Westpac’s decision to amend the terms of its off-market share buyback will be applauded by shareholders. Because of the fall in Westpac’s share price since it was first announced in early November, it had become relatively unattractive.

Under the revised terms, the tender discount range is now 0% to 10% (previously 8% to 14%), and the $3.5bn share buyback closes on Friday 11 February.

Off-market share buybacks are essentially “tax” transactions and work for some shareholders but not others. In this article, I will crunch the numbers to show who should consider accepting and who shouldn’t, and at what tender discount. And if you do accept, what are your options about re-investing the cash?

Firstly, a re-cap on what makes ‘off-market’ share buybacks special, and how Westpac has structured this buyback.

What’s special about an ‘off-market’ buyback?

There are 2 main types of buybacks. An ‘on-market’ buyback is conducted on behalf of the company by a broker purchasing the shares on the ASX. The other type is an ‘off-market’ buyback. This is conducted through a tender process and provided it is an equal access scheme, allows a company to distribute surplus franking credits to its shareholders.

It is this distribution of franking credits that makes the ‘off-market’ buyback special. Part of the sale proceeds is treated as a franked dividend, with the other part treated as a capital component. Effectively, the shareholder gets a super-sized dividend with franking credits and a materially reduced sale price for capital gains tax purposes. This makes the ‘off market’ buyback tax advantageous to some shareholders, and because they are keen to accept, means that the company can purchase the shares at a discount to the market price on the ASX.

Westpac’s ‘off-market’ buyback

Shareholders will be offered the opportunity to participate and tender all, some or none of their shares, with the tender closing at 7.00pm on Friday 11 February.

The tender will be at a discount to the market price, in a range from 0% up to a maximum discount of 10%. Because the buyback is capped (the $3.5bn represents about 5.0% of Westpac ordinary shares), Westpac will accept tenders from those shareholders offering to sell at the lowest price (highest discount) and reject those offering to sell at a higher price (lower discount).

The buyback price comprises two components – a capital component of $11.34 and the balance as a fully franked dividend. If the market price of Westpac shares is (for example) $20.00 and the tender discount is 10%, then the buy-back price will be $18.00. This will comprise a capital component of $11.34 and a fully franked dividend of $7.66 per share.

The buy-back price will be the same for all tenders – so if the buyback is cleared at a discount of 6%, shareholders who nominate discounts of 7%, 8%, 9% and 10% will be successful and receive the price at a 6% discount. Rather than nominate a % discount, shareholders can also tender ‘final price’ (take whatever the market clears at). As a scale-back on a pro-rata basis is likely, Westpac has announced some priority rules – a priority allocation to each successful tenderer for their first 380 shares. Successful tenderers who are left with a residual holding of 75 shares or less after the scaleback will also have those holdings bought back in full.

The market price will be determined by calculating the volume-weighted average price of trades on the ASX over the 5 trading days up to and including the closing day (i.e. from 7 February to 11 February). The announcement of the buy-back price and any scale back will be made on Monday 14 February.

Shareholders worried about the Westpac share price during the buy-back period can optionally set a minimum buyback price (between $15.50 and $18.50). If your tender discount is successful (this also includes ‘final price’ offers), you will only be accepted if the buy-back price is equal to or above your minimum price.

Should I accept?

The premise is that you should accept the buyback if your effective sale price (after tax) is higher than you could achieve by selling the same shares on the ASX. If you feel that you want to maintain your Westpac shareholding, you just buy them back on the ASX.

Let’s compare the two alternatives – selling your shares on market at $20.00 or selling your shares in the buyback.

We will do this from the perspective of a SMSF in the pension phase paying tax at 0%, a super fund in the accumulation phase paying tax at 15% and who is eligible for a one-third CGT discount, and an individual paying tax at the highest marginal tax rate of 47%.

