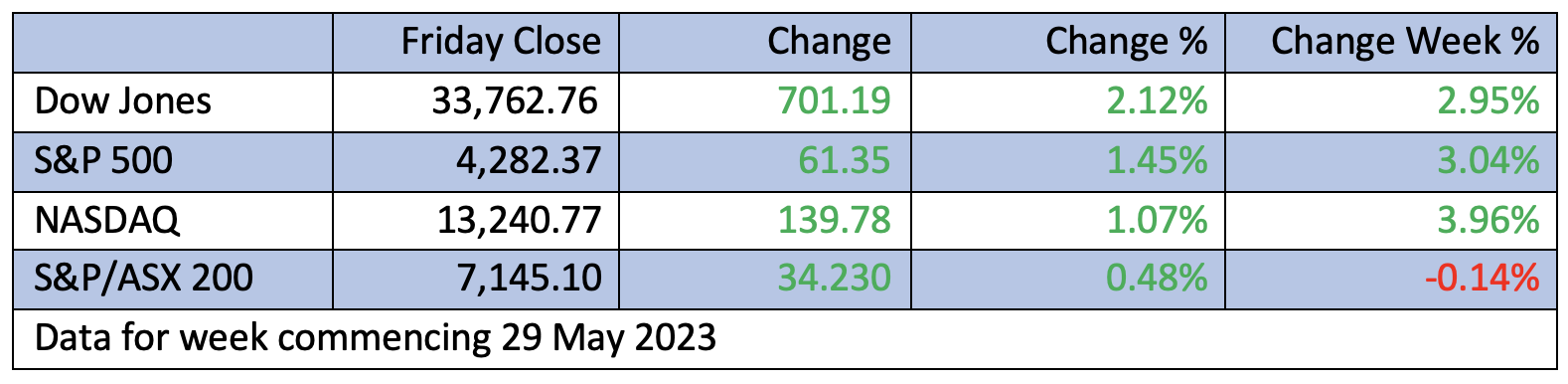

US stocks zoomed higher on the back of a double boost to investor confidence following the May jobs report, which could go down as a memorable Goldilocks result! The Dow was up over 2% while the S&P 500 and Nasdaq Composite registered 1% plus surges.

Of course, we’re not out of the woods where the bears lurk, but the good news is starting to outweigh the bad news, with the Nasdaq now up six weeks in a row and is 27% higher year-to-date. For a tech believer like yours truly, it has been a nice morning to get up before most of you!

