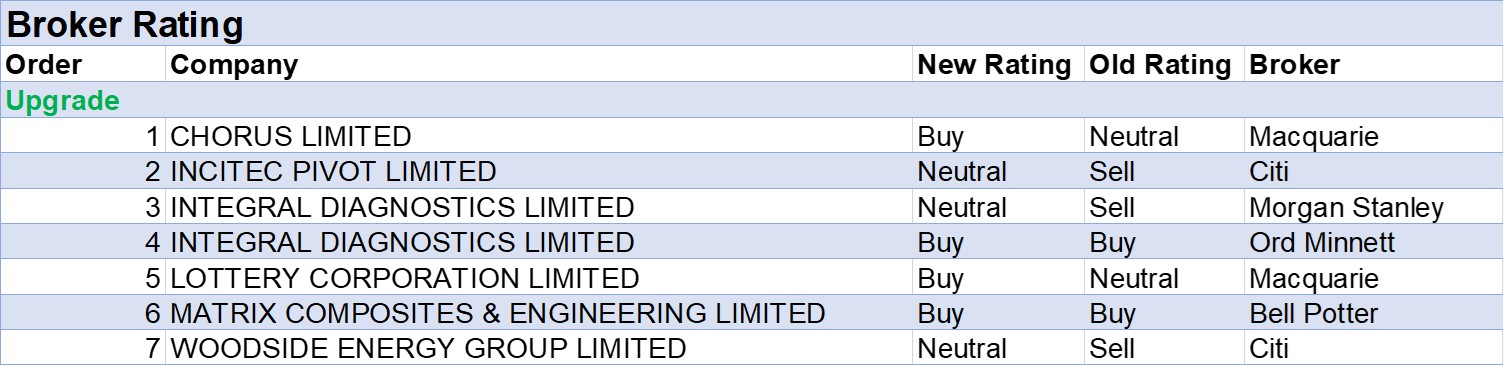

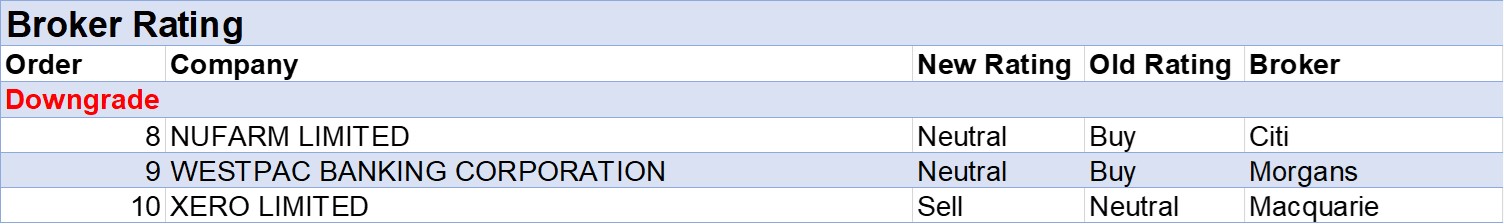

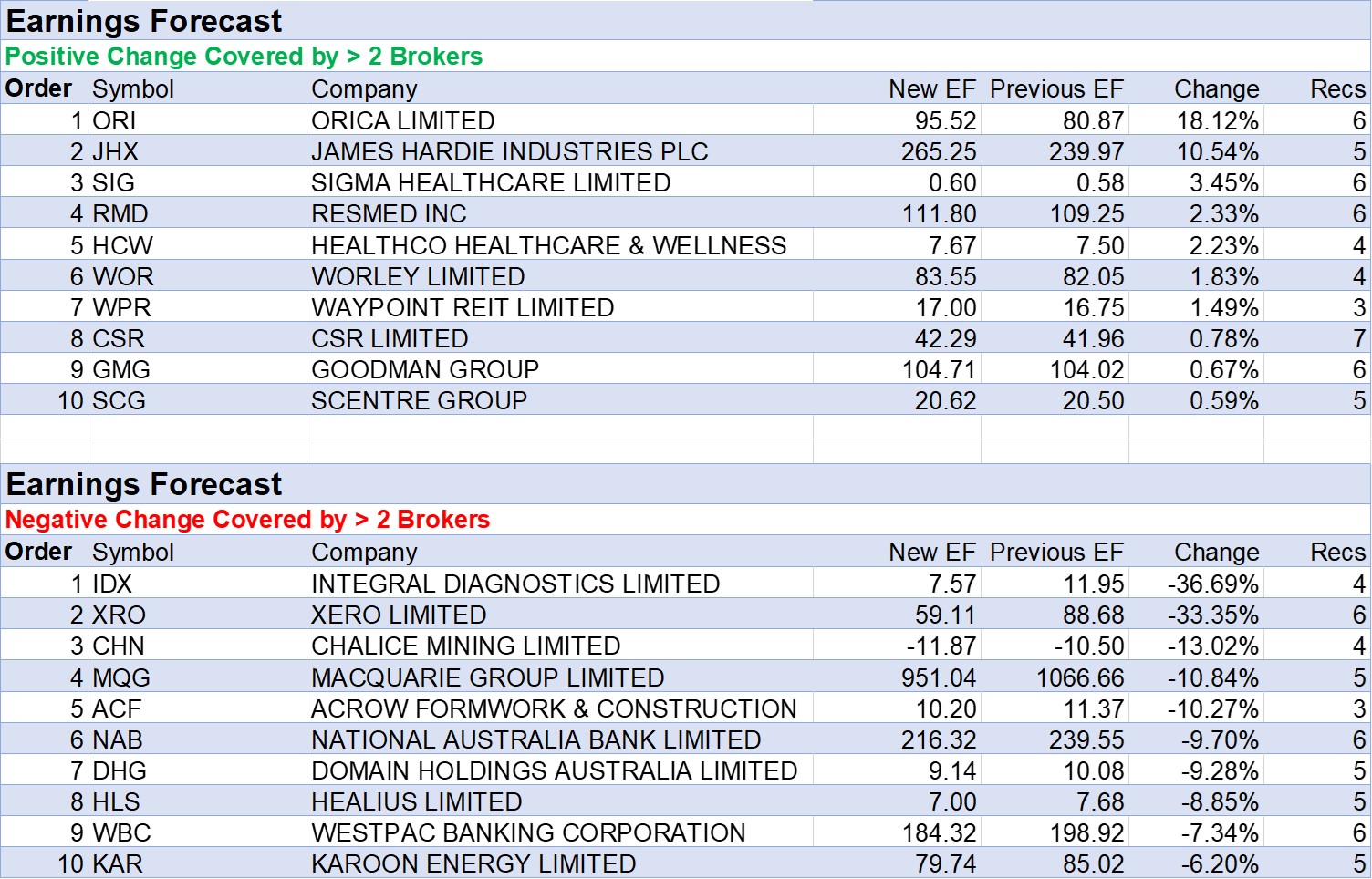

For the week ending Friday November 10 there were seven ratings upgrades and three downgrades to ASX-listed companies by brokers covered daily by FNArena, yet the size of average earnings forecast downgrades was far greater than upgrades for the third week in a row.

Brokers were disappointed by first quarter results for Integral Diagnostics, which resulted in a steep share price fall, as staff shortages and cost inflation continue to pressure margins.

Ord Minnett felt a more comprehensive cost-out program could help in the near-term and upgraded its rating to Buy from Accumulate, and suggested the share price decline was overdone. Morgan Stanley also upgraded to Equal weight from Underweight on valuation given the share price had declined by around -39% since July.

While Morgan Stanley noted cost pressures are currently outweighing rising indexation and the near-term outlook is hard to predict, a margin recovery will eventually arrive.

After four brokers refreshed research on Integral, the company appeared atop the tables below for the largest percentage fall in both average target price (-30%) and average earnings forecast (-37%).

Neutral rated Citi lowered its target by the greatest percentage to $1.90 from $3.40 after allowing for lower margins and after assuming a weighted average cost of capital (WACC) of 9.2%, up from 8.4%, due to the higher interest rate environment.

Xero was second on the earnings downgrade table. A softer than expected first half result, attributed to subscriber growth, left Macquarie cautious on the company’s average revenue per unit (ARPU) growth strategy pivot. A&NZ and International subscription growth slowed by -7% and -11%, respectively, compared to the second half of FY23.

The analyst felt future revenue growth is a concern, given peer discounting and headwinds to subscriber growth, and downgraded the company’s rating to Underperform from Neutral.

More positively, Buy rated UBS noted “earnings-capex” and free cash flow (FCF) significantly outperformed expectations due to lower R&D intensity, and felt the share price sell-off in reaction to first half results was overdone. Morgan Stanley also highlighted the strong FCF of NZ$106.7m, which lifts the Rule of 40 metric to 34% from 32%. The analyst’s review of the US business also revealed a focused growth opportunity with a measured cost base.

Macquarie Group was high on the table. First half cash earnings for Macquarie came in -20% adrift of the consensus forecast and -12% shy of Citi’s estimate. A positive share price reaction surprised the broker, though suggested the market was allowing for a miss against expectations.

A Neutral recommendation was retained with the analyst highlighting the company’s material surplus capital, the announced buyback and the probability of normalisation for asset realisations from the currently weak environment.

In a disappointing performance, according to UBS, the asset management business contributed profits before tax of $407m, down -57% half-on-half and -71% lower year-on-year. The broker lowered its target to $185 from $196 and suggested disappointing results may persist as higher inflation and the interest rate back drop continue to present challenges.

Turning to positive movements for average earnings forecasts by brokers, Orica had the best week from among stocks in the FNArena database with an 18% upgrade after a “strong” FY23 result, according to UBS, with earnings rising by 21% year-on-year.

This broker highlighted the FY23 operating performance was underpinned by recontracting pricing benefits, sustained mining demand and an uplift in technology adoption, all achieved in a period of global macroeconomic volatility, adverse weather and manufacturing down-time.

Compared to the previous corresponding period, earnings (EBIT) for APAC, EMEA, North America and Latin America grew by 24%, 24%, 11% and 1%, respectively. Digital Solutions earnings also grew by 103% to $54.3m and was a standout, in Morgan Stanley’s view. It’s felt management will continue to deliver solid, relatively certain earnings growth over the next two-to-three years.

While currently Hold-rated on Orica, Morgans would be a buyer of the stock on any material share price weakness.

Average broker earnings forecasts also rose by just over 10% for James Hardie Industries in the database last week following a “robust” second quarter performance, according to Ord Minnett.

While this broker is now more confident of near-term outperformance relative to competitors, FY24 is still expected to be a soft year for US housing construction. Sales in North America, which account for around 75% of group sales, fell by -2% in the second quarter compared to the previous corresponding quarter, with a 2% price increase overwhelmed by a -5% volume decline, explained the analyst.

According to Morgan Stanley, third quarter guidance by management, indicating a stronger volume outlook and likely higher margins, trumped a “solid” in-line second quarter performance. It’s felt strong margins will be maintained for some time.

In the good books: upgrades

1. CHORUS LIMITED ((CNU)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 1/1/1

Chorus has submitted its price-quality proposal to the Commerce Commission for the regulatory period spanning January 2025 through December 2028. Macquarie notes the company proposed total capital expenditure of -$1.5bn and operating expenditure of -$842m. The broker expects the final outcome, to be determined by the Commerce Commission, to wind up broadly in line with its current assumptions and forecasts for the period. The rating is upgraded to Outperform from Neutral, reflecting the recent -11% share price tumble, and the target price decreases to NZ$8.32 from NZ$8.95.

2. INTEGRAL DIAGNOSTICS LIMITED ((IDX)) was upgraded to Equal weight from Underweight by Morgan Stanley and to Buy from Accumulate by Ord Minnett. B/H/S: 2/2/0

In reaction to 1Q results, the stock price for Integral Diagnostics fell sharply and Morgan Stanley now upgrades its rating to Equal weight from Underweight on valuation. Since July, shares have declined by around -39%. Staff shortages and cost inflation continue to pressure margins and were greater than the analysts anticipated. As a result, FY24-26 EPS forecasts are reduced by -40%, -34% and -32%, respectively, and the target is slashed to $1.95 from $2.75. Industry view: In-Line. While Morgan Stanley expects a margin recovery will arrive, cost pressures are currently outweighing rising indexation, and the near-term outlook is described as hard to predict. A disappointing first quarter update from Integral Diagnostics, says Ord Minnett, with the company unable to deliver improved operating leverage amid clinical staff shortages and cost inflation. Domestic revenue growth of 8.4% missed market expectations, as did weak earnings margins. The broker expects a more comprehensive cost-out program can help in the near-term and does consider the share price decline overdone. The rating is upgraded to Buy from Accumulate and the target price decreases to $2.50 from $3.35.

3. INCITEC PIVOT LIMITED ((IPL)) was upgraded to Neutral from Sell by Citi. B/H/S: 2/4/0

Incitec Pivot is scheduled for FY23 release on Monday, 13 November, and Citi analysts are positioned for underlying profit after tax of $534m, which is below the market consensus forecast. Higher assumed prices for ammonia have pushed up the broker’s forecasts for FY24. Target price is unchanged at $2.90 but following a weakening in share price, Citi’s rating is hereby upgraded to Neutral from Sell. Given ABARES is forecasting winter crop production to decline -34% with yield falling by -31% versus a year ago on below-average rainfall, Citi prefers to remain cautious.

4. MATRIX COMPOSITES & ENGINEERING LIMITED ((MCE)) was upgraded to Speculative Buy from Speculative Hold by Bell Potter. B/H/S: 1/0/0

In good news for Matrix Composites & Engineering, Bell Potter has reviewed recent quarterly reports by global services providers to the offshore energy sector, concluding order backlogs point to ongoing robust near-term demand for subsea infrastructure. Another medium-term earnings catalyst for the company is leverage to growing activity across the global offshore floating wind sector, explains the broker. Bell Potter upgrades its rating to Speculative Buy from Speculative Hold and lowers its target to 32c from 34c.

5. LOTTERY CORPORATION LIMITED ((TLC)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 4/2/0

Macquarie’s trackers suggest lottery prize pools are down -7% year-on-year in the first four months of the year, and jackpot volatility is impacting volumes. The broker has adjusted forecasts for Lottery Corp to reflect these year-to-date trends, now predicting 4% growth. With Lottery Corp underperforming the ASX100 by around -11% in the last three months, and having tumbled -15% on an absolute basis, Macquarie now sees the stock as more fairly valued. The rating is upgraded to Neutral from Outperform and the target price decreases to $4.95 from $5.35.

6. WOODSIDE ENERGY GROUP LIMITED ((WDS)) was upgraded to Neutral from Sell by Citi. B/H/S: 2/4/0

Citi upgrades its rating for Woodside Energy to Neutral from Sell after a recent share price retreat and potential for yield support, with 80% of profit being paid out as dividends. The broker does, however, caution investors over management’s past record around poor execution of major growth projects, a mixed track record on M&A and unsuccessful exploration efforts. The $32 target price is unchanged.

In the not so good books: downgrades

1. NUFARM LIMITED ((NUF)) was downgraded to Neutral from Buy by Citi. B/H/S: 4/3/0

Amid a string of downgrades from Nufarm’s global peers, Citi expects crop protection lag to remain a focus, particularly as drier conditions emerge in Australia Pacific. The broker also points out distributors remain focused on de-stocking given high levels of channel inventories. Citi does point out carinata and omega-3 represent meaningful upside potential for Nufarm, with demand levels supported by a number of structural tailwinds beyond the near-term. The rating is downgraded to Neutral from Buy and the target price decreases to $4.65 from $6.90.

2. WESTPAC BANKING CORPORATION ((WBC)) was downgraded to Hold from Add by Morgans. B/H/S: 1/4/1

Westpac’s -7% earnings decline (ex-notables) for FY23 was close to Morgans’ forecast. The broker also noted resilient asset quality and a strong capital position which allowed for an increased dividend and a new share buyback program. The net interest margin (NIM) declined by -2bps to 194bps due to greater competition, offset by the benefit of higher interest rates, explains the analyst. Given recent share price strength, the broker downgrades its rating to Hold from Add. The FY24-26 earnings forecasts fall by between -3-6% partly due to a lower assumed NIM and higher costs. The target falls to $21.58 from $21.61.

3. XERO LIMITED ((XRO)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 3/1/1

A softer than expected first half result from Xero, attributed to subscriber growth, has left Macquarie cautious on the company’s average revenue per unit growth strategy pivot. The broker noted the result demonstrated a marked shift in drivers, as the Australia & New Zealand business drove top-line growth, but Macquarie remains concerned about top-line growth looking forward given peer discounting and headwinds to subscriber growth. The rating is downgraded to Underperform from Neutral, and the target price decreases to $87.00 from $119.00.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.