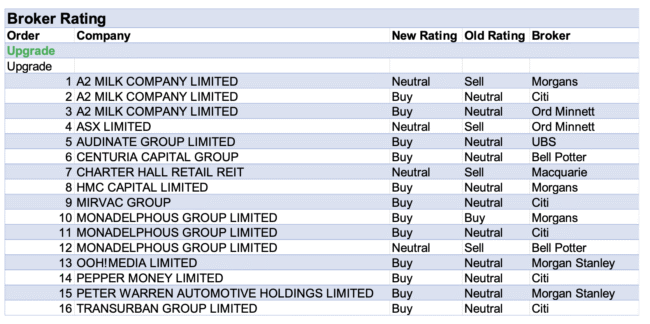

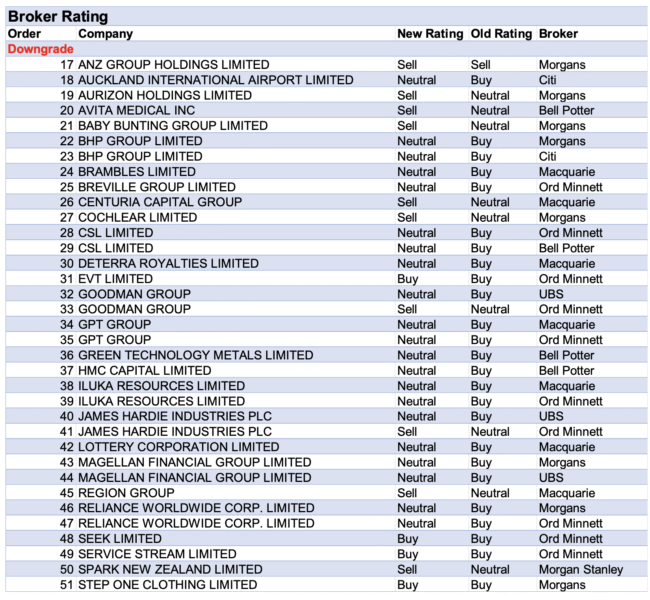

In the second last week of the reporting season ending Friday August 22, 2025, FNArena tracked 16 upgrades and 35 downgrades for ASX-listed companies from brokers monitored daily.

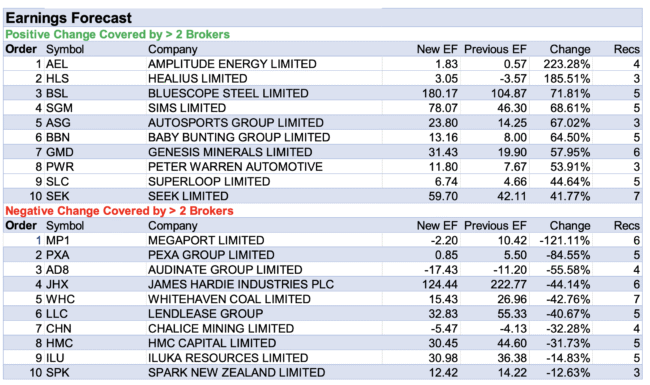

The tables reflect earnings ‘beats’ for the likes of Baby Bunting, Autosports Group, Monadelphous Group, Peter Warren Automotive, Super Retail, and Codan. ‘Misses’ are evident for Audinate Group, James Hardie Industries, HMC Capital, CSL, Reliance Worldwide, DigiCo Infrastructure REIT and BlueScope Steel.

Post in-line results, a2 Milk garnered three upgrades, as did Monadelphous. Multiple downgrades have followed result releases by BHP Group, Goodman Group, Iluka Resources, Magellan Financial, James Hardie, CSL and Reliance Worldwide.

The FY25 results release from CSL sparked a material share price fall. Ord Minnett pointed to weakness in the company’s key immunoglobulin market, ramped-up competition in the specialty products segment, and US-led softness in its Seqirus vaccine division. The broker also noted a “confounding” plan to separate the vaccine business, and a sweeping restructure of R&D and the broader business operating model to deliver targeted cost savings, which the analysts viewed as optimistic.

Healius sits in the week’s Top Ten for earnings upgrades but also in the top 10 falls in average target price. Despite a -33% reduction in target by Macquarie to 80c, the broker raised its EPS forecasts for FY26 and FY27 by 36% and 9%, respectively, to reflect an increased EBIT margin in FY27 closer to management guidance. The analyst continues to see headwinds for Helius. Medicare Benefits Schedule fee reductions are expected to pressure volumes, requiring substantial cost savings and efficiency improvements will be needed to lift the EBIT margins.

Despite not reporting so far in August, Pexa Group and Chalice Mining appear in the earnings downgrade table. UBS increased its target for Chalice Mining to $1.70 from $1 after raising its long-term palladium price forecasts to US$1,400/oz from US$1,100/oz. The broker also highlighted a key upcoming catalyst via release of the pre-feasibility study for the company’s flagship nickel-copper-platinum group element (PGE) discovery, Gonneville, within the Julimar Complex in Western Australia.

In the good books: upgrades

A2 MILK COMPANY LIMITED ((A2M)) was upgraded to Buy from Neutral by Citi and to Hold from Sell by Morgans and to Buy from Hold by Ord Minnett. B/H/S: 4/3/0

Following a further review of a2 Milk Co’s FY25 results, Citi now has more confidence in management’s ability to navigate the Chinese market, which the broker believes has been better executed than peers over the past nine years. While the broker’s FY26 EPS forecasts are cut by -8% due to one-off transformation costs, Citi sees this as manageable in light of medium-term growth opportunities.

The analysts upgrade forecasts for FY27-29 EPS by 1%, 8% and 15% respectively, reflecting contributions from Yashili (acquisition). The broker raises its target to $9.29 from $8.20 and upgrades to Buy from Neutral. a2 Milk Co delivered a strong FY25, assesses Morgans, with sales up 13.5%, earnings (EBITDA) up 17% and profit up 21%.

Growth accelerated in 2H25 as supply constraints eased, explain the analysts, lifting sales 16.7% and margins to 15.5%. Infant formula market share in China rose to 8.0%, with English Label outperforming China Label, while liquid milk and nutritional sales also grew strongly. FY26 guidance was weaker than expected by the broker, with high single-digit sales growth and a 15-16% margin, reflecting the Yashili New Zealand acquisition.

