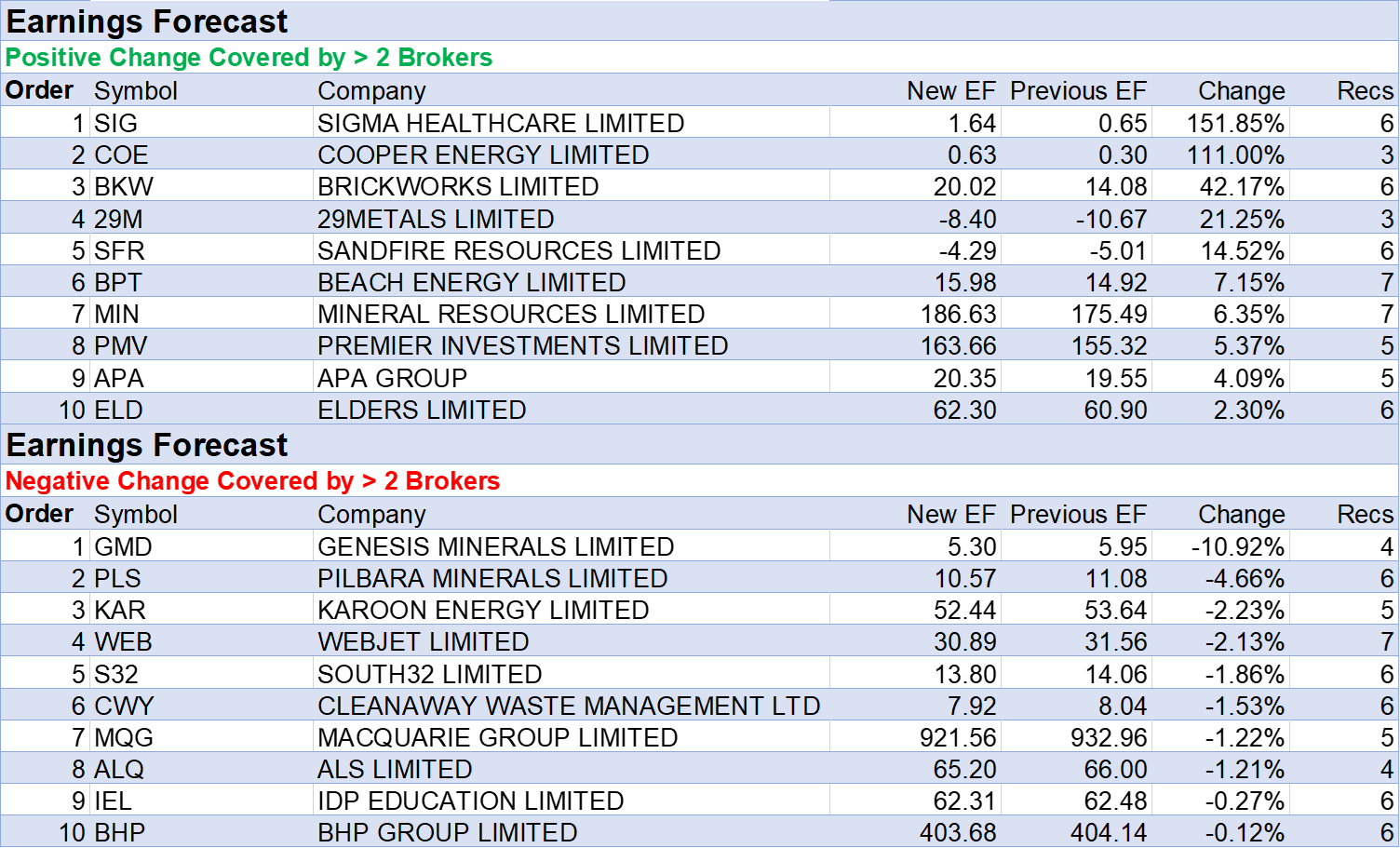

For the second week in a row, Sigma headed up the earnings upgrade table after FY24 earnings came in at the top end of management’s guidance range. Last week’s update of research by Ord Minnett propelled the average earnings forecast in the FNArena database even higher.

