Could Telstra get back to $5.00? That’s a question that until recently was unlikely to be answered in the affirmative. And while I don’t think it is necessarily on the cards, the fact that some are asking it is good news for many long suffering Telstra shareholders.

Since Mr Rudd’s NBN started to roll-out and Telstra’s once dominant position in broadband and fixed services changed to being that of “just another retailer”, Telstra has been a horrible investment for some shareholders. Missteps by Telstra haven’t helped, but the so called “NBN headwinds” have been the biggest driver of year on year declines in income and earnings, and downward pressure on the share price.

Telstra – 10 years to August 2021

Last October, with the share price at $2.84, I nominated Telstra as a ‘buy’ (see https://switzerreport.com.au/is-telstra-now-a-buy/ [1] ). I re-affirmed this in February after Telstra’s first half results with the shares trading at $3.24, saying : “I am going to stick my neck out again and say that there is more upside with Telstra. The support from dividend thirsty income seekers, plus others expecting some form of distribution in relation to the sale of TowerCo, will keep a floor on the price. I am not looking for much, maybe over time up to $3.75. I do not see a lot of downside risk in the short term, which makes it a buy/hold rather than a sell.” (See https://switzerreport.com.au/telstra-is-it-still-a-buy/ [2] )

On Friday, Telstra closed at $4.02, well above my initial target of $3.75. After forming a pretty solid base around this price, the most recent move up was triggered by a positive response to Telstra’s full year profit results.

There were four really important takes from these numbers.

Firstly, while at a headline level total income was down 11.6% to $23.1bn and underlying EBITDA was down 9.7% to $6.7bn, these were consistent with prior guidance.

Secondly, second half EBITDA was higher than the first half. Although only very modest growth (from $3.324bn to $3.365bn), this is the first time in ages that Telstra has delivered earnings growth.

Next, mobile services revenue and ARPU (average revenue per user) increased. While this may in part be due to reduced competition following the merger of Vodafone and TPG, again, it was the first time in many years that the numbers had improved. Services revenue in the second half was up 3.9% on the first half, and ARPU for post-paid customers was $48.16, up from $47.53 for the previous corresponding period.

Finally, Telstra guided to higher EBITDA in FY22 – in the range of $7.0bn to $7.3bn. Not only is this a bigger improvement than was expected, but it is also getting Telstra closer to its “FY23 ambition” of EBITDA in the range of $7.5bn to $8.5bn. Telstra has said that this is the level required to sustain the dividend at 16c per share, and to provide a return on invested capital (ROIC) of 8%.

Clearly, the impression is that Telstra has turned the corner.

Looking ahead, Telstra said that about 90% of the “NBN headwinds” had been incurred and that for FY22, in year headwinds would reduce to around $350m. It expected additional costs out of around $430m and that it was on track to achieve its productivity target of $2.7bn cumulative by the end of FY22.

Telstra is optimistic that its recent diversification initiatives into the health and energy verticals (Telstra health through the acquisition of Medical Director and PowerHealth) will make a positive contribution to earnings in FY22 and a growth platform for the future. A potential divestment/demerger of InfaCo Fixed (the business Telstra has carved out that owns all fixed infrastructure, excluding mobile phone towers) could also come into play in the second half of FY22. Earlier this year, Telstra sold a 49% share in the Towers business at a very heady multiple of 28x EV/EBITDAaL.

What do the brokers say?

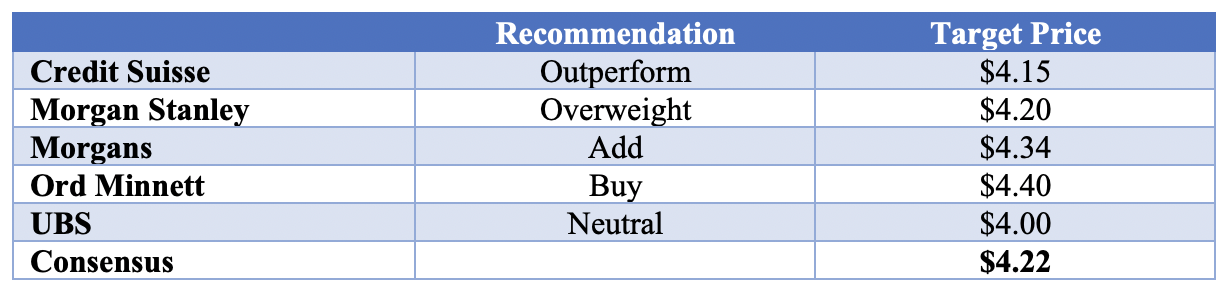

The major brokers are moderately bullish on Telstra with 4 ‘buy’ recommendations and 1 ‘neutral’ recommendation. According to FNArena, the consensus target price is $4.22, about 5% higher than Friday’s closing price of $4.02.

Source: FNArena

Interestingly, none of the brokers see any risk on the dividend – all forecast 16c per share in FY22 and FY23.

This precis of Morgans research by FNArena encapsulates the thinking:

“For three reasons the analyst retains an Add rating. Industry dynamics are improving, the sum-of-the-parts is worth more than the current share price and the abovementioned return to growth of underlying earnings.”

Bottom line

I don’t think Telstra is going to get back to $5. But I can see it going higher, just through the weight of money.

As boring as Telstra is, its appeal as a relatively secure, tax effective income stream is attractive to investors. It is also less volatile than many other shares, and the downside risk is lower. From a business point of view, Telstra remains the market leader in telecommunications and is clearly in front when it comes to 5G. There also could be upside for shareholders if or when InfraCo is spun out, sold or demerged.

At $4.30, Telstra yields 3.7%, which grossed up for franking credits takes the return to 5.3%. That’s about where I am targeting (Telstra goes ‘ex’ its 8c fully franked dividend on Wednesday – so it’s about 40c higher than today).

Portfolio investors should stick with Telstra.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.