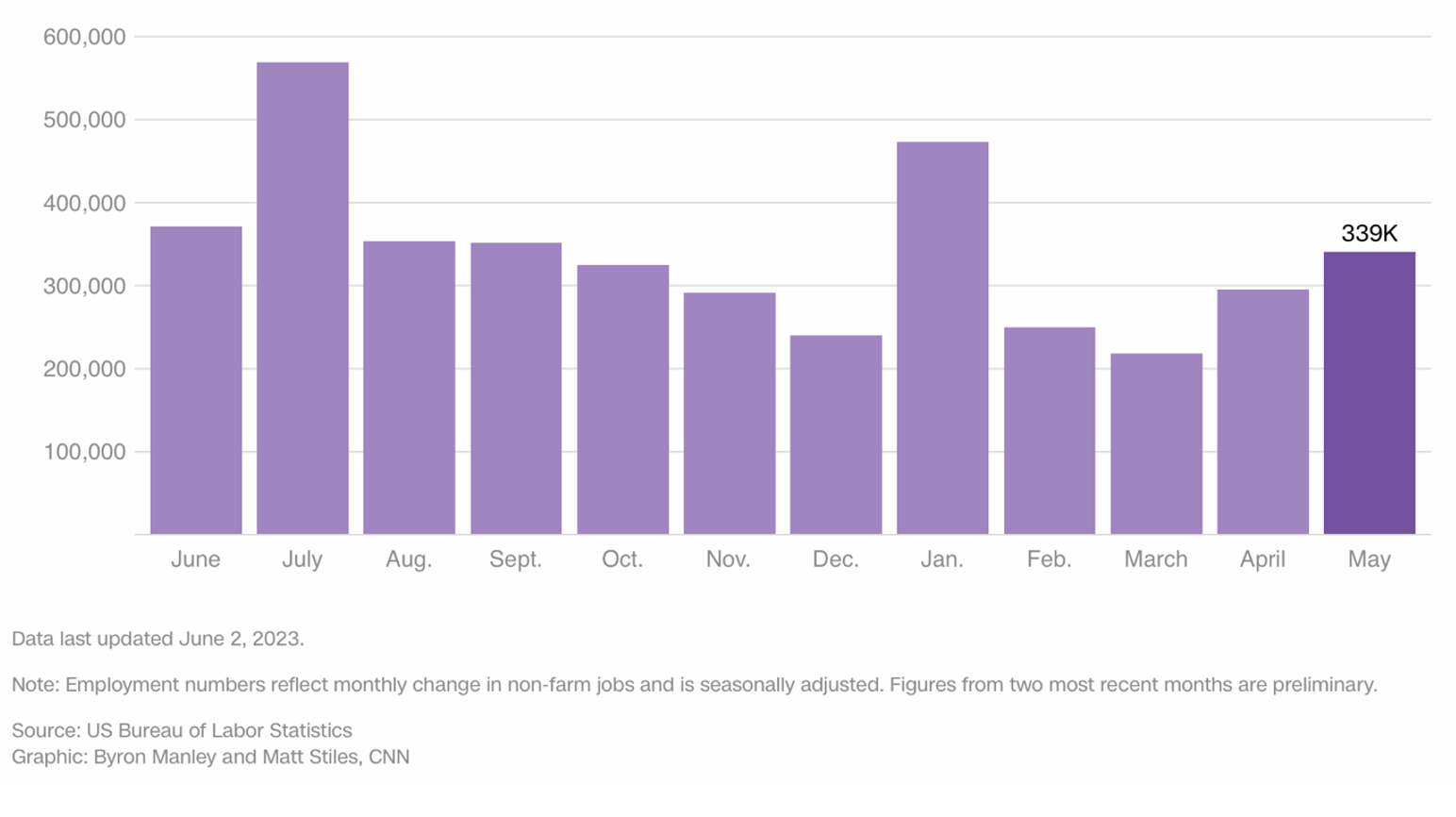

To the jobs report first, and this might surprise you, but the US created 339,000 new jobs last month, when economists were expecting only 190,000. Now usually this would mean the market would think — more jobs, then more inflation and more interest rate rises — but what follows explains why all three stock market indexes were strongly positive overnight. This is good news for our market on Monday, with the SPI suggesting an 80-point plus open.

So, why did a stronger-than-expected US jobs report lead to a very positive stocks’ response?

Well, first, the better job creation number made recession worriers less worried. Second, unemployment rose from 3.4% to 3.7%, which was an unignorable jump, indicating the labour market is at long last starting to soften.

US job creation

But it was the third statistical revelation that created the notion that what we were looking at could be a Goldilocks ‘not too hot, not too cold’ economic result. What we saw was that average hourly earnings rose less than economists expected year over year. This was an outcome that lowered fears that these job creation numbers could lead to more interest rate rises.

In the fullness of time, Wall Street could be seen overnight to be ahead of itself but for now, this looks like good news for inflation, interest rates and recession fears. I hope these conclusions are on the money. And all this positivity is on top of easing concerns about the US debt-ceiling challenge for Washington. In case you missed it, this is how CNBC reported the latest developments: “Easing concerns around the U.S. debt ceiling also helped sentiment. The Senate passed a bill to raise the debt ceiling late Thursday night, sending the bill to President Joe Biden’s desk. That comes after the House passed the Fiscal Responsibility Act on Wednesday, just days before the June 5 deadline set by U.S. Treasury Secretary Janet Yellen”.

