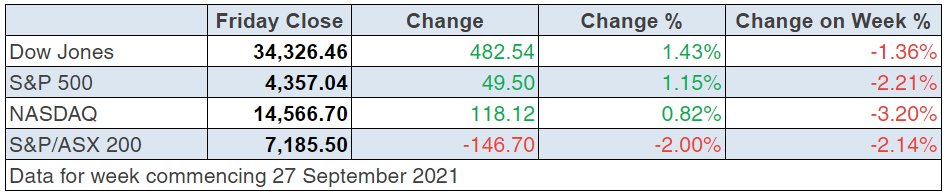

Who would have expected a 482 point gain on the Dow after such a negative week? This why I get up at 4.30 am each Saturday morning to write this column, rather than pen it the night before. Wall St can be so unpredictable and those positive Yanks drive stock markets worldwide on nearly a daily basis. This morning I bring good news in a story I thought would basically explain recent market negativity, as September often dumps on stocks each year.

The Dow Jones Industrial Average was up over 500 points when I flipped out the laptop and finished the S&P 500.

And the Nasdaq has been punished of late because rising bond yields hit tech stocks for reasons best accepted by the big influencers/fund managers who drive stock prices.

One day I will really test out the logic of the tech stocks/bond yields relationship but it will be only an academic exercise because it is what it is. When bond yields rise, tech stocks get sold, that is, until the market buys them again!

I will also get to the bottom of why September is a shocker for stocks. Jacob Sone [1]nshine of Barrons.com

shone some light on the history. “September is usually one of the worst months of the year for the stock market, but shares do better at times when they have already done well,” he explained. “Over the years dating back to 1928, the average September return for the S&P 500 [2] has been a loss of 0.99%. That makes the month far worse than May, which ranks second in providing gloom for investors with an average loss of 0.11%.”

But wait, there’s more, and it shows you why Warren Buffett has said “If past history was all that is needed to play the game of money, the richest people would be librarians.”

This from Sone [1]nshine reinforces Warren’s point: “History indicates that September 2021 could be a good month for stocks. In the years since 1928 when the S&P 500 rose by more than 13% for the first six months, the index’s median September gain was 1.4%, according to Fundstrat. Through June this year, the broad market benchmark rallied 14%.”

But history let us down, with the S&P 500 slugged by 5% for the month and our S&P/ASX 200 was off by a less dramatic 2%.

So why was Wall Street positive overnight with every sector in the green after a rough week earlier?

Well, for starters, bond yields did go lower so tech stocks went higher! But the left-field stimulus for stocks came from drug company Merck after it announced that its oral Covid-19 fighting drug has reduced the risk of hospitalisation or death by 50% for patients with mild or moderate cases.

This has been seen as an enormous fillip for the reopening trade plays and any stock that will be a beneficiary of the economy steaming faster towards normalcy. Merck’s stock was up about 9% on the news.

Travel stocks spiked and so did financials reinforcing a theme I’ve been tipping that value stocks will be winners in the near term. I also find it interesting that Caterpillar was up 1.55%, which is a bellwether stock for materials, so it will be interesting to see how the miners perform on Monday.

And not surprisingly with this good drug-economy-affecting news that oil company Exxon’s stock price was 3.6% higher.

To sum up my view on what lies ahead, Tom Lee of Fundstrat, whose market views I’ve often shared with you, came up with the following on CNBC early this morning on the September sell off: “That’s just a squiggle. As we zoom out, it’s going to look like nothing in 12 months. I know investors are nervous, and there’s a lot of headwinds here, but as you know, when the wall of worry is big, that’s often a good opportunity for investors,” Fundstrat’s Tom Lee said on “Halftime Report.”

One last important thing to note: often in early October, the September sell off gets a rerun and some big crashes do show up in the month. But history can hose down fears because it can kick off the positive period for stocks from November to April.

According to the Stock Trader’s Almanac, the S&P 500 averages a 0.8% gain in October, while November is 1.6% and December 1.5%. Go history!

