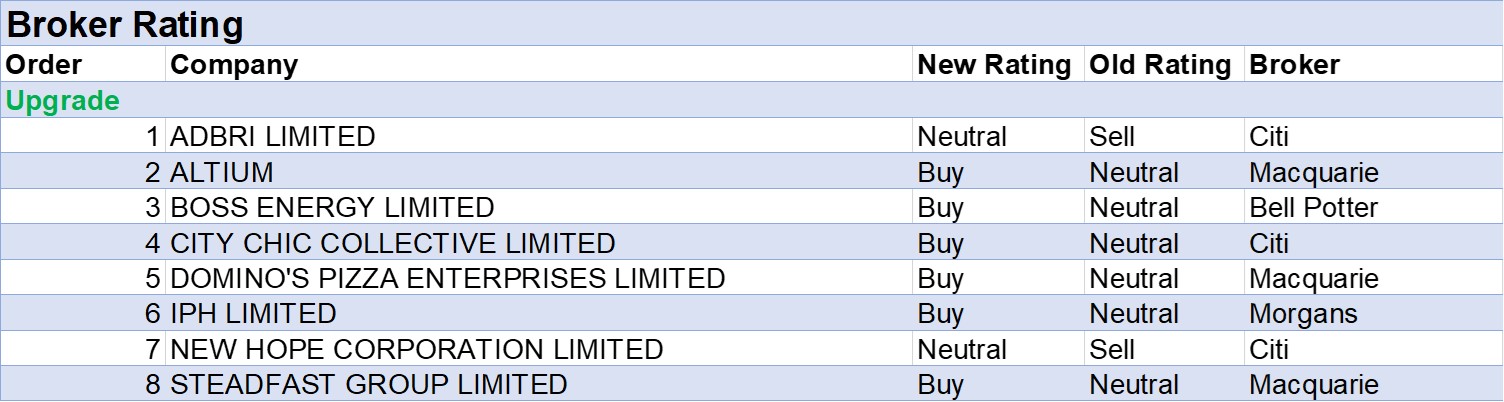

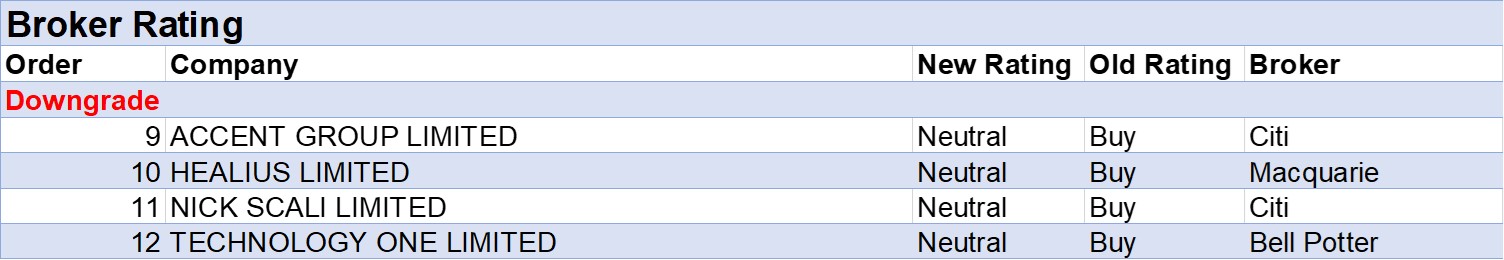

For the week ending Friday November 24 there were eight ratings upgrades and four downgrades to ASX-listed companies by brokers covered daily by FNArena.