Because we need to consider the impact of capital gains tax, we will demonstrate the outcome where the shares were purchased for $15.00 and also for $25.00. For capital gains tax purposes, the disposal price is determined by the ATO after the buyback has concluded. It is the capital component of $11.34 plus the amount by which the tax value exceeds the buyback price, the former relating to the movement in Westpac’s share price over the buyback period. Westpac will announce this price shortly after the buyback has concluded. For these examples, we will assume it is $17.14 if the discount is 4%, and $18.34 if the tender discount is 10%.

Five examples are shown:

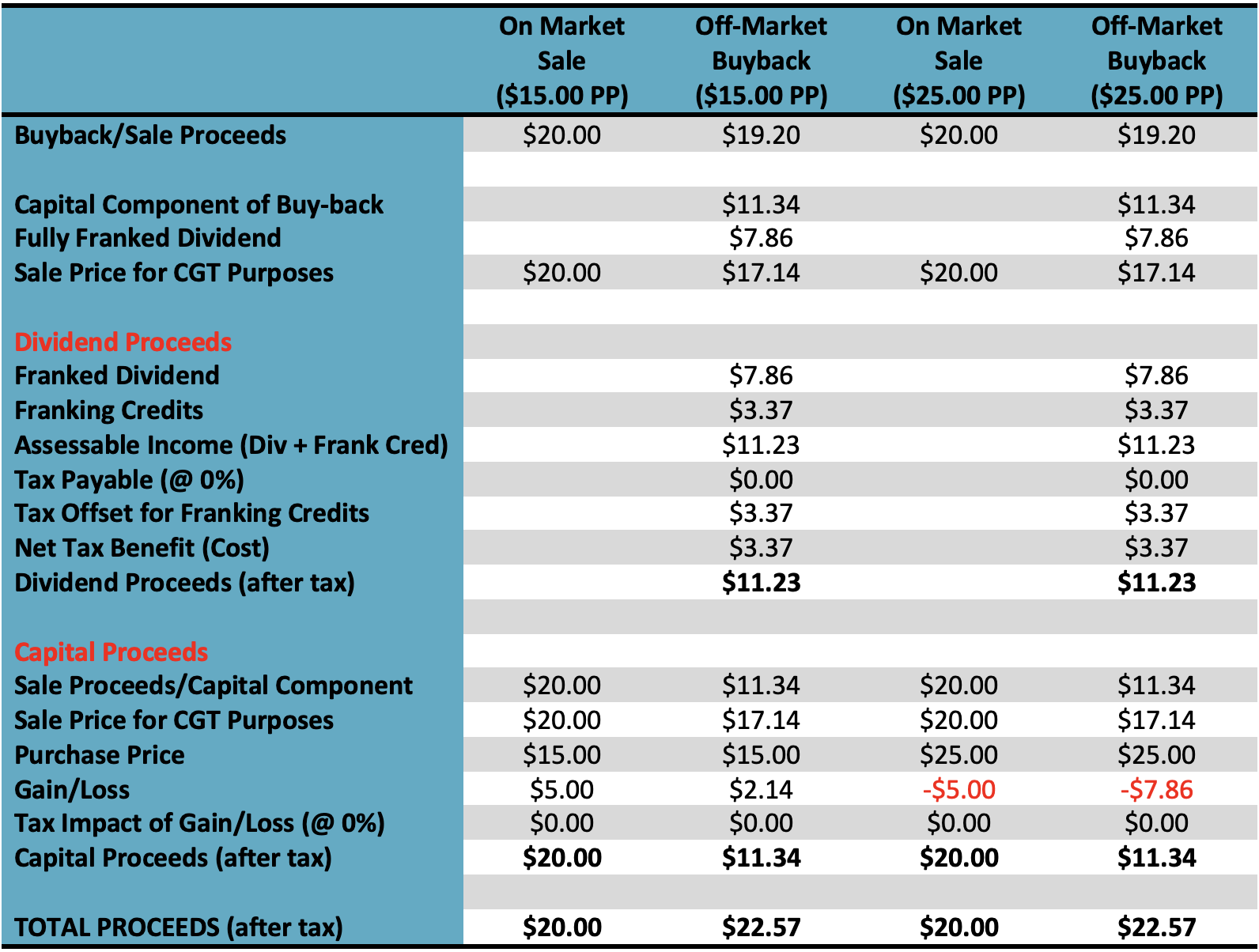

- Example 1: 0% taxpayer such as an SMSF in pension mode, 4% tender discount;

