Trump is starting to reveal his tariff policy today to a world that is still uncertain how this will play out. Who knows what will happen and what the retaliation effects might be? A universal tariff on all US imports? Higher duties in even more sectors? A no country-specific exemption? Potential carve-outs?

It’s impossible to know what Trump will do because unpredictability is part of his playbook. So, too, is making outlandish claims as bargaining chips.

We know a few things. First, tariff uncertainty will fuel heightened market volatility throughout the year, especially if it sparks a full-blown trade war.

Second, there is no quick fix from a market perspective. It will take time for markets to comprehend the effect of higher tariffs across the board on the global economy, specific countries and, most importantly, company earnings.

Third, Trump’s erratic tariff policy – and his disregard for close allies such as Canada – will play into China’s hands in the medium term.

Yes, China has much to lose from higher US tariffs. As the world’s largest exporter to the US, China relies heavily on American consumers and business for trade.

In international relations journals, there’s speculation that the groundwork is being laid for a ‘grand bargain’ between the US and China.

This could include the US lifting tariffs for China and reducing its military presence in parts of Asia (notably Taiwan) in exchange for better market access for US companies in China and stronger intellectual property protection.

If this deal happens, it’s a long way off and much could go wrong. More likely is China using Trump’s behaviour to gain greater support from other countries, particularly those in the Global South that are losing confidence in the US.

China will no doubt present itself as a stable, reliable partner, in contrast to the US, which has had the equivalent of decades of foreign-policy change in a matter of weeks as Trump upends global politics and the liberal international order.

Granted, this diplomacy will take time to feed through to trade and investment opportunities for Chinese companies and higher earnings. But China has much to gain from the US alienating countries in the Global North and South through its trade policy, foreign-aid cuts and other policies.

Green shoots for economy

More important for investors are signs of ‘green shoots’ in China’s troubled economy. In March, activity in China’s giant manufacturing sector expanded at the fastest pace in a year as infrastructure spending ramped up.

Also important was China’s e-commerce giants reporting stronger year-on-year revenue growth in the last three months of 2024. This suggests the beleaguered Chinese consumer market is showing signs of life, although there’s still a long way to go to get back to pre-pandemic spending levels.

In February, Knight Frank, a global real estate consultancy, noted data showing new-home prices in China’s troubled property market were stabilising. It’s early days, but the slightest whiff of good news in Chinese property is a big deal.

In January, the International Monetary Fund slightly raised its growth estimate for Chinese GDP to 4.6% for 2025. The IMF also said in January that China’s reported economic growth in 2024 was a ‘positive surprise’.

Perhaps the biggest news, also in January, was DeepSeek, the Chinese artificial intelligence start-up, making global headlines after demonstrating technology that rivalled Chat-GPT maker OpenAI, at lower cost. This sparked renewed interest in China’s beleaguered technology stocks.

To be clear, I’m not suggesting the worst is over for China. Its property sector is a mess, the Chinese consumption market still has many headwinds and social unrest among young people there is rising, judging by reports of the ‘lying flat’ trend that involves taking a break from relentless work and declining career opportunities.

But as I’ve written many times in this column over the years, the best time to buy is usually when market negativity about an asset peak, other investors panic and assets become irrationally oversold. That was Chinese equities early last year.

I became more bullish on Chinese equities last year in an April 2024 column, “Chinese equities a consideration for contrarians”, in this report.

I followed that up with another positive article on Chinese equities in June 2024 and again in September 2024, when I suggested reducing exposure to Indian equities (which at the time had soared) and increasing exposure to struggling Chinese equities.