While the transaction is initially EPS dilutive, the facility is expected to breakeven in FY27 and contribute positively in FY28, supporting long-term accretion and additional China Label registrations, explains Morgans. The broker cuts its FY26-27 forecasts but lifts FY28 onwards, with double-digit accretion from FY29. A NZ$300m (circa NZ41cps) special dividend is expected in 1H27.

Morgans raises its valuation to $8.00 from $6.87 and upgrades to Hold from Sell.

Ord Minnett notes a2 Milk Co reported in-line FY25 earnings, with management pointing to “wider” earnings (EBITDA) margins in FY26. The report suggests the major news has been the acquisition of the Pokeno infant manufacturing plant in the Waikato region for -NZ$282m from China Mengniu Dairy. The analyst views the transaction positively, with scope to bring forth wider margins and market share advances from new products and better control over its supply chain. Pokeno will facilitate the development of premium products.

a2 Milk Co has also sold its loss-making Mataura Valley Milk for NZ$100m, which is also viewed as a positive outcome. Ord Minnett has lowered its EPS estimates by -12.4% for FY26 and -6.5% for FY27 on the acquisition costs. The FY28 EPS forecast is raised by 5.9%. Target price lifts to $9.40 from $7.70. The stock is upgraded to Buy from Hold.

AUDINATE GROUP LIMITED ((AD8)) was upgraded to Buy from Neutral by UBS. B/H/S: 2/1/1

Audinate Group saw a challenging FY25, UBS notes, with revenue and profit not reflecting “business as usual”. Longer term, UBS remains a firm believer in audio, with Dante the digital audio “holy grail” and the structural shift from analog to digital to continue.

UBS upgrades to Buy from Neutral, underpinned by the long term opportunity. The business is high quality, not broken and will continue to benefit from being number one in a niche industry with long term structural tailwinds, the broker believes. Buying such stocks when the macro is challenging is usually the right move, UBS suggests. Target nonetheless falls to $7.10 from $10.85.

ASX LIMITED ((ASX)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 0/4/2

ASX’s FY25 result met expectations as revenue growth from data and technology operations offset weaker revenue from soft listings and issuer services. Ord Minnett notes the company had warned in early August of -$25-35m increase in operating expenses in FY26 and expects this will reduce the benefits from robust revenue growth in the near term. FY26 EPS forecast trimmed by -2.4% while FY27 was raised by 0.9% and FY28 by 0.2%. Target price $67.40. Rating upgraded to Hold from Lighten on valuation grounds.

CENTURIA CAPITAL GROUP ((CNI)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 3/1/1

Bell Potter notes Centuria Capital’s FY25 EPS was slightly above its forecast and the consensus, and FY26 EPS guidance of 13.4c was higher than its 12.6c estimate and 12.8c consensus. DPS guidance, however, missed both. The growth outlook was outlook with FY26 target for over $1bn of gross real estate acquisitions, out of which $220m is already secured within the recently established unlisted wholesale property fund.

Industrials is now the largest exposure but on risk watch are the delay in office redeployment and credit risks at Bass Capital, though unlisted fund redemptions look manageable, the broker believes. FFO/share forecast for FY26 lifted by 7.1% and by 4.6% for FY27. Rating upgraded to Buy from Hold. Target rises to $2.40 from $1.80. See also CNI downgrade.

CHARTER HALL RETAIL REIT ((CQR)) was upgraded to Neutral from Underperform by Macquarie. B/H/S: 1/2/0

Charter Hall Retail REIT’s FY25 operating earnings per share declined -7.3%, in line with Macquarie and guidance. FY26 guidance of 3.5% year on year OEPS growth and 2.8% dividend growth is -2% below Macquarie. The new Charter Hall Convenience Retail Fund will acquire from the REIT four 100%-owned assets plus other 49.9% investments and the REIT will retain a 22% stake in the new fund. The net proceeds will reduce gearing, and Macquarie sees the benefits of diversification and scale. Shares in Charter Hall Retail REIT have rallied 27% in 2025 to date but a 6.2% dividend yield and three-year CAGR of 3.9% are seen providing valuation support, leading Macquarie to upgrade to Neutral from Underperform. Target rises to $3.91 from $3.51.

HMC CAPITAL LIMITED ((HMC)) was upgraded to Buy from Hold by Morgans. B/H/S: 3/2/0

HMC Capital’s FY25 result fell short of Morgans’ expectations, with pre-tax operating EPS of 56c up 51% year-on-year but -17% below the broker’s forecast and 15% below guidance. FY26 pre-tax operating EPS guidance of at least 40cpu was in line with the broker but -7% adrift of the consensus estimate, with distributions held at 12cpu. The shortfall was mainly due to weaker performance fees in Private Equity and softer Health, Digital, and Energy strategies, explains the analyst, though operating EPS benefited from lower tax.

The broker sees real estate funds under management (FUM) as the main growth driver, with deployment across unlisted funds and capital recycling expected to support expansion in FY26. HMC Capital trades at a discount to book value, highlights Morgans, implying the market views it as ex-growth, a position the broker does not share. Potential catalysts include resolution of Healthscope negotiations, a major lease at Digital Infrastructure, and a sell-down of the Energy Transition Fund, all of which could restore investor confidence. Morgans upgrades its rating to Buy from Hold with an unchanged $4.20 target, viewing the balance sheet as sound and the turnaround path achievable over the next twelve months. See also HMC downgrade.

MIRVAC GROUP ((MGR)) was upgraded to Buy from Neutral by Citi. B/H/S: 2/3/0

Citi highlights Mirvac Group’s result showed a return to EPS growth following a tough FY25 and is expecting growth to pick up in FY27-28 as key development projects are completed. The broker sees upside to the current PE multiple of 18x FY26 earnings, and upside to the consensus forecasts for FY27-28. Rating lifted to Buy from Neutral. Target rises to $2.60 from $2.30.

