My December quarter ‘should bring a fall in inflation’ prediction has come to pass and I was surprised to see our S&P/ASX 200 up 11% since early October (six weeks!) but the next question has to be: Can this bounceback last and become a new bull market rally?

The honest answer is I don’t know. However those courageous players who’ve been invested and waiting for the arrival of a good inflation number in the US might want to take profit before the smarties and short-sellers try to test the resolve of the buyers who’ve taken that 7.7% (lower-than-expected) inflation number as a sign to buy beaten-up tech stocks, among others.

Undoubtedly, this rally could be a bear market rally or the start of a bull market, so the stock market will be sensitive to comments from Fed officials, with Anthony Doyle of Firetrail Investments telling me today that one of these has just spoken at a UBS conference and was alarmed at the market positivity following that inflation reading last week.

The Fed will want to keep the lid on positivity until there’s a stronger drop on prices so the inflation number on December 13 will be important. I think the stock market will see some sell-offs until then but there’ll be small bounce-backs as well.

So how should you play stocks now? I’m believing that inflation will keep falling and this will set 2023 up as a good year for stocks.

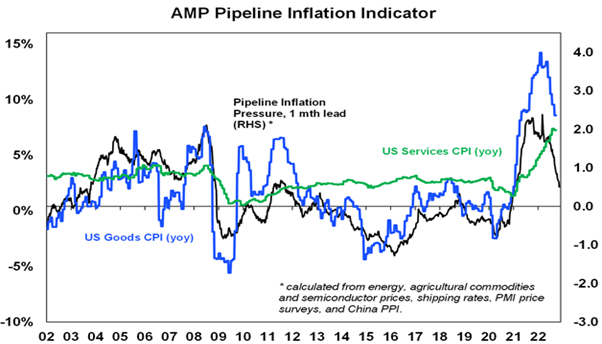

Here’s AMP’s Shane Oliver’s latest take on his Inflation Pipeline Indicators graph, which proved to be right in anticipating a fall in US prices.

“Importantly, our Pipeline Inflation Indicator is continuing to trend down and points to a further fall in US inflation,” he wrote over the weekend. “This correlates more with goods price inflation (which is slowing) but as this leads services price inflation it’s likely to slow too in the months ahead.

“It’s also worth noting that rents account for about one third of the US CPI and rapidly slowing rents for new leases in the US point to a fall in average rent inflation in the CPI over the next six months. Inflation in Australia is lagging the US by around six months, so it should start to decline here from early next year.”

Helping us lower inflation is the spike in the Oz dollar, which is up 8% in a month! Also, the news that China is easing up on COVID-restrictions should help lower cost inflation over 2023. And imagine what will happen to costs and inflation and then interest rates if the Ukraine war can end.

We’d be off to the races for stocks in 2023.

So the big watch is December’s read on November’s inflation stat and this is what Shane is seeing now: “US inflation is still too high so the Fed will remain hawkish and wary for a while yet, but October’s lower-than-expected inflation outcome and increasing signs that the cyclical peak in inflation is behind us is consistent with a downshift to a 0.5% hike at the Fed meeting next month. Money market expectations for a peak in the Fed Funds rate near 5% next year may be a bit too hawkish.”

But don’t just think this is optimistic talk from stock lovers like yours truly. Following the US inflation result, the hardheads in the bond market see fewer rate rises ahead. These people don’t just react to one number and it suggests they’re seeing what I and Shane have been predicting in this chart of his below.

This chart shows that official goods inflation (in blue) is catching up with the Pipeline graph (in black), while services inflation (in green)still has to drop. Wages and jobs data will be important watches between now and December 13.

Back to the bond market’s reaction and here is Shane again: “The lower US inflation data also pushed bond yields down sharply.”

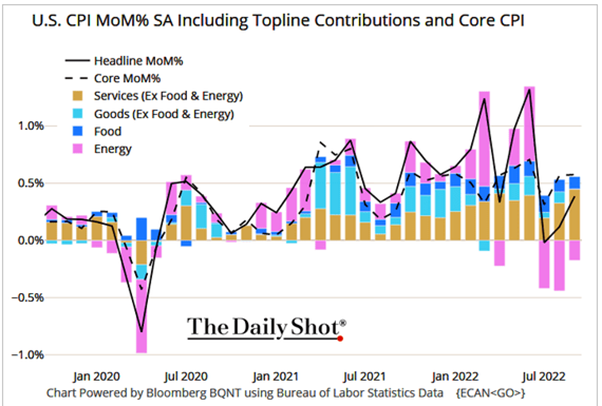

For the sake of objectivity, here’s Percy Allen on what the bears are growling: “The bearish view is that commodity inflation may have peaked, but US services sector inflation is accelerating within already 6.2% core inflation (excluding food and fuel). See chart below. This is because wages and salaries are rising at 8.6% due to labour shortages. Hence the Federal Reserve will keep its foot on the monetary brake until it reduces core inflation to its target of 2%.”

But wait there’s more.

“The tight labour market will persist with baby boomers retiring, slower immigration, and consumers switching back to labour-intensive services,” Percy explains. “The wages/prices spiral in the USA will only be stopped by increasing unemployment through monetary tightening and higher interest rates. While there is no sign yet of a major wage breakout in Australia, bears say that is inevitable given our severe labour shortage.

Historically, central bank cash rates have had to exceed the underlying inflation rate to tame it. Hence the US peak cash rate will be higher than its annual core inflation rate which since the start of this year has averaged 6.2% with no sign of waning. With interest rates and wage costs rising and consumer confidence and leading economic indicators plunging, a recession is coming that will slash profits.”

Some of the world’s best economists have tipped seven of the past two recessions and financial markets experts have probably forecasted 10 of the past two recessions. I think a recession in the US is a chance but if it happened, the Fed would cut rates and stocks would take off again.

As long as you can invest with a year in mind, going long stocks now is not a dumb play. Waiting for a sell-off and buying then would be smarter but a big fall in stocks might not come.

I think small ones are likely but big ones less so.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.