Michael Gable from Fairmont Equities sets the scene for the resources sector and why BHP is our “HOT” stock of the week:

“I have been very bullish on resource stocks for a while now, and with good reason. Firstly, they have been going up. Investments are supposed to go up, right? Most importantly though, the current macro environment is very well supportive of commodities. Increased government spending and potential for inflation is good for resources,” Michael explained.

Why does BHP stand out among the resource stocks?

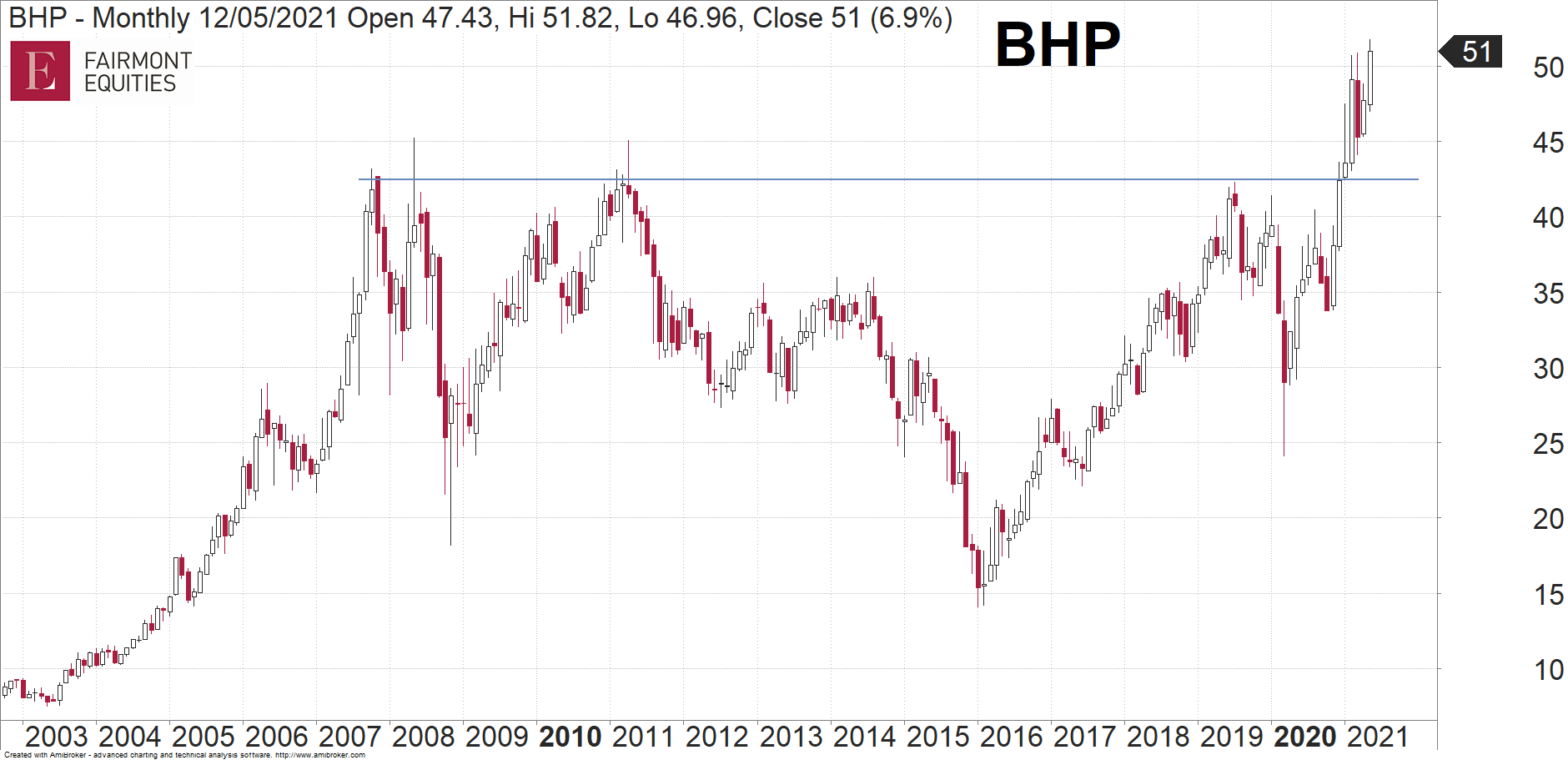

“BHP has had a great run recently, but I believe it has much further to go. If we ignore the short-term movements and look at a long-term chart of BHP, we can see why this is so. For more than a decade, there was clear line of resistance in BHP (horizontal blue line),” said Michael.

“With any chart, once a stock pushes past resistance, it is free to rally higher with no trapped buyers looking to exit at breakeven. The age-old rule of technical analysis is that the longer a stock has formed a resistance line, the more powerful the rally when it gets past it. With BHP finally pushing beyond a 13-year resistance line, it is telling me that the rally in BHP is only just getting started. Any dips are therefore a buying opportunity,” Michael said.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.