Despite a “weak” FY24 result due to fewer covid test sales, cost inflation and intense competition, the broker predicted materially better earnings in coming years due to improved operating leverage, and an ongoing focus on both cost efficiencies and private label products.

The analyst raised the FY25 margin forecast for Sigma by eight basis points as management announced the development of over 250 private label products, 80% of which will launch in the second half of FY25. The broker highlighted the gross margin for private label products is typically six times higher than for branded products.

The potential merger with Chemist Warehouse Group is not factored into Ord Minnett’s forecasts at this time, due to the risk of regulatory intervention.

Sigma also came third on the positive change to average target price list behind Webjet, which was boosted by positive management commentary at the WebBeds B2B strategy day.

According to UBS, the update highlighted Webjet’s ability to leverage technology, big data, and AI projects (currently underway) to customise and increase delivery speed to customers. As a result of these initiatives, the analyst is expecting material growth well in advance of consensus expectations.

Morgan Stanley agreed with UBS and came away from the strategy day with a more constructive outlook for the short term. Stronger total transaction value growth and lower, more competitive take-rates are expected to provide a net tailwind for near-term earnings.

An ongoing rebound in leisure travel and Webjet’s market share were implied by several targets that management expects to achieve by FY30, which were all ahead of analysts’ forecasts.

During last week, Morgans adopted a more positive view than consensus on demand conditions for commodities, in the expectation US dollar weakness and a return to growth in the West combine to offset the weak property market in China. Due to sustained supply deficits in coming years, copper and oil exposures are preferred.

The broker raised its price forecasts for both oil and LNG, resulting in higher earnings forecasts for Cooper Energy and a target of 30 cents, up from 28 cents.

Morgans is also optimistic around the early track record of the company’s new management team, who have rolled out a series of value-accretive debottlenecking activities at the long-troubled Orbost gas plant.

Citi’s earnings forecast for Sandfire Resources increased last week after the broker’s commodities team upgraded the second quarter copper price outlook to an average US$9,000 per tonne. Citi noted softer copper supply and the expectation of more aggressive interest rate cuts by the US Federal Reserve.

While the analyst’s target price for Sandfire increased to $7.30 from $6.90, the recommendation was downgraded to Sell from Neutral on a full valuation after a 20% year-to-date share price rally. It’s thought Sandfire has benefited from being the go-to-name for copper exposure on the ASX.

Early last week, 29Metals also benefited from Citi’s increased copper price forecasts, but (more) bad news was to follow. Following the suspension of operations at the company’s Capricorn Copper operations due to an extended period of rainfall, Macquarie downgraded its rating for 29Metals to Underperform from Neutral and lowered the target by -44% to 25 cents. The broker listed several negatives including: 29Metals is now a one asset producer with a leveraged balance sheet; there’s a high operating cost base at Golden Grove; and the CEO is in transition.

Morgan Stanley is also concerned about liquidity levels at 29Metals though suggested additional capital may not be required should the spot copper price rise another 5%, or debt payments are delayed. An additional insurance payment of around $15m would also help stave off the need for additional cash. Genesis Minerals received the only materially negative change to average earnings forecast by brokers last week. After taking into account details released by management on the five/ten-year outlook, Macquarie lowered EPS forecasts for FY24-28 by -28%, -9%, -54% and -43%, respectively, with meaningful upgrades for following years.

Genesis plans to mine 1.3m ounces of gold over the next five years (in line with the broker’s forecasts) though management’s estimates for around 75,000 ounces per annum over the subsequent five years is stronger than the analyst’s prior forecast. An Outperform rating and $2.00 target were maintained. MMA Offshore was downgraded to Hold from Buy last week by both Shaw and Partners and Bell Potter after a subsidiary of Singapore-based Cyan Renewables offered $2.60 per share in cash for the company after signing a binding Scheme Implementation Deed. Shaw downgraded to reflect the likelihood MMA Offshore will be acquired at the agreed price, but Bell Potter felt the door was left ajar for a potential competing offer. Bell Potter described the bid, which reflected an 11% premium to the prior closing price, as reasonable but not a knockout.

