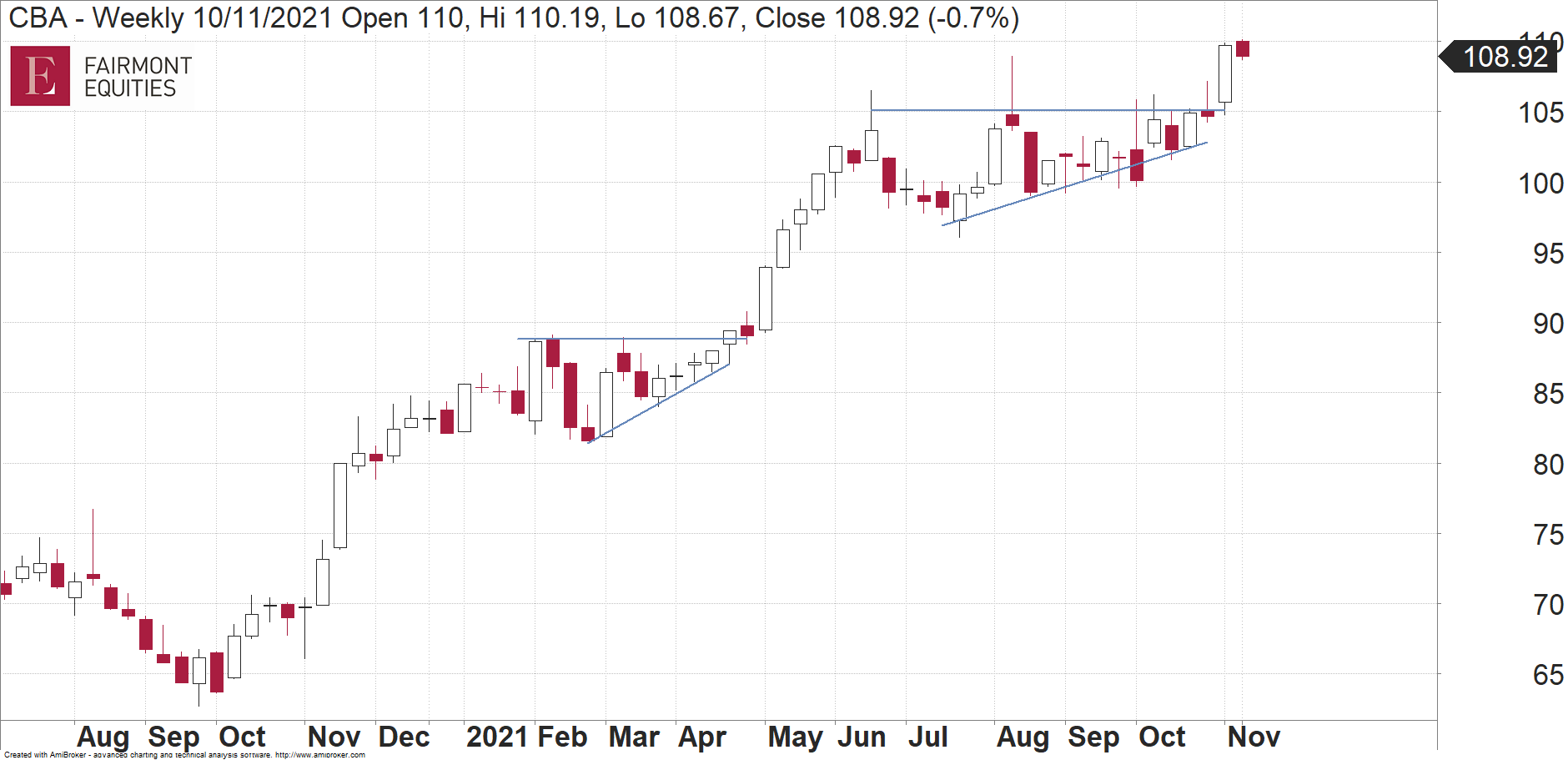

“In April during one of my videos with Peter Switzer, I identified an ascending triangle formation and the breakout from that led to a strong rally.

“An ascending triangle is essentially a situation where a share price takes a breather from a prior uptrend.

“Once again, I can see the formation of an ascending triangle, although it is much larger this time, which makes it more bullish.

“The last few days has seen a breakout occur and once again we are expecting a strong rally from here in CBA.

“Current levels, or any weakness back near $108, is a buying opportunity,” Michael said.

Commonwealth Bank (CBA)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.