We know the US stock market has surged since October last year and our market went along for the ride, albeit with a little less enthusiasm. The S&P 500 index is up 27% since late October, while the Nasdaq is up 30% and our S&P/ASX 200 index put on 14.7%.

These big gains have many expert market watchers warning a sell off is on the cards ahead of the looming reporting season in the US for the March quarter. And then there’s that old market war cry: “Sell in May and go away, come back on St Leger’s day.”

That actually worked last year with October’s start of the huge rally meaning everyone who sold out in May and got in again in mid-September, when St Leger’s Day comes around, avoided a loss of 4% and then got in for a big return that’s been a gift that’s kept on giving.

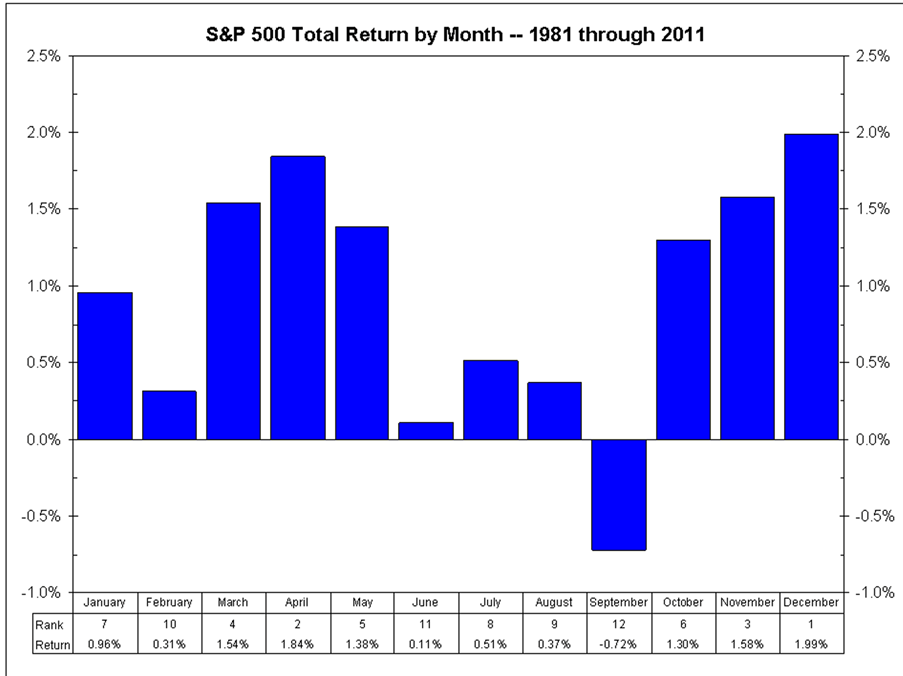

Back in 2012 I came across this research that I keep coming back to as it looked at the “sell in May” tactic over a long period. The conclusion reinforces my view that 2024 looks likely to be a good year for stocks. Before I explain why, have a look at this interesting chart.

Bianco Research

The chart above shows May typically ends a seasonally strong period for stocks, while May itself has been the 5th best month for stocks, but the statistical drama deepens when you learn that the “sell in May” advice for election years hasn’t had a great record.

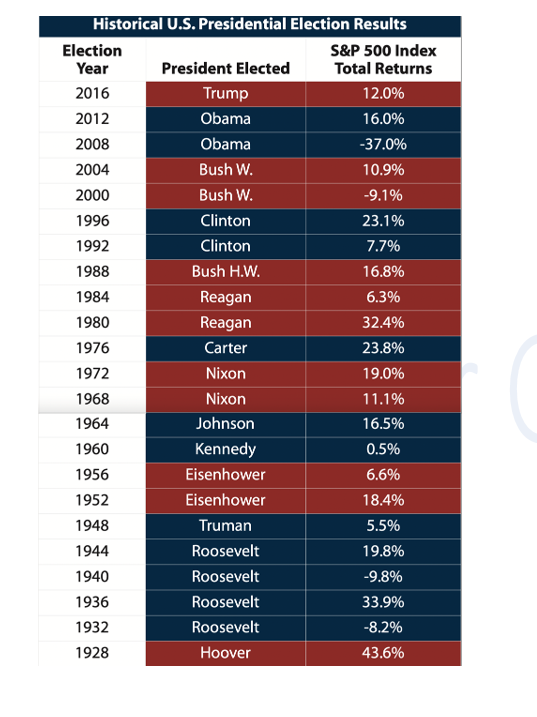

According to J.P. Morgan, over the time period 1972 to 2012, the stock market rallied in five of the eight election years, with market gains of 12-26%. Only during recession years (2000 and 2008) did the S&P500 provide negative returns. And as the Yanks don’t look set to be in a recession, we have another reason to have positive views for stocks in 2024, which adds to the case that we should say “Sell in May and go away…except in election years!”

But wait there’s more, and this comes from the latest take on the market by the Bank of America’s investment team. They’ve suggested “investors who ‘sell in May and go away’ this year could miss a big summer rally in the stock market”.

The bank’s research conforms with the analysis above but is a little more seasonal revealing “…that the stock market tends to rally during the summer of the third year of a presidential cycle.”

Interestingly, a more detailed look at history says that it looks like you shouldn’t “sell in May and go away” but instead “buy in May and sell July/August!”

For another take on stocks and US elections, here are the views of Nick Kalivas, senior equity product strategist at Invesco PowerShares in the States, which were published in 2016. This was the year Donald Trump became the 45th President of the USA!

Contrary to the common adage “sell in May and go away…the S&P 500 index has historically traded with support leading up to the presidential election”.

This is what Kalivas’s research has shown:

- Between the close of May and the close of October, the S&P 500 has rallied 19 of the last 22 election years (86% of the time) for an average gain of 6.2%.

- Although the statistics for a rally look compelling, the results are skewed by significant volatility in a few election years. In 2008, the index lost 31% during the GFC and in 1932, there was a 55.7% rise!

- The median or more historically believable gain in an election year is around 4.1%, which is still good when you throw in dividends.

- Kalivas also notes that during “…presidential election years, the volatility of monthly returns tends to rise sharply in July and August.”

How do you play this year? This table below says sitting tight works unless a recession like the 2008 GFC year, or the big recession year of 2000, comes along. Have a look at these returns in the table below.

Apart from being on the lookout for small and mid-caps that will benefit from falling interest rates and the usual gains for growth stocks at the expense of value stocks, I remain happy to play the indexes such as Vanguard Australian Share Index (VAS) for the S&P/ASX 300, which will also capture smaller companies. For US exposure, I like the iShares S&P 500 (AUD Hedged) ETF (IHVV). For a broader overseas exposure, fund managers such as WCM Global Growth Ltd (WQG), Hyperion Global Growth Companies (Managed Fund) and others are worth looking at for diversification.

I also like the risky BetaShares’ Geared Australian Equity Fund (GEAR) but I might sell it in May or June to avoid the history around July and August. Since I mentioned GEAR in this Report, it has gone from around $23 to $28.44 and its all-time high has been $29.97.

I suspect it will go higher than this in 2024 or 2025 but $30 might be a wise time to take profit before the looming threat of the month of August in a US presidential election year.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.