“In early November in this Report, I wrote about there being a lot of negativity around Chinese economic growth and iron ore prices,” Michael said.

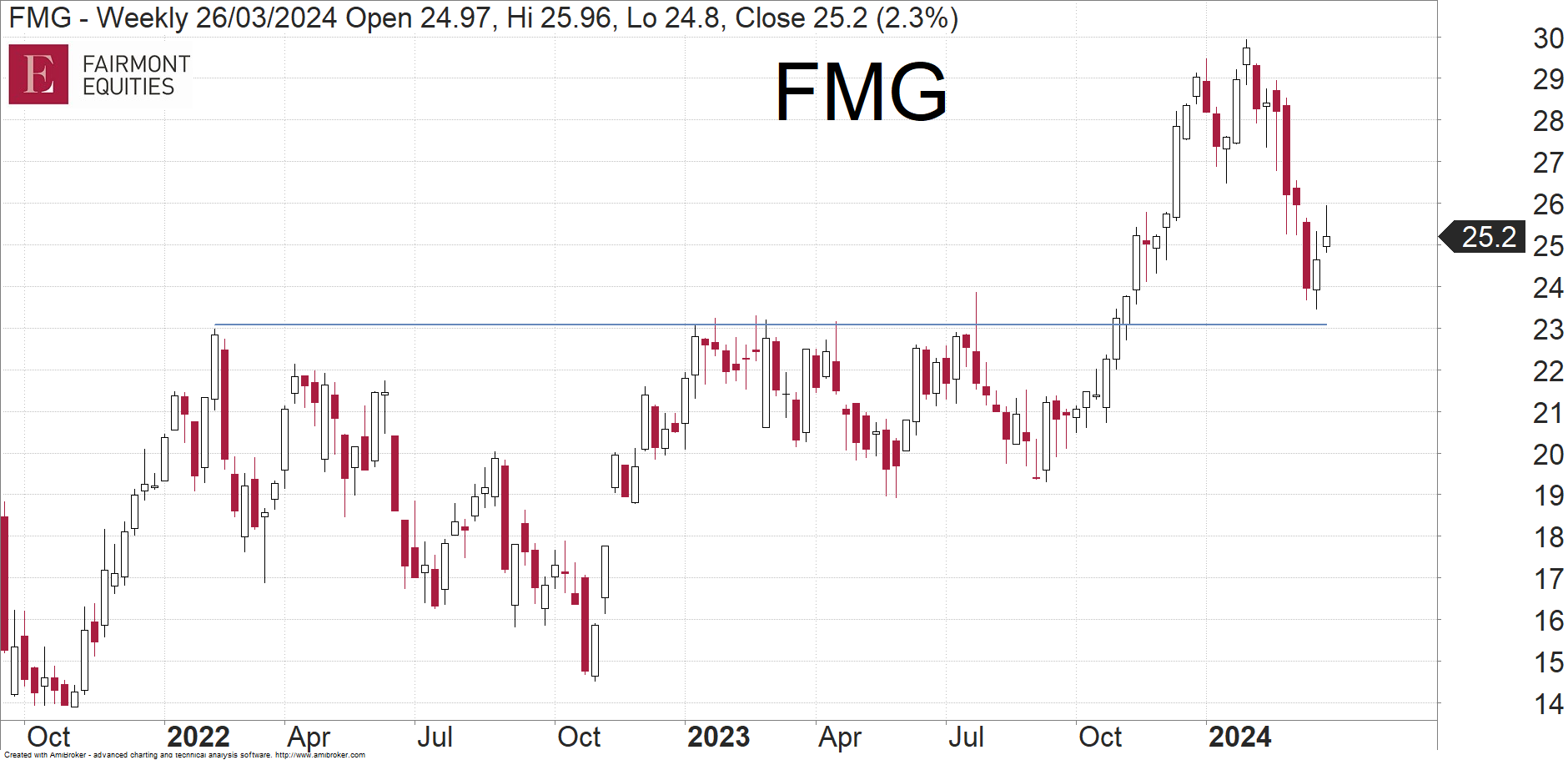

“Although many rated it as a sell, I was looking for FMG to break through $23 for a run up towards $30.

“After doing that at the end of 2023, iron ore prices have spent most of 2024 sliding lower. “However, once again, we have seen a lot of negativity around iron ore prices.

“However, iron ore prices should recover in line with improvement in global growth and I am now seeing signs of a reversal.

“The recent decline has seen FMG come back to retest the November breakout zone near $23.

“The last few days has seen it bounce strongly, triggering buy signals on the daily MACD and RSI (not shown).

“Current levels are a buying opportunity, and we expect FMG to rally back up towards $29 before consolidating again,” Michael said.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.