I am a huge fan of accounting software provider Xero (XRO). Talk to any small business owner or their accountant, the chances are that they will also sing the praises of Xero. A New Zealand company by origin, It went to the cloud first and left established competitors, including MYOB and global player Intuit (QuickBooks), in its wake.

It has also been a hit with investors, being one of Australia’s best performing tech stocks. But in the last 12 months, it has struggled to get through the $155 share price level, failing three times. The latest failure came last week after it released its profit results for the first half of FY22.

The market didn’t like that EBITDA decreased by 19% from $NZ120.8m to $NZ98.1m, as Xero returned to “pre-pandemic” levels of spend across sales and marketing and product design and technology. Although this was consistent with prior operating expense guidance, Xero is priced at “close to perfection”, so “outperformance” is expected. Growth in overseas subscribers was also slightly weaker than expected.

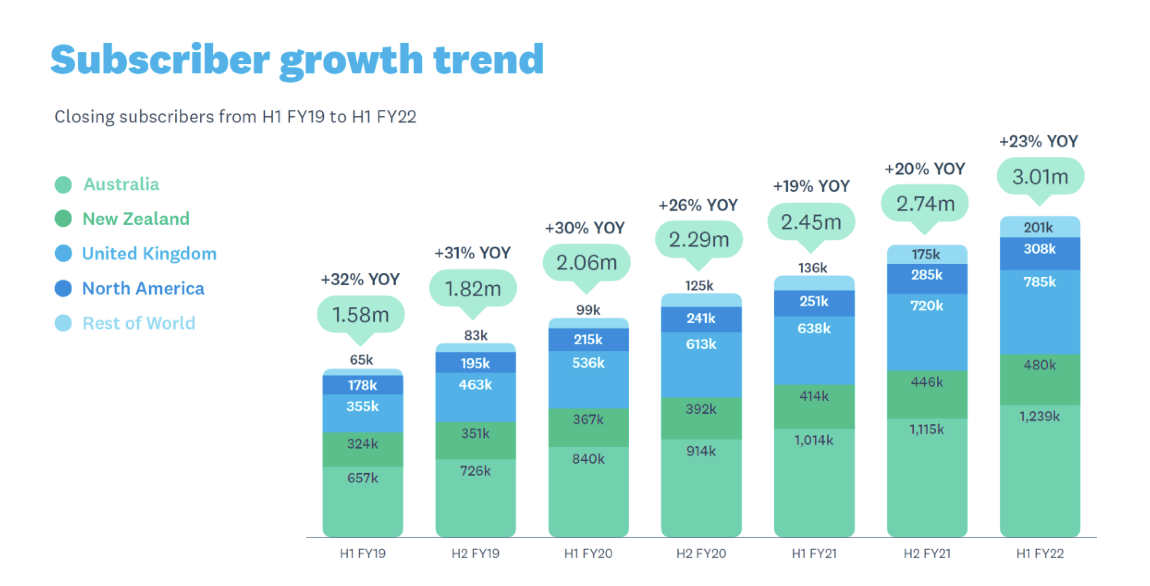

But otherwise, it was a pretty credible performance. The total number of subscribers grew by 23% to 3.01 million, with Australia adding in the half a net 124,000 customers, New Zealand 34,000, the UK 65,000, North America 23,000 and the rest of the world 26,000.

North America is potentially the biggest (and most competitive) market for Xero, and while the 23,000 net additions represented year on year growth of 130%, the market wants it to do more.

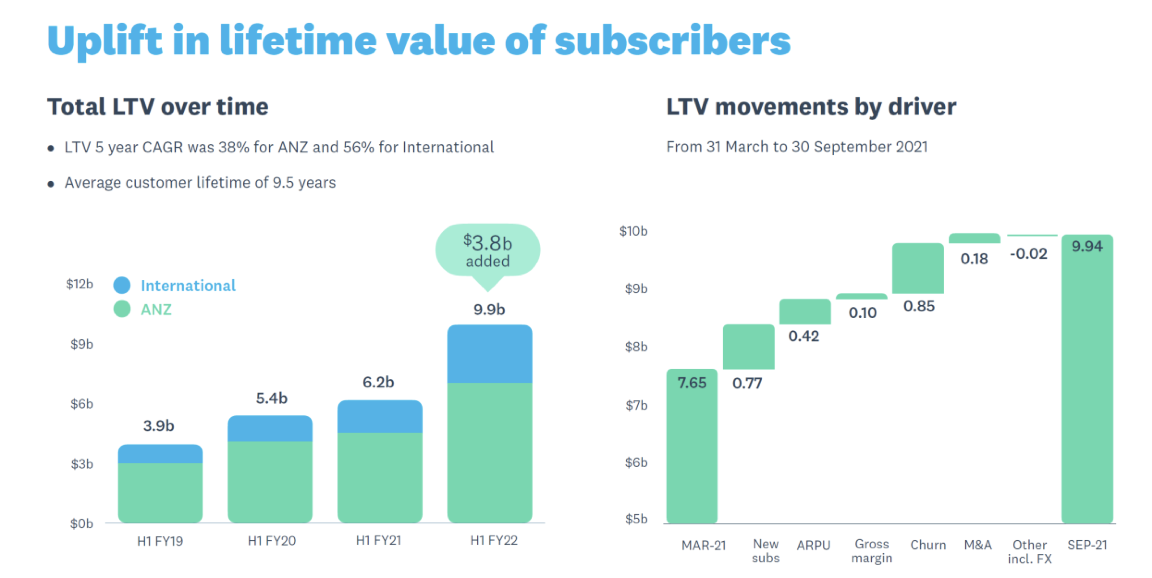

ARPU (average revenue per user per month) grew from $NZ29.30 in March to $NZ31.32 in September, with price changes and product mix offsetting a negative movement in the exchange rate. In constant currency terms, the year on year change was 7%, with the international businesses leading the way.

Higher ARPU and lower churn helped drive an increase in the LTV (lifetime value) of customers. This is a key metric for SaaS (software as a service) businesses such as Xero. In ANZ, the LTV increased from $NZ3,182 to $NZ4,080 per customer, and for international customers, from $NZ1,587 to $NZ2,262. The LTV/CAC ratio (lifetime value to cost of acquisition) improved from 5.7 to 7.4 times.

Being cloud-based, the Xero business is very scalable. More remarkably, a high proportion of accounting software in English speaking markets outside Australasia doesn’t sit in the cloud. This is one of the main opportunities for Xero in the UK and US.

The Xero strategy is to drive cloud accounting, grow a small business platform around this, and build for global scale and innovation. Currently, 87% of revenue is derived from core accounting with 11% coming from platform services. The latter includes revenue from adjacent products including document subscriptions, add on modules for payroll, projects and expenses, and payments from partners under revenue-share agreements.

To support the expansion of the platform business and drive cloud accounting, Xero has completed four acquisitions in the last 12 months. Planday, a workforce management platform for employers and employees that operates in the UK, US, France, Germany and Nordic countries (this is Xero’s most significant acquisition); Waddle, an invoice lending platform leveraging customers’ accounting data that operates in Australia; Tickstar, technology that provides access to established e-invoicing capability, and Locate, a real-time inventory tracking and management solution. Xero expects to launch the latter into the US market first.

Financially, Xero’s operating revenue rose by 23% to $NZ506m for the half-year. With EBITDA down, the company slipped to a net loss of NZ$6m for the half-year. The balance sheet remains sound, with total liquid resources of $NZ1.2bn on hand.

Looking ahead, the company says that it will continue to focus on growing its small business platform and re-investing cash generated to drive long term shareholder value. Operating expenses as a percentage of operating revenue are expected for FY22 to be in the range of 80% to 85%, with integration costs expected to add another 2%.

What do the brokers say?

While the major brokers are positive about the company’s prospects, there is a sense that it is fully valued. Macquarie and UBS, who both have “sell” recommendations on the stock, cite valuation as the main reason for their call: “too high to offer fair reward for risk to investors”.

Citi, Credit Suisse and Morgan Stanley have “buy” calls, with the former nominating a target price of $160.00.

According to FNArena, the consensus target price is $134.17, about 9.1% lower than yesterday’s ASX closing price of $147.63. The following table shows the individual broker targets and recommendations.

My view

There is no doubt that Xero is an expensive stock, trading on an EV/Gross Profit (enterprise value/gross profit) prospective multiple of about 24.0 times. Even for a company growing revenue at circa 23% pa, this is considered to be high.

But by Australian tech standards, Xero is quite unique with very sticky customers, high margin and scalable platform. By its record of innovation and delivery, it is arguably the best ASX listed tech company. It is also a market leader in its field.

That makes it a “buy” for me when others want to sell it. The brokers’ valuation shouldn’t be dismissed, but it is also worth noting that the “consensus” has been moving higher. Only six months ago, the brokers had it at $116.83 compared to the current valuation of $134.17.

My sense is that Xero will re-test the $155 level and eventually push through. It remains a core portfolio stock.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.