A review of the target price and earnings tables below shows a positive week for accounting software firm Xero and Avita Medical, while agricultural names Elders and Incitec Pivot experienced negative reviews by analysts.

Following FY23 results that exceeded expectations, Xero appeared atop the tables for both the largest percentage increase in average target price and forecast earnings by the six covering brokers in the database.

Morgan Stanley now has the highest target price of the six after an increase to $125 from $100. It’s felt actions by the new CEO have been decisive and make strategic sense, which in turn has started to de-risk the outlook for equity holders.

In particular, the broker praised management’s new commitment to further cost reductions. The technical team’s efficiency program is expected to finish by July, and, as a result, Citi envisaged upside risk to margin guidance based on current top-line trends.

After an around 20% share price rally in the last few months, Morgans lowered its rating to Hold from Add, while also raising its target to $101 from $97.

One of Xero’s key performance metrics is the “rule of 40”, which tries to strike a balance between growth and profitability by targeting the revenue growth and free cash flow margin percentage to total at least 40%.

Ord Minnett estimated the total has hovered around 30% in the last five years and will remain at a similar level for the next decade. A Sell rating is retained though the target was increased by 10% to $66.

Avita Medical came second behind Xero for percentage increase in target price and fifth on the list for increase in average forecast earnings by brokers after achieving March quarterly guidance and maintaining full year revenue guidance.

On the negative side of the ledger, Elders topped the list for the largest percentage decrease in average target price (-25%) and forecast earnings, after five covering brokers in the database updated research.

First half results reflected a volatile agricultural backdrop impacted by weaker livestock trading conditions, softer crop input prices and unseasonably wet weather, explained Macquarie, which downgraded its rating to Neutral from Outperform and lowered its target to $7.77 from $14.35.

The earnings margin fell to 5.0% from 8.8% and the return on capital (ROC) declined to 16.9% from 27.8% in the previous corresponding period.

While FY23 earnings guidance was a -5% miss against the consensus forecast, it met the prior forecast by Neutral-rated UBS, suggesting an uptick in the September half. Shaw and Partners (Buy) felt achieving this guidance will be assisted by the positive outlook for the Australian winter crop.

Incitec Pivot was second behind Elders for percentage fall in average target price last week and fourth on the earnings downgrade table.

While the company’s first half results materially missed consensus expectations, largely due to a significant fall in fertiliser prices over recent months, some brokers see value on offer.

NextDC was second on the table for lower forecast earnings after Ord Minnett updated its research for a $618m equity raising at $10.80 per share, which was announced in the previous week.

Funds raised will be used for new data centre developments in Kuala Lumpur and Auckland, together with the accelerated data hall fit-out in the third Sydney centre. Management is also evaluating Singapore and Tokyo as potential markets.

Returning to positive earnings upgrades last week, the SaaS industry group was well represented with increased forecasts for Serko, Tyro Payments and Appen.

Following FY23 results, Ord Minnett suggested the market has overlooked the likes of expense management company Serko (that may evolve into a serious player in its industry) in taking a broadly negative approach to long-duration growth assets that have been generating negative free cash flow.

The loss for the period was smaller than expected and the broker forecast Serko will be generating material free cashflow of $35m by FY26.

Macquarie raised its earnings forecast and upgraded its rating for Tyro Payments to Outperform from Neutral following a third upgrade to FY23 guidance, which eased concerns around management’s ability to manage a weaker consumer demand environment.

Brokers also raised earnings forecasts for Appen, which raised $600m in equity to provide balance sheet flexibility and help fund one-off costs associated with its previously announced cost reduction program.

Bell Potter upgraded its rating to Hold from Sell, noting no requirement for the company to take on debt or do another capital raising for at least the next three years.

