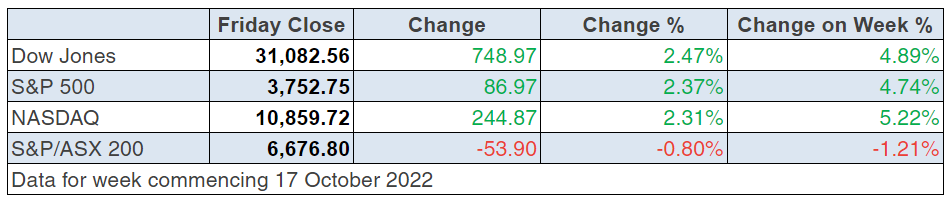

Wall Street focussed on the main game overnight — inflation and when Fed interest rate rises might slow down — and positivity was given a chance. Ahead of the close, the Dow was up nearly 2% and the S&P 500, as well as the Nasdaq, were strongly to the upside.

The stock market’s resilience at these current levels is comforting but the battle between buyers and sellers of stocks shows the latter still has the slight upper hand. What will change that?

It’s simple. US inflation must show a decent fall and we just might see it in November. That could explain why stock market drops are being partly offset by days of buying. That said, this week US company reporting has been a plus for stocks.

Last week we saw Netflix shares jump 13.1% after reversing customer losses, while United Airlines (+5%), Procter & Gamble (+0.9%) and Travelers (+4.4%) all posted upbeat earnings results, showing if the US is to head into recession, it wasn’t showing by the end of September, given these better-than-expected profit and revenue results.

Against these positives, US share markets fell on Thursday after hawkish remarks from US Federal Reserve officials prompted another surge in US government bond yields, which followed a surge in US government bond yields on Wednesday on investor expectations of bigger interest rate hikes dampened sentiment.

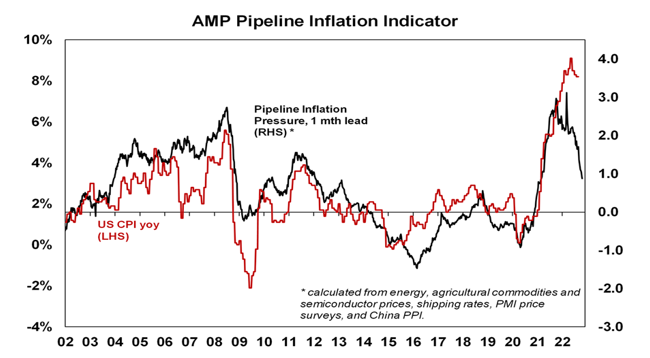

Hopefully, the Fed tough talk could be an effort to keep scaring US consumers to slow down spending to help see inflation fall ASAP. On that subject, AMP’s chief economist, Shane Oliver and his US inflation watch is keeping my hopes up that we will see a reasonable drop in the CPI in the US sooner or later. I’m hoping sooner!

This is what he revealed on Friday: “On the positive side though, signs of a slowing ahead in US inflation continue to build. A year ago, global growth, US wages data, rents, commodity prices, US government spending, car prices, money supply growth, freight rates, business surveys and inflation expectations were all point up for US inflation. Now they are all slowing or clearly pointing down.”

Furthermore, he added: “And consistent with this, our Pipeline Inflation Indicator continues to slow. Once these start to show up in actual inflation they should enable the Fed to slow down the pace of hikes, hopefully early enough to avoid a recession or at least a severe recession. Inflation in Australia is lagging the US by around 6 months so if the lead from the US continues then it should start to decline here early next year.”

Here is his Pipeline Inflation Indicator, which shows that the black line (the indicator line) is falling much faster than the CPI-red line.

Anyone needing more reason to fight market negativity should also note this from Shane: “Seasonality also starts to become more positive for shares into year end and the US share market has consistently rallied after US mid-term election years with year 3 in the 4-year presidential cycle being a strong year on average after year 2 (i.e., this year) which is normally a poor year.”

Back to Friday’s revelations on Wall Street, and Treasury yields fell from their highs on Friday morning after a news report in the Wall Street Journal “that some Fed officials are concerned about overtightening with large rate hikes.”

Stifel chief equity strategist Barry Bannister on Squawk on the Street summed up a growing belief that the US central bank needs to ease up on its rate rise program.

“We really need a Fed pause,” he said. “Not so much that they would just outright disavow future rate hikes, but that they would just say every meeting is live, and if the data goes our way, then after the first half of ’23 we don’t have to do more.”