MONADELPHOUS GROUP LIMITED ((MND)) was upgraded to Buy from Neutral by Citi and to Buy from Accumulate by Morgans and to Hold from Sell by Bell Potter. B/H/S: 3/2/0

Following further analysis of Monadelphous Group’s FY25 results, Citi raises its target to $23.60 from $19.95 and upgrades to Buy from Neutral. The broker raises its earnings forecasts and applies a higher valuation multiple, seeing scope for an upgrade cycle beginning around the AGM in three months’ time. A summary of the broker’s initial view of FY25 results follows. Citi, at first take, views the Monadelphous Group FY25 result as “solid,” with revenue up 4%, which is better than expected and 3% above consensus.

Engineering & Construction revenue beat Maintenance & Industrial Services, but both were better than anticipated by 6% and 3%, respectively. Underlying earnings (EBITDA) were better than the analyst’s forecast but in line with consensus. Secured work balances came in above 1H25 levels at $2.5bn versus $1.5bn in 1H25. A dividend of 72c was 3%-4% better than expected. Management offered optimistic commentary, the analyst states, and notes the company is “positioned for growth in FY26.” Citi points to a focus on growth in the energy sector, including energy transition opportunities. Shares are expected to react positively given the outlook and good result.

Following FY25 results for Monadelphous Group, Morgans raises its target to $24.40 from $19.50 and upgrades to Buy from Accumulate. The broker assesses a strong FY25, highlighting normalised earnings (EBITDA) of $152m, up 19% year-on-year, and margins improving to 6.7%. Profit rose 28% to $79.3m. The full-year dividend increased 24% to 72c, representing a 90% payout.

The analyst believes Engineering & Construction revenue is set to accelerate, with the FY26 order book of $570m well ahead of expectations. Support is derived from Rio Tinto’s ((RIO)) Pilbara replacement program and a revival of oil and gas projects such as Jansz IO, Pluto 1, and Cruz, explains the broker. These higher-margin projects are expected to drive further upside to profitability. Maintenance volumes are also expected to step up significantly over FY26 and FY27.

Morgans upgrades FY26 and FY27 revenue forecasts by 8% and 9%, respectively, and earnings (EBITDA) by 10-12%, with profit forecasts lifted by 8-11%. Monadelphous Group’s FY25 group revenue of $2.27bn beat Bell Potter’s forecast of $2.19bn. Net profit was, however, in line with forecast as outperformance at the revenue line was offset by weaker-than-expected EBITDA margin in 2H.

The Engineering Construction and Maintenance & Industrial Services divisions beat expectations, and the company noted $2.5bn of new contracts and extensions were secured so far in FY26. The company pointed to positive momentum in renewable energy infrastructure construction and energy industries and sees opportunities for near-term growth in sustaining capital projects.

Greenfield resource/energy project pipeline are, however, slowing. The broker lifted FY26 EPS forecast by 9% and FY27 by 7%, mainly on higher revenue forecasts. Rating upgraded to Hold from Sell, with the broker waiting to see if contract momentum builds in renewable energy and storage and transmission sector. Target lifted to $19.50 from $16.50.

OOH! MEDIA LIMITED ((OML)) was upgraded to Overweight from Equal weight by Morgan Stanley. B/H/S: 3/0/0

Morgan Stanley notes oOh!media’s 1H25 revenue was 3% ahead of consensus but EBITDA missed by -4.5%. The share price fall following the earnings miss has made the stock attractive in the broker’s view. The broker is relying on its channel checks which suggests the slowdown in ad growth expected in 2H is cyclical. It, therefore, expects the company to continue winning share from TV/radio ad budgets.

The broker is highlighting its 3-year EPS compounded annual growth rate forecast of 16% growth, seeing earnings upside risk and potential for this stock to re-rate. Target lifted to $2.00 from $1.70. Rating upgraded to Overweight from Equal weight. Industry View: Attractive.

PEPPER MONEY LIMITED ((PPM)) was upgraded to Buy from Neutral by Citi. B/H/S: 1/1/0

Pepper Money’s 1H25 result showed earnings recovery is on track, Citi highlights, with FY25 set to deliver positive EPS growth for the first time in four years. A special dividend of 12.5c was declared. New mortgage flows rose 55% y/y to $2.8bn and further growth is expected from strong 1H applications, up 30% y/y. Group margin eased -5bps to 1.98% as the lender focused on volume growth from lower-margin prime mortgages. The broker expects margin to improve to 2% based on higher 1H exit rate of over 2.05% and lower wholesale funding costs. Bad debts fell -2% y/y and while the broker expects arrears to rise, net losses are expected to be minimal. Target lifted to $2.40 from $1.75. Rating upgraded to Buy from Neutral.

PETER WARREN AUTOMOTIVE HOLDINGS LIMITED ((PWR)) was upgraded to Overweight from Equal weight by Morgan Stanley. B/H/S: 1/2/0

Morgan Stanley raises its target for Peter Warren Automotive to $2.30 from $1.40 and upgrades to Overweight from Equal weight. Industry View: In-Line. The key positive from FY25 is considered gross margin stabilisation during a tough period for new vehicle sales. The company delivered a pre-guided FY25 result, with gross margin steady at 16.1% after three halves of stability, following prior rebasing from 21% in 2H22, explains Morgan Stanley.

The result is considered encouraging given a softer backdrop for new vehicle sales. Costs were well managed, suggest the analysts, with operating expenses and interest charges both lower half-on-half, while cash conversion was strong at 86%. Net corporate debt fell to $46.7m from $60.7m a year earlier and $83.8m in 1H25.

Strategically, the broker highlights faster progress in reshaping the brand portfolio, cost discipline, and a shift toward higher-margin revenue. No formal guidance was given, but management expects earnings growth, with a focus on back-end and finance & insurance.

TRANSURBAN GROUP LIMITED ((TCL)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/2/0

Citi has upgraded its rating on Transurban Group to Buy from Neutral as it now expects any cash flow impact from NSW toll reform to be manageable due to improved outlook on Sydney/Melbourne traffic and better cost control. Outlook for Sydney/Melbourne traffic is expected to improve as the impact of further construction is expected to be limited. Traffic ramp-up in the US is also a positive. The highlight of FY25 result was cost management, commentary suggests, with overall operational cost flat y/y at $927m, and the company indicated it remains an area of focus. Target rises to $16.10 from $14.30. The broker acknowledges NSW toll reform remains a downside risk.

