Investors in packaging company Orora (ORA) will be asking whether it has paid too much to buy European bottle maker Saverglass before putting their hands in their pockets to help fund it. The acquisition, which comes at a price tag of $2.15 billion, is a company defining transaction and potentially, quite dilutive to Orora shareholders.

Orora, which was spun out of Amcor (AMC) in 2013, consists of two distinct businesses. An Australian focussed beverage packaging business (glass bottles, aluminium cans and wine closures), and a North American packaging solutions business that manufactures and designs corrugated packaging and other products for the food, beverage, technology, health care, automotive, industrial and retail markets. The North American business was largely acquired by Orora in 2018.

In Australia, Orora is number two in the cans and bottles markets (its main competitor is the Visy Group). In the USA, it has a top 5 position.

Saverglass will be the third business unit. It is a global leader in the design, manufacturing, customisation and decoration of high-end glass bottles for the premium spirit and wine markets. With an estimated global market share of 33% and sales revenue of $1.2 billion, Saverglass is the preferred bottling partner for many luxury spirit and wine producers. By sales category of bottle, spirits accounts for 65% of sales, still wines 26% and sparkling wines 9%. The company services more than 4,000 customers globally, including names such as Grey Goose, Hennessy and Glenfiddich.

Based in France, Saverglass has 6 plants and 9 furnaces, with 3 plants in France, one in Belgium, one in the UAE and the sixth in Mexico. 67% of sales are into Europe, with North America accounting for 28% and Asia/Pacific/Australia 5%.

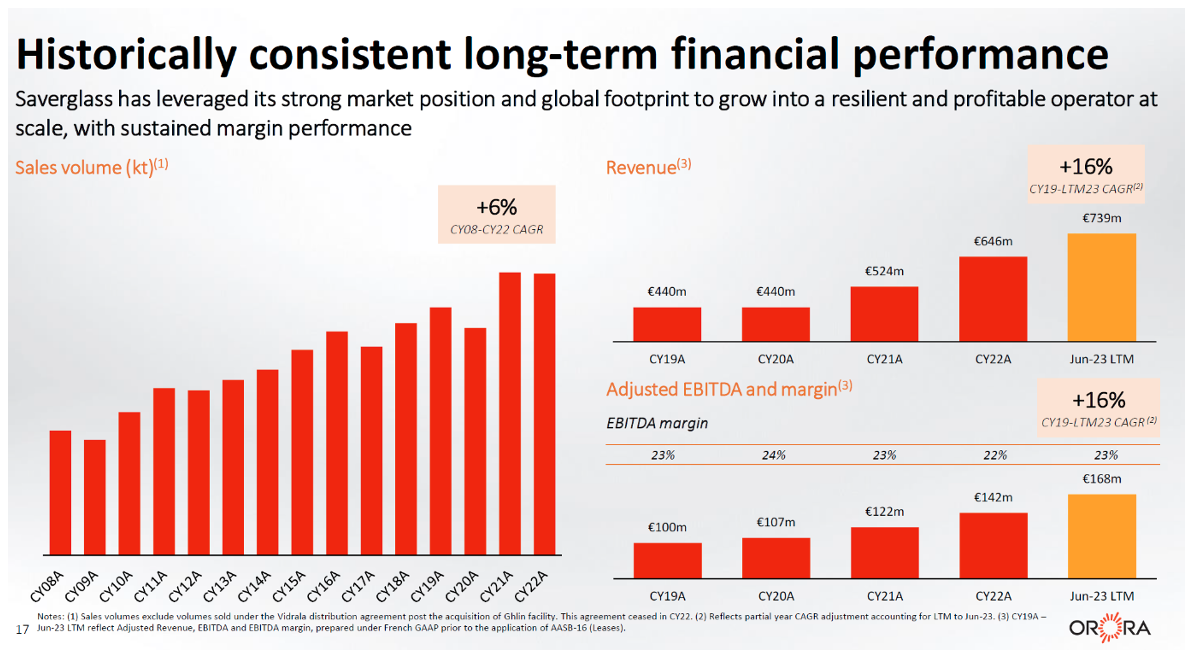

Saverglass has demonstrated consistent long-term performance. Sales volumes have grown at a compound annual growth rate (CAGR) of 6%, revenue at 16% (over the last four years) and earnings at 16%. FY23 EBITDA was $280 million with an underlying margin of 24.7% (higher than Orora’s).

