Decades of analysing unloved assets have provided an important lesson: the best contrarian opportunities are usually the hardest to buy or sell.

Market negativity towards out-of-favour assets is magnified these days due to social media and a chorus of commentators who mostly say the same thing.

Going against the ‘in-crowd’ is hard work. It’s far easier to buy stocks everybody seemingly loves and avoid hated stocks and themes.

Although momentum investing has its place for traders, it is dangerous for long-term portfolio investors who are seduced by hype and try to time markets.

As this column’s readers know, I search for stocks, sectors or themes badly unloved, ignored or overlooked. Assets that few people have a good word to say about, even though every asset has its price. Valuation is key.

I also look for megatrend ideas after the initial hype fades. Stocks linked to a hot trend often rally in their early phase, then tumble as valuation reality sets in.

All too often, the market, having earlier gushed about the megatrend and sent valuations skyrocketing, gives up on it. Valuations plunge.

As assets become irrationally oversold, the smart money starts to buy into the trend again but doesn’t talk about it because positions are being built.

Not every megatrend follows this pattern. But it’s amazing how investors often give up on hot trends that go cold, always looking for the next big idea.

Cleantech stocks are an example. Investors couldn’t get enough of cleantech in 2020 amid decarbonisation and then US President Biden’s support for the sector.

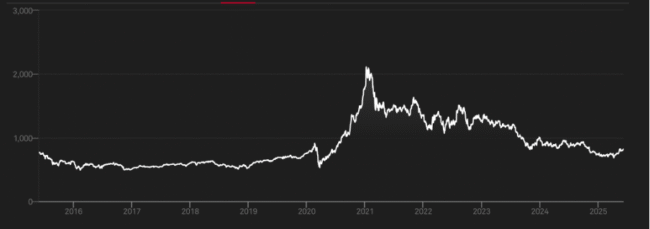

The S&P Global Clean Energy Transition Index – a key barometer for the sector – soared in 2020 as cleantech valuations boomed, as the chart below shows.

But since its peak in early 2021, the index has fallen 60% (in USD terms) in a bull market. Investors late to the trend have been smoked.

Remarkably, the index has an annualised 2% return over the past 10 years to end-May 2025. For all the hype, cleantech has been a poor long-term investment.

S&P Global Clean Energy Transition Index

Source: S&P Global

Cleantech Exchange Traded Funds (ETFs) dominate lists of worst-performing ETFs over one and three years. The Global X Hydrogen AUD ETF (ASX: HGEN), for example, is down by almost two-thirds from its 2021 peak.

President Trump, a longstanding climate-change sceptic, has compounded market negativity towards the cleantech sector.

On the first day of his second Presidential term, Trump withdrew the US from the Paris Agreement and other international climate commitments. He also rolled back several US environmental regulations targeting greenhouse gases.

Trump’s “drill, baby, drill” comment reinforced his support for fossil fuels through domestic oil and gas production, much to the chagrin of cleantech supporters.

I could outline other Trump implications for cleantech but suffice it to say he is implementing a pro-fossil fuel, climate-sceptical energy agenda. The big risk is that other countries follow his approach and wind back climate support.

Readers can form their own view on Trump’s actions and whether the US is doing enough to accelerate the transition to renewables. I’m more interested in company valuations and short-term market overaction to bad news.

Make no mistake: many cleantech companies were widely overvalued at the 2021 peak when potential ran too far ahead of reality.

Also, megatrends typically have many more company losers than winners as new technologies emerge and others fade. Green hydrogen is an example; it was meant to revolutionise energy but expectations for it are being recalibrated.

Yet for all the short-term pain, long-term trends for cleantech are still intact. 2024 was the warmest year on record, surpassing the 2023 record, NASA found.

Last year also saw an alarming increase in natural disasters with more than 150 significant events worldwide, according to the United Nations. Ocean heat was the highest in 65 years, according to the World Meteorological Organization.

Again, readers will have their own views on climate change and the appropriate level of policy urgency required. I’m interested in long-term trends and all these point to growing demand for cleantech solutions in coming decades.

Taken together, the cleantech sector is back at 2019 valuations after horrendous falls over the last few years.

Trump might be terrible for clean-energy policy, but counterintuitively he’s been good for clean-energy valuations, at least for prospective investors and contrarians. His policymaking approach has created valuation opportunity.

Like any megatrend, picking the bottom for cleantech stocks is near impossible. Valuations could fall further before they improve. Prospective investors must be able to tolerate potential short-term losses, higher risk and regulatory uncertainty.

