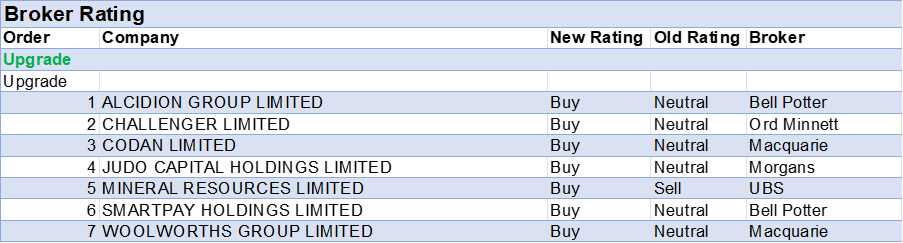

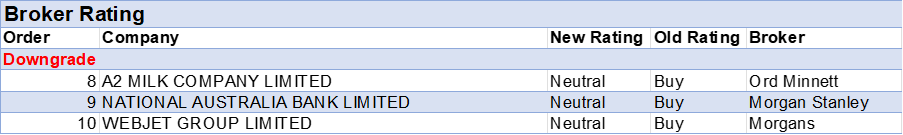

For the week ended Friday, March 21, 2025, FNArena tracked seven upgrades and three downgrades for ASX-listed companies from brokers monitored daily.

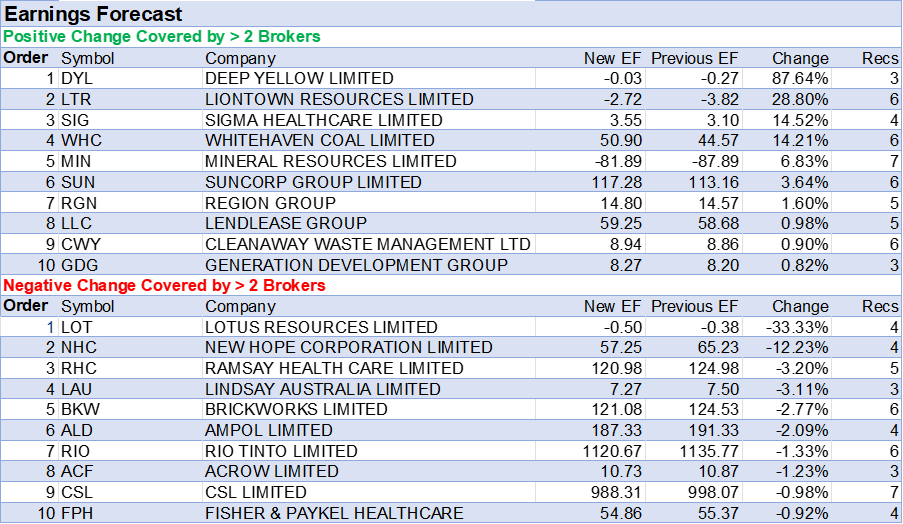

Declines in average target prices outweighed increases, while upward revisions to average earnings forecasts were more substantial than any downgrades, as shown in the tables below.

Nanosonics’ average target rose by around 7% after the long-awaited receipt of US FDA approval for the company’s Coris flexible endoscope device.

Commercial launch preparations remain on target for a phased rollout in the current March quarter to raise awareness and educate key opinion leaders before a broader commercial launch at the start of 2026.

The device is designed to automate the cleaning and reprocessing of flexible endoscopes, which are challenging to sterilise due to their complex and intricate structure, explained Ord Minnett.

Morgans viewed the FDA approval as a de-risking event allowing Nanosonics to diversify and expand, as well as further embed itself as a disinfection solutions leader within the hospital space.

Agreeing the approval is pivotal, Ord Minnett is expecting the subsequent boost to investor sentiment will drive a strong stock performance.

Emphasising Nanosonics is a strong business with a dominant market position, high-margin recurring revenue, and potential for further market penetration, Morgans retained an Add rating and raised its target by $1.00 to $5.50.

New Hope, largely a thermal coal producer primarily exporting to Asia, and Lotus Resources (uranium projects in Africa) appeared in the top two placings in both the negative change to target price and earnings tables.

Despite negative revisions to broker forecasts, New Hope’s interim results last week were sufficient to inspire a share price rally, aided by a share buyback surprise and a healthy interim dividend.

For Lotus Resources, updated research from Bell Potter was solely responsible for dragging down the average earnings estimate in the FNArena database. The broker made adjustments to operating and cost assumptions for Kayelekera and its notional development scenario for Letlhakane.