Putting it altogether in a typical American way, Terry Sandven, the chief equity strategist at U.S. Bank Wealth Management said: “The so-called Goldilocks has entered the house — clearly, on the bullish side, there are signs that inflation is starting to wane, speculation that the Fed is going to move into pause mode, increasing the likelihood of a soft landing”.

This week the St George economics team reported: “Dovish comments from multiple Federal Reserve members contributed to a fall in bond yields and pullback in expectations of another hike at the upcoming June Fed meeting.” This of course is also good for stocks.

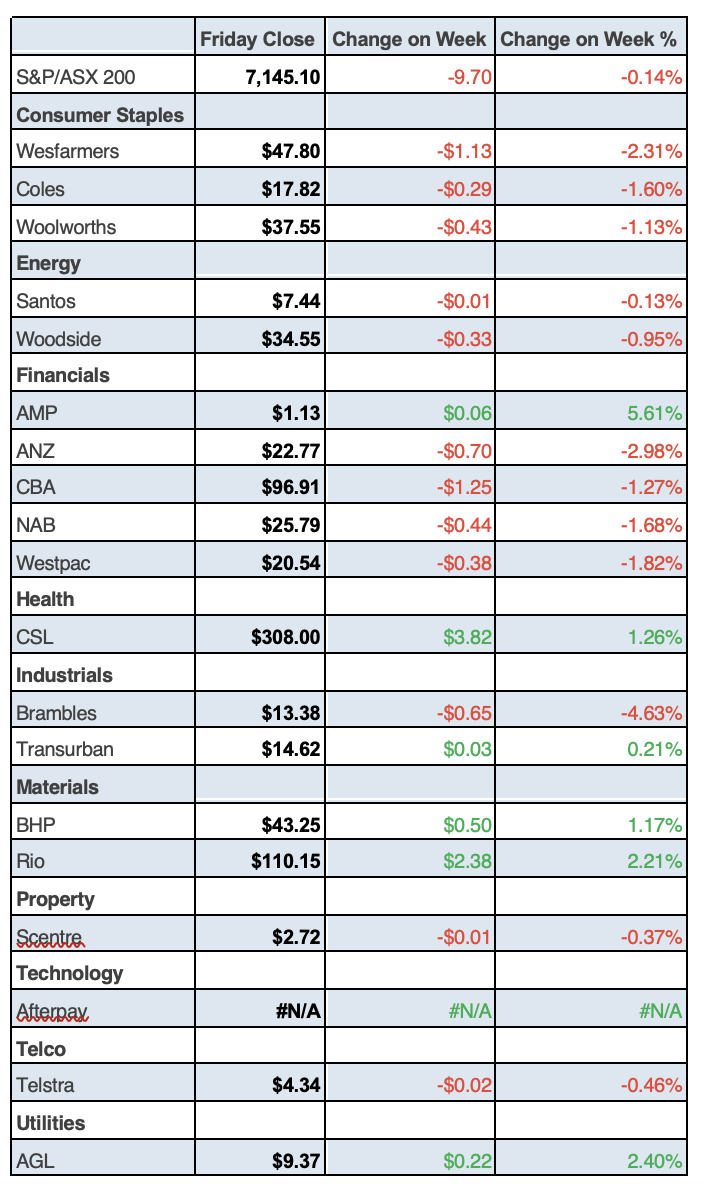

To the local story, and the US debt ceiling’s positive steps helped our market end on an up-note on Friday. The S&P/ASX 200 Index ended up 34.30 points (or 0.48%) higher, closing at 7145.10 but for the week it was a 9.7 point loss, which isn’t surprising with June being a tax-loss selling month.

In case you’re wondering, we’re up 2.86% on a year-to-date basis but down 1.29% on a one-year reading. However, on a financial year basis, we’re up a good 8.8%, which should contain those who like whinging about poor results.

