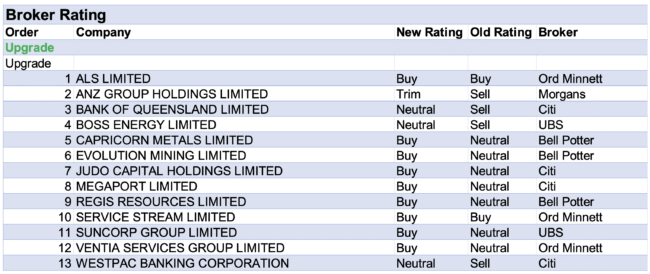

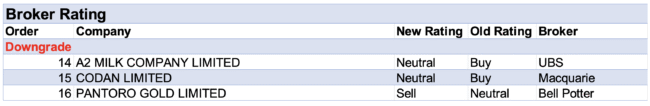

For the week ending Friday, September 12, 2025, FNArena tracked thirteen upgrades and three downgrades for ASX-listed companies from brokers monitored daily.

The size of percentage rises in average target prices outweighed reductions for the third week in a row, with Aeris Resources, Service Stream, and Temple & Webster leading the way with increases of between 9-10%.

Morgans visited Aeris Resources’ Tritton copper operations and came away more confident in the outlook. The broker now factors in the Constellation deposit starting in FY27, with higher copper and gold grades boosting forecasts.

Tritton in central west NSW has proven it can run above 2mtpa with room for lower costs if drilling success continues. Morgans expects 80,000m of drilling in FY26 to extend mine life and sees productivity gains already improving operations.

The broker’s target rises to 43c from 31c, with a Speculative Buy rating maintained.

Service Stream has secured the Defence Property and Asset Services contract for both South Australia and the Northern Territory, following a multi-year tendering process.

The contract exceeded Macquarie’s expectations in both scope and value and resulted in a 10% uplift to the broker’s FY27 revenue forecast.

Importantly, noted Ord Minnett, defence adds a new, large growth vertical to the company, diversifying away from telecommunications and highlighting operating leverage.

Citi already had a positive view on Service Stream on the back of a robust balance sheet and potential for telco volumes to surprise on the upside.

Reflecting further on Temple & Webster’s FY25 result in mid-August, Macquarie felt highlights were active users jumping 16% to a record 1.27m, repeat orders up 20%, and the company’s net promoter score hitting a record 63%.

Looking ahead, Outperform-rated Macquarie noted sales momentum is building into FY26, with revenue growth of 28% forecast, and management sticking with its medium-term sales goal of $1bn-plus. Target raised to $31.30 from $17.60.

On the flipside, average targets for uranium miners Boss Energy and Lotus Resources fell by -8% and -7%, respectively.

UBS has slashed its forecasts for Boss Energy, trimming Honeymoon production by -7% in FY26 and -18% in FY27-28, with earnings estimates cut up to -25%. This follows CEO turnover and delays reaching nameplate capacity, now under independent review.

The broker lowered its target to $2.00 from $3.50 but upgraded to Neutral from Sell after recent share price weakness.

Ord Minnett (Hold; target $2.10) noted management at Boss Energy has brought in the in-situ leaching experts to review weaker-than-expected geology at Honeymoon’s eastern end, with drilling starting mid-September and running up to nine months. A technical update is due late 2025. In the meantime, the analyst sees no clear investment case until results are known.

Lotus Resources has raised $65m at 19c a share to fund its Kayelekera project’s ramp-up, with first shipments due by late 2025. Macquarie noted working capital needs will rise over the next few quarters as stock builds in Malawi and goods are shipped before customer receipts, with financing talks taking longer than expected.

This broker raised FY25 EPS forecast slightly but cuts FY26 by -93% and FY27 by -11% on a slower ramp-up, lowering its target to 26c from 35c while keeping an Outperform rating.

With the gold price breaking higher after consolidating since April’s record, Bell Potter sees a solid base for further gains. It’s thought ASX-listed gold producers could also begin to mean-revert towards the valuations of global peers.

This broker raised its long-term gold price forecast to US$3,400/oz from US$2,800. More immediately, the estimate for the second half of 2025 was increased to US$3,500 from US$2,950, providing a fillip for the broker’s Minerals 260 target to 34c from 28c.

Separately, Morgans considered a positive update from Minerals 260, with high-grade intercepts reported across Bacchus, Phoenix, Dicksons, and Kraken, as confirming strong infill results and significant extensional growth potential.

