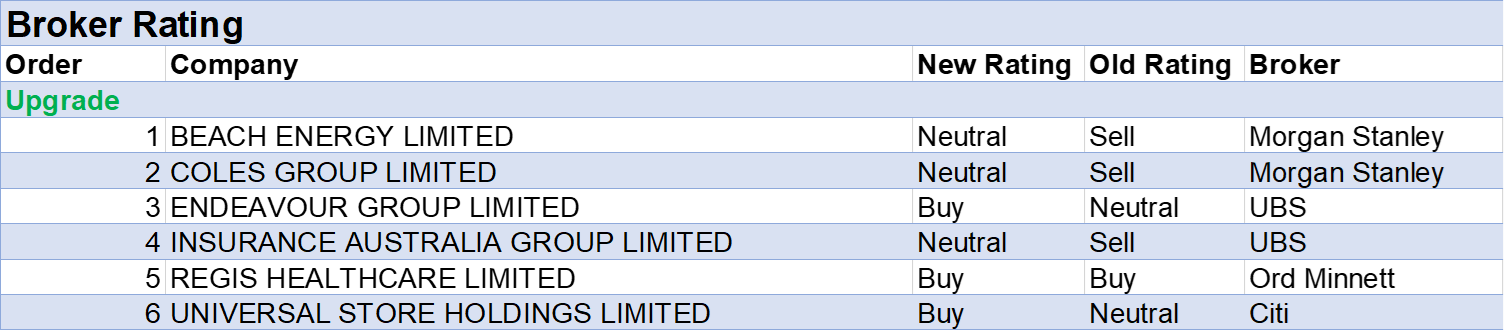

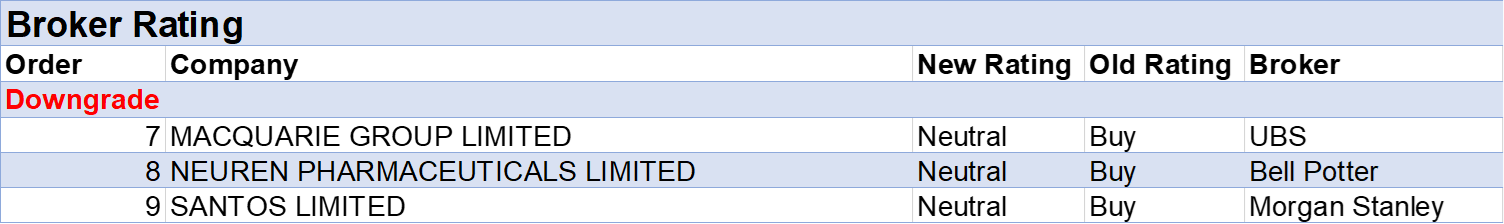

For the week ending Friday December 8 there were six ratings upgrades and three downgrades to ASX-listed companies by brokers covered daily by FNArena.