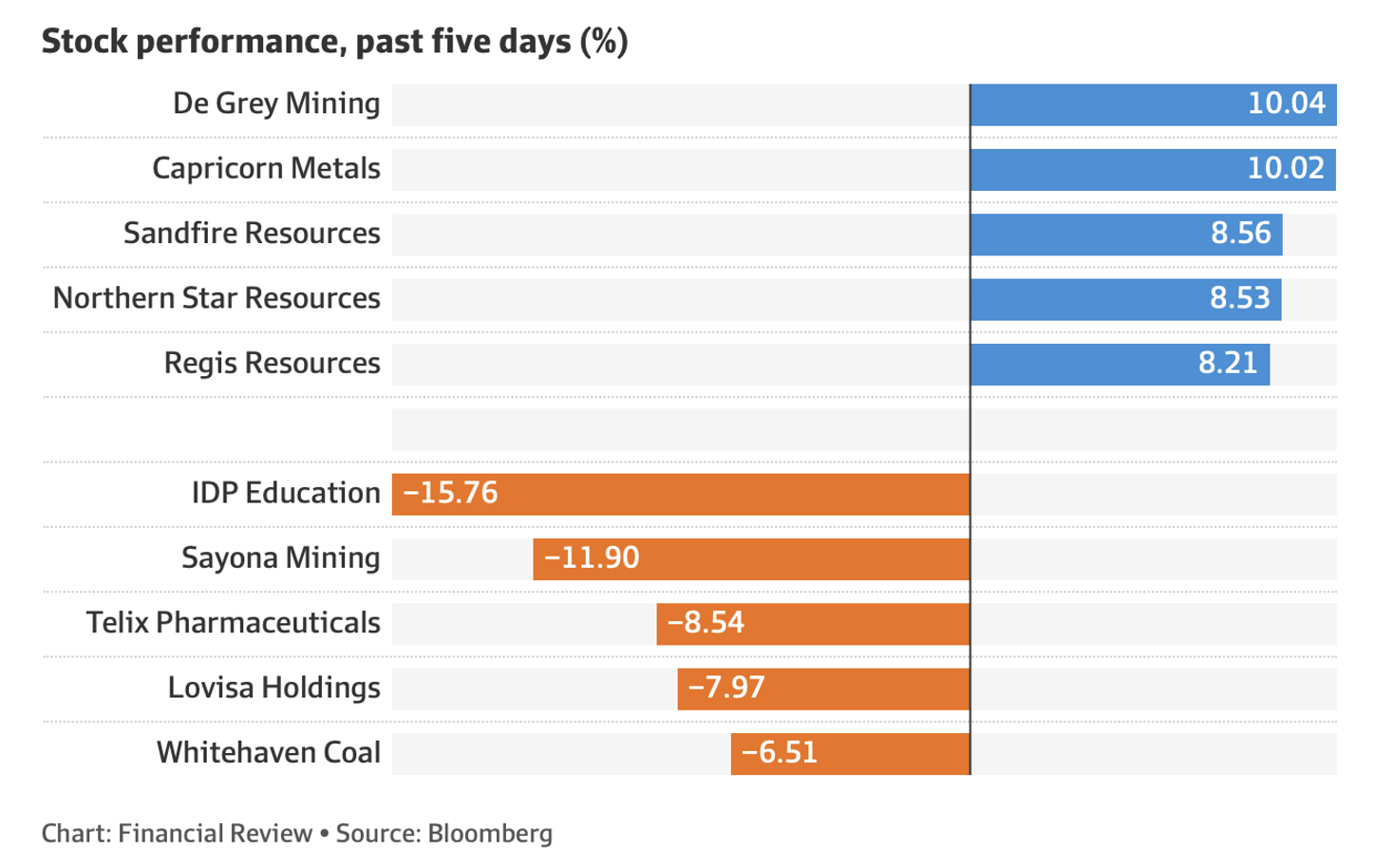

On top of the good vibes from debt-worried Washington, China is looking like it’s close to a stimulus package, which excited mining investors on Friday. This is how the AFR’s Cecil Lefort reported the consequences: “Iron ore futures for delivery in July on the Singapore exchange rallied 1.3 per cent to $US103.45. BHP Group rallied 2.8 per cent to $43.25. Rio Tinto rose 2.5 per cent to $110.15 and Fortescue Metals advanced 1.7 per cent to $19.69.”