CNBC pointed to the San Francisco Federal Reserve President Mary Daly, who said on Friday that she’d like the central bank to be able to do a “step down” on the pace of rate increases but isn’t sure when that will happen. “Daly indicated during a Q&A at the University of California Berkley that she thinks the Fed should be looking at reducing the pace of what has been a series of 0.75 percentage point rate hikes that markets expect to continue in November,” Jesse Pound and Alex Harring reported.

That indicator pipeline of Shane Oliver tells us that we might be close to that important day when the market will believe that US rate rises are close to a pause, which would run ahead of a final rise. That’s when stocks will rebound big time.

Be assured of this: falling inflation is the main games for a stock marker turnaround.

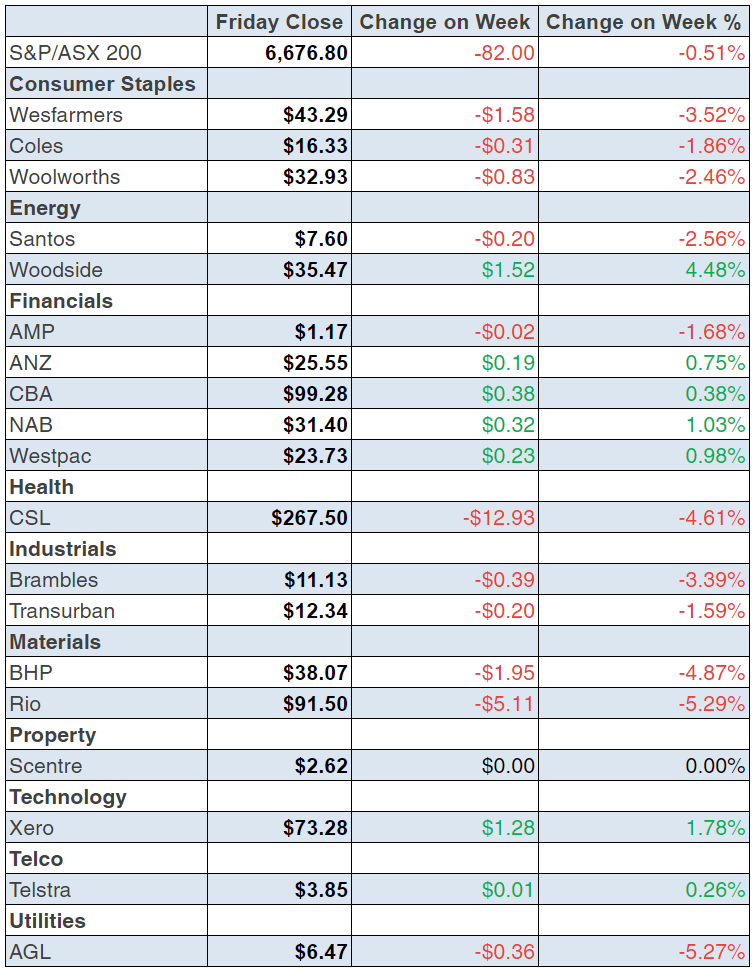

To the local story and the S&P/ASX 200 ended down 1.2% for the week after a 0.8% drop on Friday and after some up-days driven by better-than-expected company earnings in the US. And Netflix was the star up 12% on one day after beating forecasters’ guesses on the performance of the company.

All this tells us what we’re in right now with stocks — it’s a guessing game but don’t get fooled by days when company earnings excite short-term players because the main game is inflation and the data drop will be critical to what happens to stocks, meaningfully, going forward will ultimately rest on when inflation falls.

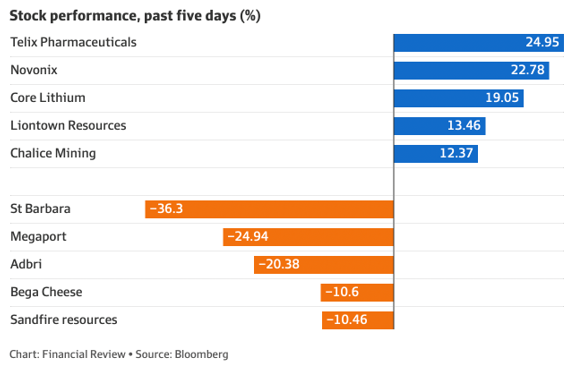

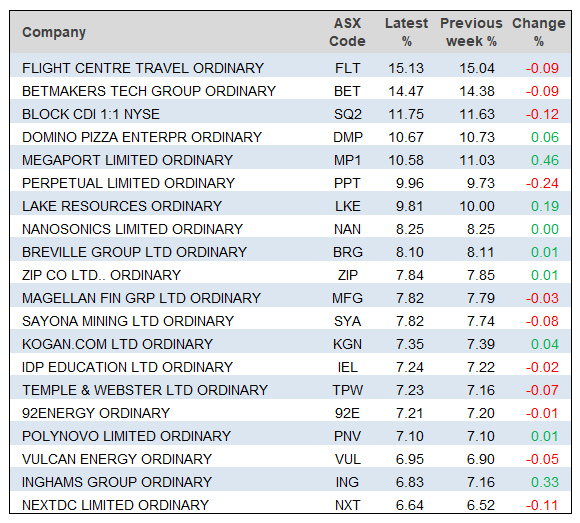

Here are the big winners and losers over the week:

Apart from the big winners and losers, energy remains a star for the market and lithium is a bit-part player.