By way of background, Lotus acquired the Kayelekera uranium project in Malawi from Paladin Energy in 2020. In late-2023, the company also merged with A-CAP Energy, gaining ownership of the Letlhakane uranium deposit in Botswana and the Wilconi nickel project in WA.

Regarding Kayelekera, Bell Potter was updating its research for the recently signed binding offtake agreement with one of the largest energy companies in North America for production of 600klbs U3O8 from 2026-2029, bringing total binding offtake to between 1.3-1.6mlbs from 2026 onwards.

Management reiterated the production commencement timeline of third quarter 2025 which should see first sales and cashflow by around the first quarter of FY26, notes Bell Potter.

On the flipside, uranium development company Deep Yellow appears atop the earnings upgrade list below after Macquarie adjudged it was on track for first production in early-2027 as the final investment decision (FID) for its Tumas operation in Namibia is due in coming weeks.

As management has needed to focus on Tumas, an additional period of around six months is required to complete the Mulga Rock (Western Australia) definitive feasibility study (FIS).

Next on the earnings upgrade list is Liontown Resources following in-line interim results, retained second-half guidance, and release of a new Board-approved capital allocation framework.

The company’s Kathleen Valley’s performance is generally tracking ahead of expectations and management is squarely focused on the transition to underground from open pit mining over 2025.

Next is Sigma Healthcare following its FY25 result (January year-end), the last before the Chemist Warehouse (reverse) acquisition last month. The next result in August will transition to a June-year-end basis.

Earnings of $68m were in line with February’s guidance by management for between $64-70m. The performance was driven by the new supply contract with Chemist Warehouse which commenced July 1 last year, and 8.5% like-for-like wholesales sales growth across Amcal and Discount Drug Stores.

Macquarie has an Underperform rating for Sigma, suggesting the market is currently being overly optimistic on the growth outlook. It’s felt expectations will re-set lower as greater detail is provided over the coming months to help market participants understand Chemist Warehouse Group financials and outlook when the groups operate and report as a combined entity.

First-half results at Whitehaven Coal highlighted to Morgan Stanley an improved operational performance and strong cash flow generation, supporting confidence that FY25 guidance will be met.

Despite weaker coal prices, the broker sees potential for a recovery driven by supply-side adjustments in China and rising demand from India. Citi agrees, pointing to India’s growing steel production and restrictions on metallurgical coke imports as key demand catalysts for metallurgical coal.

Citi also notes China’s 15% tariff on US coking coal may shift trade flows in favour of Australian supply. With Australian prime hard coking coal priced at US$183/t, near levels that challenge US East Coast producer, Citi believes supply constraints could support a price rebound.

Whitehaven’s operational flexibility to pivot between metallurgical and thermal coal provides a strategic advantage, notes Morgan Stanley.

In the good books

Upgrade

ALCIDION GROUP LIMITED ((ALC)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 1/0/0

Bell Potter notes Alcidion Group’s biggest contract to date with North Cumbria Integrated Care NHS Foundation Trust signed in February has now been finalised.

With the company delivering a modest $0.3m EBITDA in 1H25, the broker estimates a full-year EBITDA profit is likely due to $8m revenue from the contract in 2H. The broker also sees potential for a modest net profit after tax.

Target price unchanged at 11c. Rating upgraded to Buy from Hold.

CODAN LIMITED ((CDA)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 2/1/0

Macquarie’s positive view on Codan remains after “solid” 1H25 results showed communications remains the key driver for the business.

The broker believes market concern about the negative impact around Ukraine is overdone, and the company is well placed to benefit once the conflict ends.

The analyst also believes the balance sheet is supportive of M&A which management continues to pursue.

Target price cut to $17.00 from $17.13 on small working capital revisions. Rating upgraded to Outperform from Neutral.

CHALLENGER LIMITED ((CGF)) was upgraded to Buy from Hold by Ord Minnett .B/H/S: 6/1/0

Ord Minnett notes the Australian Prudential Regulation Authority’s review of illiquidity premiums will likely lower capital requirements for annuity providers.

For Challenger an estimated $500m buyback due to capital release would be 7% accretive, the broker estimates. The broker also sees potential for Challenger to alter its asset mix which could release an additional $1bn.

The broker believes reduced capital volatility justifies a higher PE and has lifted the price target to $7.00 from $6.65. Rating is upgraded to Buy from Hold.

JUDO CAPITAL HOLDINGS LIMITED ((JDO)) was upgraded to Add from Hold by Morgans .B/H/S: 4/1/1

Morgans upgrades Judo Capital to Add from Hold with an unchanged target of $2.08.

The recent share price weakness from the sell-down in banking shares and the block trade sale of two pre-IPO investors has created a buying opportunity, according to the analyst.