Both Morgans and Bell Potter have Speculative Buy ratings and Ord Minnett entered the fray last week, initiating coverage with a Buy rating and 30c target, suggesting the Bullabulling gold project restart in WA is financially viable and likely to re-rate the Minerals 260 share price.

In a bad news week for Iluka Resources, management will suspend operations at its Synthetic Rutile Kiln 2 for at least six months from December and halt mining at its Cataby mine for 12 months, citing weak synthetic rutile demand.

Ord Minnett believes this was a prudent step, and Citi noted Iluka holds significant synthetic rutile and chloride ilmenite inventory, which will be used to meet customer needs, implying flat sales in 2026 versus 2025.

Morgan Stanley had flagged ongoing pressure in the mineral sands market, particularly from weak US housing demand, but this week noted any recovery could quickly swing sentiment for Iluka.

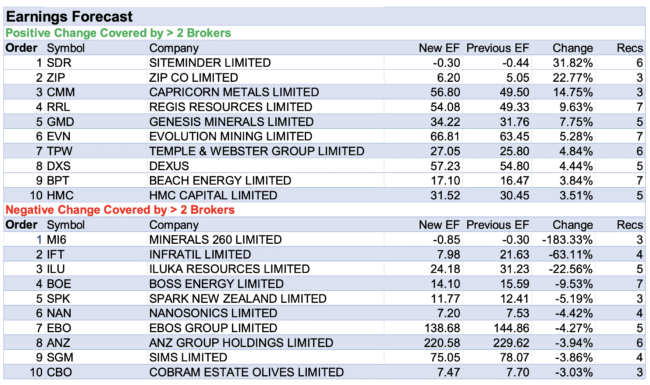

Turning to positive earnings changes, here SiteMinder heads up the table with a rise in brokers’ average FY26 estimate of around 32%. Citi noted SiteMinder’s FY25 results were solid, with annual recurring revenue up 27% in the second half on Smart Distribution, prompting a small lift to FY26 revenue forecasts.

Analyst upgrades to earnings forecasts for Zip Co continue in the wake of a FY25 earnings ‘beat’. Last week Citi highlighted August outperformed expectations, with app downloads accelerating and monthly active users hitting a record. Total sessions rose 43% year-on-year, signalling strong engagement and supporting transaction value growth.

In the good books

Upgrades

ALS LIMITED ((ALQ)) was upgraded to Accumulate from Hold by Ord Minnett .B/H/S: 6/0/0

Ord Minnett raises its target for ALS Ltd to $20.95 from $17.25 and upgrades to Accumulate from Hold, citing stronger resources exploration activity boosting volumes in the Commodities division. FY26 EBIT growth is now expected at 16%, up from 11%.

Revenue momentum in the second half will support margin expansion, suggests the broker, with improved volumes to continue into FY27.

The analyst also sees potential earnings upside from acquisitions, particularly in environmental life sciences and downstream minerals, though no M&A is currently included in forecasts.

ANZ GROUP HOLDINGS LIMITED ((ANZ)) was upgraded to Trim from Sell by Morgans .B/H/S: 0/4/1

Morgans notes ANZ Bank is cutting -3,500 roles or around -8% of staff by September 2026, plus reducing reliance on 1,000 contractors.

The aim is to simplify operations and cut costs. The program carries a -$560m pre-tax restructuring charge in 2H25, with limited impact on CET1 and frontline roles.

Cost savings were not disclosed, but the broker believes the implied benefits could roughly offset the upfront charge, with further variable cost reductions expected.

The broker made no changes to revenue forecasts at this time, but restructuring charges and cost-outs across FY26 have resulted in a -1% cut to FY25 EPS forecast, and a lift to FY26-27 EPS forecasts. DPS forecast for FY25 are trimmed.

The broker believes the initiative is DCF-accretive, resulting in an increase in target price to $29.24 from $26.84. Rating upgraded to Trim from Sell.

BOSS ENERGY LIMITED ((BOE)) was upgraded to Neutral from Sell by UBS .B/H/S: 3/3/1

UBS made significant downward revisions to its forecasts for Boss Energy after moderating FY26 expectations and cutting Honeymoon production forecasts.

The broker notes the stock has had a volatile few months following the CEO departure and uncertainty over when Honeymoon will reach nameplate capacity, which prompted the company to launch an independent review.