As the AFR reported: “Energy was the only sector in the black, up 2 per cent, buoyed by large gains in coal miners. Whitehaven jumped 4.6 per cent to $10.49. It completed a 10 per cent share-buyback and plans to do more. New Hope skyrocketed 7.7 per cent to $7.42, and briefly touched a fresh record high. Its share price has more than trebled this year.”

And on lithium, this is the story: “Lithium stocks were another bright spot in the market with Core Lithium jumping 3.4 per cent to $1.375, Pilbara Minerals up 2 per cent to $5.07 and Mineral Resources 3.1 per cent higher at $73.1.”

What I liked

- Employment rose by 900 people in September (consensus: 25,000) with full-time jobs up by 13,300, but part-time jobs fell by 12,400. (We need a slowing economy to show the RBAs rate rises are working.)

- The unemployment rate edged up from 3.48% in August to 3.54% in September, above the 48-year low of 3.42% in July 2022 (lowest since August 1974). The number of unemployed people rose by 8,800 to 499,400 in September.

- The SEEK Advertised Salary Index (ASI) rose by 3.7% over the year to September 2022, the slowest annual growth rate in 13 months. The ASI is down from 3.9% in the year to August and the recent peak of 4.5% in March 2022.

- The total number of dwelling starts fell by 2.7% to 48,076 units in the June quarter of 2022. Starts are down by 28.9% on the year. In original terms, a record 241,926 homes were being built at the end of June 2022 (most since September 1960).

- Job vacancies fell 5.9% in September. Job ads declined in 46 of the 48 detailed occupational groups during the month.

- The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index fell to -1.15% in September, down from -0.33% in August. It was the weakest reading since the pandemic first hit in 2020, and, prior to that, since early 2016.

- The weekly ANZ-Roy Morgan consumer confidence index fell by 2.8% to the lows of early August.

- US initial jobless claims fell by 12,000 to 214,000 in the past week (survey forecast: 233,000).

- The US Conference Board leading index fell by 0.4% in September (survey: -0.3%). The Philadelphia Federal Reserve manufacturing index rose from -9.9 to -8.7 in October (survey: -5).

- Housing starts in the US dropped 8.1% in September to a 1.439 million annualised rate (survey: 1.46 million).

- The NAHB housing market index fell from 46 to 38 in October, the weakest since May 2020 (survey: 43).

- European share marketsadvanced on Thursday after Liz Truss resigned as UK Prime Minister. Truss’s package of fiscal policies had caused havoc in financial markets due to their mix of tax cuts and higher spending, forcing the Bank of England to intervene.

What I didn’t like

- CBA credit & debit card spending showed that: “Consumers are yet to tighten their budgets as much as what consumer sentiment readings and the degree of monetary policy tightening that has now been delivered would suggest. The large pool of savings that was accumulated through the pandemic, the strength of the labour market and a possible ‘COVID hangover’ could help explain the resilience in consumer spending so far.”

- German producer prices soared by 45.8% in September on the same month last year (survey: 45.4%).

- The US Federal Reserve Beige Book, which surveys activity across the Fed’s twelve districts, indicated that the US economy grew modestly” and inflation continued to be “elevated”.

Remember slowdown stats are good

The Goldilocks goal for central banks is to create a slowdown that brings down inflation and as my “What I liked” section above shows, we seem to be seeing that happen, especially here. However, as I said earlier, the US is the main game and when its inflation falls, it will be great for stocks.