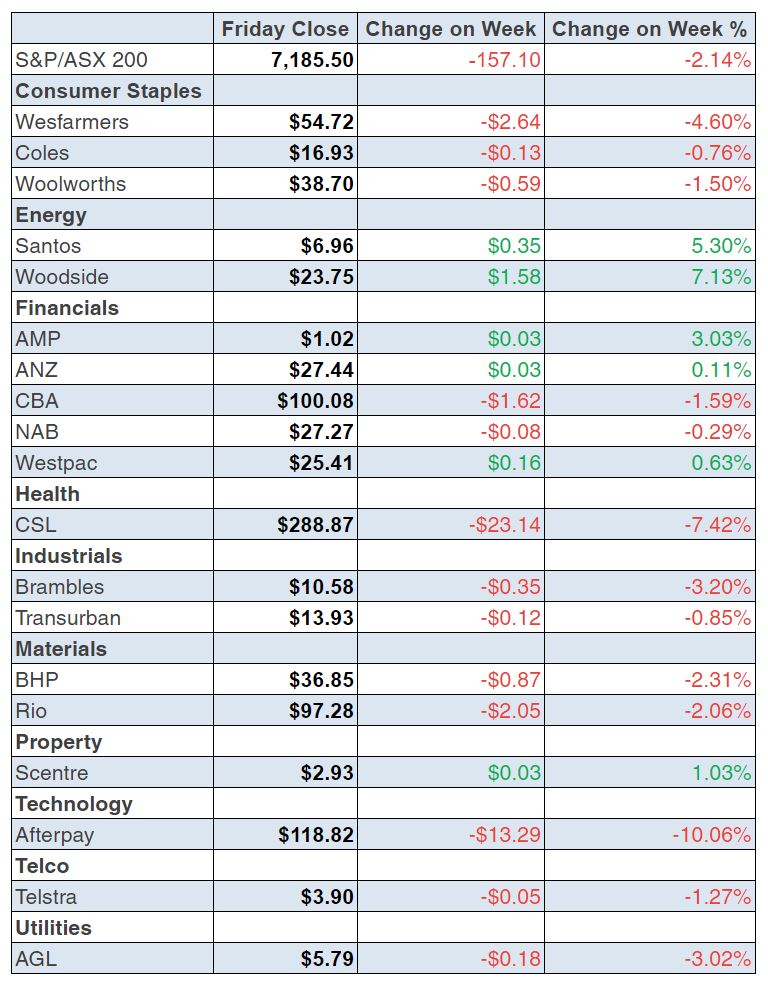

To the local story and the S&P/ASX 200 Index gave up 2.1% over the week and the volatility was best captured by the fact that we saw the Index up 1.9% on Thursday before a 2% (or 146 point) drubbing on Friday!

This is a volatile period we’re in for stocks but we will get a buying opportunity before we see stocks hopefully resume their march higher in the December to April months.

It’s been a good week for travel plays, with Qantas boss Alan Joyce determined to get us out of the country by December. And the pressure is mounting on border-closed premiers to get real about reopening their states.

The AFR pointed out that “Flight Centre firmed 1.8 per cent to $21.85, Webjet advanced 2.1 per cent to $6.47, Qantas climbed 0.7 per cent to $5.71 and Helloworld Travel closed 5.5 per cent higher at $2.70.”

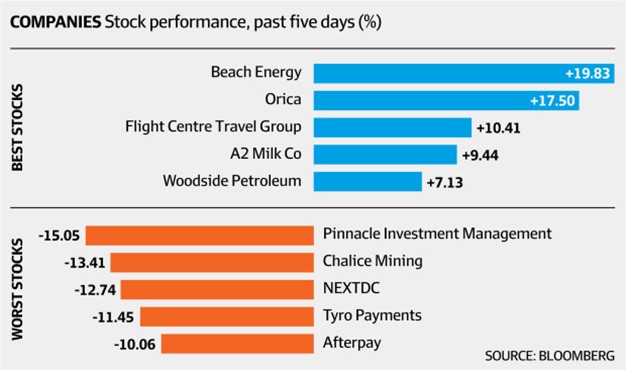

Let’s look at the big Bloomberg winners and losers.

Personally, I think there were some crazy sell offs but I come from the long-term investor perspective. Short-term players would’ve sold off a stock like Tyro for profit-taking reasons, which provides us ‘slow coach’ investors with a buying opportunity.

