“Financial year 2023 constant currency (cc) guidance is now targeting the top end (NPATA US$2.7-2.8bn, +13-18%), but increased foreign exchange (FX) headwinds look to shave US$250 million off statutory profit (US$2,550 million),” Raymond said.

“Financial year 2024 guidance was provided (NPATA +13-18%) below market expectations (consensus +28%, but in line with Morgans +16%), as Behring margins are expected to improve only “modestly” in the near term and return to pre-COVID levels over the medium term.

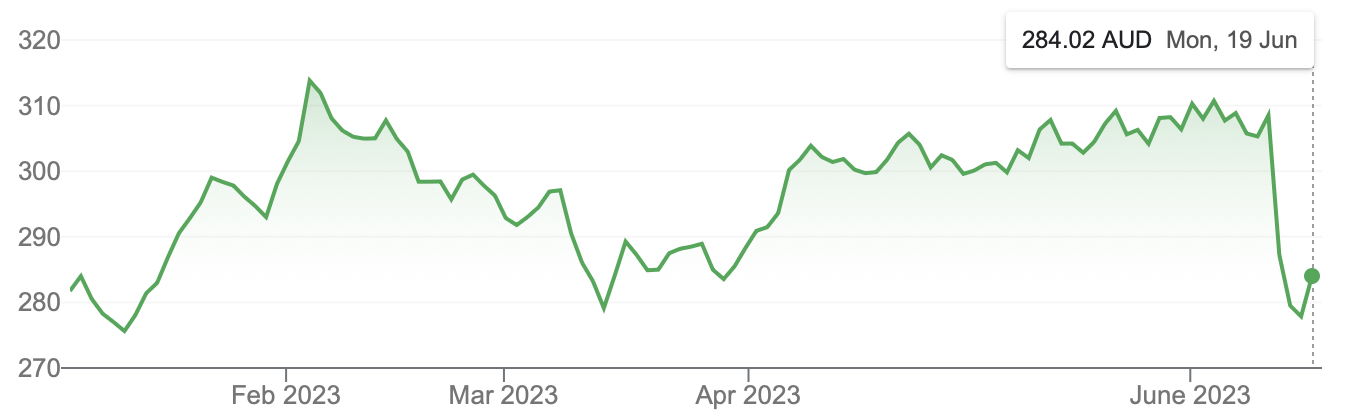

“While resetting expectations has seen shares weaker, we view it as a buying opportunity and remain confident in improving margins and earnings trajectory. We adjusted financial year 2023-2025 forecasts lower with our PT decreasing to A$323.

“that’s why we view CSL as an add to a portfolio,” Raymond said.

CSL

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.