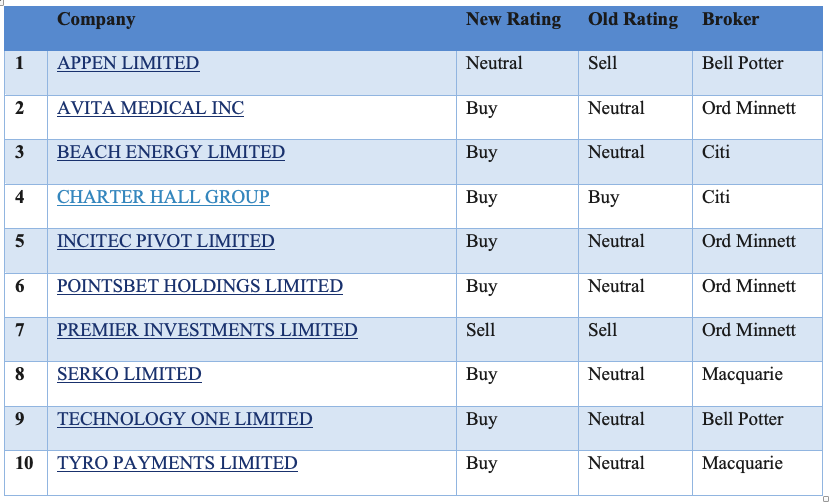

In the good books

Upgrades

APPEN LIMITED ((APX)) was upgraded to Hold from Sell by Bell Potter. B/H/S: 0/1/3

Bell Potter updates forecasts to allow for the capital raising that Appen announced. There are no changes to underlying revenue and EBITDA forecasts.

Modest reductions in forecast losses are made and the broker has removed the borrowings it previously assumed would be drawn in 2023 and 2024.

Bell Potter envisages no need for the company to take on debt or do another capital raising for at least the next three years.

Rating is upgraded to Hold from Sell and the target increases to $2.20 from $2.05. The broker suspects the main negative catalysts have now passed.

AVITA MEDICAL INC ((AVH)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 3/0/0

As the share price of Avita Medical has moved through the trigger level, Ord Minnett upgrades to Accumulate from Hold. Target is $5.60.

BEACH ENERGY LIMITED ((BPT)) was upgraded to Buy from Neutral by Citi. B/H/S: 5/1/1

Following the withdrawal of guidance relating to Waitsia and a -10% decline in the share price since April, Citi assesses the impact is minimal and upgrades to Buy from Neutral.

The broker expects a three-month delay at Waitsia and an extra -$30m in capital expenditure, a small dent in valuation.

Meanwhile, Waitsia 2P is being audited and may be updated prior to the August results, providing a catalyst. The Trigg-1 exploration results are also imminent. Target is reduced to $1.65 from $1.70.

CHARTER HALL GROUP ((CHC)) was upgraded to Buy from Neutral by Citi. B/H/S: 4/1/0

Citi upgrades its rating for Charter Hall to Buy from Neutral on evidence of rebounding transaction activity for office assets. Also, concerns have been dissipating on further downside to office values and further downside for FY24 consensus estimates.

These FY24 consensus estimates are likely to be supported by a further recovery in transaction activity and a rising CPI (20% of platform income CPI-linked), in the analyst’s view.

Citi also sees upside to FY25 earnings on performance fees.

The target falls to $14.60 from $14.80.

INCITEC PIVOT LIMITED ((IPL)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 3/3/0

Despite a negative share price reaction yesterday, first half underlying profit for Incitec Pivot was slightly ahead of Ord Minnett’s forecast. The interim dividend of 10cps also exceeded the 9cps anticipated and the broker highlights the attractive yield on offer.

A strong margin performance from Dyno Nobel Americas countered softer-than-expected margins across other segments, explains the analyst.

Management noted a favourable 2H skew for underlying earnings, without producing any numbers.

Ord Minnett upgrades its rating to Accumulate from Hold and maintains its $3.50 target price.

See also IPL downgrade.