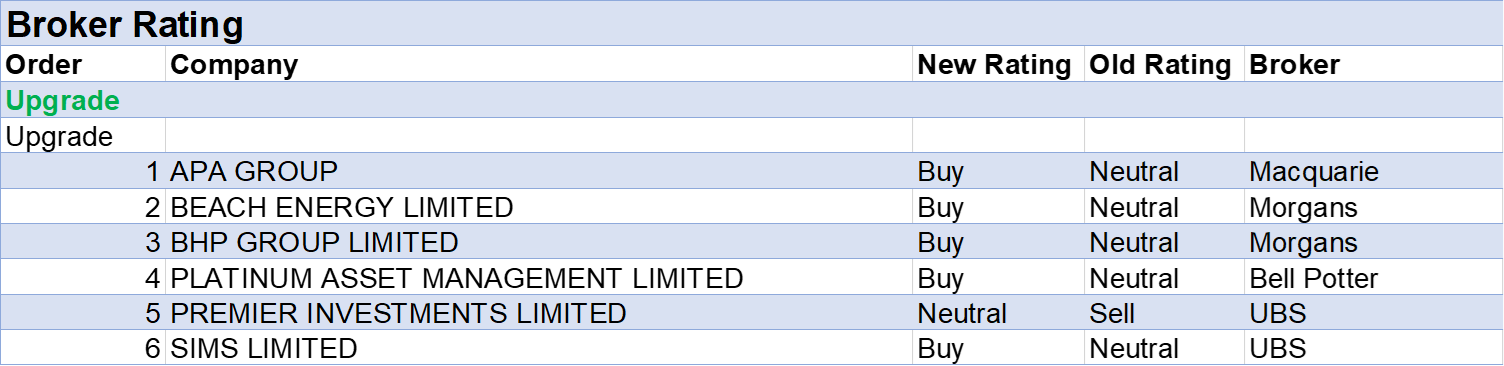

In the good books: upgrades

APA GROUP ((APA)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/3/0

Following the release of the Australian Energy Market Operator’s (AEMO’s) Gas Statement of Opportunities (GSOO) and the Victorian Gas Planning Report (VGPR), Macquarie notes (like in 2023) the market is heading for a gas shortfall. The broker suggests the likely first trouble will occur in the winter of 2026, though the material shortfall will be in 2027 or 2028. It’s felt APA Group will benefit from growing contracting in off peak on the energy performance contract (EPC) to deliver more gas in Victoria. Target rises to $9.40 from $8.90 after the broker also incorporates a lower tax assumption. The rating is upgraded to Outperform from Neutral on valuation.

BHP GROUP LIMITED ((BHP)) was upgraded to Add from Hold by Morgans. B/H/S: 2/4/0

Morgans adopts a more positive view than consensus on demand conditions for commodities in the expectation US dollar weakness and a return to growth in the West offsets the weak property market in China. Due to sustained supply deficits in coming years, the broker prefers copper and oil exposures. The iron ore price is expected to remain healthy until around 2026 when low-cost, high-quality supply from the Simandou mine in Africa enters the market, and potentially lowers prices. The analysts anticipate gold stocks could rally to ‘catch up’ to all-time highs for gold prices. Oil, LNG and uranium price forecasts are increased, while the 2024 spodumene price estimate is further trimmed. Morgans upgrades its rating for BHP Group to Add from Hold after a recent share price selloff and is preferred over Rio Tinto and Fortescue for iron ore exposure. The $47.60 target is unchanged.

BEACH ENERGY LIMITED ((BPT)) was upgraded to Add from Hold by Morgans. B/H/S: 6/1/0

Morgans adopts a more positive view than consensus on demand conditions for commodities in the expectation US dollar weakness and a return to growth in the West offsets the weak property market in China. Due to sustained supply deficits in coming years, the broker prefers copper and oil exposures. The target for Beach Energy rises to $2.15 from $1.65 and the rating is upgraded to Add from Hold after a new analyst at Morgans updates financial assumptions. Higher oil and gas price forecasts are also incorporated into forecasts.