The block trade represented 9.9% of shares on issue at $1.74, below yesterday’s closing price by around -6%.

Judo does not pay dividends, with excess capital used to fund loan growth. As such, the broker highlights investors are reliant on capital returns and the company carries higher risk than the major banks.

Morgans states if management can achieve its strategic targets, it will be Australia’s fastest-growing, most efficient bank and could be worth over $3 per share by the end of the decade.

MINERAL RESOURCES LIMITED ((MIN)) was upgraded to Buy from Sell by UBS .B/H/S: 4/3/0

UBS incorporates the latest assumptions on haul road repairs, Mineral Resources’ FY25 guidance downgrades for Onslow shipments and mining services tonnes, as well as grade discounts and a lower average cost of capital, lowering its target price to $28.60 from $33.

Concerns remain, but the analyst lifts EPS estimates by 6% for FY26 and 45% for FY27.

The stock has declined -67%, and at current levels, with the revised earnings estimates, the rating is upgraded to Buy from Sell.

UBS estimates the stock is pricing in an iron ore price of US$80/t and spodumene pricing of US$1,300/t indefinitely which is considered too pessimistic.

SMARTPAY HOLDINGS LIMITED ((SMP)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 2/0/0

Bell Potter upgrades SmartPay to Buy from Hold with a higher target price of $1.33 from 68c, following the preliminary non-binding NZ$1.00 scrip plus cash offer from Tyro Payments ((TYR)).

The 90c offer price represents a 70% premium to the previous closing price. In addition, an undisclosed international strategic bidder has made another takeover proposal for an unannounced amount, the analyst highlights.

The broker is more positive on the stock post the strategic interest, which may increase with SmartPay trialling the new terminal and acquiring solution. No change to Bell Potter’s earnings forecasts.

WOOLWORTHS GROUP LIMITED ((WOW)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 3/4/0

The final report on Supermarkets by the ACCC may create a buying opportunity, in Macquarie’s view. The broker also holds concerns around slowing global growth brought on by tariffs and raises its conviction on defensive exposures like supermarkets.

As per previous enquiries in other sectors, the broker notes the market tends to “sell the rumour” and “buy the fact”, and upon release of the relevant sector/stock report, share price performance(s) improves.

The re-rating opportunity is greatest for Woolworths Group, in the analyst’s opinion, given the five-year low on relative valuation compared to Coles Group.

Macquarie retains its $30.80 target for Woolworths Group and upgrades to Outperform from Neutral.

In the bad books

Downgrades

A2 MILK COMPANY LIMITED ((A2M)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 3/4/0

Ord Minnett retains its $7.70 target for a2 Milk Co and downgrades to Hold from Accumulate on valuation after an 11% share price surge in the last week.

The stock has outperformed the broader market by approximately 60% since February, with the recent 11% rally driven by speculation around Chinese birth stimulus measures, explains the broker.

The broker remains cautious on the long-term impact of government policies to reverse declining birth rates, citing historical challenges in similar markets.

The analyst highlights A2 Milk’s strong market position, supported by share gains in the consolidating Chinese infant milk formula market and the launch of its Genesis product.

Ord Minnett sees the shift to English labelling and upcoming supply chain efficiencies as potential catalysts for capital returns to shareholders.

NATIONAL AUSTRALIA BANK LIMITED ((NAB)) was downgraded to Equal-weight from Overweight by Morgan Stanley .B/H/S: 0/2/3

Morgan Stanley reassesses its preference for bank stocks, adjusting its rankings.

ANZ Bank ((ANZ)) is ranked first on Equal-weight, followed by National Australia Bank, which is downgraded to Equal-weight from Overweight.

Both Westpac ((WBC)) and CommBank ((CBA)) remain Underweight.

The broker sees higher execution risks due to management changes, margin pressure from competition in business banking, and a shift in the deposit mix, along with sub-industry growth in mortgages.

Target price for National Australia Bank is lowered to $34.80 from $37.40. Industry View: In-Line.

WEBJET GROUP LIMITED ((WJL)) was downgraded to Hold from Add by Morgans .B/H/S: 1/1/0

Webjet Group reiterated FY25 guidance, but FY26 is now a year of investment rather than growth acceleration, Morgans highlights.

Management outlined a 5-year growth plan aiming to double total transaction value by FY30, above consensus.

The strategy focuses on increasing wallet share through higher-margin ancillary product sales, which the analyst views as high risk.

Morgans lowers EBITDA forecasts by -1.8% for FY25 and -14.5% for FY26. Net profit after tax downgrades are more pronounced due to higher depreciation and amortisation charges.

The stock is downgraded to Hold from Add. Target price cut to 65c from $1.05.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.