This week we saw the return of the new market thinking that good US economic news is bad market news, but it doesn’t apply to all good news. Ahead of the close, US stock market indexes were mixed but the negativity that we saw for most of the week was more subdued.

Overnight, EU stock markets and the UK’s FTSE were up, helped along by the good news that China was set to reopen its economy faster than expected, as it eased up on its tough zero Covid and lockdown policies. “In remarks published by state media on Thursday, Chinese Premier Li Keqiang said the country’s easing of Covid policy would allow the economy to gather momentum,” CNBC reported overnight. And Hong Kong’s Hang Seng Index spiked 2.32%.

This is good news for the global economy’s outlook that’s currently challenged by fears that the good economic news in the States leads to too many interest rate rises and then a recession. And this from Reuters only yesterday makes a recession look more certain: “The U.S. economy is heading into a short and shallow recession over the coming year, according to economists polled by Reuters who unanimously expected the U.S. Federal Reserve to go for a smaller 50 basis point interest rate hike on December 14.

“After raising the federal funds rate 75 basis points at each of the previous four meetings, all 84 economists polled on December 2-8 expected the central bank to go for a slightly softer half a percentage point to 4.25%-4.50% this time.”

This week, the US saw a firmer-than-expected purchasing manager survey, the producer price index was higher than expected and consumer sentiment also was stronger than tipped. “The University of Michigan said Friday that its preliminary consumer sentiment index rose to 59.1 in December from 56.8 in November, recovering most of the losses registered the previous month,” marketwatch.com reported overnight. “The reading beats the 56.5 consensus forecast from economists polled by The Wall Street Journal.”

That said, the number says US consumers still look “depressed according to historical standards as the index isn’t far from its all-time low of 50.0 registered in June.”

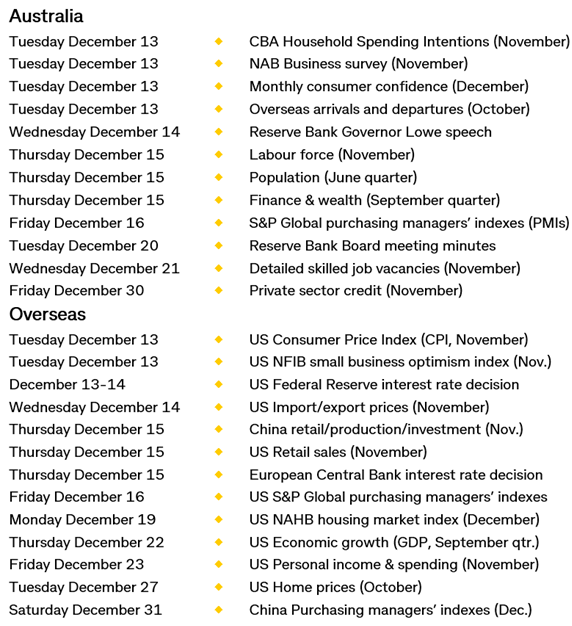

All this makes next week’s CPI in the US on Tuesday, ahead of the Fed’s next interest rate hike on Wednesday, crucial for the direction of the stock and bond markets.

