‘Defensive’ stocks classically do better when the market is under pressure and are left behind when the market soars. They have reliable earnings that are predictable, relatively immune to the risk of exogenous shocks and low but steady growth. They make great income stocks because you can almost “bank” their dividends, and provided they can grow earnings over time, their capital price should also grow.

Here are five of my favourites. The criteria I applied include:

- No banks;

- No resource companies (because they are ‘price-takers’ and have almost no influence over the revenue they earn);

- ASX top 150;

- Reasonably defensive (as demonstrated quantitatively by a low beta and overlaid with my qualitative assessment);

- Expectation that earnings should continue to grow;

- Forecast dividend yield higher than 3.0%;

- Preference for franking; and

- Variety of industry sectors to support diversification objectives.

Here are the five (in alphabetical order).

1. Amcor (AMC)

Sector: Materials

Last price: $15.14

Broker Target Price: $18.075

FY22 Forecast Dividends 65.0c FY22 Forecast Yield: 4.3%, unfranked

FY23 Forecast Dividends 66.6c FY23 Forecast Yield: 4.4%, unfranked

Beta: 1.19

Leading packaging manufacturer Amcor might sound like a strange choice for a defensive stock, particularly with a 5 year historical beta of 1.19, but since acquiring the US-based Bemis Company in 2019, earnings reliability has increased and the stock has been less volatile.

Amcor provides packaging solutions (flexible packaging and rigid plastics) for the global food, beverage and pharmaceutical sectors which are in themselves quite defensive sectors. It operates in more than 40 countries, with 225 manufacturing sites, 46,000 employees and sales over US$13.0bn.

In the first half of FY22, Amcor grew sales by 2% on a constant currency basis, EBIT (earnings before interest and taxes) by 6% and EPS (earnings per share) by 9%. In February it re-affirmed guidance for the full year of EPS growth of 7% to 11% and increased the size of its on-market buyback by US$200 million to US$600 million.

Its primary listing is on the New York Stock Exchange, and as such, reports quarterly and pays dividends quarterly. The analysts forecast these to total AUD 65.0c in FY22 and 66.6c for FY23, putting it on a yield of 4.3% for FY22 and 4.4% for FY23. With the vast bulk of earnings being derived in the US and Europe, the dividend is unfranked.

At $15.14, Amcor is trading on the relatively undemanding multiple of 14.2 times forecast FY22 earnings and 13.5 times FY23 earnings. The dividend payout ratio looks sustainable at 61%.

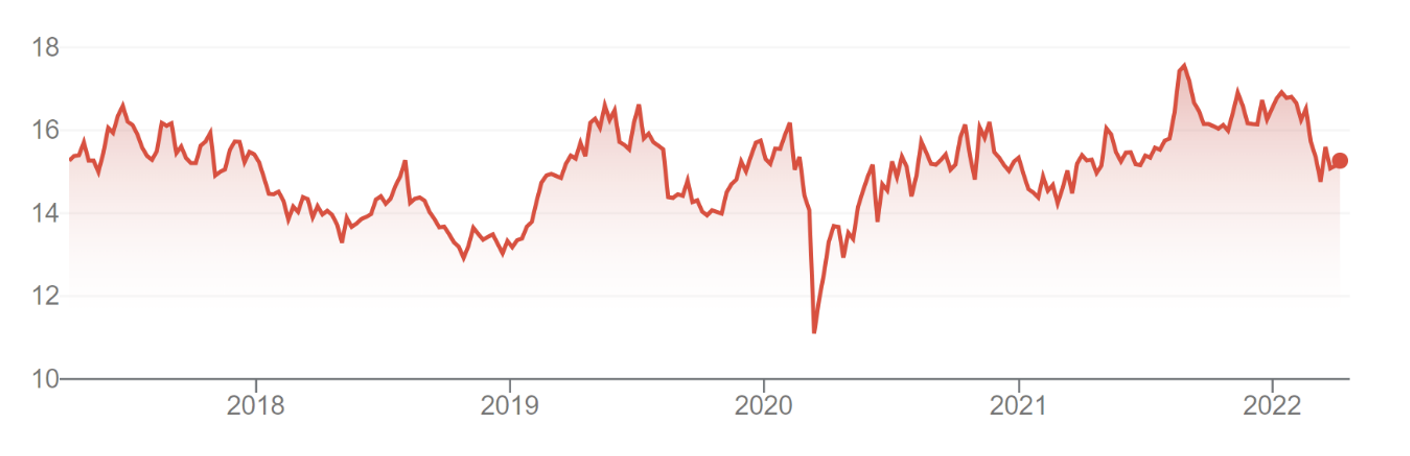

Amcor (AMC) – 4/17 – 4/22

Source: ASX

Risks include currency (if the AUD appreciates, Amcor’s earnings will be impacted), and environmental with the headwind of sustainable, less voluminous packaging. Amcor says that it is investing in what it calls “responsible packaging”, and is committed to making all of its packaging recyclable or reusable by 2025. Raw material and energy costs, as well as supply chain issues, could also impact performance.

