Share prices are arbitrary levels – there’s not much difference between a stock priced at 50 cents or $5 in terms of their attractiveness, if the companies are able to grow their value. But just looking at “$5 stocks,” here are five in that range that look to offer good buying opportunities.

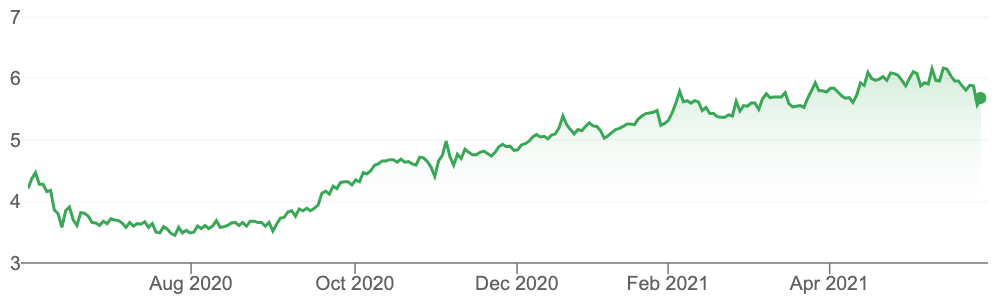

1. CSR (CSR, $5.59)

Market capitalisation: $2.7 billion

Three-year total return: 9.4% a year

Estimated Y22 dividend yield: 4% fully franked (grossed-up, 5.8%)

Analysts’ consensus valuation: $6.40 (Thomson Reuters), $6.395 (FN Arena)

Because its financial year ends on March 31, building products group CSR has already reported for FY21, delivering a rebound in net profit. CSR’s net profit rose 19 per cent to $160 million, which “beat” analysts’ consensus of about $156 million, with the flagship building products business delivering an 8% rise in earnings, and a margin that improved from 10.7% to 12%. This was despite a COVID-driven slowdown in residential construction activity, down 4 per cent over the year. The aluminium business’ earnings fell by 60% to $23 million, in line with previous guidance, after aluminium prices fell sharply at the start of the financial year: however, CSR expects aluminium earnings for FY22 financial year to be in the range of $32 million –$40 million.

In the main business, CSR is seeing strong growth on the back of the renovation boom. The company expects the Australian housing market to remain solid, with the government’s HomeBuilder program (extended in the recent Budget) supporting the sector into 2022. It is the improved housing cycle and rising Australian housing starts forecasts that are likely to underpin CSR’s earnings outlook, and brokers have started to upgrade profit expectations. CSR declared a final dividend of 14.5 cents, compared to no dividend in the previous year. On broker consensus expectations, the stock is also an attractive yield proposition, after a healthy payout in FY21 – excluding special dividends, the full-year ordinary dividend was 23 cents a share, up from 10 cents in FY21, which saw the final dividend ditched amid the COVID turmoil.

CSR (CSR)

Source: Google

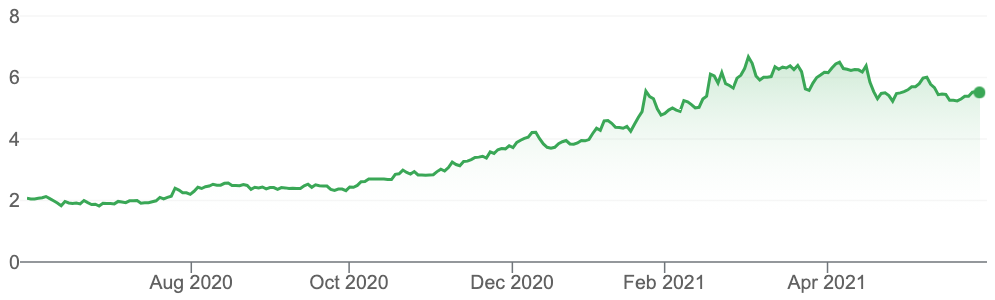

2. Lynas Rare Earths (LYC, $5.57)

Market capitalisation: $5 billion

Three-year total return: 35.7% a year

Estimated Y22 dividend yield: no dividend expected

Analysts’ consensus valuation: $6.25 (Thomson Reuters)

