It’s clearly been a great start to 2019 in equity markets, due mainly to the stunning policy backflip by the US Federal Reserve, combined with the fact that equity markets ended 2018 so poorly. Low share prices, high short interest levels and unexpected central bank policy support are a very positive short-term combination, as we have seen.

However, in amongst all the positive share price action in January and early February, it is worth noting that consensus global earnings estimates for 2019 are falling. In effect, investors are paying higher prospective P/E’s for lower consensus earnings estimates.

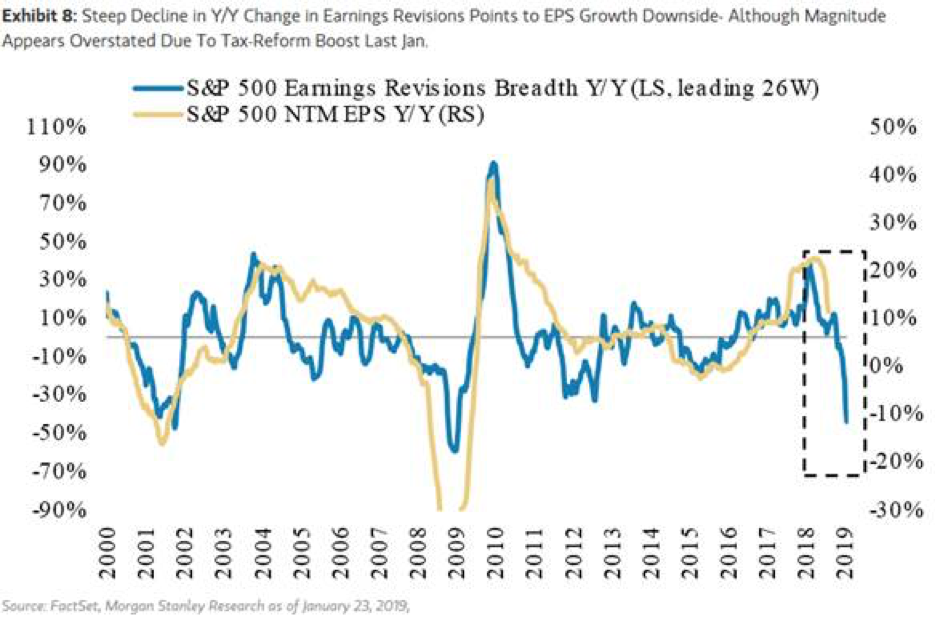

The chart below overlays the MSCI World Equity Index and the Citigroup Global Earnings Revision Index. It shows analyst profit downgrades continue to exceed upgrades. This potentially suggests the relief rally/short-covering rally we have seen to start 2019 potentially lacks fundamental earnings support.

With 62% of the MSCI World Equity Index being represented by US equities, it is worth analysing the trends from the Q4 2018 reporting season, which is in full flight right now. The key takeaways are:

- The rate of companies beating expectations is at the lowest seen since the last earnings recession in 2016.