PREMIER INVESTMENTS LIMITED ((PMV)) was Upgraded to Neutral from Sell by UBS. B/H/S: 2/2/1

Premier Investments delivered 1H earnings (EBIT) of $209.8m, exceeding forecasts by consensus, UBS and also beating management guidance for around $200m. The broker upgrades to Neutral from Sell and the target rises to $31 from $27. Even though sales growth missed expectations held by the broker and consensus, higher gross margins, and good management of cost-of-doing-business (CODB) won the day, explains the analyst. UBS is now more confident of earnings margin expansion beyond FY24, given a change in channel and brand mix along with the sound cost-of-goods sold (COGS) and CODB management. The company is working towards a demerger of Smiggle into a separately listed entity by January 2025, and is exploring a demerger of Peter Alexander into a separately listed entity during 2025.

PLATINUM ASSET MANAGEMENT LIMITED ((PTM)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/2/2

While management has been notified clients are looking to redeem -$1.4bn from funds under management (FUM) in the coming months, Bell Potter has raised its target to $1.20 from $1.13. The broker explains an expected -$20m reduction in costs from the company’s first phase of a turnaround program has a large positive impact on earnings, due to operational gearing. The -20% share price fall in reaction to the announced redemptions is overdone, believes Bell Potter, given an improving risk/return trade outlook. The rating is upgraded to Buy from Hold.

SIMS LIMITED ((SGM)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/0/1

UBS upgrades its rating for Sims to Buy from Neutral on an improving scrap price and volume outlook and because share continue to trade at around 90-95% of book value. Also, the analyst sees ongoing improvement as the company moves away from low-margin dealer-sourced volumes, while simultaneously locking in more domestic buyers. As the broker’s FY25 EPS forecast rises due to increased North America Metals (NAM) EBIT/t margin expectations, the target increases to $14.50 from $13.60. With US mill lead times lifting, and service centre inventories largely normalised, UBS expects tailwinds to emerge for Sims in the 2Q of 2024, which is a seasonally stronger period for US steel demand.

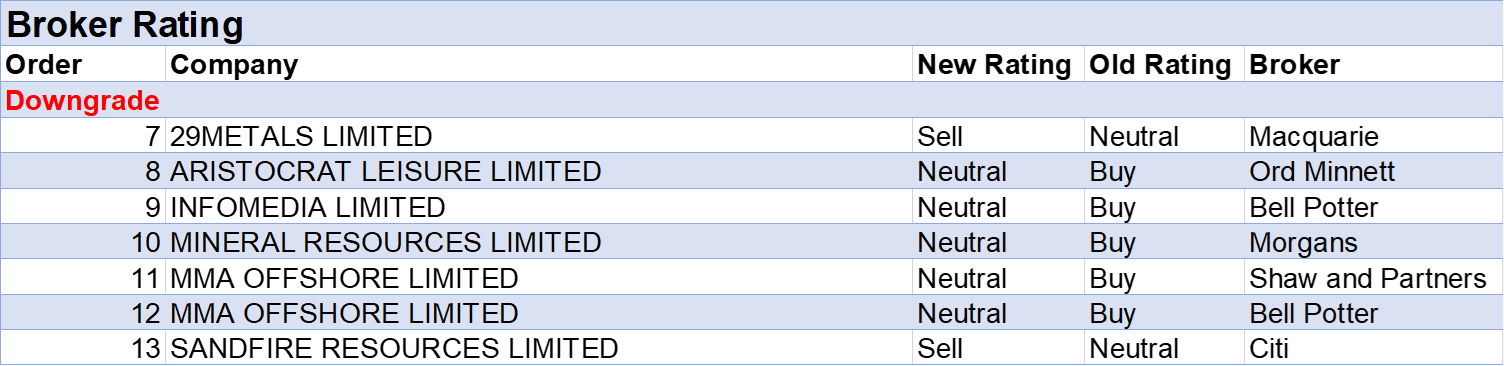

In the not so good books: downgrades

29METALS LIMITED ((29M)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 1/1/1