In the bad books: downgrades

AUCKLAND INTERNATIONAL AIRPORT LIMITED ((AIA)) was downgraded to Neutral from Buy by Citi. B/H/S: 1/3/0

Citi notes Auckland International Airport’s FY25 underlying profit after tax came in line with its estimate but was slightly above consensus. The highlight was FY26 passenger growth guidance which disappointed, though the broker notes there is typical conservativeness in issuing guidance. The 2% y/y domestic and 3% y/y international passenger growth compared with the broker’s forecast for 2.5% and 6% growth, respectively.

The broker sees an impact on retail income, with additional headwind from duty-free area fit-out disruption. While capex and medium-term growth outlook are unchanged, the broker sees limited catalysts despite improvement in macro conditions from policy rate cuts. Rating downgraded to Neutral from Buy. Target trimmed to NZ$8.10 from NZ$8.90.

ANZ GROUP HOLDINGS LIMITED ((ANZ)) was downgraded to Sell from Trim by Morgans. B/H/S: 0/4/2

Morgans downgrades ANZ Bank to Sell from Trim, as the expected total return at the current share price does not offer a sufficient risk-return on the stock. Target is raised 10% to $26.84. The bank released its 3Q25 trading update, but its quarterly reports do not include trends in revenue, costs, or earnings, which Morgans highlights as a challenge to interpret whether the balance sheet growth is translating into better financial performance.

Both loan and deposit growth are tracking above market expectations for end of 2H25, and the CET1 capital ratio rose 16bps to 11.9%. The analyst forecasts the CET1 to be 11.7% at end of FY25. Morgans has lifted its EPS estimates by 1%-2% for FY25-FY27 and flags 5% EPS growth in FY25 compared to a compound average rate for FY26-FY28 of around 1%.

AVITA MEDICAL INC ((AVH)) was downgraded to Sell from Hold by Bell Potter. B/H/S: 1/0/1

Bell Potter downgraded Avita Medical to Sell from Hold, expecting the company will require more equity in the near term due to stagnant revenue growth. The broker notes the company has delivered a string of poor quarterly results and guidance misses, resulting in dilutionary capital raise, continuing cash burn, and significant shareholder value destruction.

The Orbimed loan covenant required $10m minimum cash balance to be maintained but current revenue levels make this unlikely. The broker estimates reaching breakeven by 2Q26 will require a step-change in revenue trajectory which is not yet apparent. Target cut to $1.50 from $1.70.

AURIZON HOLDINGS LIMITED ((AZJ)) was downgraded to Trim from Hold by Morgans B/H/S: 0/4/1

Aurizon Holdings’ FY25 result was messy and disappointing, according to Morgans, with FY26 guidance showing limited underlying growth. FY26 earnings (EBITDA) guidance of $1,680-$1,750m implies only 2-5% growth after adjusting for FY25 provisions, explains the analyst. It’s thought a new $150m buyback and a Network ownership review partly offset the weaker outlook.

The broker notes FY26 dividend guidance of 19-20c represents a 5.7-6.0% yield, consistent with an 80% payout ratio, implying strong profit growth year-on-year. Network remains the key asset, highlights Morgans, with FY25 earnings (EBITDA) up 3% and expected to grow again in FY26, supported by higher allowable revenue.

The broker highlights coal earnings are expected to be only marginally higher in FY26, with contract losses and customer insolvencies weighing on future volumes. Bulk earnings declined -26% in FY25 due to doubtful debt provisions, with guidance for improvement in FY26 from higher grain volumes, though structural issues remain, cautions the broker. Containerised freight remains loss-making, and breakeven is expected to be challenging.

Morgans cuts its forecasts to align with FY26 guidance, lowers its target price to $2.89 from $2.94, and downgrades its rating to Trim from Hold.

BABY BUNTING GROUP LIMITED ((BBN)) was downgraded to Trim from Hold by Morgans. B/H/S: 3/1/0

Baby Bunting generated notably robust 4Q25 sales with a “solid” FY25 earnings report according to Morgans, and net profit after tax at the upper end of the guidance range at $12.1m. Like-for-like sales in FY25 rose 4.2%, up 6.2% in 2H25, suggesting an acceleration in May/June to 11% growth. Gross margins rose 360bps on the previous year to 40.2%, and cost of doing business lifted 8.2% or 34.8% of sales, up 120bps. The company refurbished three stores in FY25, and sales uplift is forecast by management at an additional 15%-25% growth.

Morgans raises its net profit after tax estimates by 6% and 4% for FY26/FY27, respectively, underpinned by assumed higher like-for-like sales growth and improved gross margins. FY26 guidance was also better than anticipated and infers over 50% growth at the midpoint. Rating downgraded to Trim from Hold due to the share price performance. Target lifts to $2.50 from $1.80.

BHP GROUP LIMITED ((BHP)) was downgraded to Neutral from Buy by Citi and to Hold from Accumulate by Morgans. B/H/S: 2/4/0

BHP Group’s FY25 result was solid, assesses Citi, with underlying earnings (EBITDA) of US$26.0bn, 4% ahead of the broker’s forecast and in line with consensus, though still down -10% year-on-year. Profit of US$10.16bn was also in line, while the dividend of US110c surprised to the upside due to lower capex and the Carajas receipt (relating to BHP’s participation in Samarco). Net debt of US$12.9bn left gearing at 19.8%. The broker notes FY26 cost guidance is broadly steady, with WA Iron Ore (WAIO) at US$18.25-19.75/t versus US$18.6/t in FY25 and Escondida at US$1.20-1.50/lb compared with US$1.19/lb.

Medium-term capex has been lowered to -US$10bn annually, including -US$3bn sustaining and -US$4bn growth. Major projects include the WAIO car dumper renewal and a new Escondida concentrator due to deliver first copper in 2031-32. Citi points out management targets copper equivalent production growth of 1.4% per year to FY30 and 2.2% over the next decade, both below GDP growth.

