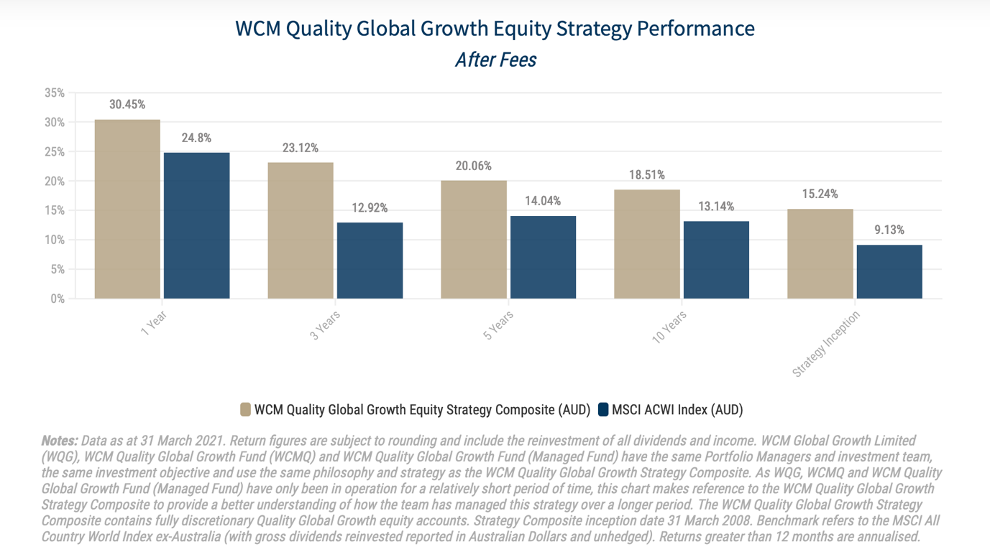

I’ve been fascinated at the performance of the US fund manager WCM that has two listed and a number of unlisted investment funds here in Australia. The performance of the US fund has been great for a long time and the local listed offerings, which simply reflect the head fund’s showing plus or minus currency, has been impressive as well.

Here’s the US fund’s numbers that prove my point:

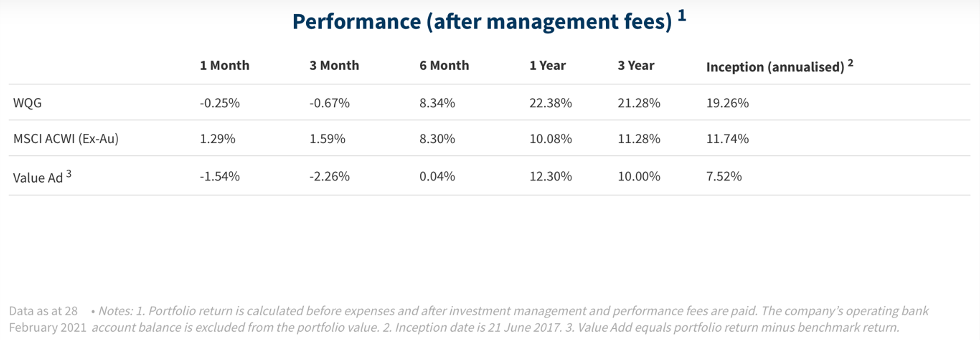

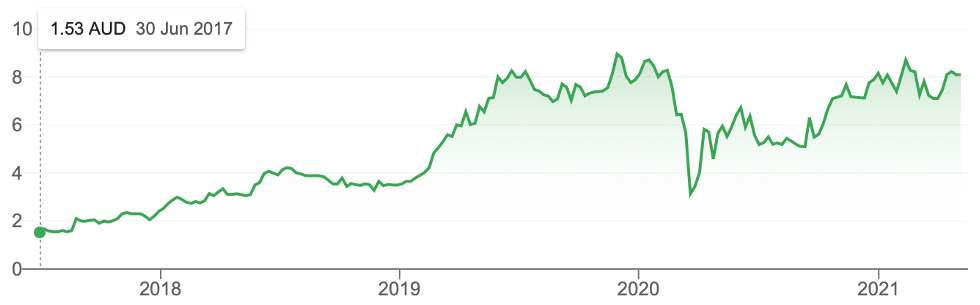

And here’s the local listed WQG performance:

WCM looks to find best-of-breed businesses, with a growing competitive edge or moat. They put their own cultural filters over the companies that look attractive to work out if they want to get into bed (aka invest) with these businesses.

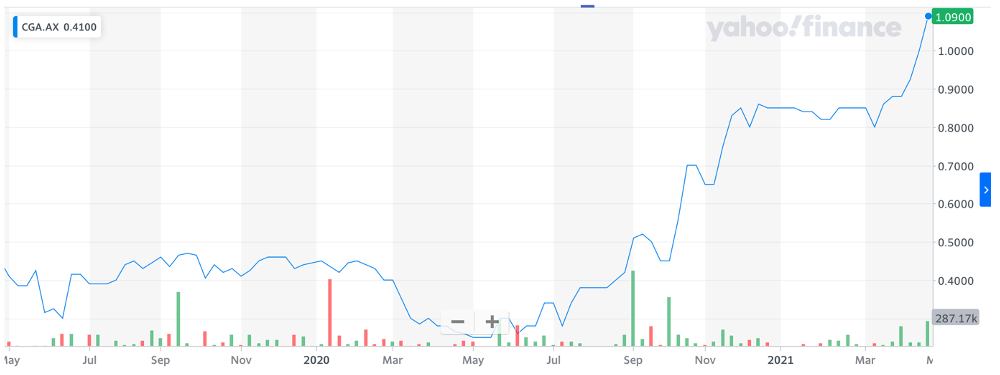

I’ve been interested in these guys and their performance because they’ve been brought to Australia by Contango Asset Management (CGA), where my son Marty is CEO. Contango runs my Switzer Dividend Growth Fund (SWTZ) and my recent Switzer Higher Yield Fund (SHYF), which is managed by Coolabah Capital’s and the AFR’s Chris Joye and his team of very smart bond market experts.