FY26 production forecast cut by -7% and FY27-28 by -18%. EBITDA forecast for FY26 trimmed by -15% and by -25% for FY27.

Target lowered to $2.00 from $3.50 as the broker also increased risk weighting for Honeymoon expansion. Rating upgraded to Neutral from Sell following share price weakness.

BANK OF QUEENSLAND LIMITED ((BOQ)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/2/2

Credit growth remains resilient, net interest margins (NIMs) are well-managed as risks tilt towards fewer rate cuts, and asset quality stays benign, supporting an improving outlook for Australian banks, suggests Citi.

The broker adjusts its valuation framework to reflect structurally lower costs of equity (CoEs) across the sector, driving target price upgrades of 10-20%.

Better momentum in the private sector is expected to skew the risk to only one more interest rate cut this cycle.

More positively, the analysts note a steepening US yield curve and narrowing interest rate differentials between Australia and the US have historically supported stronger sentiment toward Australian banks.

The broker’s order of preference among the major banks is unchanged: ANZ Bank, Westpac, National Australia Bank, and CommBank.

For Bank of Queensland, the target rises to $6.60 from $6.00 and the rating is upgraded to Neutral from Sell.

CAPRICORN METALS LIMITED ((CMM)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 2/1/0

Bell Potter highlights ASX-listed gold producers have materially underperformed North American/global peers since June 2025, a rare disconnect not explained by fundamentals.

The broker doesn’t see any sustainable justification, given catalysts like FY26 guidance misses, higher costs, or labour/power pressures are also present offshore.

With gold price breaking higher again after a period of consolidation from the April record, the broker sees this as a strong foundation for further upside in gold. ASX gold equities could mean-revert towards global peers, in the broker’s view.

Long-term gold price forecast lifted higher to US$3,400/oz from US$2,800. For 2H2025, the broker pushed the estimate to US$3,500 from US$2,950, and for 2H2027 to US$3,300 from US$2,700.

Capricorn Metals upgraded to Buy from Hold. Target rises to $13.10 from $10.55.

EVOLUTION MINING LIMITED ((EVN)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 1/1/3

Bell Potter highlights ASX-listed gold producers have materially underperformed North American/global peers since June 2025, a rare disconnect not explained by fundamentals.

Evolution Mining upgraded to Buy from Hold. Target rises to $10.55 from $8.15.

JUDO CAPITAL HOLDINGS LIMITED ((JDO)) was upgraded to Buy from Neutral by Citi .B/H/S: 6/0/0

Credit growth remains resilient, net interest margins (NIMs) are well-managed as risks tilt towards fewer rate cuts, and asset quality stays benign, supporting an improving outlook for Australian banks, suggests Citi.

For Judo Capital, the target rises to $2.00 from $1.85 and the rating is upgraded to Buy from Neutral.

MEGAPORT LIMITED ((MP1)) was upgraded to Buy from Neutral by Citi .B/H/S: 3/2/1

Citi raises its target price for Megaport to $16.30 from $15.45 and upgrades to Buy from Neutral

While the broker sees valuation as stretched there is potential upside to consensus from conservative cost guidance and stronger medium-term revenue growth.

FY26 guidance is for spending to rise by around -35% or -$50m, mainly people-related, implying headcount growth of about 160. Citi suggests opex could be lower than feared in FY26, though growth may spill into FY27.

Hiring momentum is already evident, note the analysts, with LinkedIn data showing 28 new roles in July-August and 57 positions recently posted.

The broker argues consensus revenue forecasts are too conservative, with FY26 guidance implying 20% annual recurring revenue (ARR) growth. Investment in sales is expected to drive additional ARR uplift of 5-8% over time, although with some lag.

REGIS RESOURCES LIMITED ((RRL)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 2/3/2

Bell Potter highlights ASX-listed gold producers have materially underperformed North American/global peers since June 2025, a rare disconnect not explained by fundamentals.

Regis Resources is upgraded to Buy from Hold. Target rises to $6.30 from $4.90.

SERVICE STREAM LIMITED ((SSM)) was upgraded to Buy from Accumulate by Ord Minnett .B/H/S: 3/0/0

Ord Minnett notes Service Stream has secured two Defence Base Services contracts for South Australia and Northern Territory worth $1.6bn over 6 years. The contracts begins Feb 2026 and are extendable to a maximum 10 years.