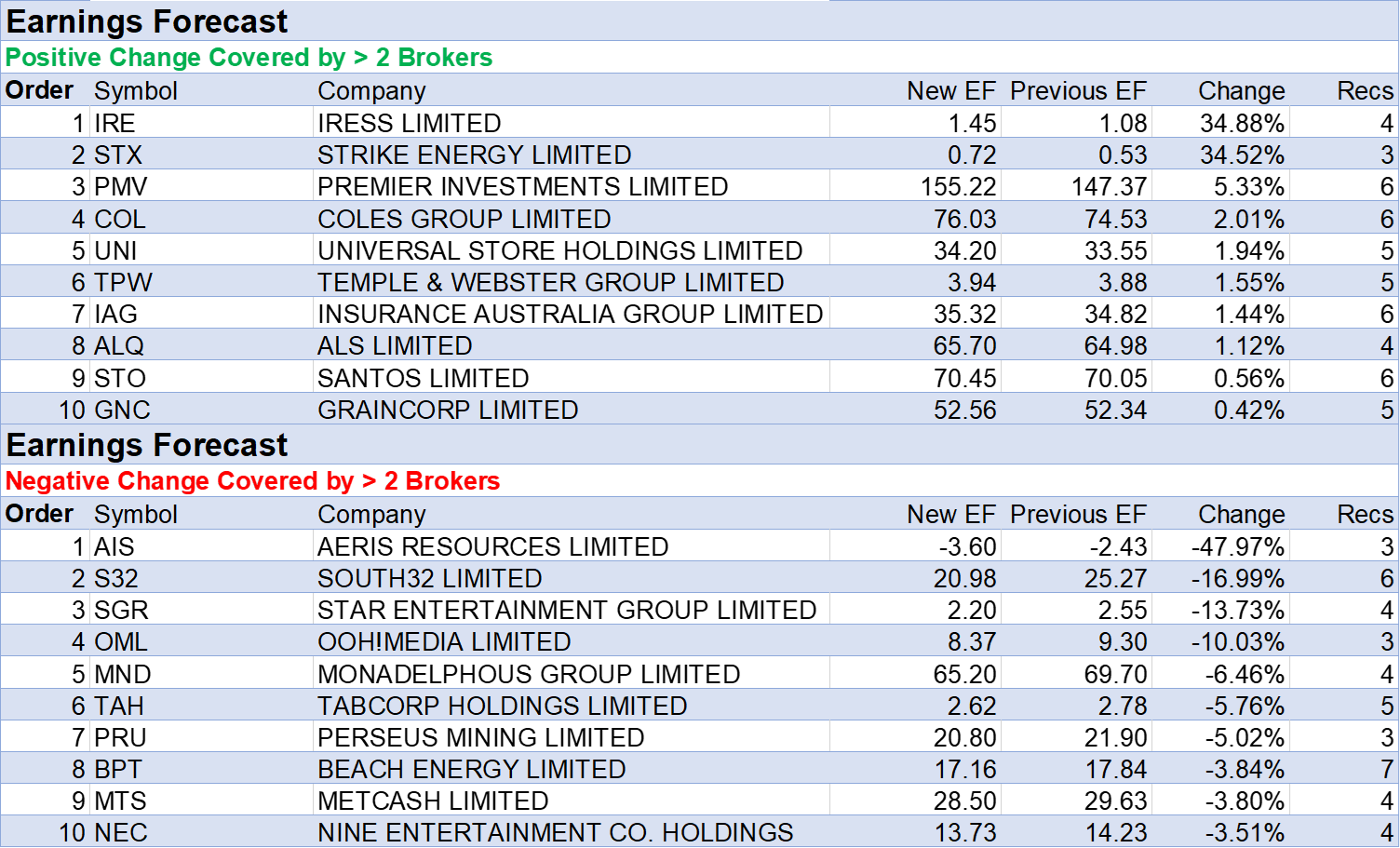

Average earnings downgrades by analysts were larger than upgrades as can be seen in the tables below.

Iress received the largest upgrade to average earnings forecasts though the percentage move was exaggerated by the small forecast numbers involved.

A strategy update by management confirmed Ord Minnett’s view a temporary earnings blip will reverse in 2024.

The analyst suggested there will be ongoing balance sheet progress from divestment of non-core businesses and improving earnings. Over the broker’s forecast period, the net debt/EBITDA ratio is expected to average 1.3 times compared to the current 2.3 times.

The broker also remains confident on the growth outlook for the company’s key segment, Superannuation, due to ongoing customer wins and numerous upcoming project implementations. The Buy rating was retained, and the target increased to $9.60 from $9.20 on lower anticipated operating expense growth.

Longer-term earnings forecasts for Outperform-rated Strike Energy were also increased last week by Macquarie. The broker noted potential upside for the share price as the two Erregulla gas developments (350km northeast of Perth) are de-risked and management targets exploration and appraisal upside.

While the analyst’s target price fell by -16% to 48c on lower assumed South Erregulla volumes, Strike is still viewed as an attractive takeover target.

Aeris Resources headed up the tables below for the largest percentage fall in average earnings forecast, as well as the largest fall in average target price for the second week in a row.

In the prior week, the average target price fell to 19.3c from 26.7c due to a $30m equity raise to fund capital requirements. Also, both Macquarie and Ord Minnett felt another capital raising would be required, with the latter noting the trade payables position of $121m at June 30, and an onerous $50m debt at 15.5% interest with WH Soul Pattinson.

