One of the hardest to understand market sell-offs for a normal person has to be lithium. Thousands of smart and novice investors had made big gains and then saw some, or even a lot of those gains disappear.

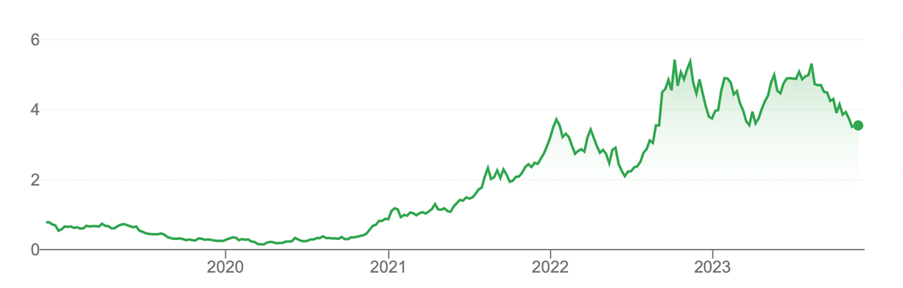

Undoubtedly, many big money-makers experienced the highs and lows that came with investing in Pilbara Minerals (PLS), which is seen by experts as a great mining company. But here below look at what has happened to its share price over the past year.

Pilbara Minerals (PLS)

At $5.37 in August, it has dropped to $3.56, which is a 33% smacking for anyone who thought that the future is electric vehicles and lithium powers the batteries that will be inside those cars of tomorrow. That has certainly been a market perception.

Of course, you have to keep the short-term fall in its price in context by looking at the longer-term chart over a five-year period. What you see is the market agreeing that lithium is the future. However, as often happens, the market got carried away, taking the price higher than it should have been, or else short-term factors changed.

I think the latter is as true as the proposition that the market got ahead of itself, as it tends to do.

Pilbara Minerals (PLS)

This chart says there’s a lot of belief in lithium and this company called Pilbara Minerals.

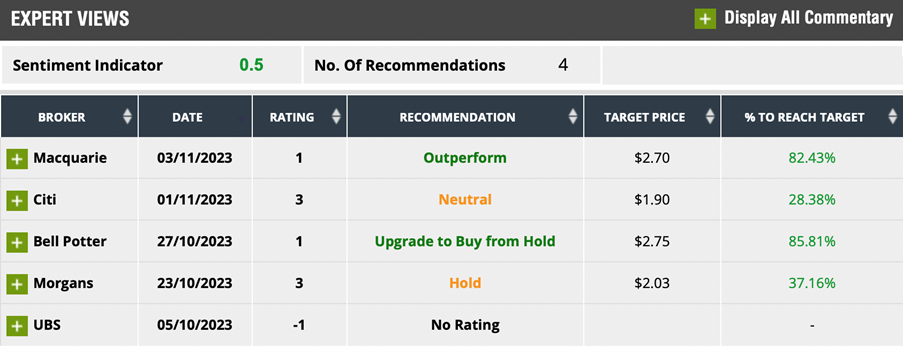

The experts from brokerages and investment banks agree. Below is what FNArena’s latest survey of PLS showed.

The consensus target price is 31.7% higher than the current price of $3.56. That means it could get to $4.69 in the future, but that’s an average. What do the true believers such as Macquarie think? This is an investment banks betting on a greener future for industry and investing.

Macquarie’s target price for PLS is $7.10, which would be a 99.44% rise ahead!

For those who may be worrying that PLS has more room to fall in price, note that even the dissenters see only a 3-4% fall ahead. If these full-time company watchers are right, PLS looks attractive for the patient long-term investor.

Its most recent dividend was around 7.7%. Going forward, the 2024 return is tipped to be 2.2% growing to 4.6% in 2025. The fall in the dividend is primarily a consequence of the lower price for lithium. This will be critically important for the future price of PLS and other lithium companies, such as Liontown Resources (LTR). Recently, this company was a victim of an audacious interference from Gina Rinehart when she took 19.9% of LTR, buying in around $3. Inevitably, this chased out US company Ablemarle with its $3 a share offer being wiped off the table.

