Incitec Pivot received two ratings downgrades by separate brokers following the release of a trading update which revealed a tale of two businesses.

While explosives are on the improve, fertiliser remains challenging, noted Morgan Stanley. Management noted lower margins for the fertiliser distribution business and pointed to necessary maintenance at Phosphate Hill.

While management reiterated the fertiliser sale is still on the table, the broker remained sceptical given gas disruption at Phosphate Hill, sulphur supply uncertainty and the potential need for FIRB approval.

Morgan Stanley downgraded its rating to Equal weight from Overweight. Persistent gas issues imply downside risk to FY24 consensus estimates and are thought to make a fertiliser sale more difficult.

Citi also lowered its rating to Sell from Neutral after lowering its FY23 and FY24 earnings forecasts on caution over nitrogen pricing.

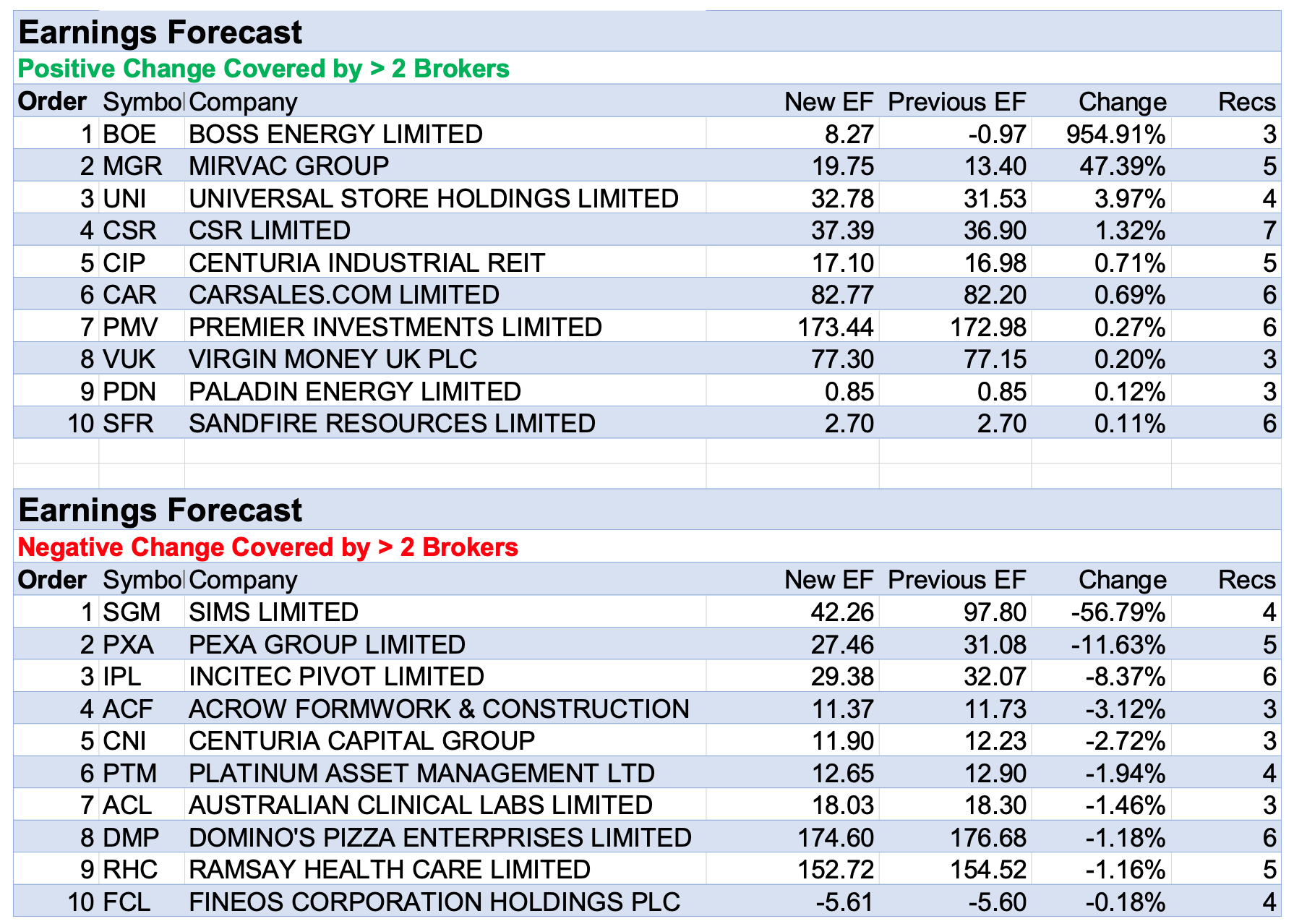

As may be seen in the table below, Incitec Pivot also received the third largest average earnings forecast downgrade by brokers.

Sims headed up that table and also suffered the greatest percentage downgrade to average target price after management released a first quarter FY24 trading update.

Softening US markets, coupled with a high degree of operating leverage, have brought about the pressure Macquarie had expected to be evident in FY23 results. Given the A&NZ Metals’ performance is likely less affected, it’s thought the US businesses made a collective loss in the first quarter of the financial year.

The balance of risk remains to the downside, noted the broker, as economic conditions slow. UBS agreed and felt near-term softness is unlikely to be resolved without a recovery in US export scrap prices.

Citi lowered its FY24 earnings forecast by -41%, though upgraded its rating to Neutral from Sell after the company’s shares were sold down heavily in reaction to the trading update.

Longer term, the broker noted Sims should benefit from the steelmaking decarbonisation trend to electric arc furnace (EAF) away from blast oxygen furnace (BOF). In EAF, the main raw material is ferrous scrap, as opposed to iron ore and coal for BOF.

Pexa Group was next on the earnings downgrade table though only because Ord Minnett initiated coverage last week and lowered the average earnings forecast for the (now) five covering brokers in the FNArena database.

This broker kicked off with an Accumulate rating and was generally upbeat on the outlook. It’s felt the market is currently being too negative by attributing significant negative value around the company’s expansion into the UK. While the analysts expect success, a strategic withdrawal could be made “without spending too much of shareholder resources”.

In Australia, the broker noted the company has a natural monopoly with the backing of the country’s largest banks and a legal mandate from state governments to move into e-conveyancing.

On the flipside, Boss Energy received the largest boost to average earnings forecasts after the release of further results on its infill drilling program at Goulds Dam, a satellite deposit within 80kms of the central Honeymoon site.

As a result, Bell Potter reduced its risk discount by -10% for resources external to Honeymoon Restart Area (HRA). The broker also lowered its risk discount for Honeymoon by -5% as the company prepares for a restart in operations in the upcoming December quarter.

The average earnings forecast for Mirvac Group also increased last week after Ord Minnett updated its numbers nearly a month after FY23 results were released.

Despite a rally since October 2022, shares still screen as being substantially undervalued in the broker’s opinion. It’s felt slightly higher residential sales volumes (near and longer-term) will more than offset lower residential gross development margins.

As less-equipped rivals exit, Ord Minnett suggests Mirvac is one of few large developers capable of end-to-end design, construction and development in-house, and offers build-to-sell apartments and houses, land-lease and build-to-rent. It’s thought such flexibility helps navigate supply-chain, government policy and market challenges.

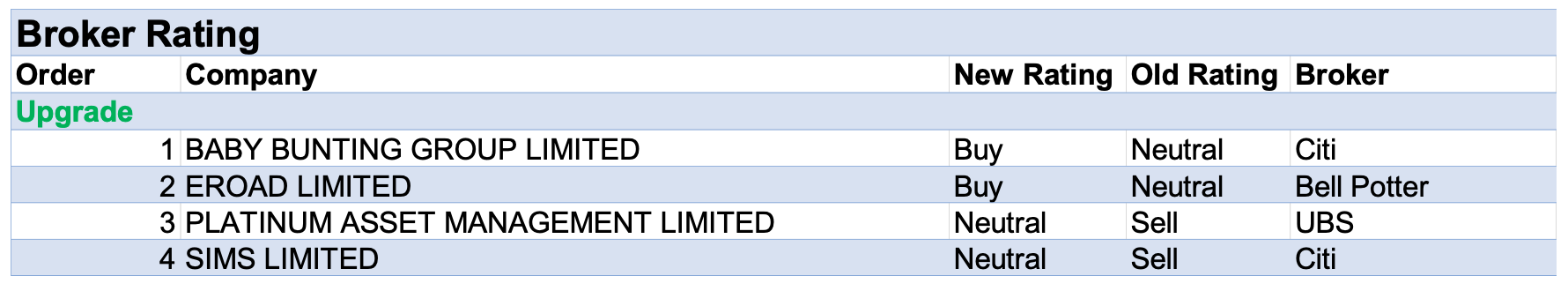

In the good books: upgrades

- BABY BUNTING GROUP LIMITED ((BBN)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/2/0

Citi upgrades to Buy from Neutral, assessing the -9% decline in the share price since the August results adequately reflects consumer uncertainty.

If the trading update at the AGM is ahead of expectations, the broker suspects it could be a catalyst to move the stock higher. Underpinning this is the expectation like-for-like sales will improve as comparables get easier to cycle.

With the new CEO commencing by the AGM, Citi anticipates a greater focus on supplier partnerships, cost optimisation and store refurbishment, which should be viewed positively, to the extent there is little pressure on the balance sheet. Target is $2.20.

- EROAD LIMITED ((ERD)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/0/0

Bell Potter updates Eroad’s forecasts to reflect the NZ$50m capital raising.

Net profit after tax estimates rise slightly to effect improved interest expense, but EPS forecasts fall into the red to reflect the dilution.

Bell Potter questions the wisdom of raising equity at such a heavy discount, particularly after rejecting a takeover offer at NZ$1.30 from Brillian APAC but is at least satisfied the balance sheet has been sufficiently supported to avoid further raisings.

Rating is upgraded to Buy from Hold given the retreat in the share price. Target price falls to 90c from $1.25.

- PLATINUM ASSET MANAGEMENT LIMITED ((PTM)) was upgraded to Neutral from Sell by UBS. B/H/S: 1/2/1

After the “worst FUM print in 11 years” Platinum Asset Management declined -14% as flow expectations were re-based and, while this outcome is considered fair, UBS believes the market has overlooked some key factors.

These include the new CEO, who may consider resetting a failing strategy, and shareholder activism pushing for capital returns.

UBS expects further pressure will be applied with respect to capital management, noting the company has never executed on its “evergreen” buyback.

These potential positive catalysts inspire the broker to upgrade to Neutral from Sell. Target is reduced to $1.25 from $1.50.

- SIMS LIMITED ((SGM)) was upgraded to Neutral from Sell by Citi. B/H/S: 0/3/1

Citi was quick in responding to Sims’ implicit profit warning yesterday, but one day later and the broker is now of the view that an upgrade to Neutral from Buy seems appropriate, given the sell-off that occurred yesterday.

Citi’s FY24 EBIT forecast has been downgraded by no less than -41%. The broker’s price target falls to $14.30 from $15.

The broker is of the view there should be slight improvement on the horizon come FY25. Also, the company is webcasting its USA Investor Day this week.

Citi analysts are hoping there might be greater clarity on market conditions following the webcast.

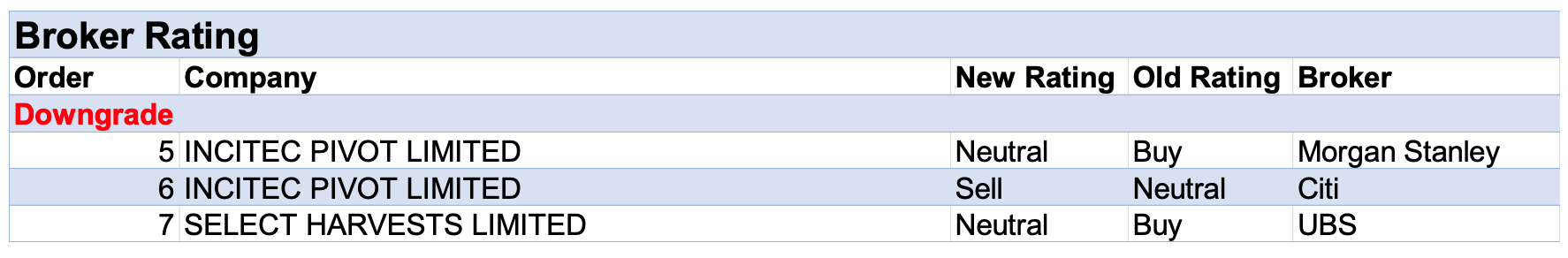

In the not so good books: downgrades

- INCITEC PIVOT LIMITED ((IPL)) was downgraded to Equal weight from Overweight by Morgan Stanley and to Sell from Neutral by Citi. B/H/S: 2/3/1

Broadly consistent with expectations, Incitec Pivot revealed explosives are improving while fertiliser remains challenging. Morgan Stanley assesses persistent gas supply issues imply downside risk to FY24 estimates, also making a sale of the fertiliser business more difficult.

Distribution earnings are now expected to be at the lower end of the $40-60m guidance range for fertilisers. The company has also disclosed a -$13-50m negative impact to FY23 EBIT related to sulphuric acid supply.

Morgan Stanley believes the gas supply issues in the fertiliser business are key risk to earnings and downgrades to Equal weight from Overweight. Target is lowered to $3.29 from $3.65. Industry view: In-Line.

Incitec Pivot has flagged lower margins in its fertiliser distribution business as well as the necessary maintenance at Phosphate Hill. Citi remains cautious about nitrogen pricing into 2024 and reduces estimates for both FY23 and FY24 earnings.

Waggaman is expected to achieve nameplate capacity in FY23 and at Moranbah production of 360-370,000t is anticipated. Yet earnings in the fertiliser distribution business are expected to be at the lower end of the usual $40-60m range.

Citi downgrades to Sell from Neutral and reduces the target to $2.90 from $3.00.

- SELECT HARVESTS LIMITED ((SHV)) was downgraded to Neutral from Buy by UBS. B/H/S: 1/1/0

UBS reassesses its view on Select Harvests pushing out a recovery in the almond price and downgrading to Neutral from Buy.

The company has reduced its FY23 almond price estimate to $6.30-6.50/kg from $7.45/kg, although this is largely offset by better volumes and ends up driving a -6% reduction to the broker’s EBIT estimates.

The broker now believes a return to the long-run almond price by FY24 is too optimistic based on recent industry feedback that signals the Californian industry oversupply may persist for longer. Target is reduced to $4.70 from $5.50.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.