Australian rare earths producer Lynas Rare Earths is in a very enviable position as a business: it has the world growing increasingly keen on its products, which are major constituents of electric vehicles (EVs) and batteries, renewable energy, consumer electronics, robotics, appliances and medical devices; and it is the only non-Chinese producer of these separated rare earth products. For example, broker UBS expects the market, just in EVs, for LYC’s major product, neodymium-praseodymium (NdPr), to triple in size over the next ten years. Aside from NdPr, which is also used in batteries and wind turbines, consumer electronics, robotics, appliances and medical devices, the company’s dysprosium, terbium, lanthanum and cerium products are also finding new uses in these areas. Lynas’ exposure to global thematic megatrends is first-class.

Lynas mines rare earths at its world-leading orebody at Mt. Weld in Western Australia, which is expected to grow as further exploration is conducted, and operates the largest single rare earths processing plant in the world, in Malaysia, which it built in 2012 to process rare earth material at a lower cost than it could in Australia (the Malaysia plant is struggling with the country’s COVID restrictions at the moment.)

Lynas has an ambitious 2025 plan to grow its processing capabilities, including a fully funded rare earths processing facility in Kalgoorlie, Western Australia, which is expected to begin operations by July 2023, and a commercial light rare earths separation plant in the US – co-funded by the US Department of Defense, which tells you how keen the US is on having a non-Chinese supply option – which may also include processing of heavy rare earths and specialty materials. By 2025, Lynas plans to have a production capacity of at least 10,500 tonnes a year of NdPr (to put that in context, first-half FY21 production was 2,709 tonnes) and to have its Kalgoorlie facility able to supply downstream operations in the US and Malaysia. As an investment exposure to the technologies of the future, LYC is right up there with the best of them.

Lynas Rare Earths (LYC)

Source: Google

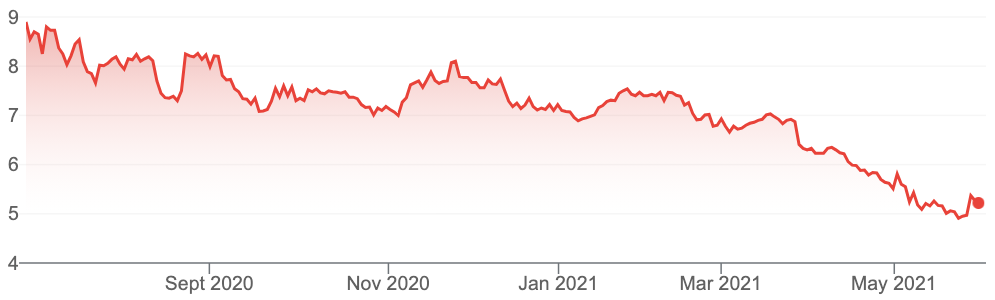

3. TPG Telecom (TPG, $5.21)

Market capitalisation: $9.8 billion

Three-year total return: 0.7% a year

Estimated Y22 dividend yield: 2.2% fully franked, grossed-up 3.1%

Analysts’ consensus valuation: $7.60 (Thomson Reuters), $7.70 (FN Arena)

Full-service telecommunications provider TPG Telecom was created from the $15 billion merger between TPG Telecom and Vodafone Hutchinson Australia in June 2020, which resulted in the formation of the second-largest telecommunications company listed on the ASX, behind Telstra. TPG owns and operate nationwide mobile and fixed networks, operating a swag of brands including Vodafone, TPG, iiNet, AAPT, Internode and Lebara.

The stock has lost about 41% since the merger, hit like most businesses by continuing uncertainty due to COVID, and also some major resignations, most notably that of founder and chairman David Teoh, who in March resigned from the board of the business that he and his wife created in 1992. The sharemarket was unimpressed with the founder’s resignation, mainly because of the potential share “overhang” that came from Teoh, his family and associates holding 17.1% of TPG Telecom, albeit with 80% of that holding subject to an escrow until the end of June 2022.