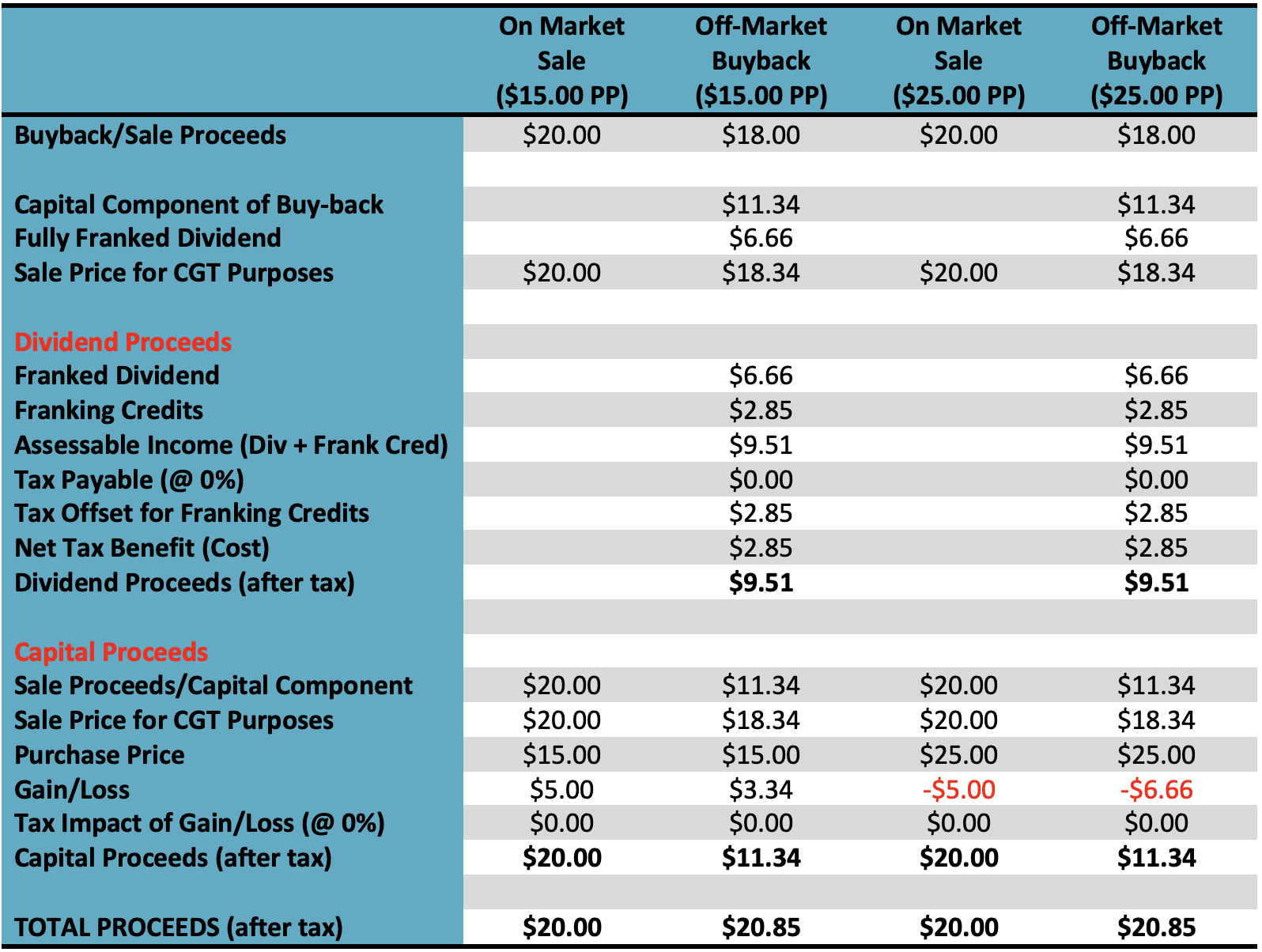

- Example 2: 0% taxpayer such as an SMSF in pension mode, 10% tender discount;