With shares trading at a 4% premium to discounted cash flow (DCF) and having outperformed Rio Tinto ((RIO)) and CommBank ((CBA)) by around 11% in three months, the broker sees valuation as full. Citi keeps its FY26 profit forecast unchanged and trims FY27 by -3%. The broker retains its target price of $43 but downgrades to Neutral from Buy. BHP Group’s FY25 result was supported by solid operational and cost performance, assesses Morgans, with copper delivering strongly through robust production and by-product credits.

Revenue fell -8% to US$51.3bn, earnings (EBITDA) declined -10%, and profit is US$10.2bn; all were broadly in line with the broker’s forecasts. A final dividend of US60c surprised to the upside, aided by strong second-half free cash flow, explains the analyst. Management increased its target net debt range to US$10-20bn from US$5-15bn, signalling softer capital discipline even as net debt rose 42% to US$12.9bn, the report highlights.

FY26 capex guidance of -US$11bn is unchanged, while cost guidance across WA Iron Ore, Escondida, and BMA compares favourably to consensus, observes the broker. Jansen Stage 1 capex has been reset higher to -US$7.0-7.4bn with first production expected mid-2027, while Stage 2 is delayed to FY31 and FY26 potash spend is set at -US$1.9bn. Despite this, copper and iron ore are seen as core strengths, though the 50:50 joint venture between BHP and Japan’s Mitsubishi Development continues to underperform. Morgans makes only minor forecast changes and leaves its target price unchanged at $43.90. The broker downgrades BHP Group to Hold from Accumulate given recent share price strength.

BREVILLE GROUP LIMITED ((BRG)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 3/3/0

Ord Minnett assesses Breville Group delivered a strong FY25 result, with profit up 14.6% to $135.9m, slightly ahead of forecasts by the broker and consensus. Revenue rose 10.9% to $1.7bn, with double-digit sales growth across the Americas, APAC and EMEA, while gross margin expanded by 20bps to 36.6%. Earnings (EBITDA) increased 10.8% to $271.9m though the broker highlights operating cash flow declined to $171.5m from $302.6m. Sales momentum remains solid into FY26, according to Ord Minnett, though US tariff costs are expected to weigh on margins. Management is implementing price rises and continuing supply chain diversification to offset the impact.

Ord Minnett makes no major forecast changes but sees near-term valuation stretched despite continued medium-term growth prospects. The broker cuts its rating to Hold from Accumulate with the $35 target price unchanged.

BRAMBLES LIMITED ((BXB)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/0

Macquarie believes Brambles FY25 performance was broadly in line, with pallet packing tech driving asset efficiency. Management is seen as executing well, but the stock is downgraded to Neutral from Outperform on valuation. Only minor changes have been made to estimates. Target price lifts to $25.50 from $24.60. FY26 guidance didn’t please the analysts, with their translation of management’s outlook as like-for-like growth is slowing so there’s a growing dependency on business improvement to support growth.

CENTURIA CAPITAL GROUP ((CNI)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 3/1/1

Centuria Capital’s FY25 EPS came in better than guidance by 4.3% and slightly above Macquarie and consensus forecasts. FY26 guidance for EPS stands at 13.4c, or growth of 9.8%, which sits above consensus by 4.7% and 6.3% above the analyst’s estimate. Net revaluations rose 1.5% over 2H25 and AUM came in at $19.7bn versus $19.6bn at December 2024. Gross real estate activity was around $2.9bn compared to circa $1.9bn in 1H25. Operating gearing fell to 12.3% from 14.5% at 1H25, with the group’s maximum gearing target around 15%. Macquarie lifts its EPS forecasts by 6.1% for FY26 and 4.3% for FY27. Target rises to $2.04 from $1.79 including the FY26 guidance. The stock is downgraded to Underperform from Neutral on valuation grounds. See also CNI upgrade.

COCHLEAR LIMITED ((COH)) was downgraded to Trim from Hold by Morgans. B/H/S: 2/2/1

Cochlear reported FY25, which missed Morgans’ expectations and came in at the bottom end of recently downgraded guidance. Net profit was affected by a margin squeeze and slight sales growth. Gross profit margin declined -120bps to 73.7% versus consensus estimate at 76.4%, with a change to lower-priced markets and scale of China manufacturing. Opex rose 5% with ongoing investments in market growth. Operating cash flow declined -40% on higher inventory levels and working capital.

Cochlear implants grew 12% in FY25, with 20% growth in 2H on the new Nucleus Nexa system in EU and APC from mid-June, but the broker notes some market share was lost in a few countries ahead of product launches. FY26 guidance came in at growth of 11%-17% or net profit after tax of $435m-$460m, with a skew to 2H26. Rating downgraded to Trim, with a slight rise in target price to $299.54 from $281.36.

CSL LIMITED ((CSL)) was downgraded to Hold from Buy by Bell Potter and to Hold from Buy by Ord Minnett. B/H/S: 5/2/0

The key disappointment for Bell Potter in CSL’s FY25 result was the modest 1% 2H25 growth in Behring due to -1% decline in immunoglobulin sales. There was a boost from Seqirus avian flu contracts which is unlikely to repeat in FY26. Overall, FY25 net profit beat the consensus and the broker’s forecast as lower tax and opex offset soft revenue growth. The outlook was also disappointing with management no longer committing to Behring margin recovery by FY27-28; the broker is now assuming delay to FY29. The company is targeting US$525m annualised cost savings but the net impact is uncertain to the broker due to reinvestment commitments.

The operational rationale for the Seqirus spin-out is clear to the broker, but valuation uplift is seen limited due to weak vaccine demand and a soft growth outlook. Target cut to $240 from $305. Rating downgraded to Hold from Buy, with Nov 5 Capital Market Day eyed for details of management’s strategic review. While CSL’s FY25 result was marginally ahead of market profit expectations, Ord Minnett notes the composition disappointed. The broker points to weakness in immunoglobulin, lost UK tenders, and US Medicare changes weighing on Behring.

Seqirus and Vifor performed better than forecast, but a lower tax rate and interest expenses flattered the bottom line, highlights the analyst. Ord Minnett has concerns around CSL’s plan to spin off Seqirus by FY26, arguing limited visibility on segment earnings and the absence of pure-play influenza comparables undermines the strategic rationale. A restructure targeting US$500-550m of annualised cost savings over three years requires -US$700-770m in one-off costs. The broker doubts management can achieve the savings and sees sales and marketing investment as more appropriate.

