Given the news about Ukraine and media attention on the oil price, it might surprise many to learn that the Australian sharemarket rose in February. In price terms, it rose by 1.1% and when dividends are included, it added 2.1%. That’s equivalent to an annualized return of over 25%!

In fact, the Australian market outperformed most other developed markets. The US, for example, lost 3.1% over the month as measured by the benchmark S&P 500 index. The Aussie market is still down this calendar year (5.3% before dividends and 4.3% after dividends), but it is doing better than other world markets.

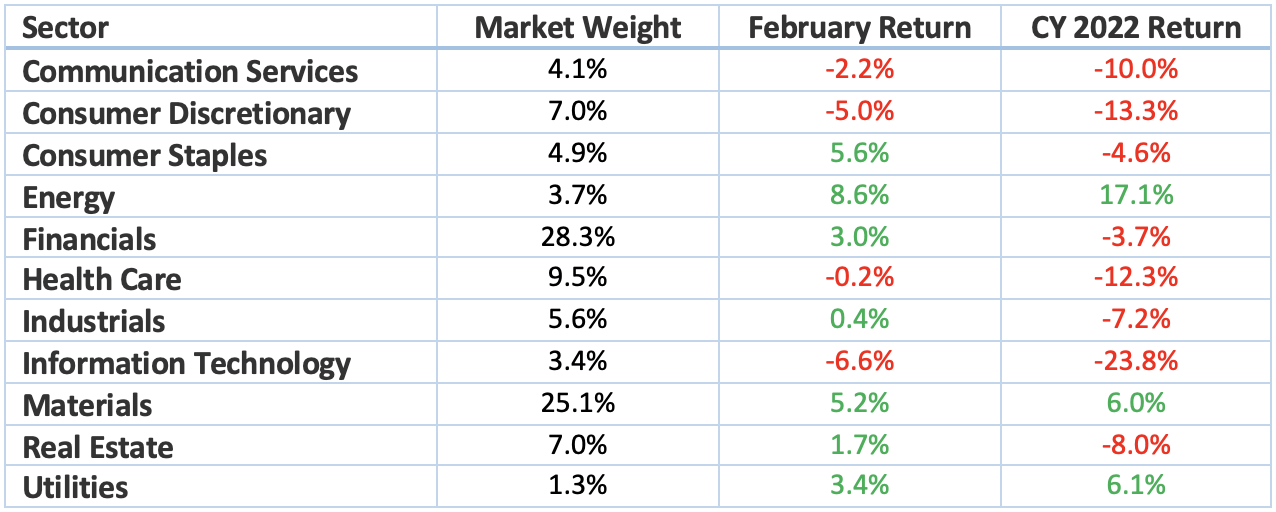

So where is the relative “outperformance” coming from?

Two sectors stand out. Energy is obviously no surprise, with our oil and LNG majors (Woodside and Santos) trading higher as the oil price rises. The sector returned 8.6% in February and is up 17.1% in 2022.

The other sector driving the market is the second largest; materials. Weighing in at 25.1% of the total market capitalization, the sector added 5.2% in February. Despite the conflict, base metals and iron ore remain firmly bid as global economic growth expands. The unification of BHP and a higher gold price also provided support.

The largest sector, financials, also ended in the black in February adding 3.0%. This came on the back of better than expected profit reports from CBA, NAB, Bendigo, Suncorp and Challenger.

Shareholders whose portfolio largely comprises ‘top 20’ stocks may actually not be feeling that much pain because the ‘top 20’ index is only down 2.8% in 2022. The pain is being felt with the mid and small cap stocks. The small ordinaries index, which tracks companies ranked 101st to 300th by market capitalization has shed 9.0%. The emerging companies index is even worse, down 9.4%. This behaviour, which sees smaller companies hit harder in a correction to a strong bull market is not that unusual because during times of market dislocation, investors seek out quality. On the negative side, the information technology sector continues to be trounced. Perhaps we have seen the making of a small bounce over the last few days, but for the month, it shed 6.6% to be down 23.8% this calendar year. Consumer discretionary, which includes companies such as Wesfarmers, Aristocrat, Tabcorp and Harvey Norman, lost 5.0% in February and is down 13.3% this year.

But can the market go higher in March and for the rest of 2022?

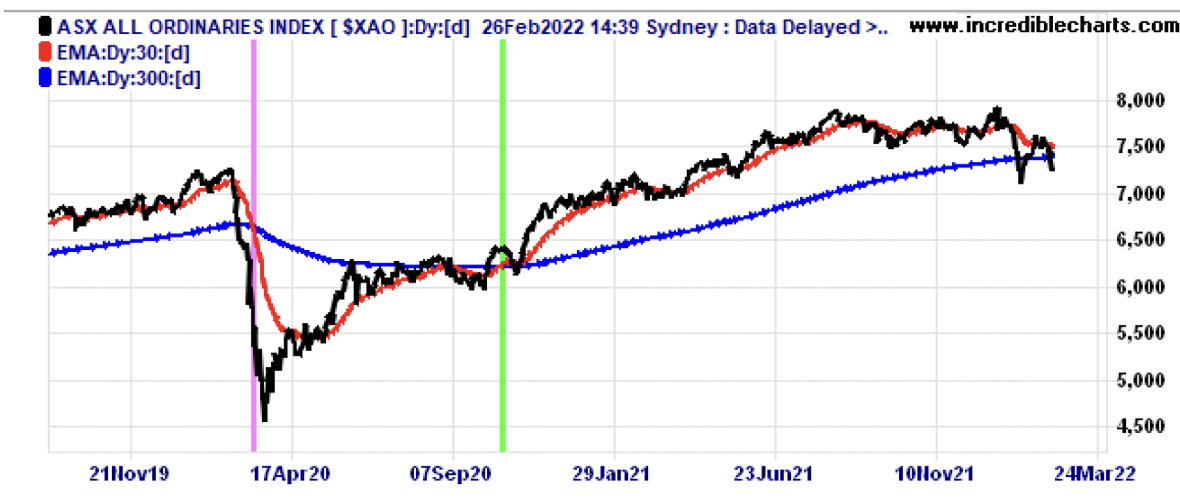

Firstly, it is important to note that the long term bullish trends (both in the US and Australia) are still in place. Percy Allen’s chart below shows that for the Australian All Ordinaries Index (shown in black), the 30-day moving average (shown in red) is still above the 300-day moving average (shown in blue). It is getting close, but the bull trend has held.

With Ukraine, the market is hoping that “common sense” will prevail. If Putin goes crazy and conflict spreads to other states in Europe, all bets are off. But assuming it is contained, investor eyes will quickly turn back to the US Federal Reserve and how it responds to the inflation threat.

The interest rate setting Open Market Committee of the Fed is due to meet on 15/16 March. On the morning of Thursday 17 March, we will wake to learn whether the Fed has lifted interest rates by 0.25% or as some fear, by 0.5%. Moreover, we will also get a read on the timing of further increases, with some investment banks expecting the Fed to lift rates as many as 7 times this year (among other reasons, there are 7 meetings of the Fed to be held in 2022).

If the Fed takes a more measured view on the timing of interest rate increases and keeps the March hike to 0.25%, this should be good for the equities markets because notwithstanding Ukraine, economic growth is accelerating.

In Australia, our highlight will be the Federal Budget which is due to be brought down on Tuesday 29 March. As a budget ahead of an election where the polls say that the Government will lose, the market is unlikely to take much notice of some of the commitments. We will also get an insight into how Treasury thinks the economy is travelling. With the Government keen to demonstrate its credibility as an economic manager, on balance, the budget is more likely to be a “positive” rather than a “negative” for the market.

Barring a calamity with Ukraine, I expect the markets to do a little better in March/April and tick higher. Dividend payment season means that there is an enormous pool of investible funds looking for a home, and with the RBA on hold and the Fed not going as hard as some had feared, equities still look attractive. In an environment of strong global economic growth, resource stocks and financials will continue to drive our market.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.