The broker highlights the contracts are EPS accretive with minimal FY26 earnings impact due to mobilisation costs. FY27 EBITDA forecast lifted by 8% and EPS by 11%.

Importantly, defence adds a new, large growth vertical to the company, diversifying away from telecommunications and highlighting operating leverage, commentary points out.

Rating upgraded to Buy from Accumulate. Target rises to $2.57 from $2.35.

SUNCORP GROUP LIMITED ((SUN)) Upgrade to Buy from Neutral by UBS .B/H/S: 3/3/0

UBS notes Suncorp Group and Insurance Australia Group have improved earnings reliability by strengthening CAT budgets and adding innovative reinsurance protections.

In the broker’s view, these measures create scope for reinsurance profit commissions, a source of upside not yet reflected in consensus. The broker’s modelling suggests insurance trading ratio margin and EPS expectations are too conservative under consensus forecasts.

After incorporating upside from reinsurance, the broker lifted EPS forecasts, which are now 4% higher vs consensus by FY27 for Suncorp Group.

Rating upgraded to Buy from Neutral. Target lifted to $23.15 from $22.75.

VENTIA SERVICES GROUP LIMITED ((VNT)) was upgraded to Accumulate from Hold by Ord Minnett .B/H/S: 2/1/0

Ord Minnett reckons the total value of contracts awarded by the Department of Defence to three companies, Downer EDI, Service Stream and Ventia Services, is higher than the headline $7.4bn due to variable works provisions.

Ventia secured $2.7bn contracts, including Living and Working Services in Tasmania, NT and Victoria, and Property and Asset Services in WA, Victoria and Tasmania.

The broker expects a thinner margin in year one but a pickup from year two. FY25 EPS forecast unchanged, but FY27 lifted by 1.6%.

Rating upgraded to Accumulate from Hold. Target rises to $5.25 from $5.20 (was $4.45 in February).

WESTPAC BANKING CORPORATION ((WBC)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/2/2

Credit growth remains resilient, net interest margins (NIMs) are well-managed as risks tilt towards fewer rate cuts, and asset quality stays benign, supporting an improving outlook for Australian banks, suggests Citi.

The broker’s order of preference among the major banks is unchanged: ANZ Bank, Westpac, National Australia Bank, and CommBank.

For Westpac, the target rises to $36.50 from $29.75. The rating is upgraded to Neutral from Sell.

In the bad books

Downgrades

A2 MILK COMPANY LIMITED ((A2M)) was downgraded to Neutral from Buy by UBS .B/H/S: 3/4/0

UBS cut its rating for a2 Milk Co to Neutral from Buy on valuation grounds, believing the current price fairly captures its forecast for net profit doubling by FY30.

The broker believes the company can lift China label market share by 200bps (150bps previous forecast) to 6% by FY32 after the upgrade of recipes.

The incremental sales of NZ$255m compare with the previous forecast of NZ$220m, and the company’s guidance of over NZ$100m by FY30.

FY28 EPS forecast lifted by 1%, and the broker now expects EPS to rise to NZ57c by FY30. Target rises to NZ$10.55 from NZ$9.95.

CODAN LIMITED ((CDA)) Downgrade to Neutral from Outperform by Macquarie .B/H/S: 1/2/0

Following on from FY25 results, Macquarie downgrades Codan to Neutral from Outperform.

Codan reported a robust FY25 earnings beat according to Macquarie, with net profit after tax 5% better than expected and 4% above consensus. Revenue also beat by 5% versus consensus, a rise of 23% on the prior year with good organic growth and the Kagwerks acquisition.

Metal detection revenue lifted 16% on the prior year with a 310bps rise in the margin. FY26 communications revenue guidance is 15%-20% with a long-term 10%-15% growth rate. Metal detection will be supported by four new products and good West African conditions.

Macquarie lifts its EPS forecasts by 14% for FY26 and 12% for FY27. Target price rises 60% to $27.15 from $17 due to the upgrade in earnings estimates, with smaller rises in outer year forecasts.

PANTORO GOLD LIMITED ((PNR)) was downgraded to Sell from Hold by Bell Potter .B/H/S: 1/0/1

Bell Potter highlights ASX-listed gold producers have materially underperformed North American/global peers since June 2025, a rare disconnect not explained by fundamentals.

Pantoro Gold is downgraded to Sell from Hold. Target rises to $4.40 from $3.15.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.