Australian property prices are about to enter a new cycle of growth as investors take advantage of low interest rates and a market that has experienced sluggish price growth over the past four years, says a leading property expert.

John McGrath, chief executive of east coast-based McGrath Estate Agents, says rising investor finance and a stabilisation in auction clearance rates are starting to signal that cashed-up investors are ready to spend again after years of GFC-inspired stock market volatility and mixed house price growth.

The opportunity to snap up property at the start of a new price-growth cycle is an attractive one for many self-managed super fund trustees, particularly those with a high net worth who can purchase property while still maintaining a diversified investment portfolio.

Switzer generally advises that property investments should not exceed 30% of your SMSF – and that’s on the high side. However, trustees who have exceptional knowledge of the property market may choose to have a higher exposure to this asset class.

Based on data from mortgage broker Australian Financial Group, which has a 10% market share, investors accounted for 37.7% of new mortgage finance approvals in September, up from 34.5% in September last year.

“If you select the right locations and types of property, you can actually do extremely well over the next three to five years in most parts of Australia,” McGrath says.

“Historically, property has doubled every seven to eight years in most of the major cities. We haven’t seen that in the last seven or eight years because of the economic cycle, but I think there will be a catch-up to some degree once we get beyond the current major economic issues.”

But what and where should you buy for the best returns?

Firstly, McGrath says stick with residential property with a five- to 10-year investment timeframe.

“Residential is better because it’s very hard to get it wrong. You can get commercial, industrial and retail property wrong quite easily – I would leave that to the expert investors and the trust funds,” he says.

Secondly, the most stable residential property investments are found within capital cities.

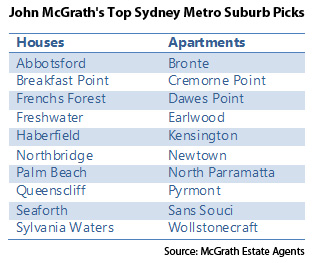

“Within those areas, the hot spots, particularly in Sydney, Melbourne and Brisbane, seem to be the inner-city ring, which is seven to eight kilometres from the middle of the CBDs,” he says, adding that the closer the property is to water – such as the Brisbane River, Port Melbourne, Sydney beaches and Sydney Harbour – the better.

Thirdly, aim to make your money through capital growth – not high rental yields – by identifying suburbs with strong price growth potential. McGrath says high rental yields can be misleading because they are often higher in areas that don’t experience robust capital gains.

“The big money that I’ve seen made and experienced myself in property is strong capital gains,” he says.

To identify these growth opportunities, McGrath says look at the in-demand neighbourhoods and investigate nearby suburbs that have not yet experienced the same strong price gains, but will benefit from a flow-on effect.

“I’m very strong on the inner-west corridor between Glebe and Haberfield,” he says, referring to the Sydney market. “Haberfield to me is a very strong suburb: strong investment prospects, close to the city, good capital growth prospects, and that fits that inner-city ring.”

[1]He says Sydney beachside suburbs such as Bronte, which took a hit during the GFC, are also likely to bounce back as the economy improves.

[1]He says Sydney beachside suburbs such as Bronte, which took a hit during the GFC, are also likely to bounce back as the economy improves.

Fourthly, McGrath says houses have historically generated higher capital gains compared with apartments. However, the gap has been narrowing as apartments become increasingly popular with young professionals and baby boomers.

And last of all, if you want to invest in more affordable areas outside inner-city rings, aim to keep your investment within a 90-minute drive of a major city.

[2]“The structure of regional cities can change quite dramatically,” he says, noting how the closure of a large company in a regional town can have an adverse effect on its economy by reducing employment and consequently demand for housing.

[2]“The structure of regional cities can change quite dramatically,” he says, noting how the closure of a large company in a regional town can have an adverse effect on its economy by reducing employment and consequently demand for housing.

He says property in regional areas, like Wollongong, that have quick commutes to a major capital have good capital growth prospects.

Once you have identified your property, don’t skip over the due diligence. Make sure the building is structurally sound, check for nearby development proposals, and if applicable, get a strata report, to make sure your investment won’t become a money pit.

“Whether you’re investing in shares or property, if you’re investing in good quality assets at what today, I think, will look like very good value ¬in hindsight – in either market, property or equities, it’s a good time to actually accumulate some good quality assets.”

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: What to watch in the coming weeks [3]

- Rudi Filapek-Vandyck: The broker wrap [4]

- Paul Rickard: A high-yielding investment to avoid [5]

- Tony Negline: How to take an artwork out of your SMSF [6]