Macquarie downgrades its rating for 29Metals to Underperform from Neutral and lowers the target by -44% to 25c following the suspension of operations at Capricorn Copper due to an extended period of rainfall. The broker lists the negatives: 29Metals is now a one asset producer with a leveraged balance sheet; there’s a high operating cost base at Golden Grove; and the CEO is in transition. The analyst doesn’t assume in forecasts a restart at Capricorn Copper as part of the base case, as that would require a long-term tailings solution. Two proposed tailings capacity options by management do not represent such a long-term solution, in the broker’s view.

ARISTOCRAT LEISURE LIMITED ((ALL)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 3/2/0

Ord Minnett expects Aristocrat Leisure’s unmatched research and development expenditure within the industry will continue to see the company maintain game quality and differentiate from lower-end competitors. Comparing Aristocrat Leisure with Light and Wonder ((LNW)) and International Game Technology, the broker notes Aristocrat Leisure typically spends 12% of revenue on design and development, versus a respective 9% and 7% from peers. Ord Minnett expects this spend can ensure consistency in deploying popular titles from Aristocrat Leisure. The rating is downgraded to Hold from Accumulate and the target price of $45.00 is retained.

INFOMEDIA LIMITED ((IFM)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 2/1/0

As both the general stock market and in particular the technology sector have rallied since Bell Potter last updated its valuation for Infomedia in February, the broker increases valuation multiples for the company. The broker downgrades the rating for Infomedia to Hold from Buy as the new target of $1.80, up from $1.75, is only around 4% ahead of the latest share price. No earnings forecast changes are made. The analyst expects a good FY24 result with reasonable margin expansion on high-single-digit revenue growth.

MINERAL RESOURCES LIMITED ((MIN)) was downgraded to Hold from Add by Morgans. B/H/S. 3/3/1

Morgans adopts a more positive view than consensus on demand conditions for commodities in the expectation US dollar weakness and a return to growth in the West offsets the weak property market in China. Despite believing lithium prices have likely bottomed, Morgans rating for Mineral Resources is downgraded to Hold from Add after a recent share price rally. The broker still sees plenty of reasons for investors to maintain their holdings. The $71 target is unchanged.

MMA OFFSHORE LIMITED ((MRM)) was downgraded to Hold from Buy by Bell Potter and to Hold from Buy by Shaw and Partners. B/H/S: 1/2/0

MMA Offshore has entered into a binding scheme implementation agreement with Cyan for the acquisition of all issued shares at $2.60 per share, in a deal the MMA Offshore has unanimously recommended to shareholders in the absence of a superior proposal. Bell Potter described the bid, which reflects an 11% premium to the prior closing price as reasonable but not a knockout. It notes this leaves the door open for a potential competing offer. The rating is downgraded to Hold from Buy and the target price decreases to $2.60 from $2.70. Aligning with Shaw and Partners valuation for MMA Offshore, a subsidiary of Singapore-based Cyan Renewables is offering $2.60 per share in cash after signing a binding Scheme Implementation Deed. The broker’s $2.60 target is maintained, and the rating downgraded to Hold from Buy to reflect the likelihood MMA Offshore will be acquired at the agreed price. Shareholders will have the opportunity to vote on the Scheme in late-June to mid-July 2024.

SANDFIRE RESOURCES LIMITED ((SFR)) was downgraded to Sell from Neutral by Citi. B/H/S: 3/2/1

Amid softer copper supply and the expectation of more aggressive cuts from the US Federal Reserve, Citi’s commodities team has upgraded its second quarter copper outlook to an average US$9,000 per tonne. The broker points out Sandfire Resources is up 20% year-to-date, benefitting from being the go to name in copper on the ASX, and now looks fully valued to Citi. The broker expects there will be other entry points in the coming two years. The rating is downgraded to Sell from Neutral, and the target price increases to $7.30 from $6.90.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.