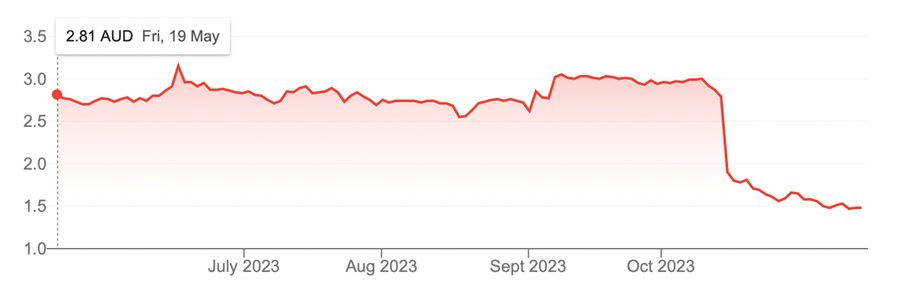

LTR shareholders saw a potential $3 pay day turn into a share with a near-halved share price. This chart shows the consequences of Gina Rinehart’s work.

Liontown (LTR)

This chart reminds me of the graphic from the book The Little Prince, which looked like a hat until you were shown inside. What was revealed was an elephant swallowed by a snake. Liontown (LTR) was certainly a victim of someone with a big appetite for lithium, which says something about the future of the product.

Why would Ablemarle offer $3? Because it believed its outlay today would return a lot more down the track. And why would Gina Rinehart spend $1.3 billion buying into LTR? Seriously, I don’t have to answer that.

This is what the analysts think of LTR:

The expected consensus rise is 58.4%, but both Macquarie and Bell Potter can see an 80% plus rise ahead.

Even for a cautious investor, a small gain of 10% over a year or two looks believable, but both LTR and PLS seem to be worth a dabble for the satellite or speculative part of a portfolio.

But why have their share price slumped so much, given this likely positive future for lithium and the companies that mine it?

Well, apart from a rise in supply, which always follows big surges in share prices, governments of the world have become less bolshy on making their voters buy electric vehicles (EVs) in the near term. High interest rates hurting the cost of living have made the idea of forcing drivers out of their perfectly good petrol cars into planet-saving EVs harder to push, especially when the push comes from unpopular politicians who have money problems post-Covid.

Also, China’s economic growth has gone off the boil, following the pandemic lockdowns, and they’re the biggest potential EV drivers, buyers and indirect consumers of lithium. But it’s not all bad news on that front.

I liked this headline from CNBC over the weekend: “China’s transition to EVs is so fast that Volkswagen is on track for its worst local sales in years!” This is what Evelyn Cheng and Quek Jie Ann has revealed: “Chinese brands are taking the lead in the country’s rapid shift to new energy vehicles, putting Volkswagen [1] on track for its smallest year of China sales since 2012, according to CNBC analysis of public data for the first three quarters of the year. The German auto giant isn’t alone in its struggles, according to CNBC’s analysis of 10 global car brands. Nissan is on track for its worst year in the market since 2009, while Hyundai is set for its lowest sales since at least that time, CNBC’s analysis showed.”

The Chinese are embracing EVs. Local players, along with Tesla, are capturing the lion share of this growing market. And if you want to see the future, just look at China. “In China, the world’s largest auto market, new energy vehicles have accounted for more than one-third of new passenger cars sold in the country so far this year,” the CNBC pair reported. “That’s according to the China Passenger Car Association, which also predicts the local auto market will grow by 20% [2] in November from a year ago.”

Personally, I’ll play lithium, but I also want to play the “picks and shovels” investment for the mineral, so Tesla looks like it has plenty of legs. But the Chinese company BYD looks even hotter! I’m going to look for the original equipment manufacturers (or OEMs) that will provide components for these EV companies. A Bernstein survey of more than 1,500 consumers in China in August and September found that BYD was the top brand that Chinese buyers of electric vehicles would consider. Tesla was next, followed by Nio, a Chinese car company.