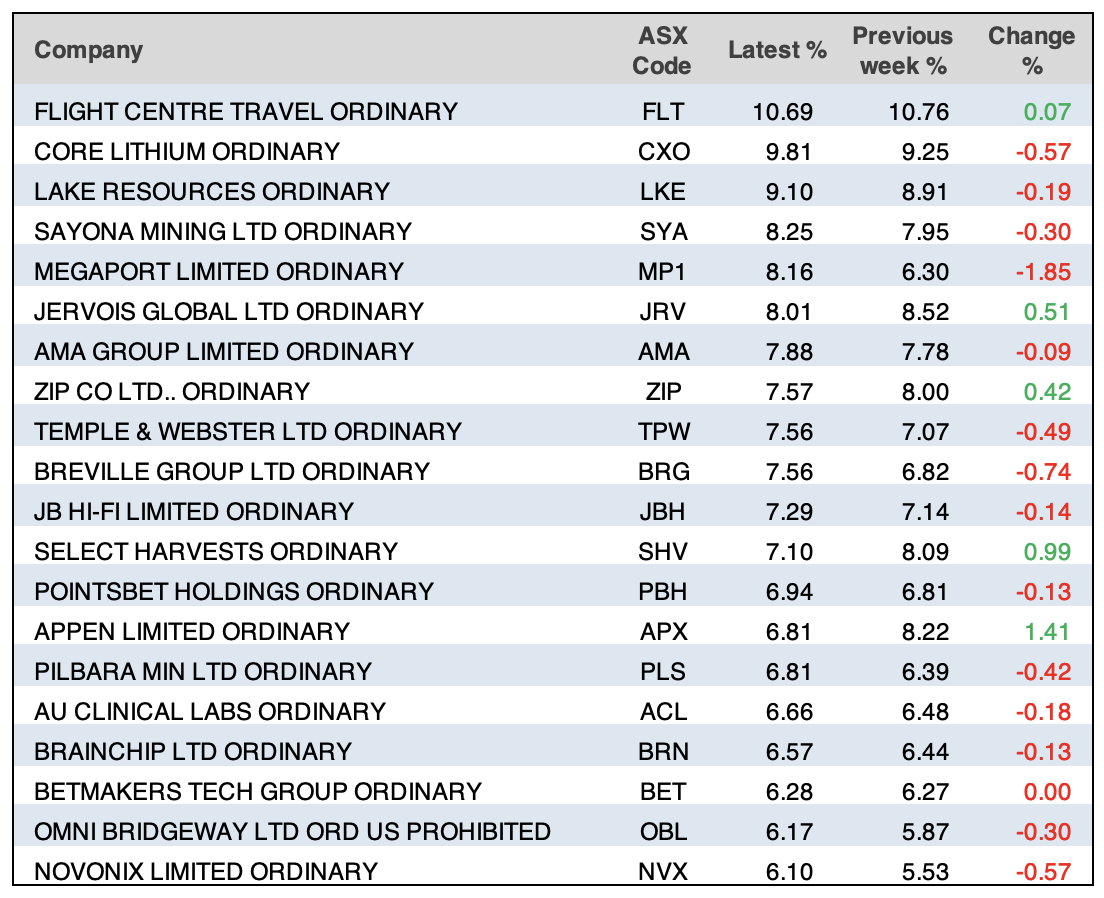

Here are the big winners and losers for the week:

Uranium miner Paladin Energy had an up and down week, off some 20% at one stage but then saw a 10% spike after the Namibian government clarified its position on taking stakes in mining and petroleum companies. The stock ended exactly where it started at 67 cents, which says there are supporters for the company but that African government is a worry.

Consumer staples fell after the Fair Work Commission granted minimum wage workers a 5.75% pay rise, despite the expectation that a 7% rise was coming.

Woolworths fell 1.42% to $37.55, while Coles gave up 1.71% to $17.82. Harvey Norman lost nothing on Friday but was off 4.55% for the week to end at $3.36.