It’s also fair to say that the 2020 result (TPG uses the calendar year as its financial year) was a disappointment: while the merged entity reported a net profit of $734 million in its first full-year result since merging, that was all courtesy of a one-off tax credit of $820 million. The pro forma result, which simulated the figures if the merger had been effective throughout 2019 and 2020, showed a 10% fall in net profit to $282 million, on the back of a 6% slide in revenue, to $5.52 billion.

However, the fixed broadband subscriber base increased by 6% from 2019 to 2.17 million, while the NBN base lifted 28% to 1.9 million. That represents net subscriber gains of 532,000 people. Tempering that was the fact that the mobile customer base went backward, hit by the absence of overseas visitors and migrants to Australia, especially international students, due to global travel restrictions.

The lack of formal guidance also worried the market, although the company did say: “Even with continuing uncertainty due to COVID, our year-to-date results are tracking well against our expectations and we will enter the second half of 2021 with increased confidence. We have moved into 2021 with increased momentum and confidence. We are already a third of the way through 2021 and we are tracking well against our forecast for the year.”

While broker consensus sees further profit falls this year, a recovery is expected to start in 2022 – on that basis, the short-term price weakness should be seen as a buying opportunity.

TPG Telecom (TPG)

Source: Google

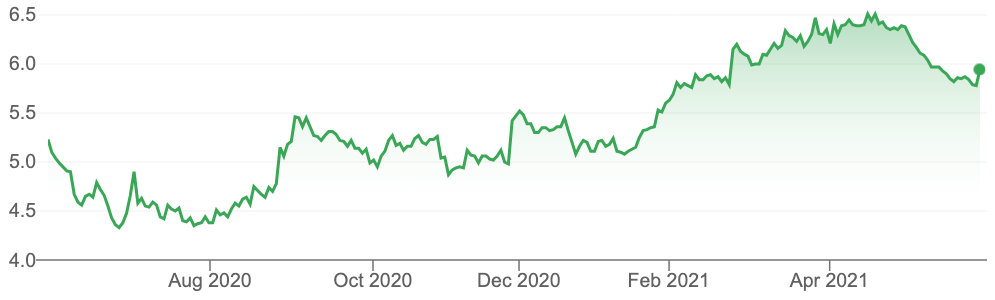

4. Bega Cheese (BGA, $5.86)

Market capitalisation: $1.7 billion

Three-year total return: –5% a year

Estimated Y22 dividend yield: 2.8% fully franked (grossed-up, 3.9%)

Analysts’ consensus valuation: $6.80 (Thomson Reuters), $6.78 (FN Arena)

Founded in 1899 as a farmer co-operative on the New South Wales south coast, Bega Cheese came to the ASX in 2011 and has burgeoned into a major player in branded food. It made a major step in 2017 with the $460 million purchase of the iconic Vegemite brand (plus and a handful of other grocery products from global food giant Mondelez International; in January, the company completed the $560 million purchase of the Lion Dairy & Drinks milk, yoghurt and juice operations, which gave Bega big brands such as Dairy Farmers, Yoplait, Big M, Masters and Farmers Union.

Bega Cheese is now one of Australia’s largest dairy businesses, with the Lion stable of brands more than doubling the size of Bega to a revenue base of about $3 billion, and greatly improving its platform for further growth in international markets. Broker Morgans says the combined businesses will generate 80% of revenue from more stable branded product sales (versus 62% before), reducing the group’s exposure to the more volatile, commodity-driven bulk earnings. This is a healthy change, given that the company’s bulk-products markets have been hit by trading conditions in its main markets and the effects of COVID-19 on international travel and the “daigou” retail channel (in which individuals or groups outside China buy products in bulk to sell in China).

