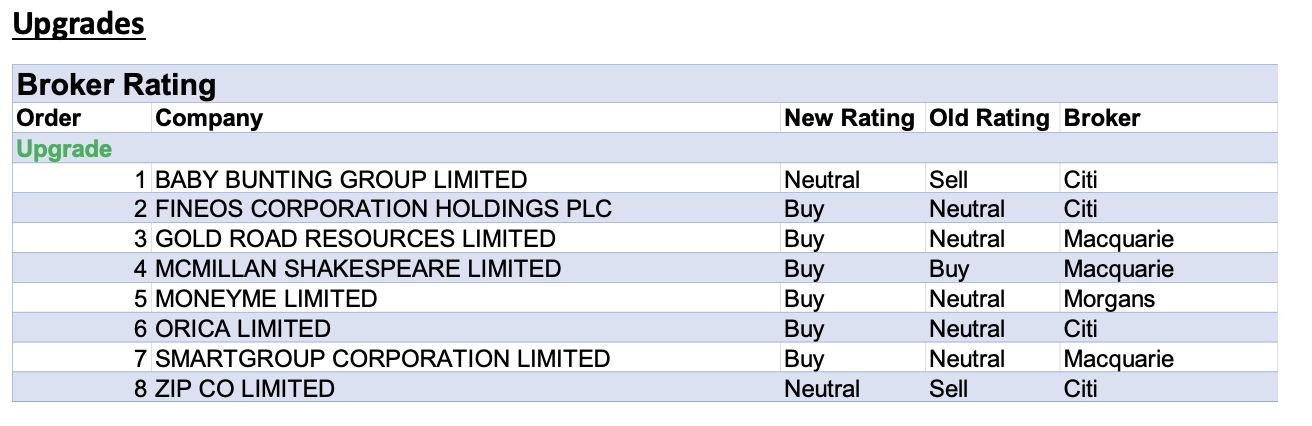

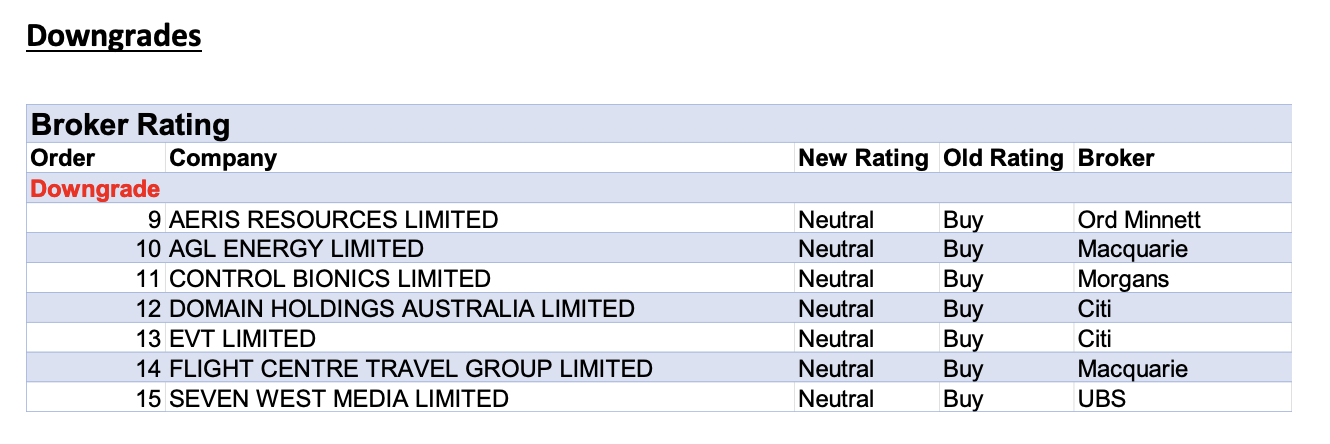

For the week ending Friday August 4 there were eight ratings upgrades and seven downgrades to ASX-listed companies by brokers covered daily by FNArena.