Last week, Bell Potter also reacted to the capital raising by reducing its target to 23c from 30c, dragging the average target in the FNArena database down to 17c from 19.3c.

South32 also received earnings downgrades from three brokers in FNArena database last week.

The company’s share price has declined broadly in line with fellow mining mid-cap peers over the last year due to a short-term deterioration in earnings, suggested Morgans. Additionally, it’s felt the fast-tracking of the Hermosa manganese and zinc development in the Patagonia Mountains of southern Arizona will be insufficient to plug a gap in South32’s growth profile.

Because of this gap, the broker’s Add recommendation is reliant upon a recovery in base metal markets including coal, copper, aluminium and nickel. Morgans target price was reduced the target to $4.80 from $5.20.

South32’s average earnings forecast was also negatively impacted by updated commodity price forecasts by both Morgan Stanley (target down to $3.85 from $4.20) and Macquarie last week.

Macquarie’s price forecasts for copper and zinc rose, while nickel, manganese and aluminium forecasts fall. The latter two changes resulted in materially lower EPS forecasts by the broker and the target fell to $3.30 from $3.40.

The average earnings forecast for Star Entertainment also fell last week, solely due to Morgans lowering its FY24 and FY25 earnings forecasts by -16% and -9%, respectively, due to a potential delay in opening for the integrated resort development at Queen’s Wharf in Brisbane and softer trading run-rates.

Morgans retained an Add rating for Star but reduced its target to 70c from 90c. The broker’s top two picks for stocks under coverage in the Gaming sector remain Aristocrat Leisure and Jumbo Interactive.

In a research piece last week, Morgan Stanley explored the risks to oOh!media’s outdoor advertising revenues from the structural growth of Retail Media.

Retailers now make up 20-30% of brand advertising spend in Australia, according to the analysts. Importantly, they are now changing strategies and the way they spend their advertising/marketing dollars.

While retailers have always spent some of their advertising budgets on their own in-store advertising, such as point-of-sale (POS) displays/banners, the broker’s industry feedback shows the rate of change for spending is now accelerating.

Morgan Stanley forecasts Retail Media spending on in-house/owned advertising platforms will be $2.8bn in 2027, up from around $1bn in 2022.

This growth provides a medium-term headwind to oOh!media’s out-of-home (OOH) revenues, yet the broker concluded the company is relatively less exposed than peers. While the analysts reduced earnings forecasts, an Equal-weight rating was retained.

IN THE GOOD BOOKS – upgrades

BEACH ENERGY LIMITED ((BPT)) was upgraded to Equal weight from Underweight by Morgan Stanley. B/H/S: 3/4/0

In a review of Australian upstream energy stocks under coverage, Morgan Stanley has a new order of preference led by Karoon Energy ((KAR)), Woodside Energy ((WDS)) and Origin Energy ((ORG)).

While large-cap upstream stocks had material downward consensus revisions following November market updates,

the broker feels local headwinds are now sufficiently priced in. An Attractive industry view is retained, and Brent forecasts remain steady.

Regarding Beach Energy, the broker upgrades its rating to Equal weight from Underweight following a -20% fall in share price over the last year.

Morgan Stanley’s target rises to $1.65 from $1.56 on improving free cash flow (FCF) growth prospects from Waitsia, and the repricing of the Lattice contract with Origin Energy.

COLES GROUP LIMITED ((COL)) was upgraded to Equal weight from Underweight by Morgan Stanley. B/H/S: 2/3/0

Morgan Stanley upgrades its rating for Coles Group to Equal weight from Underweight partly due to future benefits from supply chain investments. The target price also rises to $16.50 from $14.75.

The broker believes e-commerce will return to growth in FY24 and suggests a shift of grocery spend online remains the largest e-commerce opportunity. Online penetration rates in the US and the UK (for example) are far above Australia, explain the analysts.

Morgan Stanley’s also sees an improvement in FY24 margins for Coles due to benefits from stock loss reversal. Industry View: In-Line.

ENDEAVOUR GROUP LIMITED ((EDV)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/1/1

UBS upgrades its rating for Endeavour Group to Buy from Neutral on valuation and increases its target to $6.00 from $5.40. It’s felt markets concerns are overdone around further regulation following government imposition of spending limits on Tasmanian poker machines in September last year.