POINTSBET HOLDINGS LIMITED ((PBH)) was upgraded to Buy from Hold by Ord Minnett. B/H/S: 2/0/0

Ord Minnett bypasses an Accumulate rating and upgrades PointsBet Holdings to Buy from Hold after the ‘”bold call” to sell its US business. The target is also raised to $1.70 from $1.45.

The company has entered into a binding agreement with Fanatics Betting and Gaming to sell its US operations for US$150m though PointsBet will need to fund up to -US$21m up to transaction close after the late-June shareholder meeting.

The net proceeds will likely be distributed to shareholders, along with excess capital, in two tranches, explains the broker. It’s felt around $30-40m will remain on the balance sheet of the remaining Australian and Canadian business.

PREMIER INVESTMENTS LIMITED ((PMV)) was upgraded to Lighten from Sell by Ord Minnett. B/H/S: 3/2/0

As the share price of Premier Investments has moved through Ord Minnett’s trigger level, its rating is upgraded to Lighten from Sell.

The broker’s target price remains at $19.

SERKO LIMITED ((SKO)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 3/0/0

After some trepidation, the market should read Serko’s FY23 result as a quality beat for the Booking.com JV, Macquarie suggests. The final instalment of development workaround the hotel shop experience is scheduled to go online in the September quarter.

Investors will likely also take comfort in healthy cash balance/burn and cash flow breakeven within reach.

While slower than the broker had originally anticipated, the result provided some comfort that the JV funnel is working well, leading to an upgrade to Outperform from Neutral.

Target rises 32% to NZ$3.51.

TECHNOLOGY ONE LIMITED ((TNE)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/4/0

Bell Potter upgrades Technology One’s rating to Buy from Hold ahead of the company’s interim FY23 results on May 23, expecting a good result (including a 10% increase in the interim dividend to 4.62c).

The broker’s eye is peeled to total annual recurring revenue, which it expects will have grown 21% to $350m, putting it on track to meet its $500m target by 2026 (although Bell Potter now believes it will meet that goal by the end of FY25) and expects management to guide to such by the end of 2023.

Target price rises 6% to $17.

TYRO PAYMENTS LIMITED ((TYR)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 4/1/0

Tyro Payments has upgraded FY23 guidance for the third time, with each upgrade derived from a different source (costs, volumes, margin/pricing), Macquarie notes. FY23 earnings guidance is up 8% compared to the latest update and materially above initial guidance.

Increased pricing increases churn risk, the broker warns, however the competitive environment has likely eased more recently with less funding for start-ups looking to take share.

Upgrades demonstrate evidence of Tyro effectively controlling the controllables, which gives Macquarie more confidence on the ability to manage a weaker consumer demand environment. Upgrade to Outperform, target rises to $1.80 from $1.65.

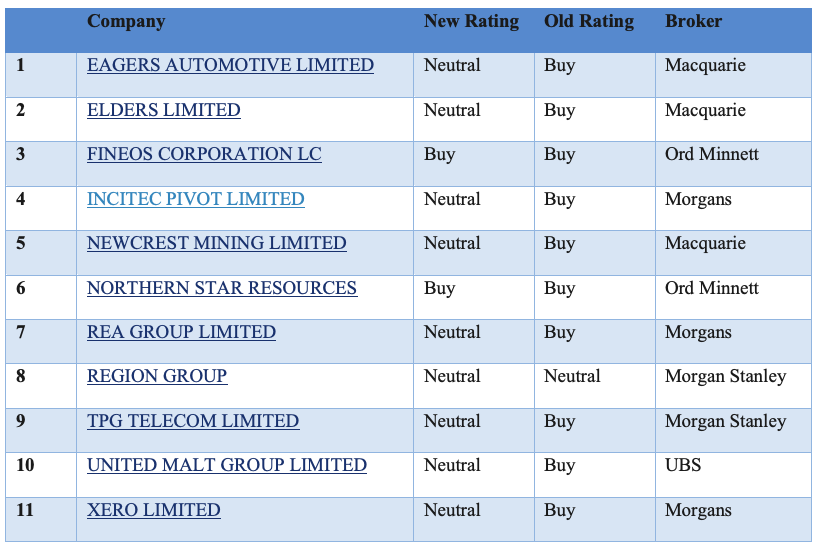

In the not so good books

Downgrades

EAGERS AUTOMOTIVE LIMITED ((APE)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 4/3/0

Macquarie welcomes the FY23 revenue guidance of $9.5-10bn, as it was ahead of expectations, although recent delays at ports and subdued Toyota volumes present some downside risk.