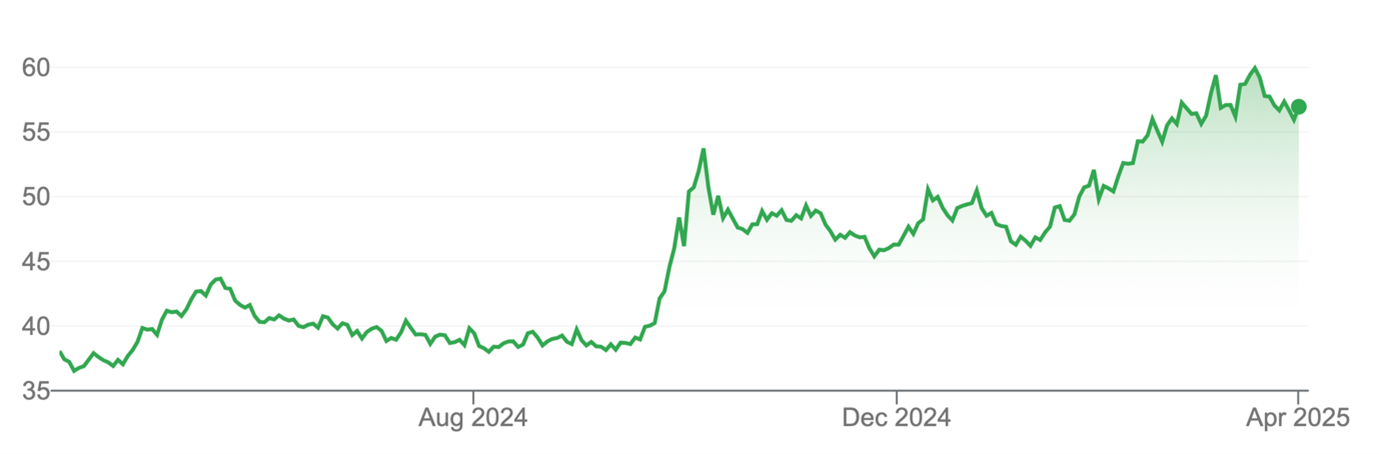

My preferred tool for Chinese exposure, the iShares China Large-Cap Exchange Traded Fund (ASX: IZZ), is up 58% over one year to end-February 2025.

Chart 1: iShares China Large-Cap AUD ETF

Source: Google Finance

Yet over five years, IZZ’s annualised return is -0.26%. Over 10 years, IZZ has returned a measly 2.4% annualised. After a lost decade of returns, Chinese equities have a lot of ground to make up, notwithstanding the last 12 months.

IZZ remains my preference for Chinese exposure. It provides exposure to 50 of the largest and most liquid Chinese companies listed in Hong Kong, including Alibaba Group Holdings, Tencent Holdings and JP.com.

I prefer the risk profile of Hong Kong-listed Chinese companies to mainland China shares. Hong Kong shares (H shares) operate under an internationally recognised legal and regulatory framework. Mainland China shares (A-shares) are governed by China’s regulatory framework. Thus, I favour IZZ over the VanEck FTSE China A50 ETF, which invests in mainland China shares.

Asian tech exposure

Elsewhere, the Betashares Asian Technology Tigers ETF (ASX: ASIA) is an option for investors seeking exposure to a larger recovery in Chinese tech stocks. The ETF tracks a portfolio of the 50 largest Asian tech stocks (excluding Japan).

ASIA is up almost 40% over one year to end-February 2025, although it is down on peak prices in early 2021.

ASIA’s average forward Price Earnings (PE) ratio in February of 14.66 times still seems undemanding for the region’s best tech stocks – provided the Chinese authorities continue to show renewed support for the country’s tech sector, which seems the case after DeepSeek’s success and the message it sent to the West about China’s AI capabilities.

Chart 2: Betashares Asian Technology Tigers ETF

Of the two ETFs, I prefer IZZ. At this stage, broad-based rather than sector-specific exposure to China is the safer bet. There’s enough risk in Chinese equities as it is without having to pinpoint sectors, although there’s a lot to like about Asian tech companies after their average valuation sunk in the past few years.

A final note of caution. Chinese equities are not for the risk averse. The country has substantial economic, regulatory and demographic challenges. It’s also a key player in an increasingly volatile geopolitical environment, thanks to Trump.

Prospective investors in Chinese equities need a higher risk appetite and long-term focus. It will take years for a Chinese turnaround to play out and no recovery occurs in a straight line. After gains this year, a larger pullback is possible.

Moreover, Chinese equities should only be a small part of a balanced portfolio, through the emerging-markets component. For most investors, that allocation would be below 5%, depending on the size of the emerging-market allocation.

Long experience has taught me that markets can fall much further – and take much longer to recover – than investors realise. Equally, investors often underestimate the power and duration of the best recoveries.

Yes, China has many challenges. But as the world focuses even more on Trump this week (if that’s possible) it’s worth thinking about the United States’ main strategic rival – China – and valuations in Chinese equities.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 1 April 2025