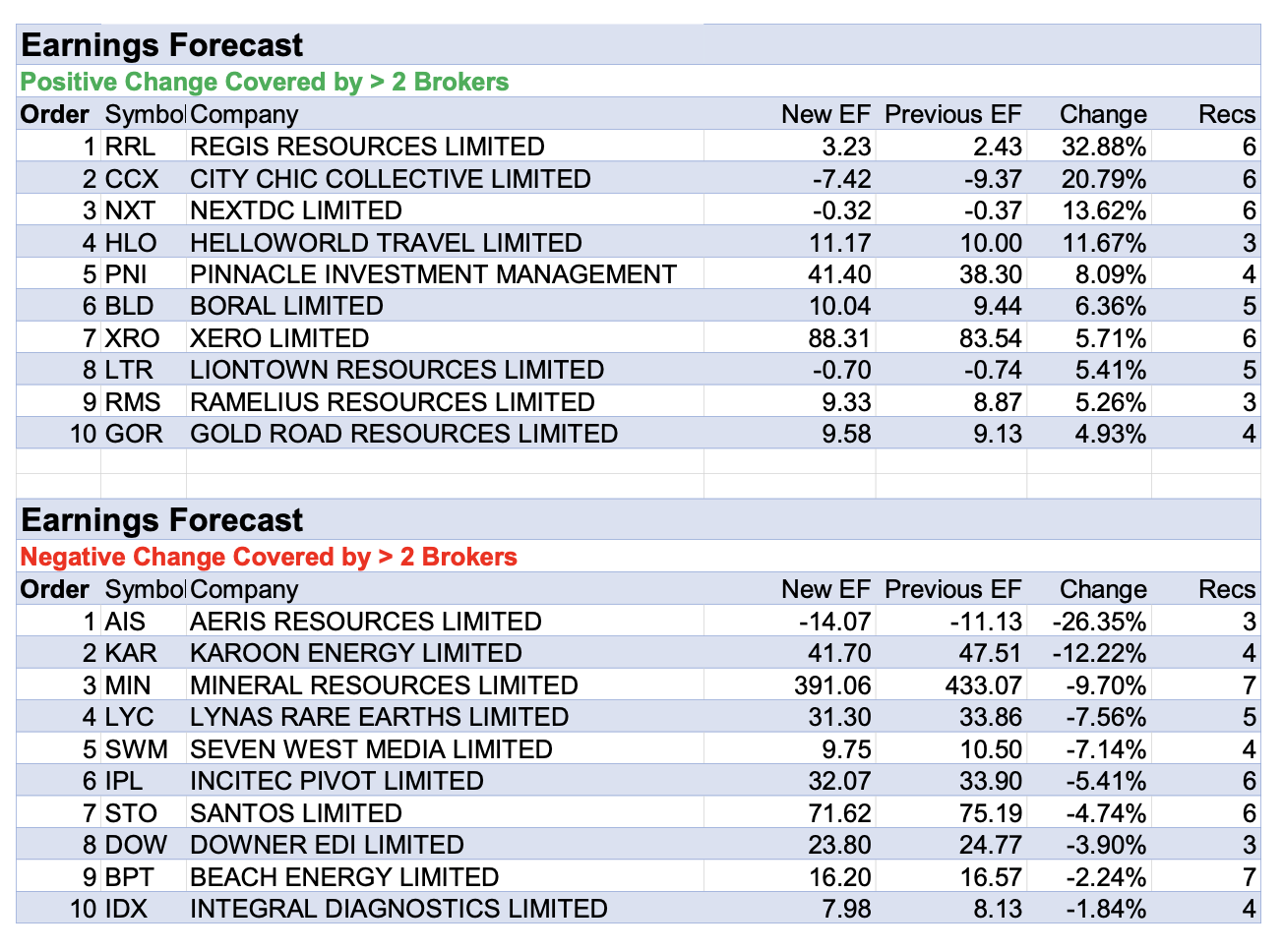

In a reversal of the general trend, percentage upgrades to earnings forecasts were greater than for downgrades, while for the second week in a row Resource sector companies were prevalent among the top ten placings in the earnings downgrade table below.

The average earnings forecast for Aeris Resources fell by -26% last week after brokers were disappointed by fourth quarter results and FY24 guidance.

The company is a mid-tier base and precious metals producer, with copper dominating the portfolio.

FY24 guidance was lower than Macquarie’s previous estimate, largely due to the company’s zinc, copper and silver operations at the Jaguar mine in WA being placed on care & maintenance.

The broker halved its 12-month target price to 30c and maintained its Outperform rating, while Ord Minnett downgraded its rating to Hold from Buy and reduced its target to 27c from 74c, though could still see longer-term value appeal and green shoots at the long-life Tritton copper mine in NSW.

Given lower production, costs associated with the closure and a higher-than-expected forecast capital spend, management has entered into an onerous debt package, suggests Ord Minnett, with 30%-shareholder WH Soul Pattinson.

Karoon Energy received the next largest downgrade to its average earnings forecast by brokers after fourth quarter production fell by -15%. Sales revenue and volumes were a touch below Ord Minnett’s expectations.

Revenue was a -4% miss against the consensus forecast, while a small miss on realised price was considered by Morgans more timing-driven on cargoes.

On the flipside, Regis Resources received the largest (33%) increase to average earnings forecast.

Following the release of June quarter production and FY24 guidance, Citi raised FY23 forecasts though lowered those for FY24, while Morgans downgraded its rating to Hold from Add on valuation.

June quarter production was pre-released and all-in sustaining costs (AISC) were flat quarter-on-quarter. Costs rose at the Duketon Gold Project in WA, while Tropicana’s (also WA) costs improved by 14%, beating forecasts by Citi and consensus.

Management suggested increasing costs will likely see operations at Duketon North suspended at the end of FY24.

Citi’s Sell rating for Regis was unchanged and its target fell to $1.50 from $1.75 on a higher capex forecast and after assuming higher costs persist following disappointing FY24 cost guidance.

Earnings forecasts for data centre operator NextDC rose after Citi performed a review of the Technology/Internet sector prior to this month’s reporting season.

The analysts like the company, which runs 11 data centres around Australia, for its defensive exposure and inflation-linked price-escalators.

Ord Minnett also increased its forecasts for Helloworld Travel after management increased FY23 earnings guidance, which provided further validation to the broker’s core thesis for the sector: households are spending an increasing percentage of their gross disposable income on holidays and such expenditure has historically behaved as a non-discretionary item in Australia.

Fineos Corp received the largest percentage increase (20%) to average target price for stocks covered daily by FNArena and was also included in above-mentioned report by Citi.

Fineos is increasing its contract wins and the broker felt the recent Guardian Life contract will be key to unlocking further Policy & Billing contracts

Smartgroup Corp was next after Macquarie noted the impact of the fringe benefits tax (FBT) exemption on demand for electric vehicles, funded via novated lease, had materially exceeded its expectations.

EVs represented more than 20% of Smartgroup’s quotes in the March quarter and the analyst estimated yields per vehicle could be 20% higher compared to yields for internal combustion engine (ICE) vehicles.

This broker anticipated ongoing upside risk to earnings and allowed for 25% volume growth in the second half of 2023 and 33% in 2024. The rating was upgraded to Outperform from Neutral and the target raised to $10 from $5.90.

The average target price for SiteMinder was also increased by brokers to $5.16 from $4.68 following disclosure of buoyant FY23 trading and an upbeat FY24 outlook.

UBS downgraded its rating for Seven West Media to Neutral from Buy and slashed its target to 41c from 60c after conducting a review of the Australian media sector.

Weakness in the sector around advertising markets will persist for the next six months given recently weak consumer and business confidence data, and the broker noted Seven West will likely fare worst.

The company is experiencing falling revenue in key TV markets, mainly in metropolitan free-to-air. Largely because of this slippage, UBS lowered its long-term earnings margin assumption for Seven West to 12% from 15%.

In the good books

BABY BUNTING GROUP LIMITED ((BBN)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/5/0

FY23 net profit of $10.2m was broadly in line with Citi’s estimates. Sales were better-than-expected, partially offset by weaker gross margins. The broker notes while sales trends have improved since early June they remained negative in the final three weeks of FY23, and in July.