What I liked

- Those US job numbers for May!

- Despite the wrong overreaction to the inflation number this week, I liked this from CBA’s economics team: “Inflation has clearly peaked and is continuing to decelerate despite the uptick in the annual rate.”

- New housing fell by 2.9% in April to be 25.8% lower for the year, showing rate rises are working in this sector.

- New lending dropped 3.8% for owner occupiers and 0.9% for investors. (The RBA needs to see that their 11 rate rises are working to slow down the economy or else they will keep raising. That’s why bad economic news could be good news for interest rate worriers and the economy.)

- The total volume of capex rose by 2.4% in the March quarter, which reduces recession fears here.

- Eurozone CPI inflation fell more than expected in May to 6.1% from 7%, with core inflation falling to 5.3% from 5.6%.

- The S&P Global Manufacturing PMI for the US was revised lower to 48.4 in May, from the preliminary read of 48.5. This was down from the read of 50.2 recorded in April. This shows a slowdown is happening and is less recession like.

What I didn’t like

- Consumer prices rose by 0.3% a month on a seasonally adjusted basis in April, slower than the 0.5% pace recorded in March. But headlines focused on the annual number that rose from 6.3% to 6.8%, even though it was driven by old news and the statistical vagaries of how the annual number is calculated.

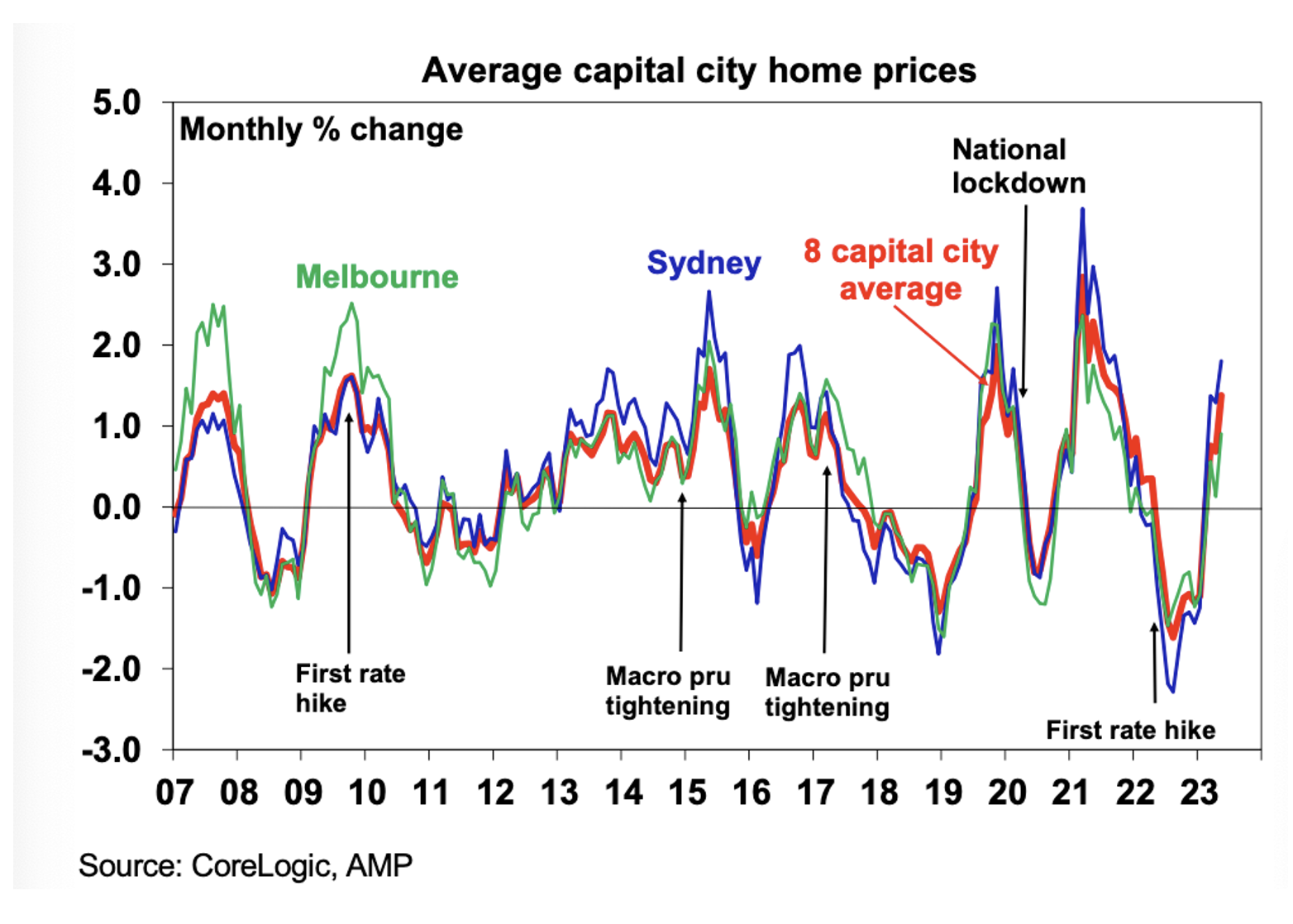

- Dwelling prices rose by a strong 1.4% across the eight capital cities in May – the third consecutive monthly gain. “Dwelling prices have now risen by 2.8% since February in a remarkable turnaround given the RBA increased the cash rate by 25 basis points in February, March and May to take the cash rate to 3.85%,” Craig James of CommSec noted. This is more a problem of a lack of supply but the RBA could see it as too many buyers meaning they need to hit us with more rate hikes.

