“While there is a potential for short-term weakness in iron ore prices due to:

- lower steel mill margins;

- COVID interruptions; and

- talk of slowing growth in China,

Chinese steel prices and inventories remain under pressure. As such, we see the iron ore price to remain at an elevated level,” Raymond said.

Despite a strong price outperformance, Raymond Chan says Morgans continues to see BHP as a core portfolio holding, due to the following five reasons:

1. Best in breed

Through the last two cycles, BHP has transformed itself into the best and lowest cost iron ore miner and is best placed to defend against cost/labour headwinds.

2. Petroleum leverage

While BHP is about to divest its petroleum business to Woodside (WPL), the value of this proposed deal has grown significantly since its first announcement. WPL shareholders will vote in the coming months.

3. ESG profile transforming

Many fund managers with an Environment, Social and Governance (ESG) mandate have been unable to invest in BHP in the past, BHP is in the process of divesting all its fossil fuel exposures and will become more “investable” in today’s ESG world.

4. Smart M&A

We think it’s probable that BHP will seek to add more growth options, especially in copper and nickel (BHP’s long-time favourite commodities).

5. Dividend profile

A projected FY23 yield of 7.5%.

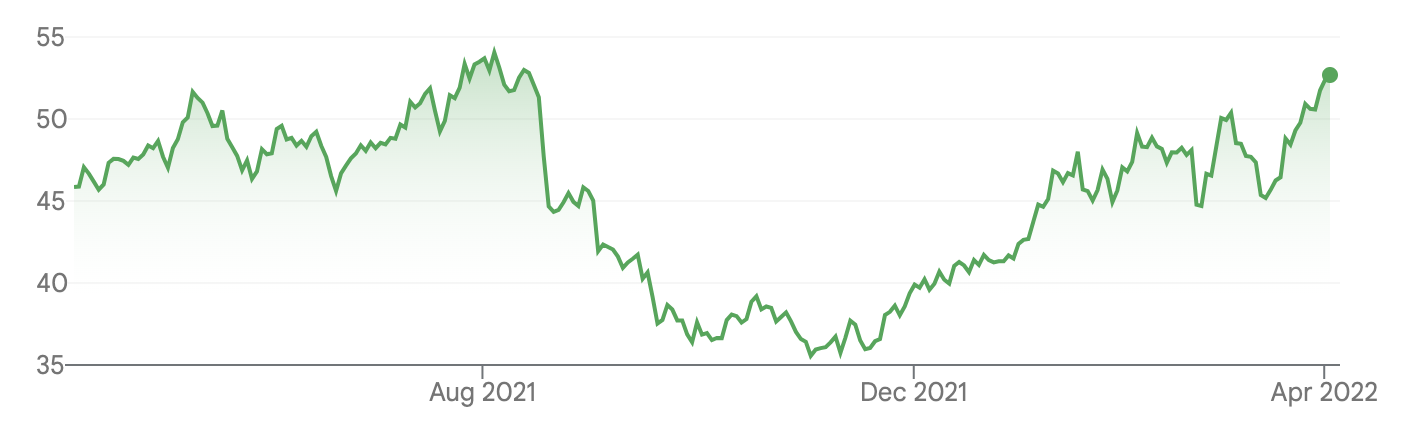

BHP Group (BHP)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.