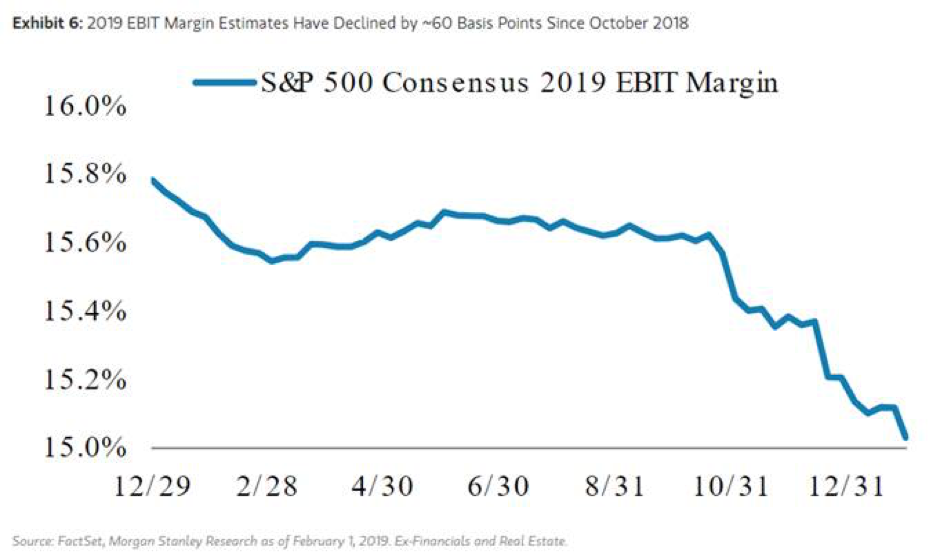

- Margins are coming in weaker than expected.

- Forward guidance coming down sharply and broadly across almost every sector.

The table below illustrates US S&P500 earnings revision breadth and year-on-year EPS growth estimates for the index overall.

Interestingly, we have seen earnings misses and consensus downgrades to selected US megacaps such as Amazon, Microsoft, Caterpillar, and Alphabet. Even Apple’s numbers led to further negative earnings revisions yet the stock rallied. Most of the disappointments were focused on operating margins dropping. This is leading to US equities offering low earnings growth in 2019.

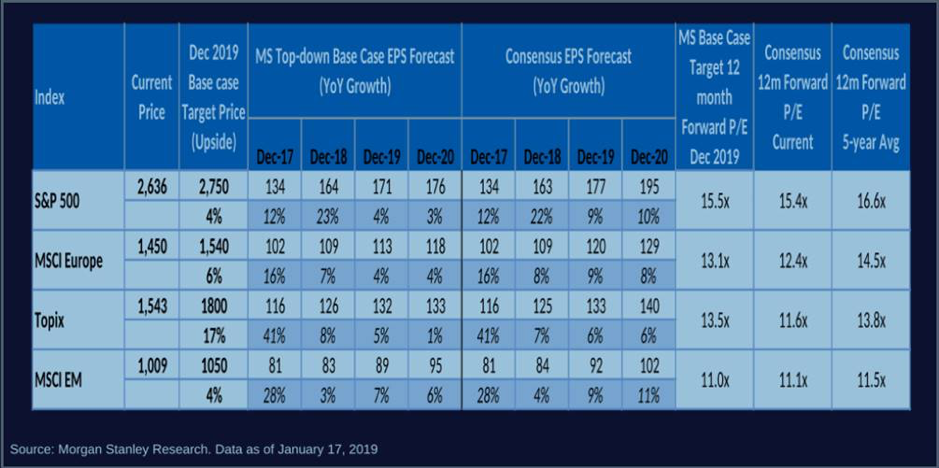

2019 offers significantly less earnings growth in the USA, as the one-off positive effects of tax cuts and buybacks cycle through. Margins have potentially peaked in US equities. We expect mid-single digit EPS growth from the S&P500 in 2019 and feel broadly there is better growth at cheaper prices to be found elsewhere, particularly Asia. The table below compiled by Morgan Stanley Global Research compares the comparative earnings growth forecast in 2019. You can see S&P500 EPS growth drops from +23% in 2018 to just +4% in 2019, while on the other hand MSCI EM EPS growth goes from +3% in 2018 to +7% in 2019. US equities, however, currently remain at a significant P/E premium to the rest of the world, despite no longer having an earnings growth advantage.

You can see US equities had a huge EPS growth advantage over the rest of the world in 2018. That is behind us now and we have a much more level playing field in earnings growth globally. This, to me, is an important development, as it combines with a major backflip from the Federal Reserve.

In my opinion, interest rate differentials and earnings growth differentials no longer favour US equities and the US dollar. Last year if you simply held US equities in US dollars, you did very nicely. I don’t think it will be as simple as that in 2019 and I believe we are past the point of peak outperformance of US equities in US dollars. Time will tell.

A classic example to me of potentially “peak USA” was the Apple (AAPL.US) result. I simply don’t believe revenue loss from flattening iPhone sales will be offset by services growth. I continue to feel Apple is a “device company” and will need to continue to sell “devices”. iPhone sales sill represent 62% of AAPL revenues. I did listen into the AAPL conference call led by CEO Tim Cook, and while the numbers are huge, the momentum is headed south. Below is a summary of that conference call.