Nice to see A2Milk have a good week and Woodside, which gained as energy shortages have led to big price spikes for oil and gas.

Meanwhile, the banks and big iron ore miners had a rough week, with both the CBA and BHP down over 2% for the week. But I bet in 12 months’ time both stocks will be a lot higher.

A blue-chip buying opportunity is on the way, provided you’re prepared to be a waiter!

What I liked

- Building approvals rose by 6.8% in August and low interest rates and not being able to fly overseas possibly is helping the building boom.

- Private sector credit (loans outstanding) rose 0.6% in August to be up 4.7% on the year.

- The ANZ/Roy Morgan consumer sentiment index rose 0.4% in the past week to a 10-week high of 103.7.

- The federal budget was in deficit by $134.2 billion in 2020/21 or 6.5% of GDP – the biggest deficit as a share in GDP in 75 years. Big but $27 billion less than expected!

- The Australian Bureau of Statistics (ABS) reported that the value of engineering construction (includes structures like bridges, roads and dams) rose by 3.2% in real terms (inflation-adjusted) in the June quarter. Given that we are about to enter October, this data is one of the more ‘historic’ releases in recent times.

- The US economy grew at an annual rate of 6.7% in the June quarter.

- The Chicago purchasing managers index fell from 66.8 to 64.7 in September (survey: 65). It’s a fall but it’s a big number.

- The US S&P/Case-Shiller home price index in July was 19.9% up on a year ago (survey: 20%)

- Durable goods orders rose by 1.8% in August (survey: 0.7%).

What I didn’t like

- Retail trade fell by 1.7% in August to be down 0.7% on a year ago.

- Job vacancies fell by 9.8% in the three months to August — blame lockdowns.

- US consumer confidence fell from 115.2 to 109.3 in September (survey: 114.5)

- US Treasury Secretary Janet Yellen also urged lawmakers to avert a government shutdown and raise the debt ceiling, warning that failure could cause “serious harm” to the economy.

- In testimony to the Senate, US Federal Reserve Chair, Jerome Powell,noted: “As reopening continues, bottlenecks, hiring difficulties, and other constraints could again prove to be greater and more enduring than anticipated, posing upside risks to inflation.”

- Investors watched attempts by Congress to avoid a government shutdown and suspend or raise the debt ceiling. Also, US Federal Reserve chair, Jerome Powell, referred to “tension” between high inflation and a higher-than desired level of unemployment.

Why stocks are sliding now

CommSec’s Craig James had a shot at why stocks are giving into gravity right now, and here they are:

- Inflation concerns.

- Rising bond yields.

- The Evergrande debt crisis in China.

- Fears that a power crisis could crimp Chinese economic growth.

- Rising oil prices (largely relates to first two issues).

- Central bank policy.

- Uncertainty over a US government shutdown and need to raise the debt ceiling.

- Covid issues: rising Delta cases; rising vaccination rates.

- Global supply chain issues.

- Sector rotation: from ‘growth’ to ‘value’.

- Geopolitics.

- Falls in iron ore prices (Australia).

- September – traditionally a softer month for share markets.

Even with all this I’m betting on positivity and that Merck news could be a gamechanger for reopening of economies and buoyant stock prices. Go life!

The week in review:

- Read my article on whether there is Still time to load up on the banks – except for Commonwealth bank (CBA)? [3]

- Paul Rickard looks at Transurban (TLC) and whether you should take up your entitlements, and perhaps buy more? [4]

- James Dunn has a deeper look at 3 potentially rewarding medical device stocks [5]

- Tony Featherstone explores two vehicle financiers that stand out, Money3 Corporation (MNY) & MoneyMe (MME) [6]

- For our “HOT” stocks this week, Raymond Chan from Morgans explores both APA Group (APA) & Brickworks Limited (BKW) [7] while Michael Gable from Fairmont Equities talks about Fortescue (FMG) [8]

- In Buy, Hold, Sell – What the Brokers Say this week, there were 9 upgrades and 3 downgrades in the first edition [9], and in the second edition there were 3 upgrades and 2 downgrades [10].