Amcor operates in Russia and Ukraine. It has scaled down its operations in Russia and proactively closed in Kharkiv. Macquarie estimates that Russia represents 2% to 3% of annual sales.

2. Charter Hall Long WALE REIT (CLW)

Sector: Real Estate

Last price: $5.34

Broker Target Price: $5.56

FY22 Forecast Dividends 30.6c FY22 Forecast Yield: 5.7%, unfranked

FY23 Forecast Dividends 31.1c FY23 Forecast Yield: 5.8%, unfranked

Beta: 0.84

Charter Hall Long WALE REIT is a $7.0bn property trust that owns a portfolio of high-quality real estate assets with a long WALE (weighted average lease expiry). The WALE is currently 12.2 years.

There are 549 assets across industrial and logistics, retail, office, telco exchanges and agri-logistics. By value, approximately 23% is in industrial, 42% in retail (BP service stations, pubs and bottle shops), 19% in office and the balance of 17% in social infrastructure and agri-logistics. The portfolio occupancy is 99.9%.

CLW boasts a “best in class” tenant register. Major tenants include the Endeavour Group (18%), Government or government-owned entities (18%), Telstra (13%), BP (10%), Inghams (5%), Coles (4%) and David Jones (4%).

Look through gearing is 30.8%. The weighted average debt maturity is 5.5 years, with staggered maturities over a 5 year period from FY24 to FY32.

For FY22, it has guided to operating EPS of no less than 30.5c per unit, representing growth of no less than 4.5% over FY21. With the Brokers expecting that this will be fully paid out to unitholders, this puts CLW on a yield of 5.7% (unfranked).

The brokers remain favourably disposed. According to FNArena, of the 4 major brokers that cover the stock, there are 4 buy recommendations. The consensus target price is $5.56 (range of $5.23 to $5.85). The last reported NTA (net tangible asset value) is $5.89 per unit as at 31 December.

Charter Hall Long WALE REIT (CLW) – 4/17 – 4/22

Source: ASX

3. Coles (COL)

Sector: Consumer Staples

Last price: $17.89

Broker Target Price: $18.81

FY22 Forecast Distribution 60.7c FY22 Forecast Yield: 3.4%, 100% franked

FY23 Forecast Distribution 65.9c FY23 Forecast Yield: 3.7%, 100% franked

Beta: 0.72

Experience says that eight out of ten times, you are better off sticking with the “market leader” rather than the “number two”. But the gap between Coles (COL) and leader Woolworths (WOW) is closing and there is more to like about Coles now.

Coles (COL) -11/18 – 4/22

Source: ASX

Whether a discount on forward price multiples of almost 24% is sufficient (Coles is trading at a multiple of 23.7 forecast FY22 earnings, Woolworths at 31.0 times forecast FY22 earnings) only time will tell, but for income seekers, Coles is pretty “rock solid” when it comes to the dividend. With most brokers forecasting total dividends of about 60c in FY22 rising to almost 66c in FY23, this puts Coles on a prospective dividend yield of 3.4% to 3.7% (fully franked).

Coles is a classic “income stock” – with predictable top line and bottom line numbers, low beta (market volatility), and for the shareholder, reliable and consistent dividends. Further, if Management can execute well, it has the opportunity to close the gap on the market leader.

Brokers see upside, with a consensus target price of $18.81. The range is a low of $17.25 through to a high of $19.70.

4. Medibank Private (MPL)

Sector: Financials

Last price: $3.05

Broker Target Price: $3.38

FY22 Forecast Distribution 12.9c FY22 Forecast Yield: 4.2%, 100% franked

FY23 Forecast Distribution 13.7c FY23 Forecast Yield: 4.5%, 100% franked

Beta: 0.69

Despite the challenges facing private health insurance, in particular participation and affordability, I like Medibank Private because, over the last few years, it has increased its number of policyholders and its market share. When you are the clear market leader in a highly regulated market, this is hard – so this tells me that the team at Medibank is executing well. Further, it is advancing a number of initiatives such as in-home care, health and wellbeing services, and telehealth ancillary services to create a competitive advantage in health insurance.

In the first 6 months, Medibank grew the number of policyholders by 1.5% or 28,100. Market share increased to 27.34%.