- Building approvals fell by 8.1% in April, a very weak result. The annual pace of approvals is now down24.1% for the year. This comes as immigration is spiking, pushing up rents, home prices and inflation! The RBA’s rate rises have unintended consequences.

- Chinese May business conditions PMIs were mostly softwith weak manufacturing conditions (with the official manufacturing PMI showing a fall but the Caixin PMI up). Overall, this adds to concerns that the Chinese recovery is weaker than expected, particularly in manufacturing, which, in turn, partly explains the ongoing weakness in industrial commodity prices.

That wage decision looked good but…

AMP’s Shane Oliver explained why the smaller-than-expected 5.75% increase of the minimum wage (tipped to be 7%) could force up interest rates again. “The Fair Work Commission’s decision to increase award rates of pay by 5.75% and to realign the minimum wage to a higher award rate, resulting in a de facto 8.65% increase in the minimum wage, all from 1 July, means a significant step up from last year’s increases of 4.6% in award wages and a 5.2% rise in the minimum wage respectively”.

I hope Dr Phil can look past this pay rise and not raise rates on Tuesday but I’m finding it harder to see him and his board not reacting to the concerted push for wage rises by just about every union right now.

Switzer This Week

TV

- Peter Switzer and Paul Rickard answer your questions on ZIP, APX, HVN & more! [1]

- Why does Shaw & Partners think ZIP will rise over 240%? [2]

Switzer Report

- Artificial intelligence boom is good news for tech service companies [3]

- “HOT” stock: Altium (ALU) [4]

- Questions of the Week [5]

- Two tech companies to watch [6]

- “HOT” stock: A.P. Eagers Limited (APE) [7]

- 3 ‘new’ biotechs [8]

- BUY, HOLD & SELL [9]

Switzer Daily

- Wage rises could KO the expected interest rate pause and kill jobs. [10]

- Inflation disappointing but Dr Phil should ‘zip it’ on rate rises! [11]

- Crown Casino cops a record-breaking fine! [12]

- NSW Premier shows the nation how to beat inflation to get interest rates down [13]

- Death and taxes are inevitable but so is paying more for aged care, childcare, etc. [14]