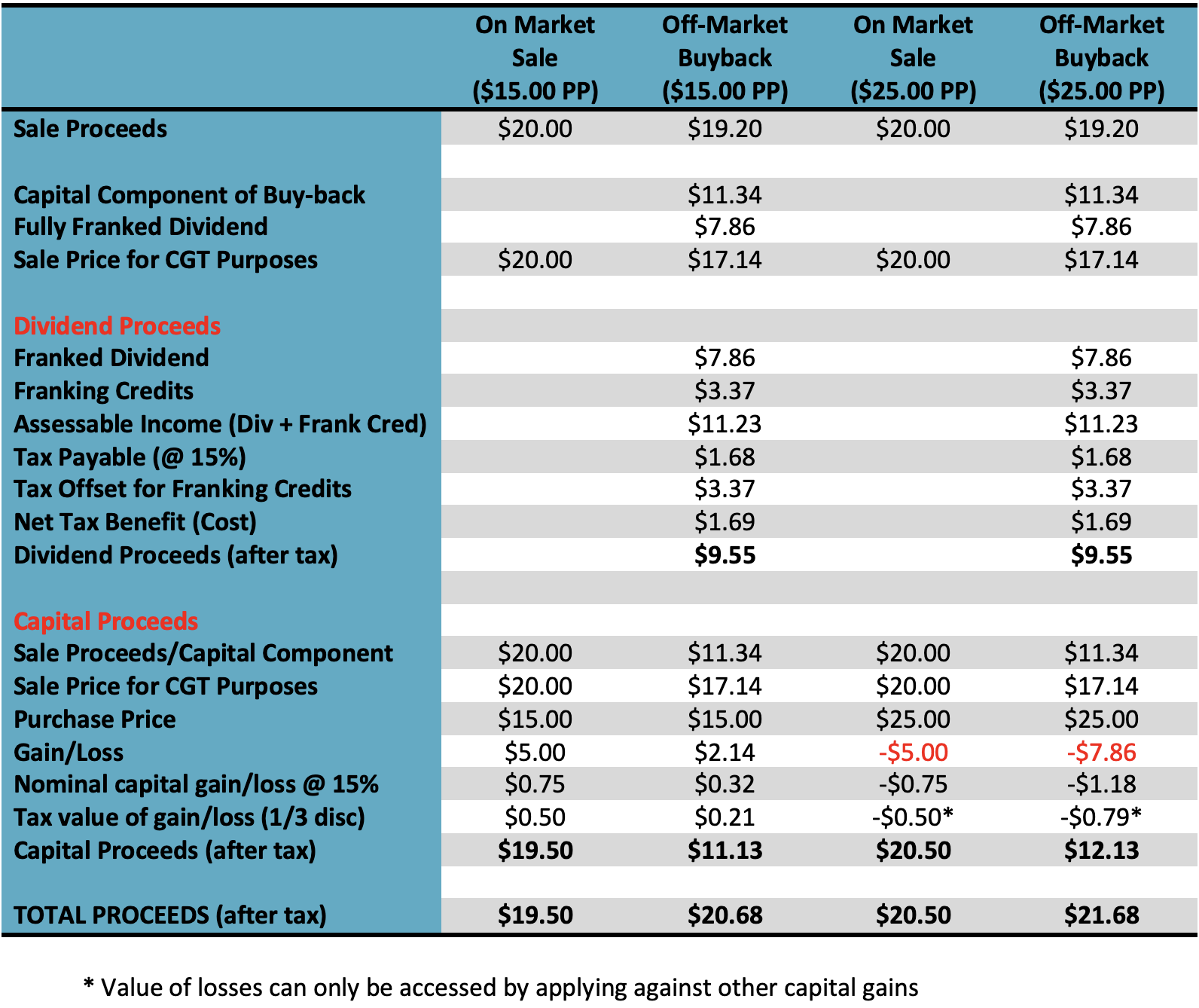

- Example 3: 15% taxpayer such as an SMSF in accumulation mode, 4% tender discount;