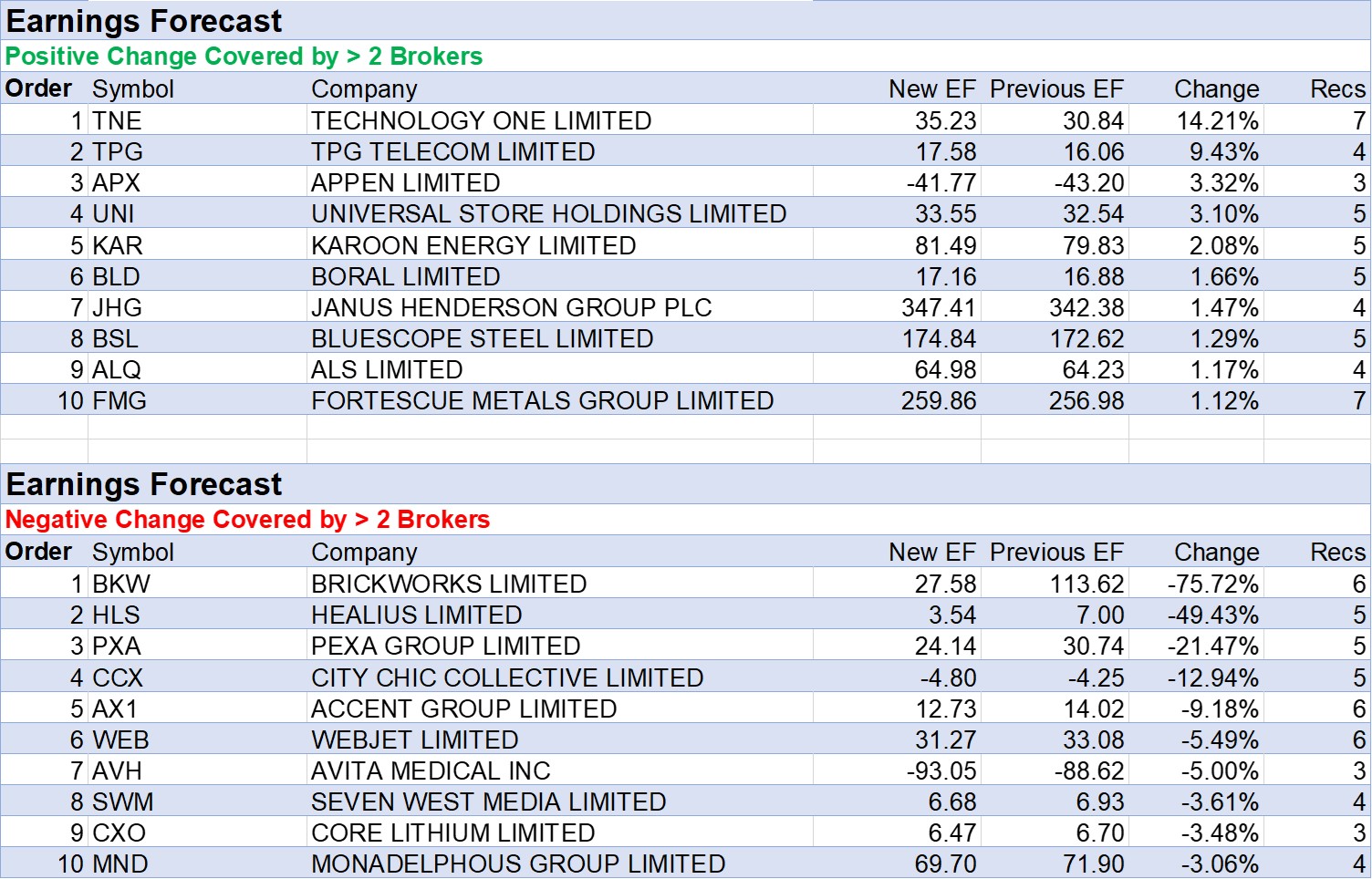

As has been the trend over the last few months, the percentage changes for downgrades were greater than for upgrades to average earnings forecasts.

Brickworks received the largest of these earnings downgrades after a first quarter trading update.

Morgans suggested management’s outlook commentary was arguably the weakest among building product peers and maintained a Hold recommendation. A share price closer to $20 (currently $25.14) would likely prompt a rating upgrade to Add by the broker.

While first quarter Building Product earnings beat the previous corresponding period, the company pointed to a softening outlook for Building Products broadly in line with prior guidance.

Management also anticipated a -10% valuation decline in the Property division for the first half of FY24 due to economic volatility and limited industry transactions.

Bell Potter felt this would be the final devaluation for Brickworks, while peers still have some way to go.

Healius also received forecast earnings downgrades after announcing an equity raise of $187m via an underwritten institutional and retail entitlement offer at $1.20 per share. Capital raised will mostly be applied against debt.

Morgans believed the company had been pressured by its lending syndicate to raise this capital at a steep discount to the currently depressed share price.

This broker also noted a softer-than-expected earnings outlook by management, and was uncertain on the earnings trajectory for the business.

Macquarie agreed on an uncertain near-term outlook, and, despite a favourable longer-term outlook and improved balance sheet position, downgraded its rating to Neutral from Outperform.