The Endeavour Group share price has fallen -33% since that time. However, an around -40-50% decline in gaming earnings (EBIT) from FY27 onwards would be required to justify the current share price, point out the analysts.

The company is not as strong a gaming operator relative to peers, notes the broker, and gaming revenue is recovering following smoking bans introduced in mid-2000s.

Also, government budgets are not currently forecasting a decline in gaming revenues, highlights UBS.

INSURANCE AUSTRALIA GROUP LIMITED ((IAG)) was upgraded to Neutral from Sell by UBS. B/H/S: 3/3/0

While UBS has previously voiced concerns around claims inflation weighing on earnings for Insurance Australia Group, the broker feels repricing action, which started slowly through 2022, could support optimism around margins if pace continues for another twelve months.

The broker sees possibility that Insurance Australia Group could exceed its mid-term margin guidance in FY25 amid ongoing repricing and rising yields.

UBS anticipates insurance will remain an attractive sector for investors into 2024. The rating is upgraded to Neutral from Sell and the target price increases to $6.00 from $5.10.

REGIS HEALTHCARE LIMITED ((REG)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 2/0/0

The government has announced a $2.2b increase to sector funding from December 1.

In a sector that has become conditioned to negative funding surprises, this is a material positive, Ord Minnett suggests, and is expected to support operators funding Fair Work’s 5.75% increase in annual award wage decision.

With upside to consensus near-term, operating conditions remaining supportive and positive catalysts looming, the broker upgrades Regis Healthcare to Buy from Accumulate and lifts its target to $3.50 from $3.10.

UNIVERSAL STORE HOLDINGS LIMITED ((UNI)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/1/0

With several indicators of a strong Black Friday sales period for Universal Store, Citi has upgraded its rating on the retailer. The broker does note risk that Christmas and Boxing Day shopping may have been pulled forward, it feels potential downside is relatively subdued.

The broker’s data suggested improvement in both foot traffic and sales across Australian clothing retailers during the recent Black Friday sales, relative to the preceding weeks.

The rating is upgraded to Buy from Neutral, and the target price increases to $3.93 from $3.70.

IN THE NOT-SO-GOOD BOOKS – downgrades

MACQUARIE GROUP LIMITED ((MQG)) was downgraded to Neutral from Buy by UBS. B/H/S: 2/3/0

While Macquarie Group’s commodities and global markets business has been an outsized contributor for the company in recent years, contributing 48% to profits as of the first half of FY24, UBS is anticipating the super cycle could be at an end based on peer analysis.

Given implied commodity forecasts, UBS has lowered its expected commodity revenues -7%, -16% and -19% through to FY26. This sees group earnings per share forecasts decrease -1.5% over the same period.

The rating is downgraded to Neutral from Buy and the target price decreases to $180.00 from $185.00.

NEUREN PHARMACEUTICALS LIMITED ((NEU)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 0/1/0

The first of Neuren Pharmaceuticals’ four Phase 2 trials for NNZ-2591 is expected to read out over the next two to three weeks, with readout for the remaining three expected over the coming twelve months.

This is a key milestone, points out Bell Potter, being the first time there have been clinical data for patients using NNZ-2591. The broker believes it is likely the safety and pharmacokinetics (PK) endpoints will be successful.

The rating is downgraded to Hold from Buy and the target price of $17.50 is retained.

SANTOS LIMITED ((STO)) was downgraded to Equal weight from Overweight by Morgan Stanley. B/H/S: 4/2/0

In a review of Australian upstream energy stocks under coverage, Morgan Stanley has a new order of preference led by Karoon Energy ((KAR)), Woodside Energy ((WDS)) and Origin Energy ((ORG)).

While large-cap upstream stocks had material downward consensus revisions following November market updates, the broker feels local headwinds are now sufficiently priced in. An Attractive industry view is retained, and Brent forecasts remain steady.

Regarding Santos, the broker’s rating is downgraded to Equal weight from Overweight and the target falls to $7.71 from $8.88, based on reduced balance sheet flexibility, and higher environmental planning litigation risk relative to peers.

The lower valuation is also partly due to lower guidance provided at the company’s Investor Day presentation on November 22, along with updated commodity and currency assumptions by Morgan Stanley.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.