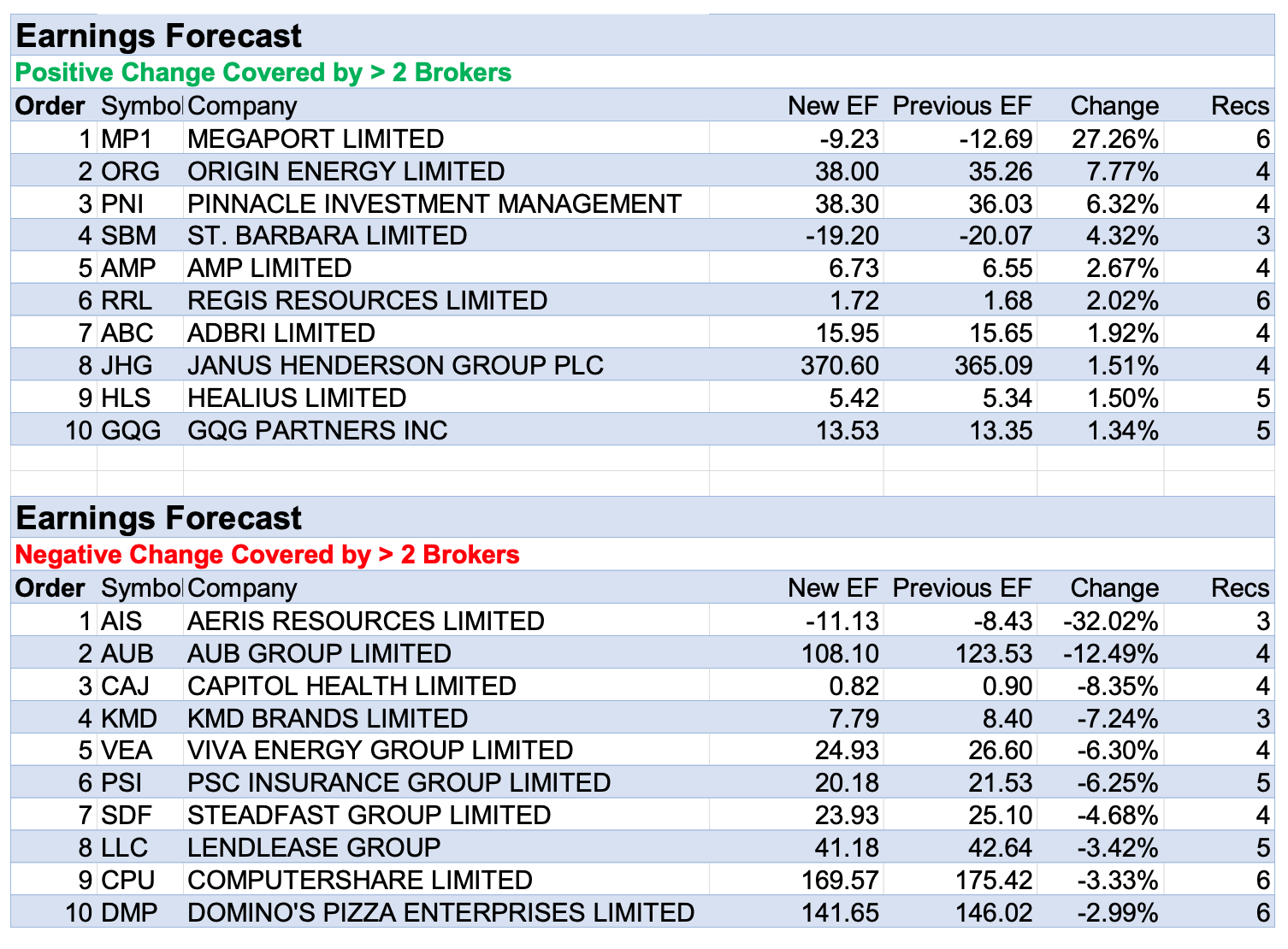

Positive and negative percentage adjustments to average forecast earnings were of a similar magnitude, as can be seen in the tables below.