- And in Questions of the week [11], Paul Rickard answered questions from subscribers about Magellan Financial Group (MFG), APA Group (APA) and Bubs Australia (BUB)

Our videos of the week:

- Webinar: Is there a stock market rotation on? What stocks will win and which ones will lose? [12]

- Are the banks a buy? These stocks look HOT: Bluescope, GDC, WPL & more! | SwitzerTV: Investing [13]

- Hot retail stocks: UNI, DSK,JYC. Is BHP in the buy zone? + Property Prices: Up or down? [14]

Top Stocks – how they fared:  The Week Ahead:

The Week Ahead:

Australia

Tuesday October 5 – Reserve Bank Board meeting

Tuesday October 5 – Job advertisements (September)

Tuesday October 5 – Retail trade (August)

Tuesday October 5 – International trade (August)

Tuesday October 5 – New vehicle sales (September)

Thursday October 7 – Weekly payroll jobs & wages (Sept 11)

Thursday October 7 – Purchasing manager index: Services

Friday October 8 – Financial Stability Review

Overseas

Monday October 4 – US Factory orders (August)

Monday October 4 – US New vehicle sales (September)

Tuesday October 5 – US International trade (August)

Tuesday October 5 – US Purchasing managers: Services

Wednesday October 6 – US ADP Employment (September)

Thursday October 7 – US Challenger job cuts (September)

Thursday October 7 – US Consumer credit (August)

Friday October 8 – US Nonfarm Payrolls (September)

Friday October 8 – China Purchasing managers: Services

Food for thought: “Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business”– Peter Lynch

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

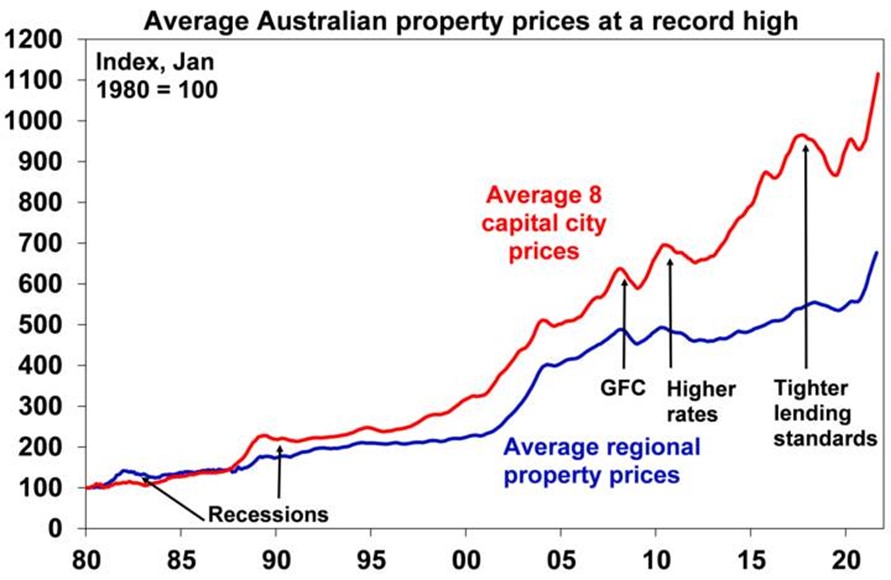

Chart of the week:

Chart of the week:Shane Oliver from AMP Capital shared the following chart this week and says ‘after a dip around mid-last year in response to the initial national coronavirus lockdown, average residential property prices have since risen around 20% according to CoreLogic.’

Top 5 most clicked:

Top 5 most clicked:- 3 potentially rewarding medical device stocks [5] – James Dunn

- Still time to load up on the banks – except for CBA? [3] – Peter Switzer

- Transurban: should you take up your entitlements, and perhaps buy more? [4] – Paul Rickard

- Questions of the Week [11] – Paul Rickard

- My take on Money3 & MoneyMe [6] – Tony Featherstone

Recent Switzer Reports:

- Monday 27 September: Still time to load up on the banks – except for CBA? [15]

- Thursday 30 September: My take on Money3 & MoneyMe [16]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.