Ord Minnett recommended investors participate in the equity raising, and highlighted the takeover offer by Australian Clinical Labs for Healius does not extend to new shares issued by Healius.

Pexa Group was next on the earnings downgrade table below. Last week’s investor day produced a positive, in Morgan Stanley’s view, in the form of reaffirmed FY24 guidance, though management commentary on the sustainability of recent growth in Australian property transfers was more cautious than expected.

Additionally, there was still no commitment on what the broker considers the key investment debate: when do Pexa UK’s earnings losses peak and then turnaround?

While Morgans lowered its FY24 earnings forecast for Pexa Group to align with managements increased spending intentions, the broker approved of the announced cost-out plan, which aims to cut the group’s global workforce by -12%.

In another positive, according to the analyst, management announced Pexa UK company is dealing with two of the top 10 banks on a product launch scheduled for mid-2024.

TechnologyOne received the largest percentage upgrade to average forecast earnings in the FNArena database, following the release of FY23 results last week.

After reviewing a 3% beat against consensus earnings and profit forecasts in FY23, Morgan Stanley suggested the current share price premium of around 20% to global ERP peers and the company’s long-run average was justified.

Ord Minnett disagreed and stayed with a Lighten recommendation. Nonetheless, the analyst was impressed by the company’s world-leading rate of customer retention while transitioning to a SaaS business model.

Management pulled forward its $500m annual recurring revenue target to FY25 and reiterated this target would double in size every five years, due to stronger-than-expected customer adoption and a robust sales pipeline, explained Morgan Stanley.

Appen received the largest percentage increase in average target price. But the sole reason was Macquarie (target $1.02) ceasing research coverage, which raised the average target to $1.66 from $1.50.

More positively, management advised October was its strongest revenue month this year and anticipates ongoing improvement for the remainder of the year.

In the good books

Upgrades

ADBRI LIMITED ((ABC)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/3/1

Following a sustained period of underperformance, Citi is lifting its rating on Adbri. The broker continues to expect softer residential volumes, it points out industry pricing appears incrementally more positive.

The rating is upgraded to Neutral from Sell and the target price of $2.25 is retained.

ALTIUM ((ALU)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 2/4/0

Altium’s investor day provided Macquarie with early signs the new strategy is resonating with both existing and new customers. These customers represent an expansion into a different engineering domain at the same customer, and in some cases, new customers in new areas of the value chain.

New deal wins at large customers will drive future results, the broker suggests. Moreover, the rollout strategy is to land at large customers, then grow wallet share.

Macquarie has upgraded its earnings forecasts and increased its target to $49.70 from $39.10. Upgrade to Outperform from Neutral.

BOSS ENERGY LIMITED ((BOE)) was upgraded to Buy from Hold by Bell Potter .B/H/S: 1/1/1

With Boss Energy pulling back from the highs of October, Bell Potter has taken the opportunity to lift its rating on the stock with the share price tumbling -13%, and the broker points out opportunity to buy the dip.

The broker sees a number of positive catalysts coming through for Boss Energy, including the signing of an offtake agreement ahead of production, commencement of production, and further momentum in uranium markets.

The rating is upgraded to Buy from Hold and the target price of $5.53 is retained.

CITY CHIC COLLECTIVE LIMITED ((CCX)) was upgraded to Buy, High Risk from Neutral, High Risk by Citi .B/H/S: 2/3/0

Citi upgrades its rating for City Chic Collective to Buy, High Risk from Neutral, High Risk, and increases its target to 62c from 55c, in the belief additional cost savings and lower marketing will offset lower sales forecasts.

An AGM trading update demonstrated to the broker progress on the strategy to make the business sustainable on a lower sales base.

Management found an additional -$3m in annualised cost savings in head office wages and by optimising labour in stores. Inventory levels are also on the improve, and the broker expects higher margins and reduced working capital.

Management continues to expect profitability in the 2H, but Citi cautions whether there can be a return to full-price sales given extended clearance activities.

DOMINO’S PIZZA ENTERPRISES LIMITED ((DMP)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 5/0/1

Macquarie anticipates margin improvement for franchisees of Domino’s Pizza Enterprises from the addition of higher margin menu products.

An improvement in the overall growth outlook is expected as store openings depend on store-level profitability, explains the analyst. Hence, the rating is upgraded to Outperform from Neutral. It’s also felt cost-of-goods-sold (COGS) pressures have peaked.

In addition, commentary from offshore competitors indicates to Macquarie fast food customer demand remains, despite rising cost of living pressures.

The target rises to $58 from $54 due to an improved earnings outlook for both A&NZ and Europe.

IPH LIMITED ((IPH)) was upgraded to Add from Hold by Morgans .B/H/S: 4/0/0

Should additional signs emerge of organic growth, Morgans sees upside risk for shares of IPH. Given the recent de-rating of shares, the rating is upgraded to Add from Hold, though any meaningful Australian dollar upside would present a headwind.

Another bolt-on Canadian acquisition for -$124m was announced, and management will now focus on bedding down the three recent Canadian purchases.

While the broker makes EPS upgrades for the acquisition, a lower assumed multiple and higher risk-free rate result in an $8.15 target, down from $8.90.

NEW HOPE CORPORATION LIMITED ((NHC)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/3/1

A big first quarter for New Hope, with the company delivering its first mined coal at New Acland Stage 3. The company mined 0.2m tonnes at the site over the quarter, producing 0.06m tonnes of saleable coal.

Company-wide, New Hope produced 2m tonnes of saleable coal over the period, up 26% year-on-year, while total coal sold of 1.8m tonnes was down -3% year-on-year.

With the share price retreating -19% from October highs, the rating is upgraded to Neutral from Sell and the target price of $5.20 is retained.

STEADFAST GROUP LIMITED ((SDF)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 3/1/0

Steadfast Group has raised $280m at $5.14 in an institutional placement with a further $30m in an SPP over the coming months, which clears capital-raise risk, Macquarie notes.

Steadfast has acquired Sure Underwriting Agency which the broker believes is a good asset with solid underwriting capacity, exceptional management and optionality nationally, internationally and in strata risks.

Macquarie does not believe the premium rate cycle in Australia is done yet, expecting it will hold at 14-15% for SME clients for the coming 12 months. Upgrade to Outperform from Neutral. Target falls to $5.90 from $6.40 on dilution.

In the not so good books

Downgrades

ACCENT GROUP LIMITED ((AX1)) was downgraded to Neutral from Buy by Citi .B/H/S: 3/2/1

Following a review of the trading update provided by Accent Group for the first 19 weeks of FY24, Citi was disappointed by softer-than-anticipated gross margins and cost-of-doing-business (CODB) pressure.

Lower gross margins and a higher CODB offsets the rollout of more stores in the broker’s forecasts, and the target falls by -9% to$1.93. Store rollout guidance was increased to 70 new stores in the 1H, up from at least 50 in FY24.

Citi’s rating for Accent Group is downgraded to Neutral from Buy.

HEALIUS LIMITED ((HLS)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 1/3/1

Healius is raising $187m to reduce net debt. First half earnings guidance was well below Macquarie’s expectations, suggesting strong improvement in the second half is required to meet FY24 guidance.

The broker has cut earnings per share forecasts to reflect the raising and weaker guidance. Target falls to $1.95 from $2.90.

Despite a favourable longer-term outlook and improved balance sheet position, the nearer-term outlook remains uncertain, Macquarie suggests. Downgrade to Neutral from Outperform.

NICK SCALI LIMITED ((NCK)) was downgraded to Neutral from Buy by Citi .B/H/S: 1/1/0

It is Citi’s view that the unexpected sale of 42% of Nick Scali’s major shareholder stake has created uncertainty, leaving the broker to downgrade on the stock. The broker feels it is prudent to wait until the first half results release before considering a more positive outlook.

Citi does point out Nick Scali’s fundamentals, including key housing indicators and long duration roll out opportunities, remain positive.

The rating is downgraded to Neutral from Buy and the target price decreases to $11.57 from $13.35.

TECHNOLOGY ONE LIMITED ((TNE)) was downgraded to Hold from Buy by Bell Potter .B/H/S: 0/6/0

TechnologyOne’s FY23 result fell -2% shy of Bell Potter’s forecast but was above guidance, the broker sheeting the miss back to -$2m in due diligence costs on an acquisition that did not go ahead. The dividend outpaced. No guidance was provided.

The company sharply outpaced on cash flow, with cash flow generation landing at 102% of net profit after tax, but higher expenses took the shine off as the company pulled them forward given the strength of the result.

EPS forecasts fall -2% to -3% due to cuts to margin forecasts (although revenue forecasts rise).

Rating is downgraded to Hold from Buy on valuation. Target price falls -3% to $17.25 from $17.75 due to a rise in the risk-free rate.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.