Citi finds limited information regarding Baby Bunting’s strategy and so lacks confidence that sales are on track to turn sustainably positive over the short term.

Rating is upgraded to Neutral from Sell while the Target is raised to $1.65 from $1.10 to reflect earnings changes and higher market and peer multiples.

FINEOS CORPORATION HOLDINGS PLC ((FCL)) was upgraded to Buy from Neutral by Citi .B/H/S: 3/1/0

In a sector preview to the upcoming August reporting season in Australia, Citi analysts have upgraded Fineos Corp to Buy from Hold.

While the analysts feel more confident about the growth path ahead, they also still think Fineos needs additional capital and have now assumed an equity raise in 1H24.

Price target lifts to $2.95 (we had $1.39 up until now).

GOLD ROAD RESOURCES LIMITED ((GOR)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 4/0/0

June quarter production from Gold Road Resources was 3% ahead of Macquarie’s estimates, at 76,100 ounces.

While operating rates of production drills and the availability of blasting resources have been below the mine plan, and adverse weather has weighed on material movements, the company has not lifted AISC guidance for 2023.

AISC is now expected to be at the upper end of the $1540-1660/oz guidance range. Macquarie upgrades to Outperform from Neutral and retains a $1.90 target.

MONEYME LIMITED ((MME)) was upgraded to Speculative Buy from Hold by Morgans .B/H/S: 1/0/0

As a gap has opened up between Morgans target of 28c and the current share price of MoneyMe, the broker’s rating is upgraded to Speculative Buy from Hold.

A 4Q trading update highlighted to the analyst management’s ongoing focus to maintain profitability and temper book growth given the current macro environment. The credit quality of the book has continued to improve, with net losses down on the sequential quarter.

Minimal changes are made to the broker’s forecasts, yet the target falls to 28c from 33c after applying a lower multiple due to a sector/peer de-rating.

MCMILLAN SHAKESPEARE LIMITED ((MMS)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 2/2/0

Industry feedback signals to Macquarie the level of EV demand has not found a peak yet. McMillan Shakespeare has indicated the EV FBT exemption is driving demand, with orders up 331% in the first half.

The broker upgrades the stock to Outperform from Neutral and the target is lifted to $20.47 from $14.78. As vehicle supply is improving the broker expects material earnings upgrades will be forthcoming.

ORICA LIMITED ((ORI)) was upgraded to Buy from Neutral by Citi .B/H/S: 4/2/0

Citi expects demand for explosives will remain stronger for longer due to strong mining demand across the Asian Pacific and higher prices, as companies play catch-up as covid-induced labour issues ease.

The broker observes Orica’s share price has lagged global peers and is trading at a -5% discount to the ASX200.

Meanwhile, Citi speculates that urea prices and ammonia prices may be finding support.

Rating upgraded to Buy from Neutral. Target price rises to $17.45 from $17.40.

SMARTGROUP CORPORATION LIMITED ((SIQ)) was upgraded to Outperform from Neutral by Macquarie .B/H/S: 4/1/0

Industry feedback has signalled to Macquarie the level of EV demand has not yet found a peak and ICE activity is flat or slightly higher. EVs represented more than 20% of Smartgroup Corp’s quotes in the March quarter.

Moreover, the impact of the FBT exemption on demand as materially exceeded expectations and this is a positive driver of per-unit profitability.

Macquarie considers upside risk to earnings remains and allows for 25% volume growth in the second half of 2023 and 33% in 2024. Rating is upgraded to Outperform from Neutral and the target is lifted to $10.00 from $5.90.

ZIP CO LIMITED ((ZIP)) was upgraded to Neutral from Sell by Citi .B/H/S: 1/2/2

In a sector preview to the upcoming August reporting season in Australia, Citi analysts have upgraded their rating for Zip Co to Neutral from Sell.

The justification for the move is explained through the fact management has achieved stronger than expected progress on expanding gross profit margins and reducing costs.

In the not so good books

AGL ENERGY LIMITED ((AGL)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 2/3/0

Macquarie assesses the risk of an earnings disappointment from AGL Energy has increased. Historically, the strongest lead indicator for the performance of the utility has been the forward curve as it determines both retail and C&I pricing.

The FY25 curve is reflecting soft demand, strong coal generator performance and falling underlying commodity prices.

While retail churn has seasonally gathered momentum the broker suggests this is nothing unusual, given price rises. Rating is downgraded to Neutral from Outperform and the target lowered to $11.43 from $11.59.

AERIS RESOURCES LIMITED ((AIS)) was downgraded to Hold from Buy by Ord Minnett .B/H/S: 2/1/0

The fourth quarter report from Aeris Resources was weaker than Ord Minnett expected as Jaguar and Mount Colin underperformed.

FY24 guidance was also significantly below expectations as Jaguar was closed because of seismic issues that have limited access to higher grade stopes.

The company has entered into an onerous debt package associated with Jaguar’s closure costs and higher-than-expected capital expenditure forecasts.

While still envisaging longer-term value appeal, Ord Minnett downgrades to Hold from Buy and reduces the target to $0.27 from $0.74.

CONTROL BIONICS LIMITED ((CBL)) was downgraded to Hold from Speculative Buy by Morgans .B/H/S: 0/1/0

Morgans lowers its target for Control Bionics to 9c from 58c after lowering its forecasts in line with new management guidance and to reflect a new $1.1m capital raise and the potential for another during FY24. The rating is downgraded to Hold from Speculative Buy.

Despite these negatives, the analysts highlight sales momentum apparent in the company’s 4Q cashflow report and for the prior quarter.

Management has adopted a more focused direct-to-hospital strategy in Japan to drive near-term sales, explains the broker. Also, testing is being finalised for the Drove (self driving wheelchair) with potential for sales in FY24, post a Therapeutic Goods Administration submission.

DOMAIN HOLDINGS AUSTRALIA LIMITED ((DHG)) was downgraded to Neutral from Buy by Citi .B/H/S: 0/4/0

In a sector preview to the upcoming August reporting season in Australia, Citi analysts have decided to downgrade Domain Holdings Australia to Neutral from Buy.

The analysts continue to see strong results and upside to consensus forecasts, but they don’t see the stock price as compelling enough to warrant a Buy rating.

EVT LIMITED ((EVT)) was downgraded to Neutral from Buy by Citi .B/H/S: 1/1/0

Citi is not joining the euphoria stemming from Barbie and Oppenheimer releases and has downgraded EVT Ltd to Neutral from Buy.

The analysts justify their decision through increased risks to EVT’s cinema business, regardless of the large ticket sales because of both movie blockbusters.

The broker cites the ongoing writers and actors’ strike, potentially adversely impacting the box office in 2024/25, on top of a potential slowdown in customer spend on entertainment due to cost-of-living pressures.

Citi remains more positive on the hotel business, but adds here industry data also point to slower growth. Corporate cost out programs could represent downside risk.

FLIGHT CENTRE TRAVEL GROUP LIMITED ((FLT)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 2/3/0

After Flight Centre Travel upgraded FY23 guidance on July 20, Macquarie decides to raise its earnings forecasts largely due to higher margin assumptions, which elevates its target by 8% to $23.

The broker’s rating is downgraded to Neutral from Outperform on valuation after a 58% year-to-date share price rally.

The analyst highlights the company’s total transaction value (TTV) for FY23 of $22bn represents 93% of the record FY19 level. It’s thought market share gains are ongoing with Leisure demand remaining strong and the corporate business outperforming peers.

SEVEN WEST MEDIA LIMITED ((SWM)) was downgraded to Neutral from Buy by UBS .B/H/S: 1/2/1

UBS conducts a review of the Australian Media Sector. The broker observes advertising markets worsened in the June quarter, the market falling -17% on the previous year. The good news is the broker was expecting a fall of -22% and raises its assumptions accordingly.

But the brakes remain on given low consumer confidence and business confidence data and the broker expects weakness to persist for six months before the markets start to recover in the next June half, before hitting full stride in FY25.

The broker expects Seven West Media will suffer most from these trends, noting the company is experiencing falls in revenue in key TV markets, mainly metro FT where viewership kept falling in FY23.

Rating is downgraded to Neutral from Buy. Target price falls to 41c from 60c.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.