With CSL abandoning its 3-5 year timeline for Behring margin recovery, Ord Minnett sees added uncertainty and complexity in the investment case. The broker cuts its EPS forecasts by -1-8% for FY26-FY28 and by -12% beyond. Ord Minnett lowers its target price to $258.00 from $310.00 and downgrades by two ratings notches to Hold from Buy.

DETERRA ROYALTIES LIMITED ((DRR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/0

Macquarie downgrades Deterra Royalties to Neutral from Outperform due to the strong share price performance. No change in the $4.20 target price. FY25 earnings came in as expected, with slightly higher revenue and earnings (EBITDA) by 3% and 6%, respectively, above consensus, while net profit after tax was 1% above forecast. The analyst noted a changing revenue mix, with Mining Area C (MAC) now at nameplate, Deterra’s core revenue is expected to be less exposed to iron ore prices in the absence of additional volume growth. Management continues to point to Thacker Pass, with first production in 2027 as a significant cash generator in the longer term, with divestments of non-core assets also on the table. Full year dividend per share of 22c, with 13c fully franked in 2H, was in line, reflecting a 75% payout ratio.

EVT LIMITED ((EVT)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 3/0/0

EVT Ltd has acquired Pro-invest Hotels’ third-party hotel management business for -$74m, including -$30m deferred, with management projecting annual earnings (EBITDA) of $8-9m, including synergies. Ord Minnett explains Pro-invest manages 15 hotels with 3,196 keys across A&NZ, and while common in the US, the model is at an early stage of adoption locally. The sector offers significant growth potential across A&NZ and Asia Pacific, in the broker’s opinion, though some hotel owners may see a conflict of interest given EVT also operates its own brands. The broker has lifted its EPS forecasts by 2% for FY26 and 3% for FY27 following the acquisition. The target price rises to $18.94 from $17.89 and the rating is downgraded to Accumulate from Buy.

GOODMAN GROUP ((GMG)) was downgraded to Neutral from Buy by UBS and to Lighten from Hold by Ord Minnett. B/H/S: 3/3/0

UBS raises its target price for Goodman Group to $36.63 from $36.00 and downgrades to Neutral from Buy following FY25 results. The group reported operating EPS of 118c, in line with consensus and slightly ahead of UBS at 117.2c. FY26 guidance for 9% growth was a touch below consensus but is seen as conservative, with scope for upgrades through the year, suggests the broker.

The analysts highlight progress in data centre developments in Paris and LA, with 0.5GW targeted to be in production by the end of FY26, consistent with expectations. Work in progress fell to $12.9bn from $13.7bn in March, occupancy eased to 96.5%, and rental reversion slowed to 15% from 24%. UBS upgrades FY26-28 operating EPS forecasts by around 3% on higher performance fees, rebased operating costs and lower finance costs, partly offset by reduced outer-year development earnings. Ord Minnett notes Goodman Group’s FY25 earnings was a modest beat vs its forecast, but EPS growth guidance for FY26 was lower than its expectation and the market. Work in progress (WIP) declined to $12.9bn from $13.7bn in the June quarter but is expected to rise to $15bn by end-FY26, with the broker noting the $2bn Artarmon data centre is not included in WIP.

Data centres accounted for 57% of WIP and 500MW of installed capacity is targeted by end-FY26, with work already begun on 300MW. The broker lifted FFO forecasts for FY26 and FY27 by 0.5% and 0.8%, respectively. Target unchanged at $32.50. Rating downgraded to Lighten from Hold on valuation grounds.

GPT GROUP ((GPT)) was downgraded to Hold from Accumulate by Ord Minnett and to Neutral from Outperform by Macquarie. B/H/S: 2/3/0

GPT Group delivered strong first-half 2025 earnings, assesses Ord Minnett, with funds from operations (FFO) up 4.4% year-on-year. An interim distribution of 12cpu was declared. Office assets outperformed with like-for-like net property income growth of 6.5%, retail rose 5.6%, and logistics grew 5%, highlights the analyst. Management expects occupancy of 94% in office and near full levels in retail and logistics.

Assets under management (AUM) rose $2.2bn to $36.6bn, and guidance suggests to the broker 3% FFO growth in 2025 to at least 33.2cpu, with distributions of at least 24cpu. Ord Minnett lifts its FFO forecasts by 2.2% for 2025, 2.6% for 2026 and 2.7% for 2027, and raises its target price to $5.30 from $5.15. The rating is downgraded to Hold from Accumulate on valuation. GPT Group’s first half 2025 funds from operations were up 4.4% year on year and 4.5% ahead of consensus. 2025 guidance is upgraded to FFO growth equal to or greater than 3%. Dividend guidance is unchanged at 24cps.

The first half included a contribution from trading profits which is not anticipated to recur in the second, Macquarie notes. Commentary stipulates the loss of earnings will be partially offset by continued strong income growth and the first full period contribution from assumption of retail property management rights.

Management suggested the focus has shifted to execution following a period of refocusing resources to align with strategy. Execution of strategy offers upside potential to valuation in the medium to long term, but on a 21.5% year to date rally, Macquarie downgrades to Neutral from Outperform. Target falls to $5.29 from $5.36.

GREEN TECHNOLOGY METALS LIMITED ((GT1)) was downgraded to Speculative Hold from Speculative Buy by Bell Potter. B/H/S: 0/1/0

Green Technology Metals continues to advance its Ontario-based lithium projects, with Bell Potter highlighting progress across Seymour, Root and the Ontario Lithium Conversion Facility. At Seymour, the company secured two 21-year mining leases, though the Definitive Feasibility Study (DFS) has been deferred amid weaker lithium prices, with the environmental assessment expected by end-2025.

Work is progressing on the Pre-Feasibility Study (PFS) in partnership with downstream development partner EcoPro Innovation, note the analysts. Development will require a meaningful recovery in lithium prices, cautions the broker, though a vertically integrated path with EcoPro could improve feasibility. Given development uncertainty, Bell Potter downgrades its rating to Speculative Hold from Speculative Buy and sets a 4.5c target price, down from 14c.