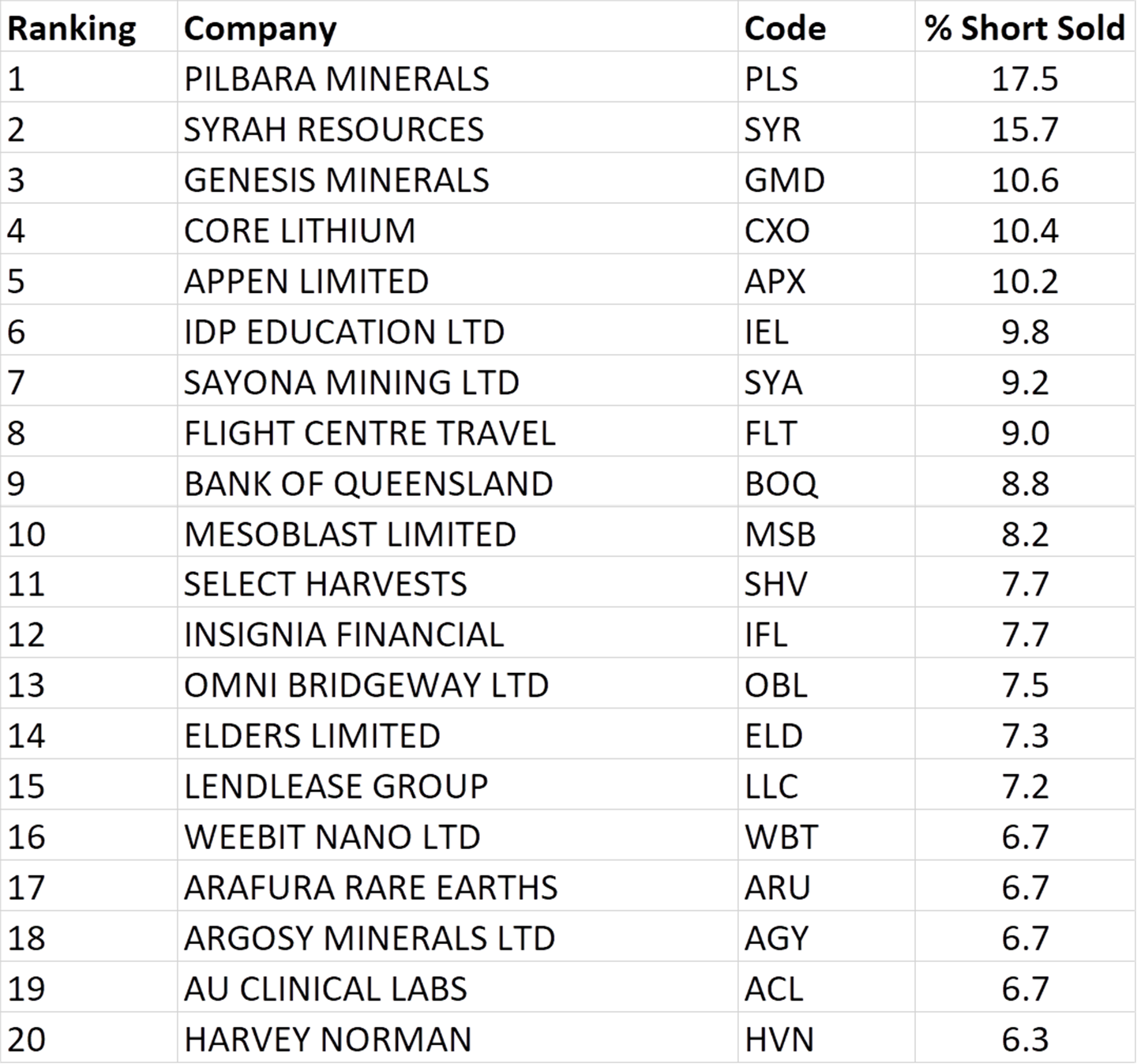

While all this makes the future of lithium and EVs look promising, right now the short sellers are in control. But one day they’ll know it’s time to get out and squeeze plays will push the share price higher. Note where PLS is on the table of the most shorted stocks:

Interestingly, Core Lithium (CXO) was up 4.11% on Friday and 2.7% for the week. While no one could tell why, watching the share prices of these companies in coming weeks could be a smart thing to do.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances