What an extraordinary period in markets this is. I haven’t seen anything like this since the peak of the dotcom bubble.

When prices are moving irrespective of, or even inverse to, fundamentals, it is very hard to remain disciplined in the investment process. It becomes easy to give in to FOMO (fear of missing out) and buy whatever stock or group of stocks are rising and buy into the “it’s different this time “ or “new normal” argument.

It’s not different this time

Trust me, it’s not different this time and there is no new normal. They are convenient phrases for completely losing investment discipline. I prefer “no pain no gain”, which reflects my last six months of fund underperformance, driven by adhering to an investment process that weights valuation and structural growth over pure momentum. It’s a tough time to be disciplined and somewhat contrarian, but it will prove the right medium-term strategy, as it always has.

Developed markets, particularly US equities, have crushed returns in emerging markets but particularly China. Momentum stocks have crushed value stocks, with P/E being added way beyond earnings revisions.

This is exactly what happened at the peak of the dotcom boom, where the “haves” and “have nots” P/E divergence went off the charts, only to revert two years later completely the other way.

This has been the same in Australia, where mid and small cap industrials have crushed broader value stocks. Just look how many Australian small cap managers are moving into new expensive offices!!

P/E equations

Credit Suisse did some interesting work on P/E additions/subtractions post the August Australian reporting season. I quote directly from their note below:

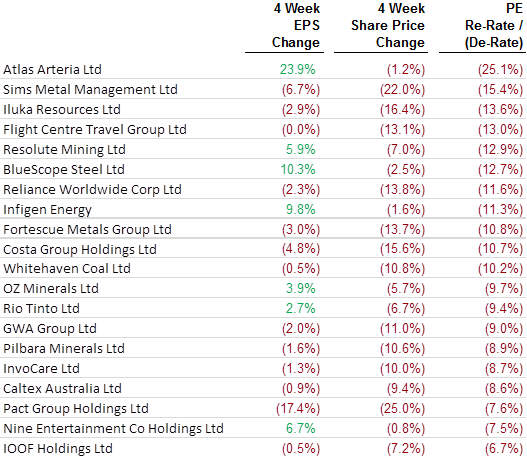

Using the S&P/ASX 200, I downloaded the last four weeks of EPS changes, compared them to the last four weeks of share price changes, to get the implied PE re-rate / de-rate. Overall, the S&P/ASX 200 saw EPS downgrades of only -2.5% versus share price moves of 1.3%. This led to a net PE re-rate of 3.8%. But when you look at the extremities of this sample, the moves are very large. After sorting these stocks by largest re-rate, the following are the top 20 stocks:

As you can see, there were no big EPS upgrade stories in this list and yet we saw some huge share price moves which has led to large PE re-ratings. It is interesting to note that seven of this top 20 list are tech companies. However, when it comes to these tech companies, EPS is clearly not the key driver, as the market tends to focus on revenue while they are growing businesses (and EPS can be volatile while the company is in investment mode). But even when you look at the revenue upgrades, they were nowhere near how much the share prices rallied. It looks clear to me that many of these stocks have moved into bubble territory.

The top 20 P/E de-rates are below.

The rest of the world

August globally saw more of the same. Positive returns for global equities (+1.2%) masked stark divergences between the US and Rest of World. The S&P 500 gained 3.3% in August, while stocks in Europe, Japan and emerging markets (EM) were down on the month. EM assets saw a particularly sharp decline, with Brazilian equities down 11.4% (in US dollars), emerging market dollar credit spreads widening 58 basis points and the emerging markets foreign exchange index falling 3.7%. Within global equities, the spread between ‘Growth’ and ‘Value’ performance in August was at 2.9% and US tech was the best-performing global sector. Trade-weighted US dollar was stronger in August (+1.2%), with the US dollar appreciating against most of the G10 (except the Japanese yen and the Swiss franc) and emerging market currencies.

US dollar strength and “trade war” rhetoric ahead of the US mid-term elections have driven unprecedented outperformance of US equities over all other developed and emerging markets. In fact, it’s clear that fund managers have been rotating to US equities from all other developed and emerging markets due to short-term uncertainty. The outperformance of US equities is broadly unprecedented, but particularly so is the performance of US technology shares. The NASDAQ 100 Index has outperformed the Shanghai Composite Index by 39% this year.

Watch for the signals

We believe this underperformance is being driven by an unsustainable rotation. Asia facing structural growth stocks now represent value, due to unprecedented rotation from emerging markets ETFs to developed markets. The world’s largest Emerging Markets ETF (EEM.US) now has 17% of its free float shorted. That degree of short interest has historically proved a contrarian signal.

I remain strongly of the view that, despite short-term underperformance, that the investment case for our key structural growth stock investments remains compelling. This is particularly so after the recent Hong Kong reporting season broadly exceeded our estimates. While HK stocks fell in August, driven by rotation to developed markets, we simply believe we are buying structural earnings growth at cheaper multiples than previously. Later in this note we will look specifically at Ping An Insurance (2318.HK) as an example of a high conviction investment case.

The reason for my Asian biased positioning is valuation. Below is a P/E chart of Travelsky (green) versus Amadeus IT Group (AMS.SP) (red). Both are global distribution system (GDS) airline booking systems. The blended forward P/E of Travelsky is 16.8 times versus 29.7 times for Amadeus. Travelsky offers prospective EPS growth of 16%, versus 4.5% for Amadeus. Travelsky has 20% of its market cap in cash versus Amadeus with $2.5 billion in debt. We believe Travelsky is unquestionable cheap on all investment criteria.

Ping An update

The Ping An Insurance Company (SHA: 601318) remains the funds 3rd largest holding. Today I also thought it would be useful to update you on our investment thesis on Ping An. It is a classic example of a structural growth stock on a value multiple.

During the month, Ping An reported a solid first half result that exceeded market expectations. Key highlights of the result are as follows:

- Group operating profit of RMB59.3 billion (23% yoy) with strong performance at each key divisional level, particularly the core Life & Health insurance division and the Fintech & Healthtech businesses.

- Declared an Interim dividend of RMB 0.62 per share (24% yoy). Whilst the current dividend yield is a relatively modest 2.9%, Ping An has grown its dividends at a compound rate of over 50% per annum over the past four years and full year dividends are likely to be up another 25-30% this year.

- EPS of RMB 3.25 per share (34% yoy) versus consensus expectations of RMB 3.06. First half EPS has contributed around 59% of the current full year consensus earnings, suggesting further earnings upgrade potential.

Ping An made solid progress in adding customers to the company’s eco-system of businesses and is continuing to have success in cross-selling multiple products into its client base. As at 30 June, the company had 179 million retail customers (up from 143 million in June 2017) and each customer held, on average, 2.39 contracts with the group (up from 2.28 in June 2017). This cross-selling opportunity is a key advantage of Ping An over its competitors and a major motivating factor for its agent based sales force. As cross-selling penetration increases, so does the agent commission pool, in turn driving growth in the number of agents in a virtuous cycle.

At current prices, Ping An trades at around 11.8 times consensus CY18 EPS and around 9.8 times CY19 EPS. Believe it or not that’s a cheaper multiple than structurally challenged AMP in Australia.

No pain no gain

While it was another frustrating month of performance for the those of us adhering to a disciplined investment process, I take comfort that we have worn a lot of pain in an unprecedented rotation, yet we will come out the other side owning the best structural growth businesses in the world at, what I believe will prove, cheap multiples.

Quality and duration are rarely on sale. I have used this period to increase both the quality and duration of the portfolio at fire sale multiples in a genuine Asian capitulation.

As I wrote last week [1], I think the BATS (Baidu, Alibaba, Tencent and Samsung) will prove excellent medium-term investments at current prices. I also think PING AN and Travelsky, mentioned in this note, are structural growth stocks trading on value multiples. JD.COM has also been grossly oversold in recent weeks.

On the other side of the equation, I think it’s time to be very, very cautious on pure momentum stocks that have simply added P/E over the last six months. That includes Australian industrial small and mid-caps.

When China and emerging markets bottom, and in my view that day is very close, the rotation will go the other way and P/E added by popularity in a narrow band of “have” stocks will reverse. Falls could be 25% to 50% and the stocks would still be expensive.

Price is what you pay, value is what you get. I’m happy to buy the best of Asia and avoid stocks that can’t in any way be justified by conventional valuation approaches.

Small and mid-cap Australian industrials do look a classic bubble to me, as do vast parts of the “next generation” technology sector globally. I wonder whether the recent Afterpay (APT) placement was the bell ringing. Investment discipline will be rewarded.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.