Strategically, Orora argues that the Saverglass acquisition:

- Is a unique acquisition of a global market leader, that extends and enhances Orora’s core competencies in premium value-added beverage packaging;

- Is well-positioned to benefit from ongoing growth trends in premium spirits and wines (preumisation, proliferation of new and craft brands);

- Unlocks significant value creation opportunities in the combined group, leveraging complementary footprint, sustainability practices and customer networks (for example, Orora’s existing Gawler site in South Australia will ehnace Saverglass’s missing APAC coverage; Orora’s existing distribution and customer relationships will provide Saverglass a platform to accelerate growth in the North Amereican wine and spirits markets);

- Creates a global, diversified packing player of scale with a strengthened platform and multilple growth pathways;

- Has a highly capable management team, who will become the centrepiece of Orora’s global glass bsuiness unit; and

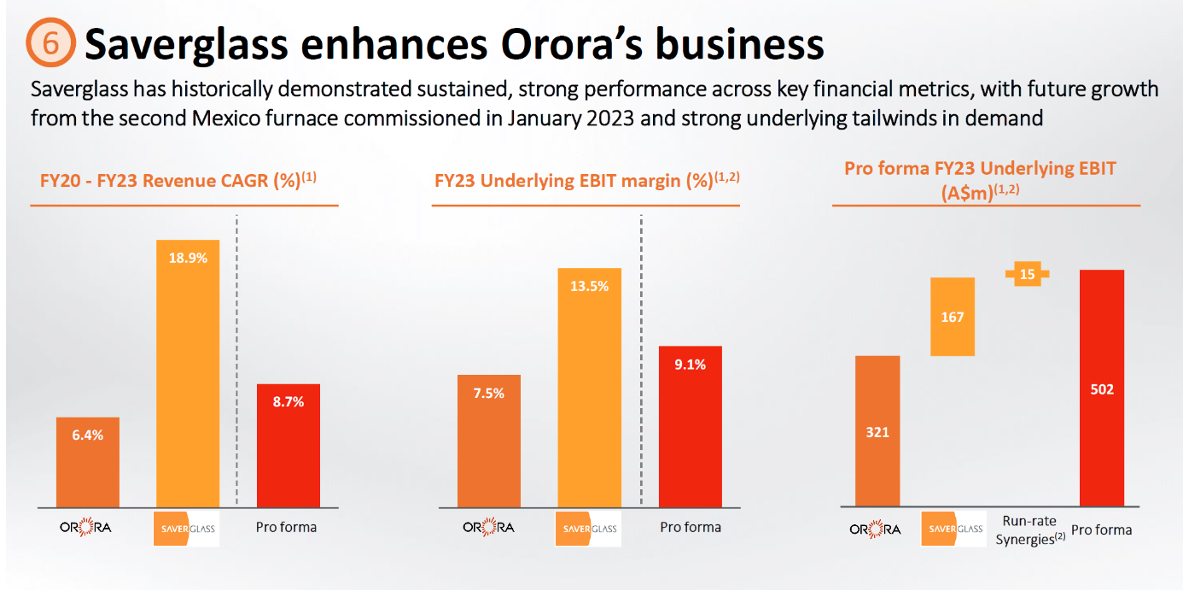

- Financially, Saverglass enhances Orora’s businees. The revenue CAGR increases, the underlying EBIT margin improves by 1.3% and underlying EBIT rises from $321 million to $502 million. This is after run-rate synergies of $15 million.

And the price?

Orora is paying an enterprise value of $2,156 million for the deal which is a multiple of 7.7 times Saverglass’s last 12 months EBITDA of $280 million. Adjusting for run-rate synergies of $15 million, the multiple falls to 7.3 times.

Orora says that it expects the deal to be “mid-single digit earnings per share (EPS) accretive in the first full financial year of ownership”, and that the “return on investment is expected to generate an attractive premium to the weighted average cost of capital”).

Transaction funding and equity raising

The consideration of $2,156 million plus transaction costs of $64 million is being funded by a fully underwritten equity raising of $1,345 million and new debt of $875 million.

The equity raising is being conducted through an $895 million non-renounceable entitlement offer and an institutional placement of $450 million. The entitlement offer is based on 1 new share for every 2.55 shares currently held, at an offer price of $2.70 per new share.

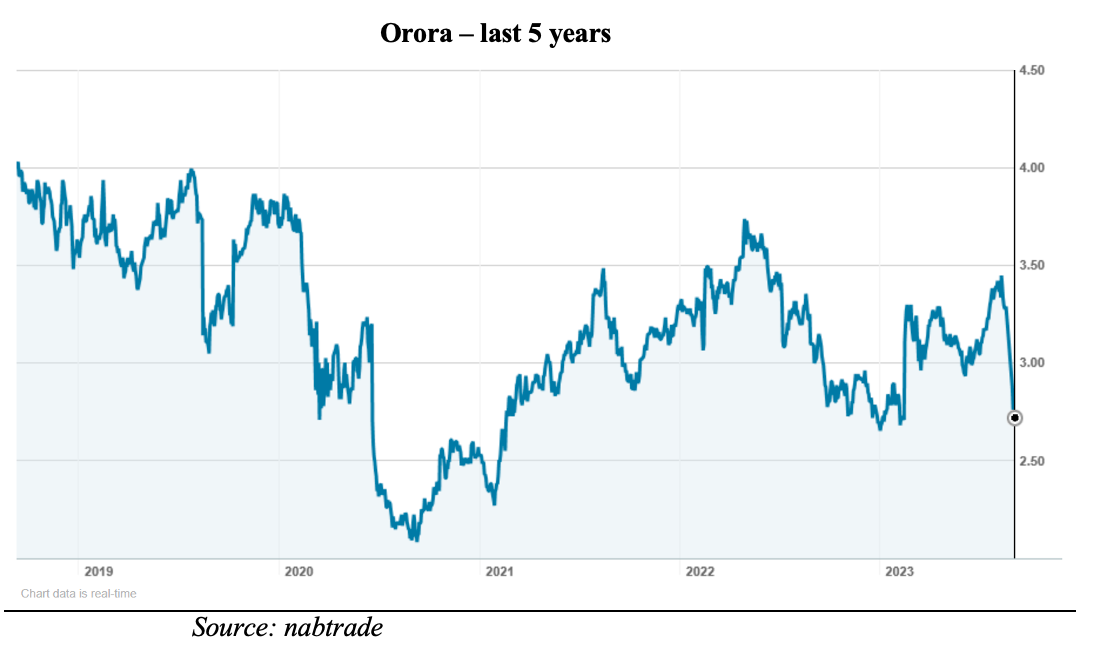

The offer price of $2.70 represents a 14.5% discount to the theoretical ex-rights price, and a 21.3% discount to Orora’s share price immediately prior to the announcement of the deal.

The first part of the entitlement offer, to institutions, has already been conducted. Approximately 83% of entitlements available to institutional investors were taken up to raise $668 million. In addition, institutional investors contributed a further $450 million via a placement at the same price of $2.70.

The second part of the entitlement offer is to retail investors. The offer opens tomorrow (Tuesday) and is scheduled to close on Monday 25 September.

In addition to subscribing for new shares on a 1 for 2.55 basis (i.e., if you own 1,000 Orora shares, you will be entitled to buy 393 new shares at $2.70 each), retail investors will also be able to apply for additional shares in excess of their entitlement up to a maximum of 50% of their entitlement.

The new debt of $875 million will see Orora’s pro-forma leverage (net debt to EBITDA) increase from 2.05x to 2.50x, at the top of Orora’s target range of 2.0 – 2.5x.

What do the brokers say?

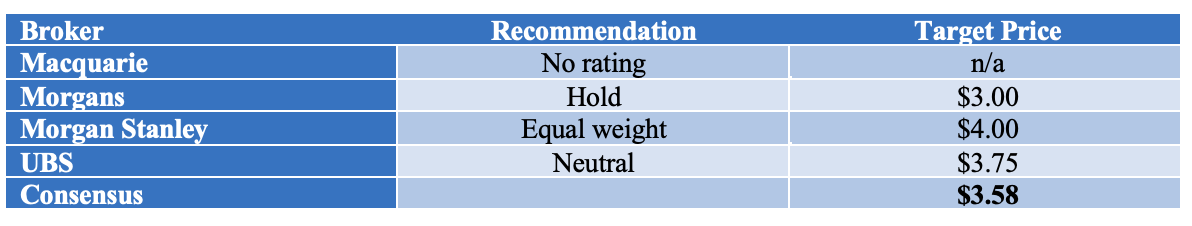

In the main, the brokers are supportive of the acquisition, while noting the execution and integration risks. Because of the size of the equity raising, the acquisition is viewed as reducing EPS in FY24, before becoming accretive in FY25.

All the major brokers have a “neutral” rating on the stock, although the target price is approximately 33% higher than the issue price of $2.70.

They forecast flat earnings per share growth in FY24 (following the issue of new shares), before rising by around 9% in FY25. This puts Orora on a multiple of 11.7x forecast FY24 earnings and 10.7x forecast FY25 earnings. Based on the closing ASX price of $2.69, a prospective dividend yield of 6.5% for FY24 and 7.2% for FY25 (unfranked).

Bottom line

Orora is probably paying too much for the Saverglass business based on the fact that half the purchase price will be accounted for as goodwill and intangible assets. The EBITDA multiple of 7.3x looks OK, but there is a lot of depreciation and amortisation to come. Paying “too much” is the price that most acquirers must pay.

The real test is whether it proves to be EPS accretive (quickly) and provides Orora with a better long-term growth path. Prima facie, the rationale for the acquisition appears to make sense.

Another positive is that the acquisition synergies of $15 million per annum are quite modest and should be achievable.

The main negative (in the short term) is that Orora has issued a truckload of stock at quite a big discount. Some institutions voted with their feet by not participating in the entitlement offer, and the fact that it traded under the issue price (albeit just by 1 cent) on Friday is not an encouraging sign.

My sense is that it is worth backing Management and that participation in the raising will be good long-term buying. However, the overhang of stock means that short-term gains will be limited. My view? It’s for long-term investors.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.