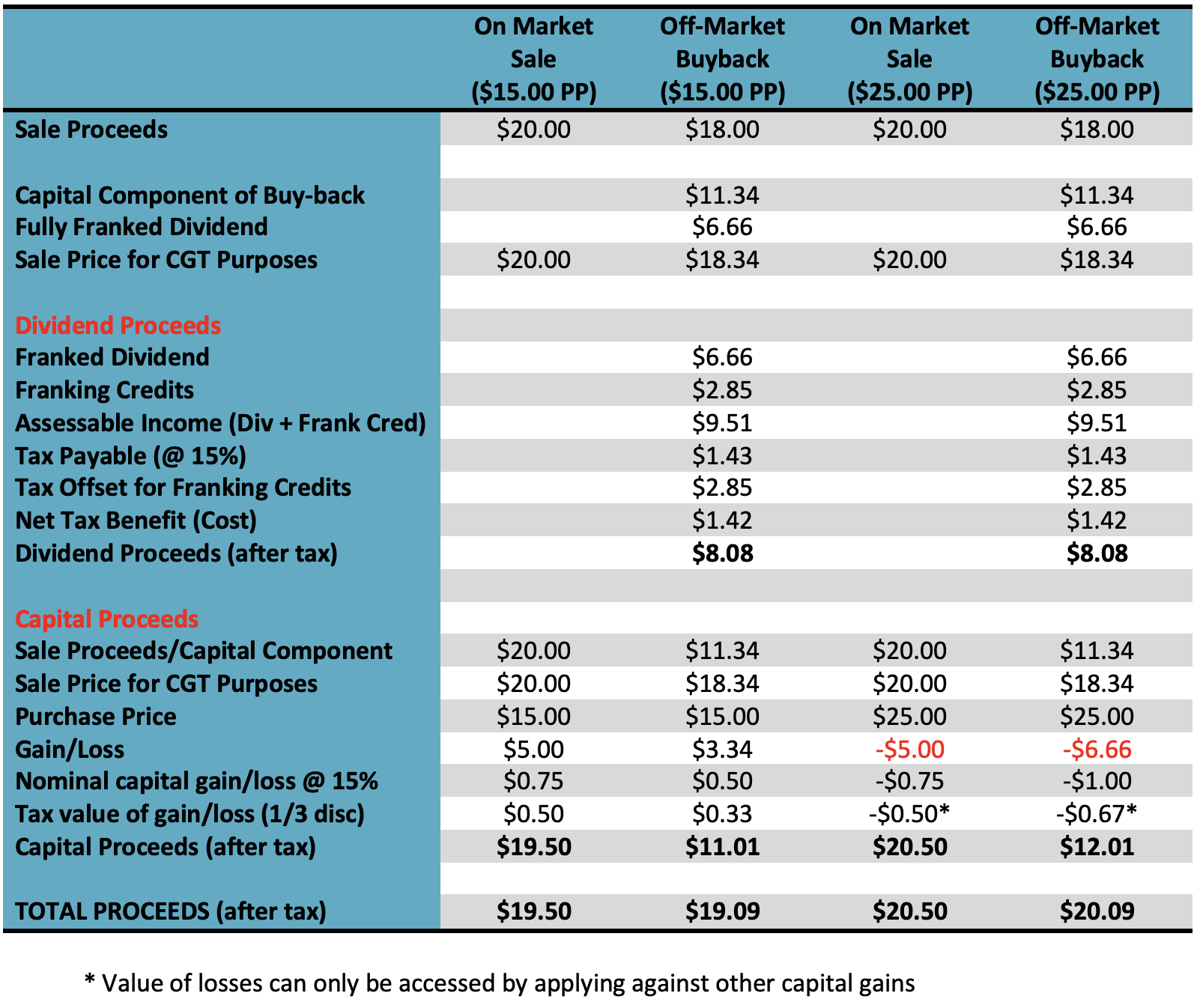

- Example 4: 15% taxpayer such as an SMSF in accumulation mode, 10% discount;

- Example 5: 47% taxpayer eligible for 50% CGT discount, 4% tender discount.

