The mining company OZ Minerals (OZL), based in Adelaide, was formed after the merger [1] of Oxiana Limited [2] and Zinifex [3] in 2008.

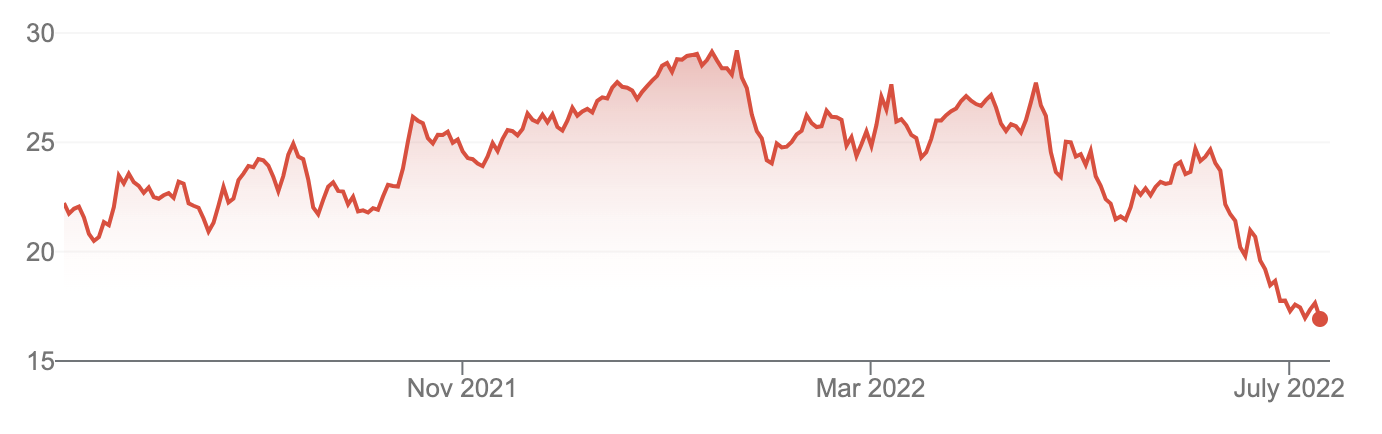

On the negative front, Raymond says there are three problems. “Over the past three years, OZL is pretty much trading in tandem with the copper price, which is under a lot of selling pressure given its proxy for global growth.

“Another problem with OZL is its cost inflation and operational issues at Carrapateena. The market is likely to need six months of evidence before backing this name again.

“Lastly, if OZL pushes ahead for its growth project, this will require fresh capital and limit dividend payout,” Raymond added.

“On a positive note,” Raymond said, “a long-term buying opportunity may emerge as history shows investors made good money every time they bought OZL at a 20% discount to consensus NPV.

“Short-term trading is likely to be difficult for OZL, however, investors should do well on a 2-3 year investment horizon,” Raymond concluded.

Oz Mineral Limited (OZL)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.