“BHP will report its full year report on August 16,” said Raymond. “As it has released its quarterly production report, we have a good idea of what the results are going to be like.

“Last financial year, BHP delivered strong production growth and managed its cost structure well – unlike many others.

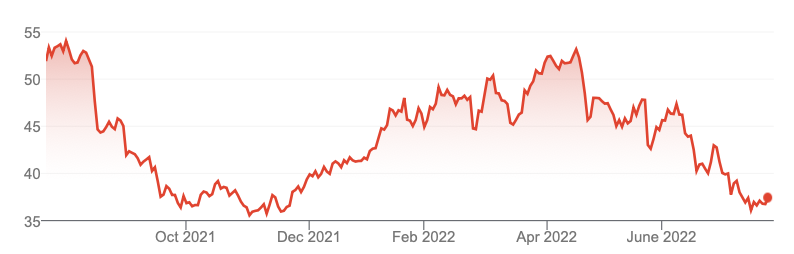

“Given the weakness in commodities (ranging from iron ore, copper and nickel), the company’s share price has come under selling pressure.

“In its quarterly report, it also downgraded financial year 2023 production guidance – which resulted in further price weakness.

“More importantly, iron ore is made up of BHP’s 53% revenue and the company downgraded its iron ore forecast to 246 – 256 m/t (on the low side of consensus 254 m) and lifted its cost expectation from US$18-19 to US$20.

“Having said that, the iron ore cost of production of US$20 is still way higher than what iron ore is trading at currently. As such, profit will remain strong.

“While the next two to three months hold uncertainty, particularly around the rate of growth in key commodity consumer products in China, we continue to see healthy fundamentals for iron ore, coal and base metals heading into 2023.

“This leaves BHP’s share price looking attractive at current levels.

“BHP is trading on a 7% dividend yield and at an approximate 30% discount to our target price.

“Our analyst holds an ADD recommendation on the stock.

BHP Group (BHP)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.