With a 4% discount, the buyback price is $19.20 ($20.00 less $0.80 or 4%). This comprises a capital component of $11.34 and a fully franked dividend of $7.86. The franking credits are $3.37. With a 10% tender discount, the buyback price is $18.00. This comprises a capital component of $11.34 and fully franked dividend of $6.66. The franking credits are $2.85.

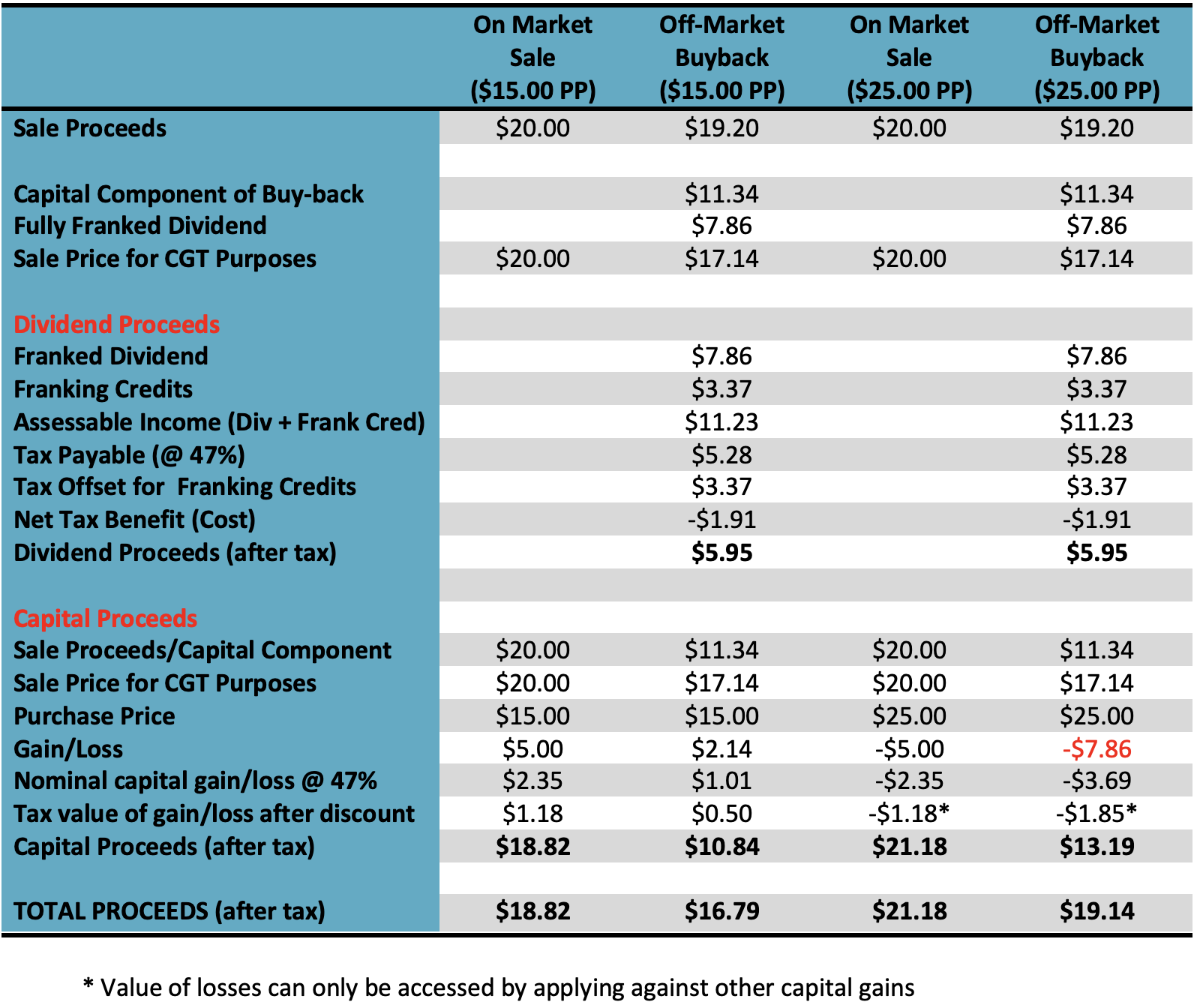

In each example, there are two purchase prices: $15.00 and $25.00. Columns 1 and 2 compare the after-tax proceeds of an on-market sale at $20.00 and participation in the buyback, assuming a purchase price of $15.00, and columns 3 and 4 compare the after-tax proceeds of an on-market sale at $20.00 and participation in the buyback, assuming a purchase price of $25.00.

The total proceeds are the sum of the dividend component and the capital proceeds.

In the first two examples, because the tax rate is 0%, the franking credits are fully refundable in cash. There is no tax to pay on any capital gain, or opportunity to apply a capital loss to offset another capital gain.

Example 1 – 0% taxpayer, 4% tender discount

Example 2 – 0% taxpayer, 10% tender discount

In the third and fourth examples, the tax rate is 15%. Effectively, half the franking credits are available as a tax refund (with no tax to pay on the dividend). On the capital side, after application of the one-third CGT discount, gains are taxed at 10% and the value of a capital loss to offset another capital gain is also 10% of the loss.

Example 3 – 15% taxpayer (assumed to be a super fund), 4% tender discount

Example 4 – 15% taxpayer (assumed to be a super fund), 10% tender discount

In the final example below, the tax rate is 47%. There is net tax to pay on the fully franked dividend. On the capital side, after application of the 50% CGT discount, gains are taxed at 23.5% and the value of a capital loss to offset another capital gain is 23.5% of the loss.

Example 5 – 47% taxpayer, 4% tender discount

Conclusion