The association of WCM with Contango and the US fund manager’s performance has been good for the funds under management for Contango, which is now over $1 billion. And the stock price chart is showing that the market is noting CGA’s better position. This has got me thinking that I’d like to first find local companies that might pass the WCM test and eventually I’d like to create an Aussie fund based on these best-of-breed businesses that grow moats and great culture.

CGA 2 years

Source: au.finance.yahoo.com

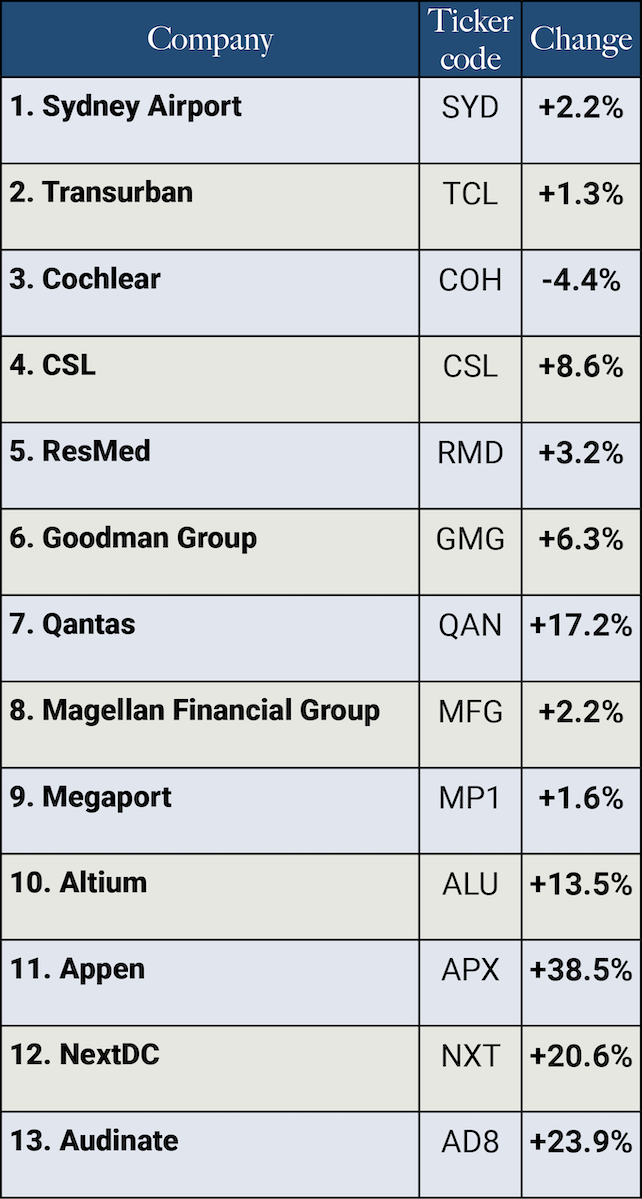

So I’ve scanned the ASX 200 list of companies and here’s my starting group of businesses that are best-of-breed in their industry, with what the experts surveyed on FNArena is the future share price rise or fall in the near term:

All these companies are best-of-breed and many have good moats to protect their potential profits and growth, but I’m not sure about whether they have growing moats. And I’m no expert on their cultures so it will have to be a research goal for me in coming weeks.

One interesting company that Michael Wayne of Medallion Financial talked about during our Investor Strategy Day was Audinate (AD8), which seems to have a growing moat and is definitely best-of-breed. The question mark is about its culture and I’ll endeavour to get the company’s CEO for my TV show and this Report ASAP.

This is what Michael shared with me on my TV show last Thursday. (https://www.youtube.com/watch?v=dbTwCA4Yzpk [1] )

As the table above shows, AD8 has a 23.9% upside if the experts can be believed.

“The company has been a Covid-loser,” said Michael. “It’s audio equipment that allows electronic equipment to connect with each other without the need for the wires.”

He says it’s high-end audio for sporting events, musical festivals and the like and AD8 provides a product called Dante, which is embedded to allow the equipment to communicate. This is how the company website explains its crucial IP: “Dante replaces point-to-point and audio and video connections with easy-to-use, scalable, flexible networking. Adopted by hundreds of manufacturers in thousands of professional products, Dante is the de facto standard for modern connectivity.”

I asked Michael “Is it like Sonos?” And he replied: “Yes, but better quality…and it’s getting adoption rates 17 times faster than its nearest competitor.”

What’s AD8’s story?

The company started in the audio space but is now moving into the video digital sector.

It seemed similar to Bluetooth but Michael says Bluetooth is a lesser quality tech alternative owned by a not-for-profit operation. This quote from Michael got me thinking about the company’s moat: “AD8 has the potential to be an unregulated monopoly.”

Given its innovation into video, that got me thinking about an expanding moat!

This company is certainly a beneficiary of the reopening, getting back-to-normal economy ahead, which should gain from the comeback of business and events that need quality audio connections

To me, this looks like a company that WCM might run its culture filters over but I might dabble a bit even before I test out its culture.

Here’s the latest price action, which also looks promising. I will ask Mike Gable from Fairmont Equities to run his technical analysis over the business, so watch out for my TV shows this week [2].

Audinate (AD8)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.