HMC CAPITAL LIMITED ((HMC)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 3/2/0

Following FY25 results for HMC Capital, Bell Potter lowers its target to $3.60 from $8.15 and downgrades to Hold from Buy. The broker cuts its FY26-28 EPS forecasts by -34% to -29% due to slower divisional growth, impairment, and higher corporate costs. The FY25 result was below the analysts’ expectations, with pre-tax EPS of 56c, -16% versus the broker and -18% versus consensus. The outcome was impacted by a -$31.9m impairment to align with Digico Infrastructure REIT’s ((DGT)) June 2025 net asset value (NAV). Guidance for FY26 is at least 40c pre-tax EPS and a 12c dividend, consistent with the broker and consensus.

Bell Potter believes limited unlisted capital sources available to HMC Capital at this stage mean the company must demonstrate clear execution in FY26 to rebuild confidence from both direct and equities investors. See also HMC upgrade.

ILUKA RESOURCES LIMITED ((ILU)) was downgraded to Hold from Accumulate by Ord Minnett and to Neutral from Outperform by Macquarie. B/H/S: 1/4/0

Ord Minnett observes Iluka Resources’ June half 2025 profit of $92m was in line with the consensus forecast, though the dividend was softer-than-expected. The Eneabba rare earth refinery dominated attention. The share price has rallied more than 50% since the MP Materials–US Department of Defence deal, leaving much of the rare earth upside already priced in, suggests the broker. Iluka is in a peak capex phase with Balranald and Eneabba construction, leading to negative free cash flow in 2025-26, explain the analysts. Stronger yields of more than 9% are expected from 2028. Ramp-up risks remain material compared to pure-play rare earth peers, cautions the broker, while soft mineral sands markets continue to weigh on near-term earnings.

Ord Minnett lifts its target price to $6.00 from $5.50 but downgrades its rating to Hold from Accumulate. On a first take, Macquarie noted Iluka Resources reported generally in line 1H2025 results. Revenue was within 1% of consensus with earnings (EBITDA) broadly meeting expectations.

Mineral sands earnings missed by -5%, offset by a higher contribution from Deterra Royalties ((DRR)). Group net profit after tax came in 6% above consensus but met Macquarie’s forecast. The interim dividend at 2c missed consensus forecast by -1c.

Macquarie also points to a challenging zircon market and a downward trend in titanium oxide prices, but the market is recognising Iluka’s rare earths exposure as an offset, pushing the share price up 18% year to date, with July’s Defence Dept contract highlighting the importance. This leads the broker to pull back to Neutral from Outperform. Target unchanged at $6.30.

JAMES HARDIE INDUSTRIES PLC ((JHX)) was downgraded to Sell from Hold by Ord Minnett and to Neutral from Buy by UBS. B/H/S: 3/2/1

Ord Minnett lowers its target price for James Hardie Industries to $29.00 from $41.50 and downgrades to Sell from Hold following June quarter results. Earnings were well below forecasts by the broker and the market, with North American fibre cement sales down -12% versus expectations for a -1% decline. Weak housing demand in Texas, Georgia and Florida, along with tighter inventory management by customers, contributed to the shortfall, explains the analyst. The AZEK acquisition added less to earnings than anticipated by the broker, raising concerns over management’s assumption the transaction would be accretive.

The sales slump also highlights poor earnings visibility and suggests to Ord Minnett James Hardie may be losing market share in the US. The broker cuts its FY26-FY28 EPS forecasts by -36.5%, -33.0% and -28.4%, respectively, and removes share buybacks from its financial model before FY29. James Hardie Industries’ first quarter underlying profit declined -29% year on year, -19% below consensus. The miss was due to North American earnings result -17% below given a more challenged volume environment, UBS notes.

Those volumes were down -14% with the company noting that volumes in its core Southern states market (60% of exteriors) were down more than -20%. Persistently high rates and tariff volatility, alongside ongoing affordability challenges, are also driving the lower demand environment, with homebuilders reducing production rates. Longer term, UBS continues to expect James Hardie to benefit from the structural underbuild of US housing and ongoing material conversion across siding and decking. However, in the short term, the broker sees increased risk on earnings. Downgrade to Neutral from Buy, target falls to $36 from $50.

MAGELLAN FINANCIAL GROUP LIMITED ((MFG)) was downgraded to Neutral from Buy by UBS and to Hold from Accumulate by Morgans. B/H/S: 0/3/1

Magellan Financial’s operating profit was in line with UBS though some 5% higher than a messy consensus given disclosure changes. The result reflected an -11% miss on the second half for Investment Management driven by weaker average fee margins, which were offset by a strong beat in Partnerships & Investments. M&A ambitions appear to be down the agenda while Vinva distribution is integrated, UBS notes. Nevertheless, following a sharp share price recovery, the broker suspects there will be more limited appetite to execute the buyback at current levels. UBS estimates the implied multiple on Investment Management is likely 8x for FY26 which appears fair given its declining earnings profile. Downgrade to Neutral from Buy, target rises to $10.70 from $9.50.

Magellan Financial reported FY25 results which met expectations, with Morgans noting revenue was slightly lower than anticipated due to management fee compression, offset by higher principal investment income and associate contributions. A special 21c dividend was declared.

Barrenjoey, Vinva and Finclear outperformed, while core business growth remained limited. Associates generated 20% of operating earnings, with Barrenjoey up 36% in 2H on the previous half. Commentary highlights the core earnings are stabilising, with some fee and flow pressures remaining, while growth optionality is evident in associates. Morgans upgrades its earnings forecast by 5% to account for higher dividend and associate contributions against previous assumptions. The stock is downgraded to Hold from Accumulate, with a new target of $10.74 from $8.73 due to an upgraded valuation ascribed.

REGION GROUP ((RGN)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 3/1/2

Macquarie downgrades Region Group to Underperform from Neutral as the stock is trading broadly in line with its long-term metrics. The REIT reported FY25 funds from operations of 15.5c, up 0.6%, which met both guidance and Macquarie/consensus expectations. The CEO, Anthony Mellows, will retire and the succession plan is underway. FY26 funds from operations guidance is for 2.6% growth to 15.9c, which meets consensus and is above the analyst’s estimate by 1.1%. FY26 dividend guidance stands at 14c, a rise of 2.2%. FUM grew 9.8% in 2H over 1H25 to $747.3m, and gearing stands at the lower end of the target range at 32.5%. Target price is raised to $2.21 from $2.16.