Highlights:

- Sales fell from $88.3bn to $84.3bn year-on-year in Q4 (-4.5%).

- EPS grew from $3.92 to $4.22 (+7.65%). NB: Shares out have reduced from 5,081.7m to 4,729.8m year-on-year (-6.9%). See below for more detail.

- GM 38% (products 34%, services 64%).

- iPhone and China were the key drags on earnings. Global iPhone sales were down ~$9.0bn year-on-year, while total China sales were down ~$4.8bn year-on-year.

- Ended the quarter with Net cash of $130bn. Still have a plan to get to zero net cash over time through capital management.

- Will provide an update on capital management at the March qtr

Guidance for fiscal 2019 2Q

- Revenue $55-59bn (compared to $61.1bn in 2018). Consensus prior to result is US$58.97bn – we have seen mild consensus downgrades of ~3%.

- Guidance includes -$1.3bn impact from FX and a more challenging macro environment.

- GM to be between 37-38% (60bps impact from FX, and seasonal impact). NB: was 38.3% in prior corresponding period.

- Q2 guidance implies the steepest Q1 – Q2 slowdown in sales in history. Same factors that hit Q1 will hit Q2 (eg FX, weaker macro – particularly in EM, weak iPhone, good growth ex-iPhone).

China

- China sales fell from $18.0bn to $13.2bn year-on-year.

- However, record services revenue in China for the quarter and very strong wearables sales in China (+50% year-on-year).

- For the full calendar year, 2018 saw slight positive growth in China.

- 2/3 of Mac and iPad customers in China are new users.

- Has been some impact from the halt on new game approvals in China but they believe this will be temporary.

iPhone

- iPhone sales fell from $61.1bn to $52.0bn (-15%) – responsible for more than 100% of Apple’s revenue decline year-on-year for the quarter.

- Singled out China and Turkey as being very weak.

- Q4’17 iPhone was 69% of total sales. In Q4’18 that fell to 62%. Services grew from 10% last year to 13%.

- Now have 900m devices in circulation: +75m in the LTM.

Why was iPhone so weak?:

- FX movements: made the iPhone much more expensive outside of the US (e.g. Turkey sales fell hugely, given Lira depreciation)

- Subsidies: globally networks have reduced subsidies offered to users on iPhones (Japan singled out).

- Battery replacement program: battery replacement has made customers hold on to old iPhones longer – this is short-term pain but strategically important to grow installed device numbers longer term.

Initiatives to turn-around:

- Improving financing options for instalment purchases.

- Grow trade-in program.

- Also shifting investor sentiment to focus on number of devices in circulation (which will drive services growth).

Services

- Highest quarterly music revenue ever. Record quarter for App store, Apple pay.

- Best App store year ever.

- Apple News has the largest readership globally.

- US$41bn of revenue in 2018. Diversified with no one category >30% of total services revenue.

iPad/wearables, home & accessory

- iPad saw best growth in 6 years.

- Apple watch and air pods had strong quarters.

Interesting note on Buybacks:

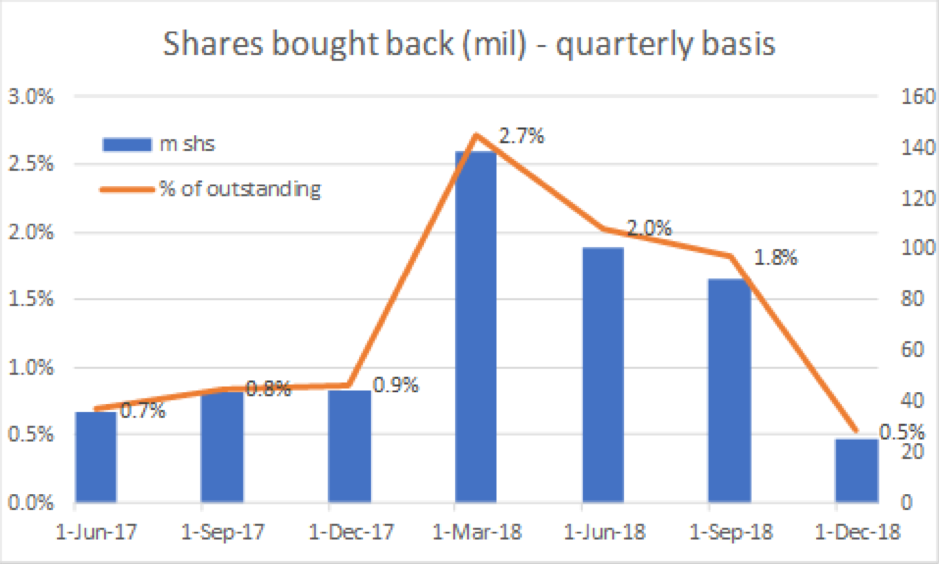

- Buybacks drove most of the bottom line earnings growth in the quarter. However, interestingly, the company bought back the least number of shares in several years (despite the share price weakness).

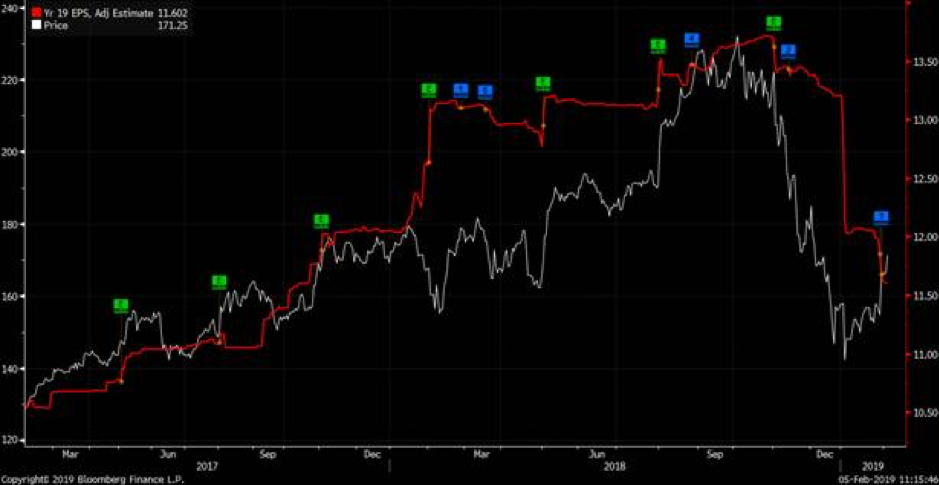

AAPL shares bounced on that result after falling -38% ahead of it. Clearly, there were expectations of a weak result and it was weak. The share price had been leading the consensus estimates down but now the rebound appears overdone to me versus lowered consensus estimates. The chart below overlays consensus AAPL FY19 EPS estimates and the AAPL share price. To put this in context, AAPL is in a consensus earnings downgrade cycle with consensus FY19 EPS -13.3% in the last six months.

Consensus is now that AAPL FY19 EPS goes backwards by -3% vs 2018 in FY19. That earnings growth would be worse, except for the positive effect of ongoing share buybacks on EPS.

Don’t get me wrong, AAPL has a pristine balance sheet and is one of the greatest brands on earth. Yet it is just another stock and the sales growth of its key product has peaked. They need the higher margin services business to grow and grow very quickly to offset the clear fact we are past “peak iPhone”. On a forward P/E of 14.7x and with EPS going backwards, I think you can take the risk of NOT owning Apple shares in 2019.

Apple is the largest weighting in the MSCI World Index and largest weighting in the S&P500 Index. As I am typing this note, Apple has regained its title of the largest market capitalisation company in the world after Amazon shares fell after reporting earnings.

In my opinion the best of Apple’s long-term outperformance is behind it and this is another clear reason I see US equities underperforming in 2019. The bounce we are seeing in US equities, driven by the Fed, may well be giving you a chance to reduce exposure.

I remain of the view that better buying opportunities will present themselves in the weeks and months ahead. Discipline will be rewarded: DON’T BE SUCKED INTO SHORT-SQUEEZES that will fizzle out on weakening fundamentals.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.