For a 0% taxpayer such as a SMSF in the pension phase, the buyback is attractive at a low discount rate (worth $2.57 at a 4% discount and $20.00 share price), and marginally attractive at a discount of 10% (worth 85c at a $20.00 share price). If the Westpac share price heads higher between now and the pricing period in the second week of February, it will become more attractive because the franked dividend component increases, and if it heads lower, less attractive. (If the market price is $22.00 and the discount is 4%, it is worth $3.31per share, if it falls to $19.00, it is worth $2.20 per share.)

Of course, to access the refundable franking credits, you will need to lodge your tax return for 21/22, so there will be a bit of a time delay to receive the full proceeds.

For a 15% taxpayer such as a SMSF in the accumulation phase, the buyback is marginally attractive at a low tender discount (worth $1.18 at a 4% discount and $20.00 share price). It doesn’t work at high discount rates (refer to Table 4)

For high rate taxpayers (anyone paying a marginal tax rate of 30% or more), the buyback doesn’t work. Don’t even bother to open the offer document – throw it in the WPB.

From a tax point of view, it is clear who should accept and who shouldn’t, and potentially at what discount rate. You can leave the hard work to the institutional investors and tender ‘final price’ (meaning that your offer will clear at whatever the market determines is the discount), but this buyback carries more pricing risk than other buybacks. My guess is that it will clear in the 4% to 7% range.

Finally, if you do plan to accept, a critical decision is what to do with the money. Do you re-invest in Westpac and buy on the ASX the shares you sold into the buyback? Do you do this before the buyback is completed (potentially taking some risk on the scale back and final market price), or do you wait until the result is announced and payment is received on 18 February? Alternatively, do you say that Westpac is an underperformer, and perhaps invest in one of the other banks? Or do you lighten up on the banking sector, or just reduce your overall equities exposure?

For those that want to stay invested in banks and have the patience, my inclination is to re-invest the buyback proceeds back into Westpac shares.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.