In Paul Rickard’s article above he takes a serious look at Macquarie Bank, its recent performance and its future. Raymond Chan is also a fan of Macquarie for the following reasons.

“Macquarie Bank’s (MQG) financial year 2023 net profit after tax (NPAT) of $5.18 billion was +10% on the participating convertible preferred share (pcp) and 2% above company compiled consensus ($5.08 billion),” Raymond said.

The second half of 2023 dividend (A$4.50 per share, 40% franked) was 18% above consensus ($3.82 per share).

“In our view, it could be argued this was a lower quality beat by MQG, but there is no doubt the diversity of its franchise seems to help Macquarie generally find a way to outperform.

“We lower our MQG financial year 2024/financial year 2025 earnings per share (EPS) by -9%-10% based on more conservative assumptions in Commodities and Global Markets (CGM) and Macquarie Asset Management (MAM).

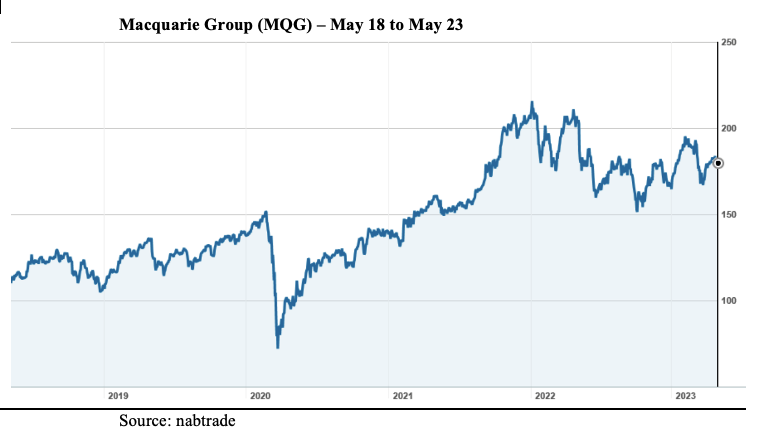

“Our price target (PT) falls to $202 (previously $215).

“We maintain our ADD recommendation, with more than 10% upside to our price target,” Raymond said.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.