Megaport received the largest (27%) percentage upgrade to average forecast earnings last week after five brokers weighed in with new research following a management upgrade to financial year 2023 earnings guidance of around 18%.

Macquarie attributed the upgrade to cost reductions and lower churn yet stayed with its Neutral rating on concerns around the pace of sales, including the acquisition and ramp-up of new sales personnel.

Nonetheless, the broker raised its 12-month target to $9 from $6, and the average target price for Megaport in the FNArena database also rose to $10.13 from $9.18, the largest move of the week.

Despite a tailwind from generative AI, Citi suggested risk/reward for the company is currently not compelling and downgraded its rating to Neutral from Buy, given the need for increased spending to ward off competition and execution risks around the operational turnaround.

Morgans was far more buoyant, particularly now that Megaport has achieved the “huge milestone” of around $15 million per annum in free cash flow.

On the flipside, gold miner St Barbara received the largest percentage downgrade to average forecast earnings last week after Macquarie resumed coverage following a seven-month hiatus with a 35 cents target price, down from 57 cents previously.

The broker was required to cease coverage in late 2022 as Macquarie Capital was acting as advisor to the company when Genesis Minerals ((GMD)) announced an all-scrip-based merger through a reverse scheme of arrangement.

By April this year, merger plans were being altered and finally rejigged to allow Genesis Minerals to buy St Barbara’s Leonora assets for $600 million via a mixture of cash and shares. Then, along came a couple of bids for Leonora by Silver Lake Resources ((SLR)) in May.

Finally, the asset was sold on June 30 to Genesis Minerals, resulting in a strong (according to Macquarie) notional net cash position of $192 million.

While the outlook remains unclear, the analyst can see value in the development of Fifteen Mile Stream project at the Atlantic operations in Canada.

The Simberi gold mine in Papua New Guinea is now expected to be the main producing asset over the next few years. An upcoming sulphide project has the potential to extend the life of mine by at least 10 years and Macquarie feels an alternative development plan could be a key medium-term opportunity.

Aeris Resources was next on the earnings downgrade table after providing its financial year 2023 production report and withdrawing financial year 2023 earnings and cost guidance as a result of production misses.

Nonetheless, Bell Potter considered the production updates were positive, largely because of a lift in copper production at the Tritton operations (near Cobar in NSW).

Both Tritton and Cracow ended the year strongly, according to Macquarie, while Mount Colin and Jaguar were weak because of deferred ore processing at the former and weaker production at the latter.

While this broker considered the outlook for financial year 2024 was positive, EPS forecasts for financial year 2023 and financial year 2024 were reduced by -33% and -14%, respectively.

Morgan Stanley highlighted growth remains compelling for ASX-listed Insurance Brokers, driven by climate change tailwinds and capital-light exposure to premium rises, along with potential growth derived from M&A and global expansion.

While the analysts also initiated coverage on PSC Insurance with an Overweight rating and Steadfast Group (Equal-weight on a full current valuation), Overweight-rated AUB Group was considered the best opportunity in terms of relative earnings growth and value. A $37 target was set.

While some investors are cautious around gearing levels after the purchase in late-2022 of Tysers, a leading Lloyd’s wholesale broker, the analysts believe access provided to the Lloyd’s market for cross-sell opportunities will outweigh the negatives.

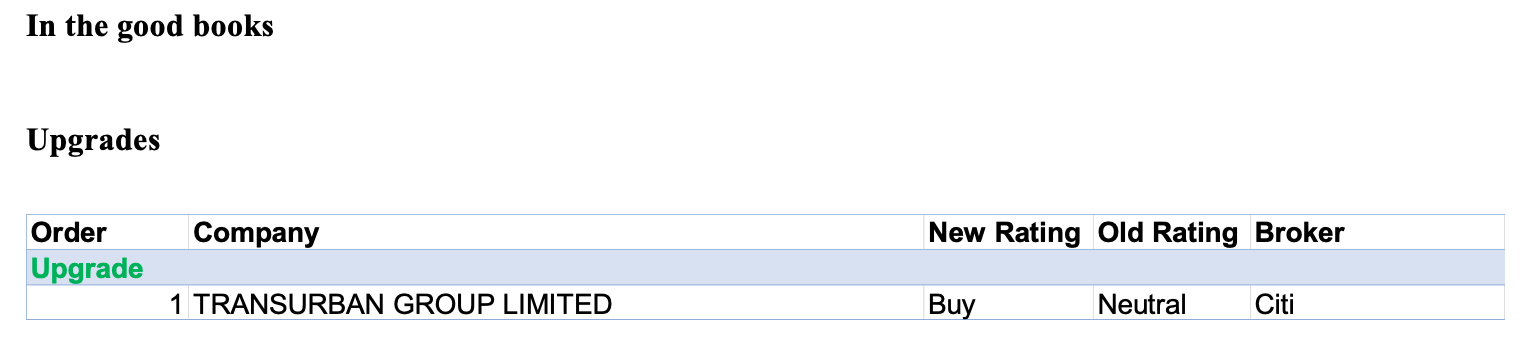

TRANSURBAN GROUP LIMITED ((TCL)) was upgraded to Buy from Neutral by Citi. B/H/S: 3/2/0

Citi upgrades Transurban Group to Buy from Neutral amid upside to CPI-linked tolls. The passing through of CPI occurs with a delay in half-yearly increases in Brisbane and annual increases in WestConnex so the broker envisages upside to EBITDA and free cash forecasts.

While toll usage is not immune to the consumer pressures that exist, Citi suspects growth in toll roads could hold up because of the time savings involved.

Some share price risk exists with the company participating in a bid for a stake in Horizon Roads, which owns EastLink, given the potential for equity raising. Target is steady at $16.20.

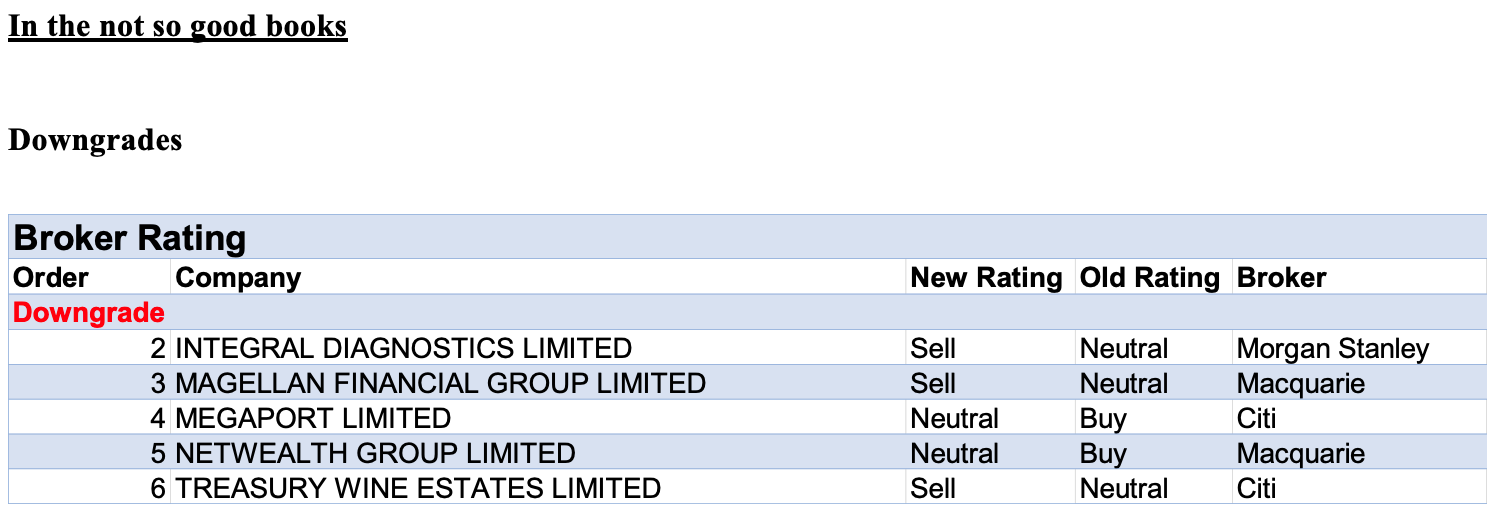

INTEGRAL DIAGNOSTICS LIMITED ((IDX)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 2/1/1

Morgan Stanley observes, for most healthcare companies, volume recovery post the pandemic has been sluggish, accompanied by higher costs, although PE multiples across the healthcare sector are considered inflated.

Hence, the broker favours those stocks where financial year 2023 guidance has been recently affirmed and financial year 2024 expectations have been reset.

Slow volume growth characterised Integral Diagnostics in the first half of financial year 2023, and while the company has indicated an inflection point has now been passed, the broker finds it difficult to project the trajectory of an assumed recovery in margins.

The rating is downgraded to Underweight from Equal weight. Target is steady at $2.70. Industry view In-Line.

MAGELLAN FINANCIAL GROUP LIMITED ((MFG)) was downgraded to Underperform from Neutral by Macquarie. B/H/S: 1/2/2

Magellan Financial experienced further institutional outflows in June while retail overflows were broadly stable. Macquarie estimates around $5 billion in institutional funds under management remain in global equities and there is risk of further outflows.

The company delivered around $11 million in performance fees in financial year 2023, primarily from 0.9% outperformance in the global fund.

The broker downgrades to Underperform from Neutral, as the funds management business is considered overvalued while outflows are persisting. Target is reduced to $7.25 from $7.50.

MEGAPORT LIMITED ((MP1)) was downgraded to Neutral from Buy by Citi. B/H/S: 3/3/0

Despite the tailwind from generative AI for Megaport, Citi suggests risk/reward is currently not compelling given the need for increased spending to ward off competition. Additional investment of around -$8m is assumed for financial year 2024.

Moreover, the broker sees execution risk for the operational turnaround and decides to downgrade its rating to Neutral from Buy.

Citi’s target rises to $9.05 from $7.40 on lower cost forecasts and a lower Australian dollar. The company’s new financial year 2023 guidance implies to the analysts fourth quarter earnings (EBITDA) of around $12 million.

NETWEALTH GROUP LIMITED ((NWL)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/3/0

Net inflows of $3.1 billion were in line with Macquarie’s expectations. The broker assesses the relative attractiveness of term deposits relative to Netwealth Group’s cash transaction account and equities is leading to headwinds on margins and net flows.

The company is looking to implement measures to offset this in the first half of financial year 2024, although to the broker it seems unlikely trends will normalise in the near term while interest rates are elevated.

Rating is downgraded to Neutral from Outperform on valuation grounds. The target is reduced to $14.40 from $15.

TREASURY WINE ESTATES LIMITED ((TWE)) was downgraded to Sell from Neutral by Citi. B/H/S: 3/2/1

Citi is concerned about the ability of Treasury Wine Estates to manage inflation pressures that impact its cost base and consumer demand. The broker is also aware of the margin downside should volumes moved from the on-premises channel to the off-premises channel.

Citi downgrades to Sell from Neutral although the lifting of tariffs in China represents a risk to the new rating. Nevertheless, any associated earnings rebound is likely to be constrained over the short to medium term by weak consumer sentiment and high inventory levels.

The company is also unlikely to divert wine from other markets where it has been building its brand. The broker reduces financial year 2024 and financial year 2025 underlying net profit forecast by -5% and -7%, respectively. Target is lowered to $10.25 from $12.75.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.