In the first six months of FY21, BGA’s normalised EBITDA (earnings before interest, tax, depreciation and amortisation) grew by 51% to $73 million, and net profit rose 98%, to $29.7 million, despite a 4.5% revenue decline, to $708 million. It was generally a stronger result than the market expected, and price targets rose as a result. Bega Cheese looks attractive value at present levels.

Bega Cheese (BGA)

Source: Google

5. Life 360 (360, $5.74)

Market capitalisation: $901 million

Three-year total return: n/a

Estimated Y22 dividend yield: no dividend expected

Analysts’ consensus valuation: $8.67 (Thomson Reuters), $8.30 (FN Arena)

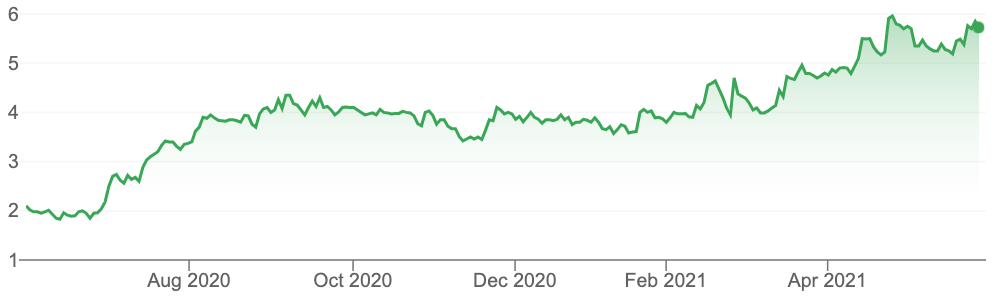

The San Francisco-based Life360 was one of my ‘Five Stocks For 2021’ back in January in the Investment Outlook 2021 eBook [1] and it has moved nicely from $3.77 to $5.75 – but brokers think it has quite some way to go yet. The company developed the Life360 mobile app, a market-leading app that provides a safety and coordination service for families, with features that range from location and communication, driving safety (including real-time speed monitoring), car crash alerts and roadside assistance, SOS alerts, identity protection, and disaster, medical and travel assistance. As at March 2021, Life360 has more than 28 million monthly active users (MAU), in more than 140 countries.

The really interesting thing about Life360 is that the company is scaling-up from a location tracking app to a suite of membership services – the company describes it as moving from a “where are you?” focus to a “how are you?” focus. Membership was launched in July 2020, only to be hurt by COVID, as the core features of the product became less relevant while people were not able to be out and about as much. Back in January I said, “This is poised to rebound as normal life slowly returns” – and that’s what the company has seen.

In the March 2021 quarterly report, CEO Chris Hulls said: “We are excited by Life360’s accelerating growth momentum in the March quarter, particularly in the US where the benefits of the vaccine rollout are beginning to be felt. We are encouraged that the early signs of recovery in Australia are now being replicated in our largest market, the US. Globally, new registrations are at their highest level since March 2020, prior to the onset of COVID. In the US, organic registrations increased 13% versus the December quarter; additionally, the month of March delivered the strongest growth in Paying Circle additions since November 2019 and this is with our much higher priced Membership plans. It is very encouraging to see that as COVID infections and restrictions reduce, we see a corresponding positive impact on our growth rates. This reinforces our confidence that COVID is turning from a headwind in 2020 to a tailwind in 2021.”

I considered this stock for last week’s article on small and unknown (to investors, that is) global leaders [2], and it really can be viewed that way – as a global leader in a potentially massive market. The primary growth target is the English-speaking nations, although the company thinks there will be “strong cultural overlap” with EU markets. The membership model is really only just getting started.

Life360 is not profitable yet, but the company has outlined the pathway to profit. In its formal 2021 guidance (it is a calendar-year reporter), Life360 says that by December 2021 it anticipates delivering annualised monthly revenue in the range of US$110 million–US$120 million, and based on the planned investment in growth, it expects an underlying EBITDA loss of no greater than US$15 million (in 2020 the loss was US$16.3 million, and in 2019 it was $29 million).

Life360 (360)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.