forecasts significantly exceeded the size of upgrades, as can be seen in the tables below.

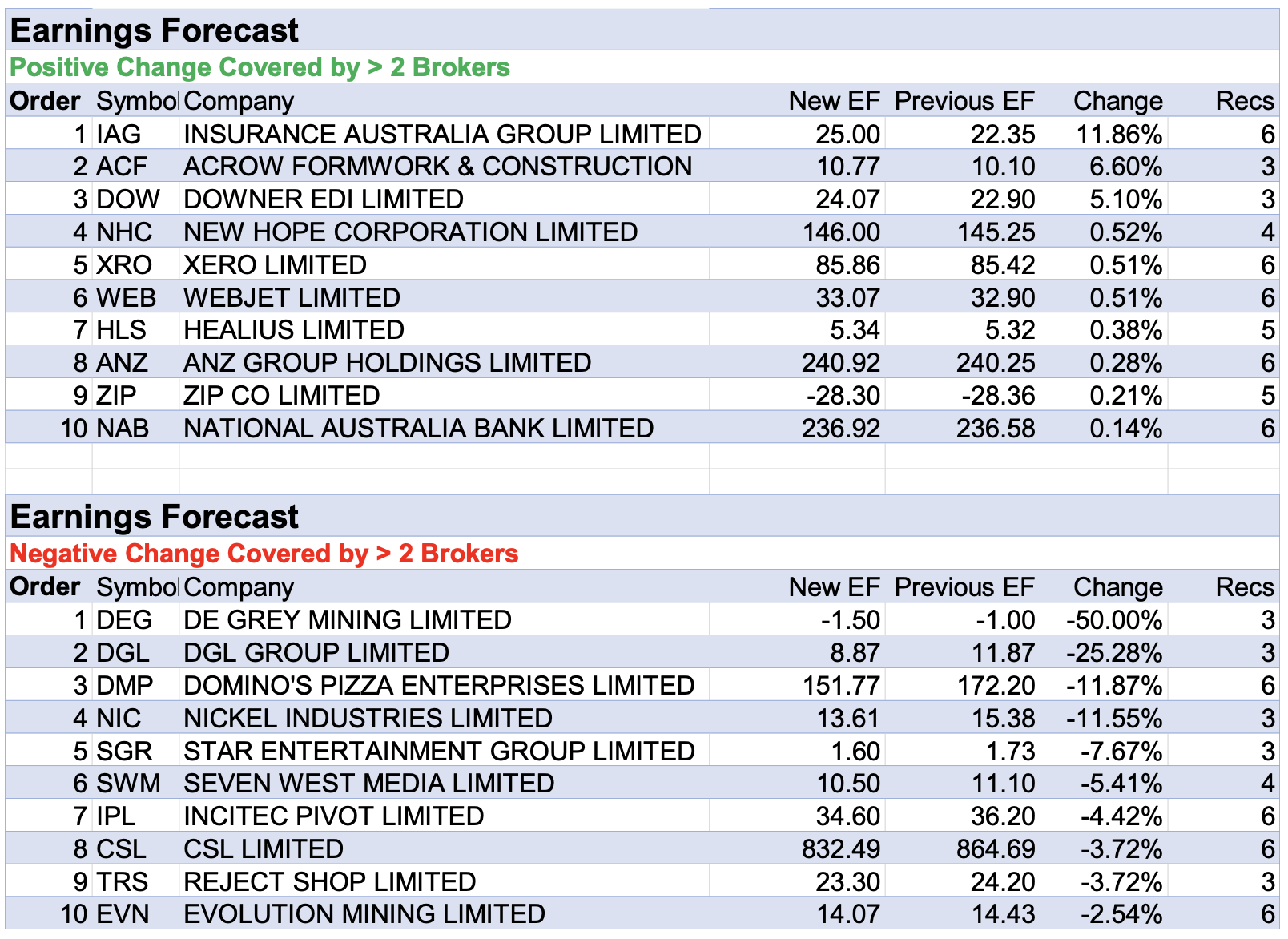

Insurance Australia Group received the only material percentage upgrade to forecast earnings (11.9%) by brokers and the largest percentage increase (3.73%) in target price.

At the group’s investor day, management reiterated FY23 margin guidance, which was a better than UBS was expecting. It’s thought favourable results in Australia covered for an earnings shortfall in New Zealand.

Morgan Stanley highlighted pricing is higher in the second half of the financial year compared to the first half for motor, home, intermediated and in New Zealand, though Australian pricing has not risen in the past few months due to emerging customer affordability constraints.

Amid rising global yields and widening credit spreads, Ord Minnett observed investment income on the company’s $12bn in assets should improve materially from FY23 onwards.

On the flipside, De Grey Mining, which 100% owns the Mallina gold project in Western Australia, received the largest percentage downgrade to forecast earnings last week, though investors should not be alarmed.

While the earnings downgrades were largely due to refreshed research by UBS, the small forecast numbers involved exaggerated the percentage change.

Moreover, this broker was bullish on De Grey’s prospects after management announced the addition of 1m ounces to the Mallina resource, and, more importantly, increased the Measured & Indicated (M&I) category by 1.1m ounces.

Total resources now stand at 11.7m ounces with 8.1m ounces in M&I and 9.5m ounces at the Hemi deposit alone. According to UBS, Hemi is an increasingly scarce and valuable long-life asset, and the broker eagerly awaits more project detail with the definitive feasibility study due next quarter.

Macquarie notes the potential of an underground operation at Hemi which is not included in its base case valuation. It’s thought such an operation could both extend the mine life of Mallina and incrementally boost production via the higher-grade ore feed.

DGL Group also received lower earnings forecasts from brokers as well as the largest percentage decrease in average target price.

Management downgraded FY23 earnings guidance by -10% mainly due to broad-based cost inflation, particularly in the Environmental division, and cited the impacts of rising wages, some higher raw material costs and increased dumping charges.

As a result of the earnings downgrade, Morgans lowered its rating to Hold from Add and slashed its target to $1.00 from $2.10 on lower earnings forecasts and after applying a -20% valuation discount to reflect increased earnings uncertainty.

Next on the earnings downgrade table is Domino’s Pizza Enterprises, which also received an over -16% downgrade to its 12-month target price. In addition, the company received two ratings downgrades by separate brokers in the database.

Store rollout targets have been a key driver for Domino’s growth over the years, noted Macquarie, while the secondary driver has been same store sales.

Unfortunately, brokers were disappointed by store rollouts, sales and costs, after a second half earnings downgrade, though some positives are emerging.

Nickel Industries also received earnings downgrades from brokers after announcing a strategic partnership with major Indonesian conglomerate, PT United Tractors. The company will issue 857m shares at $1.10 each for proceeds of $943m and United Tractors will now have a 19.9% stake.

The two companies also entered into an associated, conditional, collaboration agreement, whereby United Tractors will fund a contributing 20% interest in the Excelsior Nickel Cobalt High Pressure Acid Leach (HPAL) project.

Incorporating the United Tractors share placement results in dilution to the company’s forecast EPS, explained Macquarie, but this is offset by a rise in the analyst’s net present value due to an increased valuation from cash build.

This broker upgraded its rating to Outperform from Neutral and highlighted the placement will result in a net cash position and help de-risk the balance sheet, while Citi noted the capital raise overhang for the group’s shares has now passed.

In the good books

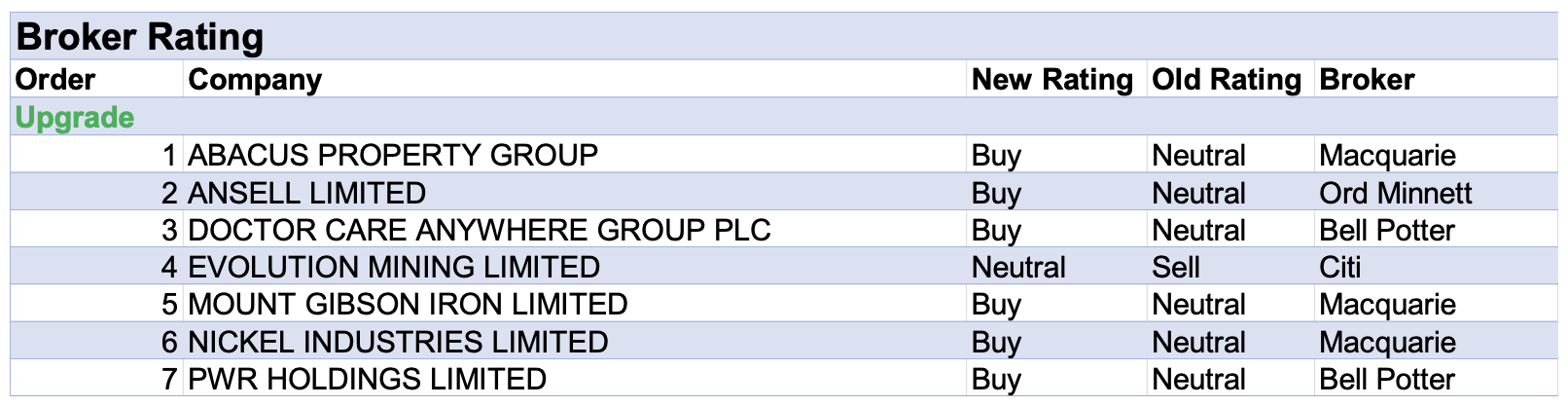

Upgrades

ABACUS PROPERTY GROUP ((ABP)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 4/0/0

Abacus Property intends to de-staple its storage business by August. Macquarie estimates the stock is currently trading at a -19% discount to listed peers and the de-stapling will result in a neutral outcome for current shareholders.

The key to a re-rating will be the market pricing of the new entity. While market pricing is uncertain the broker believes the current valuation of Abacus Property is attractive.

As Macquarie is comfortable about the financial outcomes from de-stapling the rating is upgraded to Outperform from Neutral. Target is $2.90.

ANSELL LIMITED ((ANN)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 1/5/0

The share price of Ansell has moved through Ord Minnett’s trigger level and the rating is upgraded to Accumulate from Hold. Target is $30.

DOCTOR CARE ANYWHERE GROUP PLC ((DOC)) was upgraded to Speculative Buy from Hold by Bell Potter. B/H/S: 1/0/0

Doctor Care Anywhere has reached agreement on its annual price increase and Bell Potter believes there is reason to expect record revenue generation in the months ahead.

The company expects to launch its mixed clinical workforce this month and has reaffirmed guidance that includes an annualised revenue run rate in the range of GBP42-46m by the end of June.

The loss-making Tasmanian subsidiary has been sold for $3m, having been acquired in 2021 for $11m in scrip and cash. The broker notes expansion into the Australian market was ill-timed as the company lacked the balance sheet to invest.

Rating is upgraded to Speculative Buy from Hold and the target raised to 8c from 6c.

EVOLUTION MINING LIMITED ((EVN)) was upgraded to Neutral from Sell by Citi. B/H/S: 1/2/2

Having visited Cowal and Ernest Henry, Citi is convinced mine life extensions at these high-quality assets are a case of when, not if. The broker upgrades Evolution Mining to Neutral from Sell, believing the end of the operations downgrades has been reached.

Citi remains bullish on precious metals and copper because of the decarbonisation theme, although asserts Evolution Mining still needs to demonstrate it can deliver. Target is raised to $3.30 from $3.10.

MOUNT GIBSON IRON LIMITED ((MGX)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 1/0/0

Mount Gibson Iron has increased shipment rates and is on track to achieve and potentially surpass its FY23 guidance of 2.9m wmt. On Macquarie’s forecasts the company generates around $700m in cash over the remaining life of the mine, which lifts to $1bn at spot.

The broker forecasts cash of $133m at the end of FY23, a 60% increase quarter on quarter. Rating is upgraded to Outperform from Neutral given the strong cash flow, and the target is raised to $0.60 from $0.50.

NICKEL INDUSTRIES LIMITED ((NIC)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 2/1/0

The analysts at Macquarie visited the Hengjaya nickel mine and the IMIP (Indonesia Morowali Industrial Park) and several RKEF, HPAL and stainless-steel facilities.

The visit highlighted to the broker potential upside for Nickel Industries from a new haul road (opening soon) which will connect the Hengjaya nickel mine to IMIP. Haulage could increase by around 12mt per year.

In a positive announcement, according to Macquarie, a conditional 19.99% placement to United Tractors will help de-risk the balance sheet and result in a net cash position. The rating is upgraded to Outperform from Neutral, and the target rises by 18.3% to $1.10.

PWR HOLDINGS LIMITED ((PWH)) was Upgraded to Buy from Hold by Bell Potter. B/H/S: 3/1/0

Bell Potter expects PWR Holdings will likely experience similar revenue weakness to that announced by peers in recent trading updates.

The broker observes wage pressure, rising set-up costs in the UK and potential softness in the aftermarket sector (offset by rises in motorsports and operating equipment manufacturing forecasts).

On the cost front, Bell Potter notes the company can fully expense costs in the period incurred so changes are minimal.

EPS forecasts fall -3% in FY23; -4% in FY24; and -3% in FY23 to reflect increase operating expenditure forecasts.

Rating upgraded to Buy from Hold. Target price eases to $10.50 from $10.75.

In the not so good books

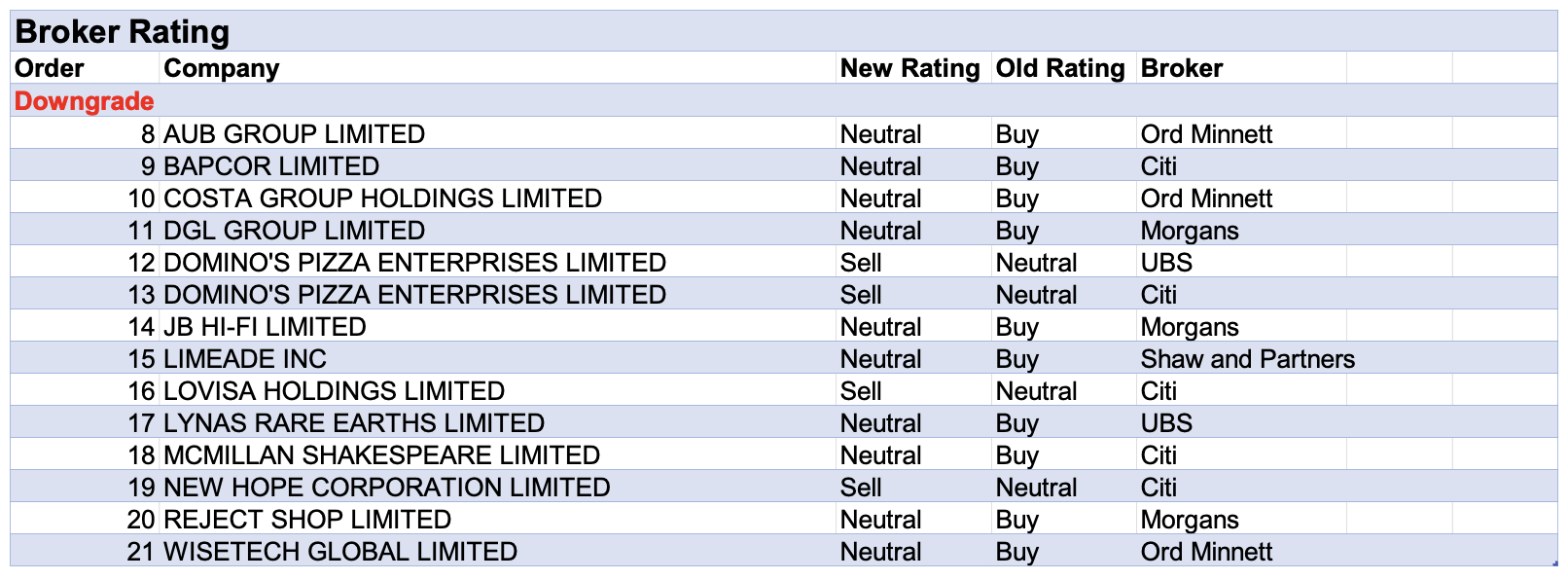

Downgrades

AUB GROUP LIMITED ((AUB)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 2/1/0

As the share price of AUB Group has moved through the trigger level Ord Minnett downgrades to Hold from Accumulate. Target is $29.

BAPCOR LIMITED ((BAP)) was downgraded to Neutral from Buy by Citi. B/H/S: 3/3/0

Citi flags increasing concerns around the outlook for Bapcor’s retail division and the commitment to the Thai roll-out. A more challenging economic environment is also going to make it harder for the company to achieve its FY25 EBIT target of more than $100m.

The broker points to estimated retail sales growth of just 1% in FY24 and the downside risk to consumer demand, particularly for more discretionary products.

Many other retailers have recently downgraded, the broker adds, and credit card data in the US is showing a slowdown in auto parts demand. Hence, the category may not be as resilient as previously thought.

Rating is downgraded to Neutral from Buy and the target lowered to $6.49 from $9.18.

COSTA GROUP HOLDINGS LIMITED ((CGC)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 2/3/0

Ord Minnett downgrades Costa Group’s rating to Hold from Accumulate on valuation grounds. Target price is steady at $3.10.

DGL GROUP LIMITED ((DGL)) was downgraded to Hold from Add by Morgans. B/H/S: 1/2/0

Implied 2H earnings have been cut by -17-18%, explains Morgans, after DGL Group lowered underlying earnings (EBITDA) guidance by -10% to a range of $64-66m.

Cost increases across the board and particularly in the Environmental division were responsible for the lower guidance, explains the analyst. Management also cited the impacts of rising wages, some raw material costs and increased dumping charges.

The broker decides to downgrade its rating to Hold from Add and lowers its target to $1.00 from $2.10 on lower earnings forecasts and after applying a -20% discount to reflect increased earnings uncertainty.

DOMINO’S PIZZA ENTERPRISES LIMITED ((DMP)) was downgraded to Sell from Neutral by UBS and to Sell from Neutral by Citi. B/H/S: 3/1/2

In a trading update Domino’s Pizza Enterprises indicated same-store sales growth in the second half was 0.2%, down -4.3% on the prior comparable half.

The company has confirmed store openings will not meet its 3–5-year outlook in FY23 or FY24, and it will undertake $53-59m in annualised cost savings with a third to be shared with franchisees.

UBS had previously assumed execution would improve but is now more cautious. Lower rates of near-term organic store growth are incorporated in estimates and lower long-term EBIT margins.

Given the reduced confidence in the growth profile, the broker downgrades to Sell from Neutral. Target is reduced to $40 from $60.

Citi downgrades Domino’s Pizza Enterprises to Sell from Neutral, believing it increasingly unlikely franchisee profitability will improve materially in the short term. The broker is also cautious regarding the competitive risks in Australia with signs delivery volumes remain under pressure.

On further analysis of the takeaway sales in Australia and websites and apps across key markets, estimates for FY24-25 earnings per share are cut by -11-19% to reflect a slower roll-out and higher costs. Target is reduced to $42.80 from $58.00.

JB HI-FI LIMITED ((JBH)) was downgraded to Hold from Add by Morgans. B/H/S: 1/3/1

Morgans lowers earnings forecasts for all Discretionary Retail stocks under its coverage in the expectation of ongoing consumer stress from elevated inflation and higher interest rates. Recent profit warnings by companies in the sector contributed to this view.

More positively, the analysts expect inflation will moderate in coming months and consumer sentiment may start to improve.

For JB Hi-Fi, the broker lowers its FY24 EPS forecast by -5%, respectively, and its target to $45 from $50. The rating is downgraded to Hold from Add on valuation given shares have significantly outperformed the Discretionary Retail sector over the past three months.

Morgans considers the company is trading close to fair value given the risks around consumer spending, especially given a lack of significant store rollout potential.

LIMEADE INC ((LME)) was downgraded to Hold from Buy by Shaw and Partners. B/H/S: 0/1/0

Limeade’s board has approved a merger with WebMD Health Services.

Under the deal, WebMD will buy 100% of Limeade for 42c a share, cash, – a 325% premium to the last close. The offer is in line with Shaw and Partners’ target price of 40c, so the broker considers it to be fair.

Shaw and Partners observes long-term investors are taking advantage of the current illiquid market and the focus on cash burn and adds that companies in a similar position to Limeade include Whispir ((WSP)), Keypath ((KED)) and XPON Technologies ((XPN)).

Holistics wellbeing solutions provider WebMD is owned by California-based Internet brands.

The broker observes that prior to the announcement, the company was trading on just 0.3x revenue; enjoyed $58m in recurring revenue; its customers included some of the world’s largest companies; had invested $150m of capital into its software platform; and was a strategic partner with Microsoft on Viva.

Rating downgraded to Hold from Buy. Target price rises to 43c from 40c.

LOVISA HOLDINGS LIMITED ((LOV)) was downgraded to Sell from Neutral by Citi. B/H/S: 4/2/1

Citi downgrades its rating for Lovisa Holdings to Sell from Neutral on concerns declining foot traffic in general and weaker sales trends revealed by other retailers may impact.

More specifically, the analysts feel site selection criteria in the store rollout may be less stringent than before, and margins may reduce on staffing issues.

Moreover, the company has relatively less staff-per-store compared to other retailers and less flexibility to optimise store rosters to offset minimum wage headwinds, explains Citi.

There is no indication the $25.75 target price has changed.

LYNAS RARE EARTHS LIMITED ((LYC)) was downgraded to Neutral from Buy by UBS. B/H/S: 3/1/1

Following a share price rally for Lynas Rare Earths and a more cautious outlook on NdPr pricing by UBS, the broker lowers its rating to Neutral from Buy.

UBS downgrades its NdPr price forecasts for FY23-25 by -9%, -11% and -10%, respectively. The target falls to $8.30 from $8.60 as the broker’s long-term NdPr price forecast of US$95/kg determines most of the valuation and is unchanged.

Several factors are weighing on the NdPr price including a surplus of primary material and less discipline from China producers to maintain pricing in the face of growing ex-China supply, explain the analysts.

MCMILLAN SHAKESPEARE LIMITED ((MMS)) was downgraded to Neutral from Buy by Citi. B/H/S: 2/2/0

The South Australian government has extended McMillan Shakespeare’s contract to June 30, 2024, to enable sufficient time to “rigorously evaluate the tender submissions”.

Citi considers the extension an indication there are several providers that are still in the running. The broker had previously believed the incumbent provider would retain the contract but now assesses renewal may not be straightforward.

Rating is downgraded to Neutral from Buy, reflecting the recent performance of the share price while the target is steady at $16.10.

NEW HOPE CORPORATION LIMITED ((NHC)) was downgraded to Sell from Neutral by Citi. B/H/S: 2/1/1

Citi observes, in line with its base case for a substantial drop in natural gas prices, thermal coal, which competes with gas in power generation, could also experience sizeable downside over the coming quarter.

Besides this, thermal coal market fundamentals are looser because of historically elevated inventory among high calorie value importers and El Nino pointing to a drier and/or warmer climate over the coming months for major exporters, including Colombia and Australia.

The broker downgrades New Hope to Sell from Neutral to reflect outperformance in the share price recently. Target is lowered to $4.00 from $4.80.

REJECT SHOP LIMITED ((TRS)) was downgraded to Hold from Add by Morgans. B/H/S: 2/1/0

Morgans lowers earnings forecasts for all Discretionary Retail stocks under its coverage in the expectation of ongoing consumer stress from elevated inflation and higher interest rates. Recent profit warnings by companies in the sector contributed to this view.

More positively, the analysts expect inflation will moderate in coming months and consumer sentiment may start to improve.

For the Reject Shop, the broker downgrades its rating to Hold from Add and recommends investors take profits after recent share price strength. The target is decreased to $4.25 from $4.60 on lower earnings estimates.

WISETECH GLOBAL LIMITED ((WTC)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 2/4/0

Ord Minnett downgrades WiseTech Global to Hold from Accumulate on valuation grounds. Target price is steady at $90.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.