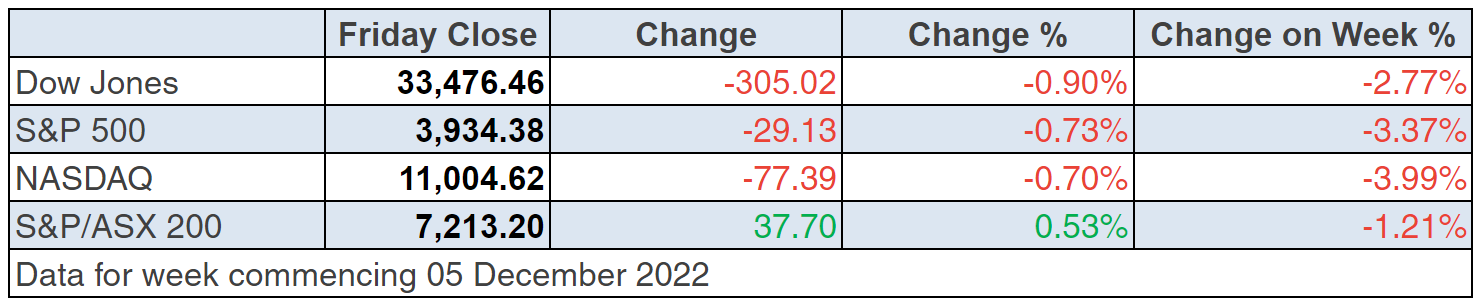

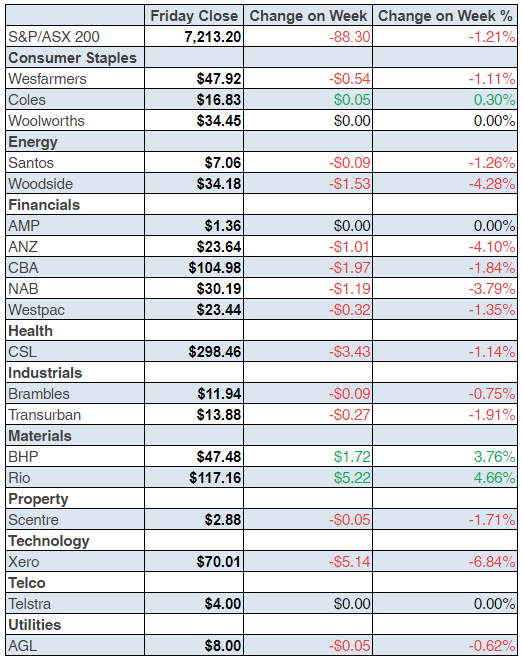

To the local story and the key market index — the S&P/ASX 200 — was down 1.21% or 88 points because the good US news, which I’ve already pointed out, was seen as bad news for stocks. Our fall was less than the Yanks because reports that China was loosening its Covid-lockdown policy helped resource prices.

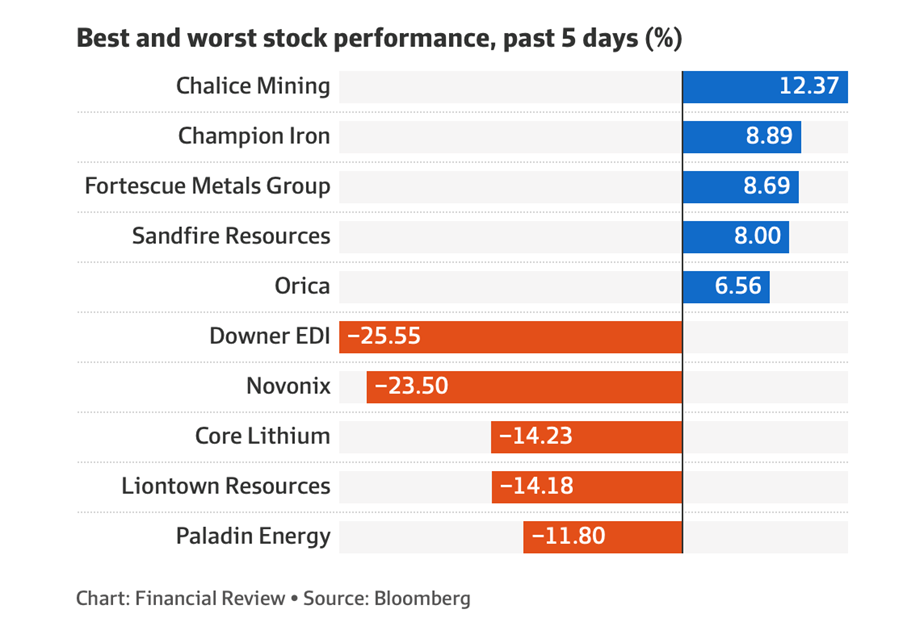

BHP was up 2.11% for the week to $47.48 and Rio put on 3.17% to $117.16. But the big outperformers were Champion Iron and Fortescue. This Bloomberg/AFR chart shows that clearly:

This virtually says iron ore and copper look good but lithium is in for a slide. This negativity about a resource that’s bound to be in big demand as electric vehicles grow in popularity, was created by Goldman Sachs, who put out a report that gave lithium the thumbs down.

The report speculated that prices would fall in 2023 and it gave Core Lithium the thumbs down but Allkem the thumbs up because it put production growth potential at fourfold.

There is no apparent news as to why Novonix crashed this week, but it is down 83% this year, with some analysts questioning its viability, despite its hailed intellectual property/technology.

What I liked

- Company profits fell by 12.4% in the third quarter of this year and were led lower by the mining sector, which is a good slowing economy sign.

- A lift in new claims for unemployment insurance in the US was cited as evidence that the economy was slowing and the stock market liked it.

- Euro zone gross domestic product (a measure of economic growth) rose slightly more than expected, up 0.3% in the September quarter to be up 2.3% on the year.If the EU can dodge a recession, it will be a miracle for them and a bonus for the global economy.

- The S&P Global services index in the US fell from 47.8 to 46.2 in November (survey: 46.1)

- The rising optimism about an easing of Covid restrictions in China.

What I didn’t like

- Wages and salaries rose by 2.9% for the quarter and are up by 11% over the past year, which isn’t good for inflation.

- Our forecast for the third quarter of 2022 GDP now stands at 0.7% for the quarter and 6.3% for the year, which is a big number and could support high inflation.

- In US economic data,the ISM services index rose from 54.4 to 56.5 in November (survey: 53.3), which is why stocks sold off on Wall Street earlier in the week.

- Eurozone business activity fell for a fifth month.

Central banks have to be careful

Both the Fed and our RBA have to be careful about too many interest rate rises. It was good to read Craig James’ take on the RBA following the 0.25% increase of the cash rate on Tuesday.

The RBA has implicitly signalled a willingness to pause in the tightening cycle today by noting that “the Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course.”

The CBA expects one further quarter per cent rate hike next February for a peak in the cash rate of 3.35% but a majority of economists see two more hikes ahead. The Reserve Bank expects the economy to slow to 1.5% growth over 2023 and 2024, so next week’s long list of economic data drops here and in the US will help me work out if we can trust the RBA’s forecast and how stocks should perform rolling into 2023.

The best news next week would be another fall in the US inflation reading, which the market this week thought was less likely. Over the month before this week, the US stock market surged around 7% and we added 5% or so.

Let’s hope the well-known unreliability of economic statistics actually produces a good inflation number!

The week in review:

- In this week’s Switzer Report, I tell you why you shouldn’t give up on tech stocks yet and how they could be an excellent investment for 2023: I know you might have every reason to be frustrated with tech stocks but keep the faith as it will reap you rewards. [1]

- Paul Rickard talks about some portfolios that have outperformed as market goes positive: [2] After one of the toughest years in recent memory, the sharemarket has moved into positive territory. A rally of 13.0% in the months of October and November means that the year to date return, including dividends, is 2.2%. In price terms, which excludes dividends, the S&P/ASX 200 is down just 2.2%.

- Tony Featherstone tells us about 3 ETFs that eliminate the effect of currency moves on offshore asset returns: [3] Here’s how Tony suggests to hedge your bets in a low-return environment

- James Dunn discusses his 6 favourite stocks for the grandkids’ stockings: [4] Here’s a selection of six shares that I think would make great gifts for the kids or even better, the grandchildren.