For the full year, Medibank has guided to policyholder growth of between 3.1% and 3.3% including continued growth in the premium ‘Medibank’ brand, a 2.3% increase in average claims expense per policy unit, management expenses of $530 million and a productivity target of $15 million.

The brokers are forecasting a total dividend of 12.9c for FY22, rising to 13.7c per share for FY23. At $3.05, a yield of 4.2% to 4.5%, fully franked.

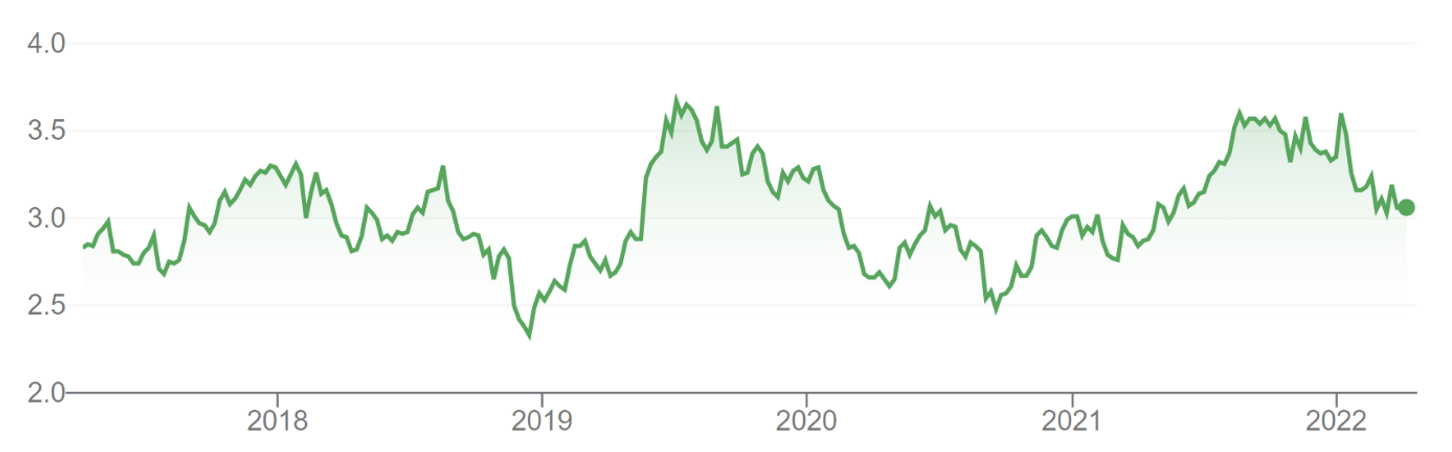

Medibank Private (MPL) – 4/16 – 4/22

Source: ASX

Medibank has pulled back this year, and the brokers now see more value. The consensus target price is $3.38. According to FNArena, there are 4 ‘buy’ recommendations, 2 ‘neutral’ recommendations and 1 ‘sell’ recommendation, with the range of target prices from a low of $3.00 to a high of $3.65.

5. Telstra (TLS)

Sector: Communication Services

Last price: $3.94

Broker Target Price: $4.43

FY22 Forecast Distribution 16.0c FY22 Forecast Yield: 4.1%, 100% franked

FY23 Forecast Distribution 16.0c FY23 Forecast Yield: 4.1%, 100% franked

Beta: 0.75

After almost a decade of declining earnings, Telstra has turned the corner. In the December half, underlying EBITDA was up 5.1% to $3,495 million. Sequentially, Telstra achieved earnings growth of $41 million in the second half of FY21 and $130 million in the first half of FY22. For the second half of FY22, it is guiding to further growth of up to $300 million, which would take the full year outcome from $7.0bn to $7.3bn.

This is taking Telstra closer to it its target underlying EBITDA of $7.5bn – the number required to sustain the dividend (once the one-off proceeds from the NBN end) at 16c per share.

The major brokers are positive on Telstra, with a consensus target price of $4.43. The range is a low of $4.00 through to a high of $4.60. According to FNArena, there are 4 ‘buy’ recommendations and 1 ‘neutral’ recommendation.

Telstra (TLS) – 4/17 to 4/22

Source: ASX

Looking ahead, the brokers have Telstra trading on a multiple of 28.2 times forecast FY22 earnings and 23.4 times forecast FY23 earnings. Each of the brokers forecasts a dividend of 16c per share for FY22 and for FY23.

Telstra is low risk, almost an annuity-style of stock where you can pencil in the 16c fully franked dividend. It is no rock star, but under CEO Andy Penn (and hopefully CEO designate Vicky Brady), it will deliver on its key promise of low single-digit earnings growth.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.