Moreover, a recovery will take time to unfold. There is no quick fix. This is an idea for experienced growth-focused investors with at least a 7-10 year timeframe.

Caveats aside, prospective investors are buying into a sector that has had the last six years of gains wiped off, largely due to overvaluation and, lately, Trump.

Here are two ASX-quoted ETFs to consider:

VanEck Global Clean Energy ETF (ASX: CLNE)

CLNE provides concentrated exposure to 30 of the largest global companies involved in clean-energy production, technology and equipment.

Just over a third of CLNE is invested in power producers and energy traders, and almost another third in electrical-equipment manufacturers. Almost half of CLNE’s portfolio is invested in US clean-energy companies.

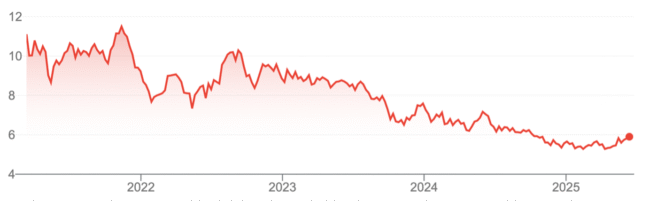

CLNE returned about -18% over one year to end-May 2025. Over three years, the annualised return is around -10%. The ETF launched just as cleantech stocks lost favour, which reinforces the danger of buying thematic ETFs after prices peak.

CLNE’s average forward Price Earnings (PE) ratio was 16 times at end-May 2025, and the price-to-book ratio was 1.43 times. The annual fee is 0.65%.

Van Eck Global Clean Energy ETF

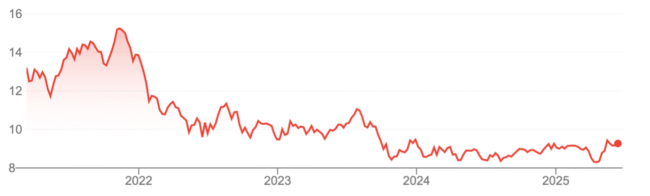

BetaShares Climate Change Innovation ETF (ASX: ERTH)

ERTH provides exposure to up to 100 global companies that make at least half of their revenue from products or services that help address climate change or other environmental problems through the reduction of CO2 emissions.

ERTH’s underlying index includes well-known global companies in clean energy, green transport, waste management, sustainable product development, and energy efficiency and storage. Almost half of ERTH is invested in US stocks.

After losing almost 30% in calendar year 2022, ERTH has continued to edge lower. The ETF’s return since inception in March 2021 is an annualised -8%. Ouch!

Prospective investors might view that as an opportunity to buy ERTH at a sharply lower price, after heavy falls since late 2021.

ERTH’s forward PE was 25 times, and its price-to-book ratio was 1.25 times at end-May 2025. ERTH tends to own renewables companies more focused on climate-technology innovation, compared to CLNE.

ERTH, however, has less concentration risk than CLNE, holding 100 securities. Its combined management fee and annual expenses are similar to CLNE’s fee.

Like CLNE, ERTH looks like it might be getting ready to turn a corner.

BetaShares Climate Change Innovation ETF (ERTH)

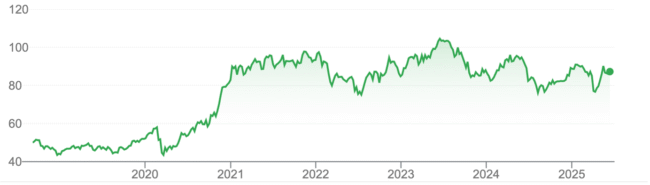

Global Battery X Tech and Lithium ETF (ASX: ACDC)

ACDC is more of a medium-term play on a lithium-price recovery and a fund for broad exposure to climate-change themes.

ACDC invests in companies throughout the lithium cycle, from upstream producers to downstream refineries and battery producers.

I’ve included ACDC in this week’s column because I like the outlook for the battered lithium sector. Lithium stocks soared in 2021 and 2022 when the lithium price soared. Investors couldn’t get enough of lithium, a big winner from electric vehicle batteries.

Launched in August 2018, ACDC leapt from $43 in March 2020 to $103 in mid-2023. The ETF now trades at $87, having been as low at $71 in the past 52 weeks.

Understandably, key lithium producers in the past year have announced plans to curtail current or future supply in response to the depressed lithium price. It will take time, but lower supply in the context of rising lithium demand due to expected growth in Electric Vehicles will lay the foundations for a lithium price recovery this decade – and in ETFs that hold lithium stocks.

Global Battery X Tech and Lithium ETF

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 10 June 2025.