- In our “HOT” stocks column today, Michael Gable, Managing Director of Fairmont Equities, tells us why he thinks Fortescue Metals Group (FMG) [5] is a buying opportunity.

- In Buy, Hold, Sell – Brokers Say, there were 1 upgrades and 11 downgrades [6] in the first edition and 1 upgrades and 4 downgrades [7] in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, [8] Can Bubs Australia deliver long term growth? For CGT purposes, what is the cost price and acquisition date for the new Woodside shares you received from BHP in June? What is the dividend yield for the ‘top 20’ stocks? What is a good program to record your share trades and dividends on?

Our videos of the week:

- What’s in store for the next 12 months and is it worth investing in tech? | [9] Switzer Investing (Monday)

- How spooked should be about the stocks sell-off and rate rises? [10] | Mad about Money

- Boom! Doom! Zoom! [11] | 8th December 2022

- How should you be investing in 2023? – Defensively or Aggressively? [12] | Switzer Investing (Thursday)

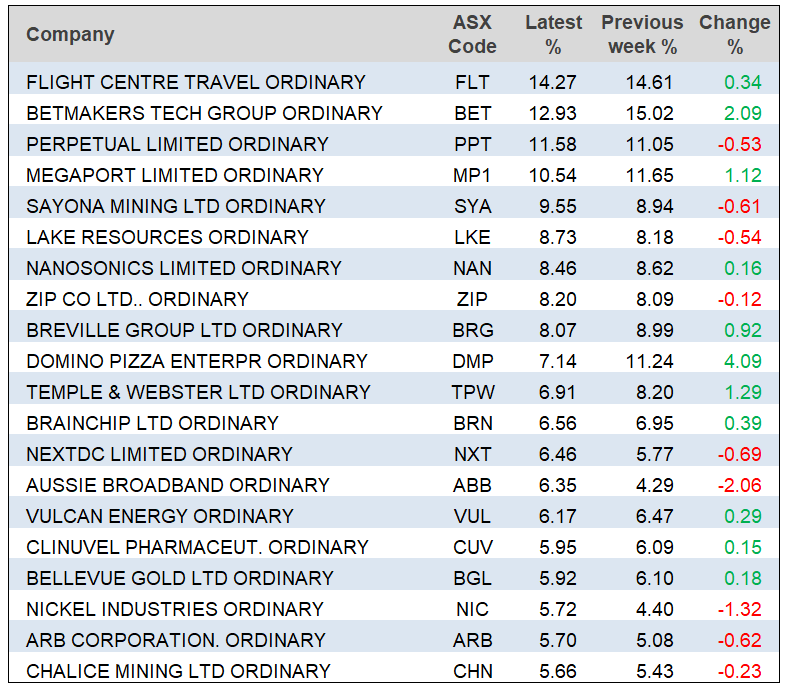

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

In Australia, the October inflation reading at 6.9% was down from 7.3% the previous month. It was that data and Powell’s statement that smaller rate hikes could start from December, that caused the S&P/ASX200 to spike sharply mid-week. However, local markets ended weaker on the Friday on thin trading as markets waited for further US and European data releases.

Source: nabtrade

Clearly, as we approach year end it is inflation that is driving markets. But perhaps what is yet to be fully priced into markets is the effects of inflation. inflation goes hand in hand with rising interest rates, which in turn causes consumers to tighten the purse strings. We are still waiting for the latter, but more importantly we are still waiting for analysts to push that anticipated falling consumer demand into their data bases and come out with revised earnings forecasts for leading corporates

That may happen before the next reporting season in March, so although the tepid rally currently taking place may well continue into the New Year, a soothsayer may suggest ‘Beware the ides of March’, which for a bit of trivia refers to the murder of Roman dictator Julius Caesar on March 15, 44BC. The market is expected to open the week higher this morning, based on ASX SPI 200 Futures trading up 20 points (0.27%) to 7,334.00 at 7.30am (05/12/22). – Damon Firth Switzer Daily

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances