The two questions all investors have to be asking are: can we trust this bounce-back of stocks? And is the worst behind us? Of course, no one can answer these questions with 100% confidence, but the answer is necessary if you want to go long stocks, turn tail to run and sell off, or even just do nothing and go with the flow.

Clearly, I must have a view (you pay me for that!) and I must have a good argument either way. And let’s be clear on this: in buying stocks we’re always climbing the so-called wall of worry. However, sometimes the worries are more numerous and more challenging than at other times.

Now is a latter situation. Here are the curve balls we have to play to invest correctly:

- The Ukraine war.

- The Fed planning to raise interest rates 7-10 times, with the next one expected to be a 0.5% hike!

- US legendary investor, Carl Icahn, tipping a recession is coming.

- Inflation is going through the roof and the war’s impact on the oil price is no help.

- There’s BA.2, which not only threatens growth but will push up inflation with supply chain problems made worse by the closure of Chinese cities, such as Shenzhen with 17.5 million people!

- And unions here and abroad are thinking it’s time for a pay rise, with inflation undermining standards of living.

But against these headwinds, we’ve seen our market rebound over 8% since January 27.

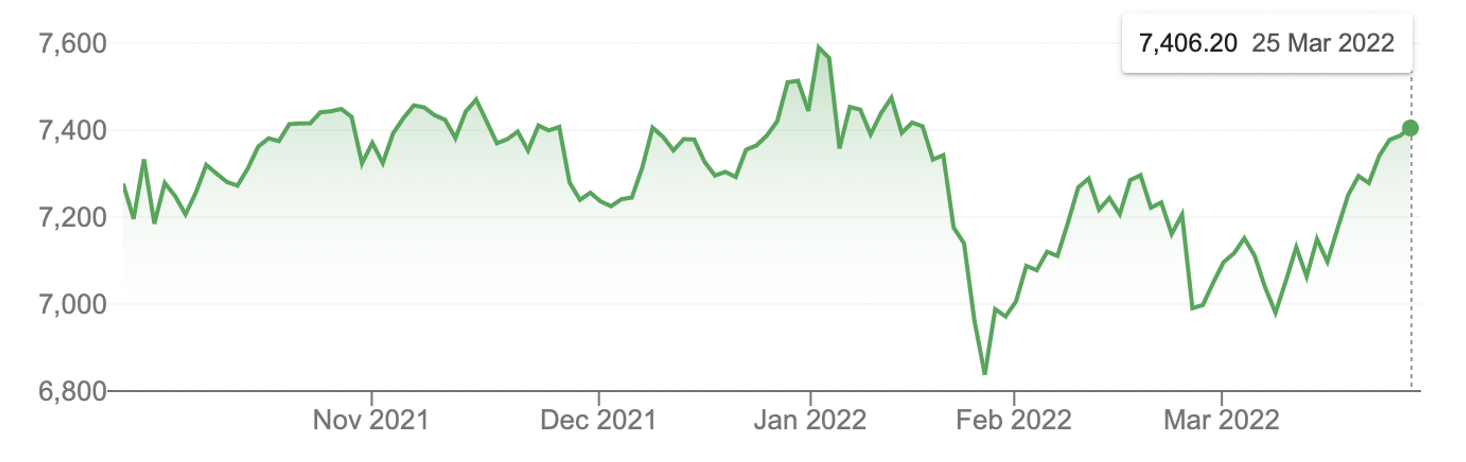

ASX 200

That fall around late February was the start of hostilities between Russia and Ukraine on February 20, but the uptrend has resumed and continued. And while we were helped by the rise in the price of oil and other commodity prices such as wheat, the US stock market has also tracked back without the commodity influences our market is lucky to have right now.

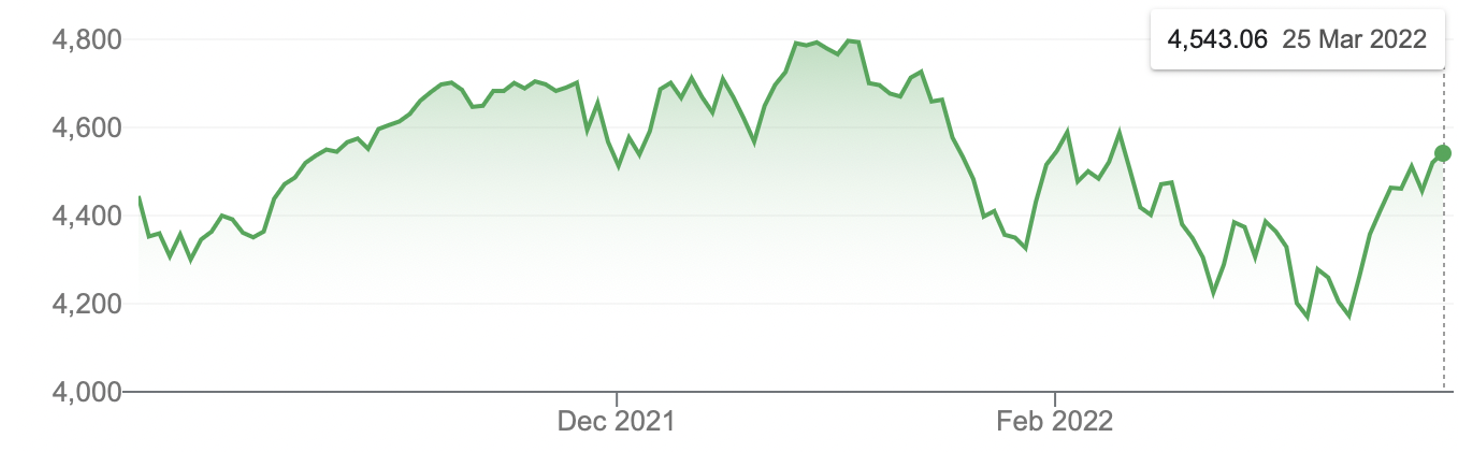

S&P 500

It’s understandable that our bounceback is bigger but still we’ve seen Wall Street and the Nasdaq with its tech stocks come back into favour as well. And even if this is only a sneak preview of what will eventually happen this year or next, investors will see the value in oversold quality tech companies.

In his weekly roundup of market developments and commentary, Percy Allan has made the following interesting points that any would-be optimist needs to take on board:

- The All-Ords share price index rose by 1.6% last week after a 3.2% rise the week before, despite the fact that both the All Ords and S&P 500 indices broke below their 300-day moving averages in the last month.

- On a short to medium-term trend analysis, the models he follows show both the Australian and US share markets last week turned bullish. On medium to long-term trend analysis, both markets are bullish.

- The yield curve is not only positive but slightly more so than its historic average spread, which is a good omen for stocks. Note, a negative yield curve often runs ahead of a recession.

- US economists largely think the US economy is underpinned by a strong labour market, solid consumer spending and better-than-expected corporate profits.

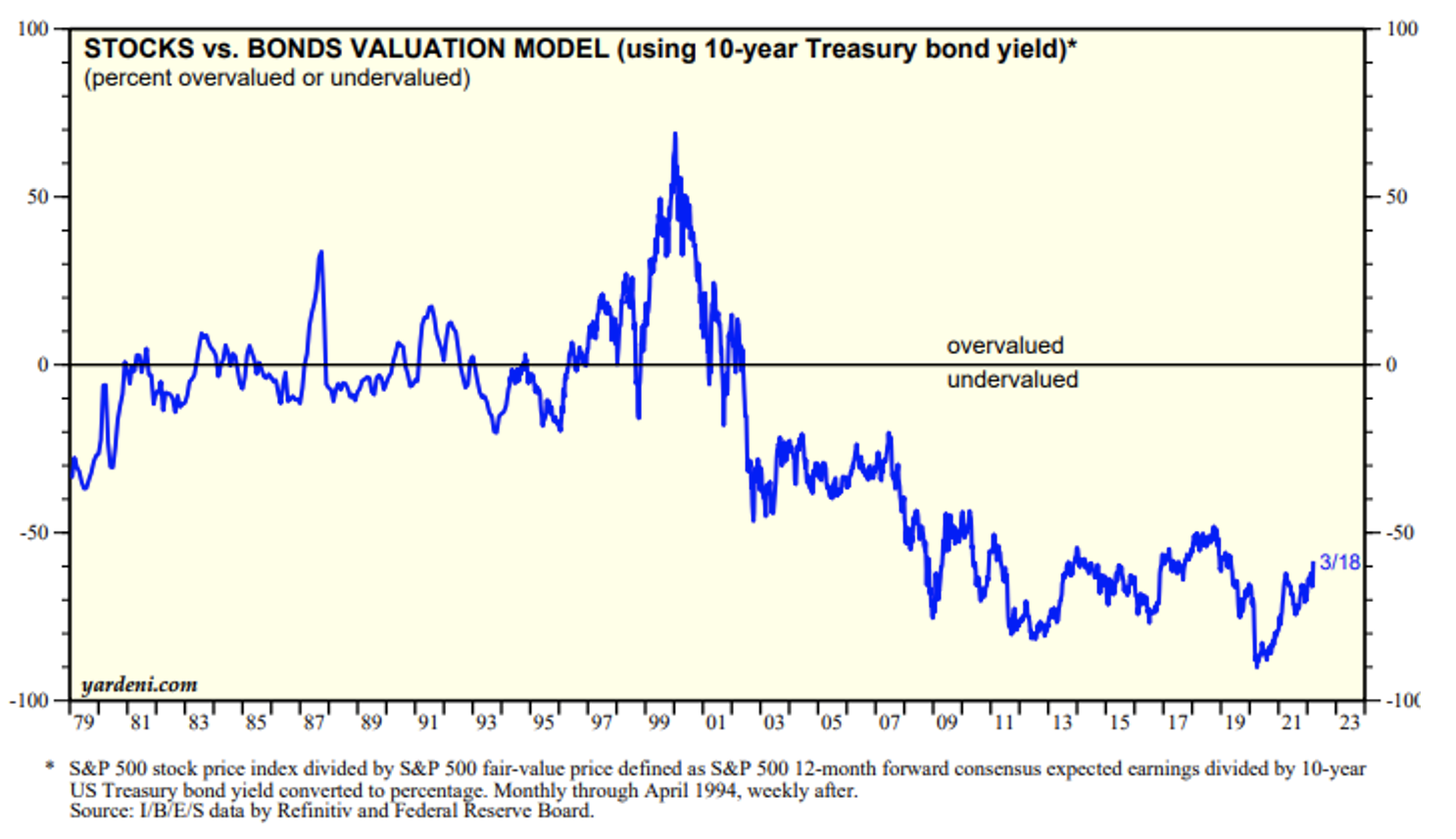

- The Bond Equity Earnings Yield Ratio or BEER indicator, which is calculated by dividing the yield of a 10-year Treasury bond by the current earnings yield of the S&P500 stock index, says stocks are undervalued, as this chart shows.

(I think the BEER indicator is influenced by the low level of interest rates, which will change over the next year as rates rise in the US. On other indicators, the US market does look overvalued but that can be tolerated because interest rates have never been so low. It’s not relevant to look at valuations without considering that very low interest rates make higher valuations of stocks more acceptable in this historically unique situation, post-pandemic.)

I could go on finding reasons to argue that stocks can go higher over this year and in 2023 but I’ll take Percy’s bottom line: “The US share market is highly overvalued so is susceptible to a shock such as a sharp rise in interest rates or oil prices. By contrast, the Australian share market on fundamental measures is only modestly overvalued though would still be sensitive to any future US market downturn.”

And the following is the important bit that I think must be understood: “But if interest rates rise only modestly and oil prices subside assuming the Ukraine crisis is resolved soon, then stock markets might hold up for some time yet. The best we can do is monitor both the Australian and US stock markets’ trends and momenta to gauge whether they are currently bullish or bearish because no crystal ball can foretell how their price indices will pan out in a week, a month or a year’s time.”

Well analysed, Percy. And it’s why I think watching for some real peace talk developments could be a big game-changer for stocks.

Of course, if Putin and Biden make it harder for a quick settlement, then oil prices will remain higher than they should be. This will keep inflation up and even give a recession a real chance of happening.

As Percy found: “Historically, a 50% surge in crude-oil prices from its long-term price trend has triggered recessions, according to Pictet Asset Management.”

The longer the oil price remains elevated, the more my optimism about stocks will dissipate.

The intriguing thing is that even with the high oil price, we’ve seen stock markets rise and tech stocks get bought.

Since March 12, the Nasdaq is up 12.3%, which sure looks like smoke from a fire that could blaze if peace happens, BA.2 is managed without lockdowns and the Fed tames inflation.

There’s a lot of ‘ifs’ and ‘buts’ in my analysis of the future but right now a lot of heavyweight influencers on US stock markets are taking the punt on tech stocks looking like attractive value.

We all know growth stocks are hurt by rising interest rates, but, at present, those buying tech are gambling that the power of rebounding economies freed from the Coronavirus, heading back to something like ‘normal’ over time, will create positives for tech businesses to outweigh the negatives from rising interest rates that will be unleashed to contain inflation.

It’s a gamble but that’s what investing in stocks can be, especially in the short run.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.