“In a sector battling volatile commodity prices and global inflationary pressures, we see BHP as offering the best risk-reward proposition in its sector,” Raymond said.

“A special dividend looks unlikely, with BHP digesting the US$7 billion OZ Minerals Ltd (OZL) acquisition this half.

“We expect net debt to finish the year at approximately US$12 billion.

“We review our assumptions ahead of BHP’s June operational result on 20/07 and financial year 2023 earnings result on 22/08 and include the OZL acquisition into our model.

“BHP’s fourth quarter operating profit result will further steer our second half of financial year 2023 expectations.

“To that end, we expect a healthy quarter in Pilbara shipments (this is a key driver).

“The OZL acquisition adds some value, but, in particular, it will help Olympic Dam mine returns look better.

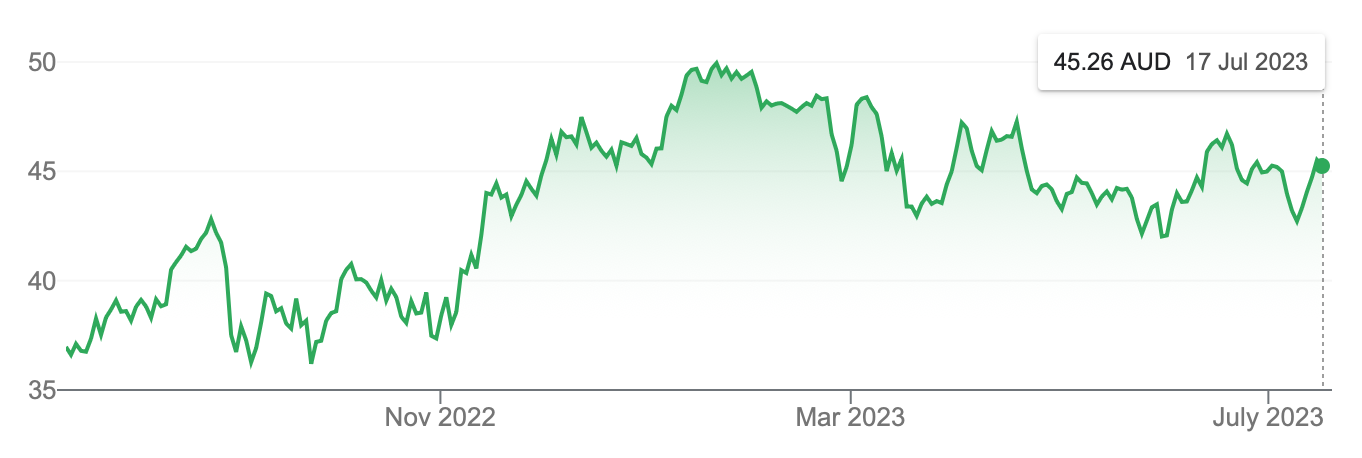

“We maintain an ADD rating, with an upgraded $51.70 per share target price (it was $50.40).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.