The week in review:

- This week in the Switzer Report, I concede the latest US CPI increases the chances of two more 0.75% rate rises from the Fed before Christmas, holding firm to my view that inflation will eventually fall. Do you wait and miss the first surge, or bite the bullet and buy at current low levels? Here’s my favoured currency-related play for now. [1]

- After one of the toughest years in recent memory, the share market has lost almost 10%, even more if you ignore dividends. Our model portfolios are doing better than the market, in relative terms outperforming, but they’re still down and here’s the full insight from Paul (Rickard). [2]

- Predicting stock winners and losers based on currency moves is a mug’s game. For starters, currencies are notoriously hard to forecast. Also, buying a company because of its offshore revenue is tricky. Tony Featherstone gives us three infrastructure-related stocks that could attract takeover bids from offshore. [3]

- Out in the wild lands beneath the S&P/ASX 200 and even the market cap required to be in the 500-stock All Ordinaries index, James Dunn thinks there are extremely interesting stock stories. In the first of a new series, here are two of them. [4]

- In our HOT stock column this week, Raymond Chan, Head of Asian Desk at Morgans, tells us why he thinks TLC (The Lottery Corporation) [5] looks attractive. Plus, Michael Gable, Managing Director of Fairmont Equities explains possible good times ahead for The a2 Milk Company (A2M). [6]

- In Buy, Hold, Sell — Brokers Say, there were 6 upgrades and 7 downgrades [7] in the first edition and 7 upgrades and 2 downgrades [8] in the second edition.

- And finally, in Paul’s (Rickard) Questions of the Week [9], could super be hit in Tuesday’s Budget? Should Paul be concerned about the ratings downgrade from Zenith? Is Wesfarmers a buy? How can you invest in the property trust sector?

Our Videos of the week:

- Stocks to buy now for when inflation drops – Domino’s Pizza, Ramsay Healthcare, CSL & more! [10] | Switzer Investing (Monday)

- Why is Wall Street rising & will the Aussie dollar ever stop falling? [11] | Mad about Money

- The prospects and performance of Dicker Data and the challenges when investing overseas! [12] | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 20 October 2022 [13]

Top Stocks – how they fared:

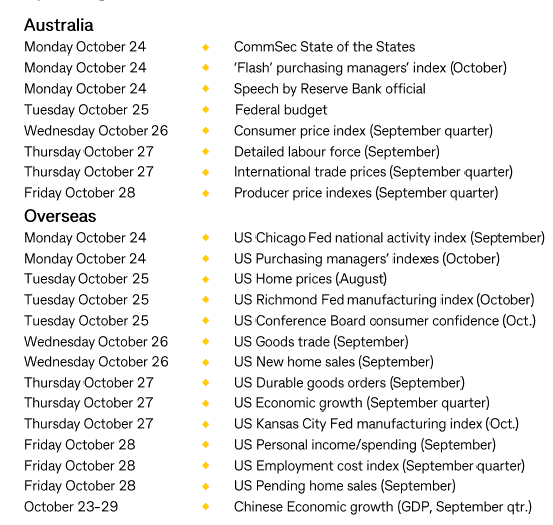

The Week Ahead:

Food for thought:

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” – Sir John Templeton

Stocks shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the Week:

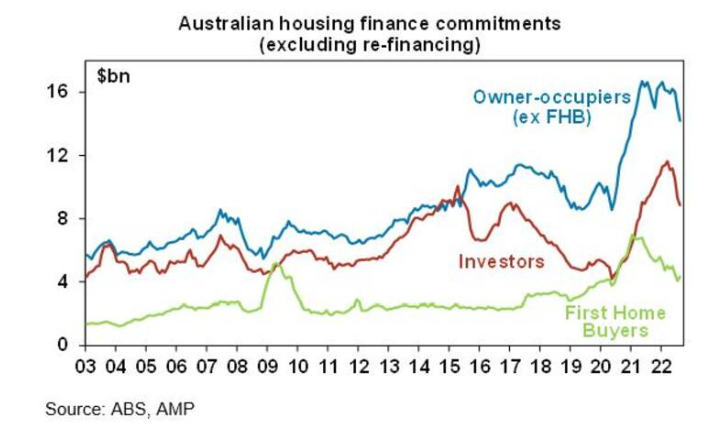

The Melbourne Institute’s Inflation Gauge rose again in September pointing to a further rise in underlying inflation, albeit it’s tending to run below the reported ABS rate of inflation. The ANZ Job Ads series fell again suggesting the labour market may be starting to cool, but it remains up 22%yoy. Housing data was mostly soft. Housing approvals bounced 28% in September after a 17% fall in July due to normally volatile apartment approvals, but the trend remains weak. Housing finance commitments continued to fall sharply, with more declines likely as higher rates and falling prices impact. – Shane Oliver, AMP

Top 5 most clicked:

Here’s my favoured play for when US inflation drops, and it’s a biggie! [1] – Peter Switzer

Portfolios outperform, but still down in a tough year [2] – Paul Rickard

Two unknown champs [4] – James Dunn

Buy, Hold, Sell – What the Brokers Say [7] – Rudi Filapek-Vandyck

Questions of the Week [9] – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.