RELIANCE WORLDWIDE CORP. LIMITED ((RWC)) was downgraded to Hold from Buy by Morgans and to Hold from Accumulate by Ord Minnett. B/H/S: 2/4/0

In the wake of FY25 results for Reliance Worldwide, Morgans cuts its FY26-28 earnings (EBITDA) forecasts by between -6-12% and lowers its target price to $4.50 from $5.45. The broker also downgrades its rating to Hold from Buy. The result was broadly in line with the analyst’s expectations, with sales up 6% to US$1,315m and earnings (EBITDA) up 1% to US$278m. Margins fell -90bps to 21.1%, though excluding Holman (specialises in plumbing, garden watering, and irrigation products) they were flat, supported by -$17.4m in cost savings and $2.3m in synergies. The broker notes conditions remain weak across all regions, with Americas sales down -2% and earnings down -1% due to subdued remodel demand. APAC region sales rose 43% on the Holman acquisition but margins were softer than expected. EMEA sales fell -4% and earnings dropped -3%, with the short-term outlook for the UK economy appearing mixed to the analyst.

Management guides to mid-single-digit sales declines in the US in the first half of FY26, flat APAC sales, and broadly steady EMEA performance. US tariffs are expected to cost -US$25-30m in FY26 but should be immaterial in FY27 once mitigation measures are in place, explains the broker.

Ord Minnett downgrades Reliance Worldwide to Hold from Accumulate due to macro uncertainty, with a decline in the target price to $4.55 from $5. The company achieved a 0.5% rise in FY25 net profit after tax, a slight beat on the analyst’s forecast, with sales revenue rising 5.5% over the period; excluding acquisitions it rose only 0.5%. EMEA sales fell -4.2% and A&NZ sales rose 2.4% excluding the Holman acquisition. US sales fell -2.1%, with group margins down to 21.2% from 22.2% a year earlier. The balance sheet remains robust. Ord Minnett believes FY26 is a transitional period for the company, with ongoing headwinds in the US and tariff pressures meaning an emphasis on prices to offset weaker volumes.

SEEK LIMITED ((SEK)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 7/0/0

Ord Minnett highlights Seek’s FY25 earnings met expectations as pricing mix helped revenue growth, offsetting the -11% decline in paid job ads in Australasia and -16% fall in Asia. The broker expects FY26 revenue growth of 11% but operating earnings to grow by 17% and net profit by 35% on strong operating leverage. The forecasts assume flat volumes in Australasia and weaker Asian markets. EPS forecast for FY26 lifted by 11% and by 10.2% for FY27. Target rises to $31 from $17. Rating downgraded to Accumulate from Buy for valuation reasons.

SPARK NEW ZEALAND LIMITED ((SPK)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 2/0/1

Morgan Stanley lowers its target price for Spark New Zealand to NZ$2.20 from NZ$2.75 and downgrades to Underweight from Equal weight, following FY25 results. Industry View: In-Line. The results confirmed to the broker declining core telco earnings, with FY26 earnings (EBITDA) guidance implying no growth. Morgan Stanley notes the sale of -75% of Spark’s data centre business will cut debt and ease funding needs but at the cost of lower long-term growth.

The analysts point to ongoing structural pressures on legacy telco earnings, combined with the capital intensity of data centres, leave little room to both fund dividends and invest in growth. Management cut its FY26 dividend outlook to around NZ17c from NZ25c in FY25. The broker expects debate on whether Spark can grow dividends beyond FY26 but sees risk to future payouts in FY27-28.

SERVICE STREAM LIMITED ((SSM)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 3/0/0

Service Stream delivered FY25 earnings (EBITDA) of $146.1m, up 13%, and profit of $68.5m, up 37% and around 3% ahead of Ord Minnett’s forecast due to a lower tax rate. Earnings margins expanded in Utilities, which the broker expects to be the key growth driver in FY26 with around 12% revenue growth from new contracts with Urban Utilities and Sydney Water. The broker expects Telco revenue and earnings will remain steady following the renewal of long-term NBN agreements, while Defence tender outcomes are a potential catalyst. The balance sheet is debt free, highlight the analysts, providing flexibility for both organic and inorganic growth, with return on equity (ROE) lifting to 13.8% and work in hand equating to around five times revenue. Ord Minnett raises its target price to $2.35 from $2.15 and downgrades its rating to Accumulate from Buy.

STEP ONE CLOTHING LIMITED ((STP)) was downgraded to Speculative Buy from Buy by Morgans. B/H/S: 2/0/0

Step One Clothing reported a sizeable FY25 earnings miss, with earnings (EBITDA) -15% below the pre-trading update and margin down -130bps to 20.1% from 21.4%. A cut in marketing spend offset the misses and underpinned a rise in net profit after tax by 2%. Challenging conditions resulted in higher promotions to attract value customers, with 63% of revenue from sales up from 37%, and average order value down to $96 from $103, implying a fall in average selling price of circa -20%. The UK performed positively, up 8.7%.

Morgans cuts its FY26/FY27 earnings (EBITDA) forecast by -42%, respectively, due to lower sales growth, significantly lower gross margins, and higher operating costs. Target price falls to 87c from $1.50, and the stock is downgraded to Speculative Buy from Buy. The analyst views FY26 as a reset year from which the company should be able to grow.

THE LOTTERY CORPORATION LIMITED ((TLC)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/1

The Lottery Corp reported underlying FY25 profit down -11% year on year but 3% ahead of consensus. Lottery Corp has been more active than usual with lottery game pricing and innovation, Macquarie notes, which supports FY26-27, making changes to Saturday Lotto (13% price increase, and increasing division one jackpot 20%) and planning to increase Powerball pricing 17%.

These two games represent around 65% of lottery volumes, and the pricing supports around 7.5% points of annual revenue benefit, assuming 75% stickiness. There has been a lot thrown at FY26 to support 14% earnings growth, but Macquarie sees growth slowing in FY27 and beyond and valuation looks full. Downgrade to Neutral from Outperform, target rises to $5.50 from $5.40.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.