How Top Stocks Fared

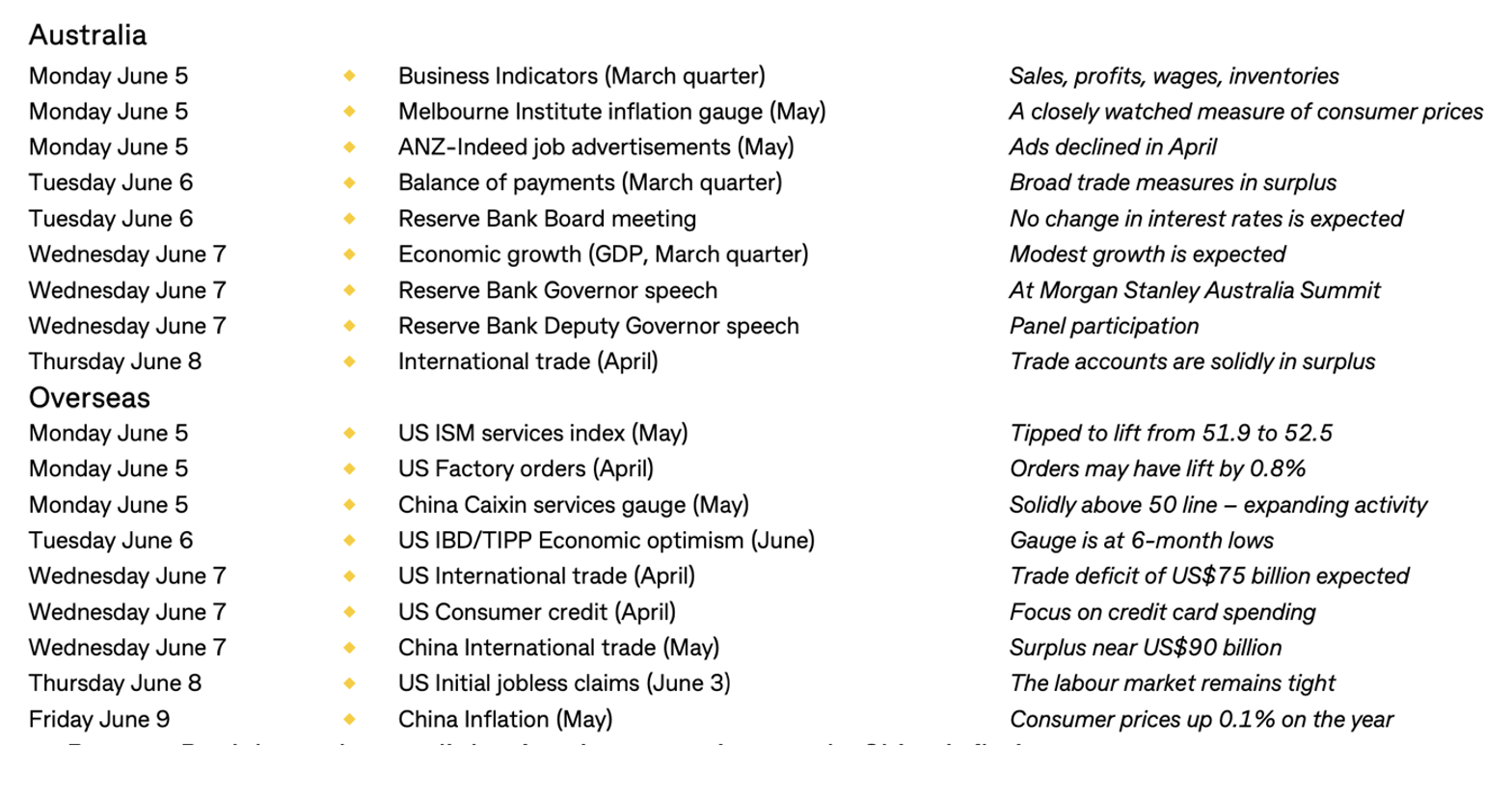

The Week Ahead

Stocks shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the Week

What happened to the ‘expert’ warnings of 25-30% slump in house prices?

Quote of the Week

AMP’s Shane Oliver on inflation: “Our assessment is that inflation will slow rapidly as the economy cools and our Australian Pipeline Inflation Indicator points to a sharp fall in inflation ahead.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.