The broker suspects achieving guidance will be contingent on total market volumes accelerating in the second half.

Although BYD Co could provide material upside for Eagers Automotive through the joint venture, longer term aspirations are likely to face competition, the broker asserts. Rating is downgraded to Neutral from Outperform and the target lowered to $15.00 from $15.50.

ELDERS LIMITED ((ELD)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/4/0

Elders reported first half underlying profit of $51m, below Macquarie’s $56m forecast. The company expects FY23 earnings to be $180-200m, with the midpoint -18% below FY22 but 14% above FY21 and -13% below the broker’s prior forecast.

The first half saw a volatile agricultural backdrop impacted by softened livestock trading conditions, weaker crop input prices and unseasonably wet weather.

Operating cashflow was weak reflecting seasonal inventory build which is expected to unwind in the second half. The broker has changed analysts and downgraded to Neutral from Outperform, warning of possible El Nino development and uncertainty over a new CEO.

Target falls to $7.77 from $14.35.

FINEOS CORPORATION HOLDINGS PLC ((FCL)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 3/1/0

As the share price of Fineos Corp has moved through the trigger level Ord Minnett downgrades to Accumulate from Buy. Target is $3.40.

INCITEC PIVOT LIMITED ((IPL)) was downgraded to Hold from Add by Morgans. B/H/S: 3/3/0

Incitec Pivot’s 1H result materially missed consensus expectations largely due to a significant fall in fertiliser prices over recent months, which Morgans thinks will likely decline further in the near term.

Corporate costs were also materially higher than expected and interest costs rose. The broker lowers its target to $3.29 from $4.55 and the rating is downgraded to Hold from Add.

The analysts also list other 1H headwinds including third party gas supply issues at Phosphate Hill, the closure of Gibson Island in January, unfavourable currency hedging on fertiliser sales and extreme weather also impacted Dyno North American explosives volumes.

See also IPL upgrade.

NEWCREST MINING LIMITED ((NCM)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/5/0

Macquarie expects the deal for Newcrest Mining shareholders to receive 0.4 Newmont shares and a $1.10 dividend will be completed and thus drops its target to $30 from $33 to roughly match the offer (which remains subject to Newmont share price movement) and pulls back to Neutral from Outperform.

Newcrest anticipates a shareholder vote will be held in September or October 2023 with implementation of the scheme expected by the end of the year.

NORTHERN STAR RESOURCES LIMITED ((NST)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 4/1/1

Ord Minnett slightly reduces estimates for FY23-25 earnings, noting the March quarter result was softer than expected. Still, Northern Star Resources remains the pick among large gold stocks when considering growth, balance sheet, capital management and valuation.

The KCGM mill optimisation, due by the end of the year, is considered a key catalyst. Ord Minnett retains a target of $14.20 but reduces the rating to Accumulate from Buy.

REA GROUP LIMITED ((REA)) was downgraded to Hold from Add by Morgans. B/H/S: 1/2/1

Following a 3Q trading update by REA Group, Morgans raises its target to $145 from $133 and downgrades its rating to Hold from Add on valuation. The update indicated a tougher quarter, particularly in terms of listings volumes, which remain subdued.

The new target also takes into account a valuation roll forward and higher medium-term volume growth, as the analyst expects volumes will begin to recover from Q2 FY24.

The broker also highlights solid revenue growth for REA India, which increased by 63% on the previous corresponding period.

REGION GROUP ((RGN)) was downgraded to Equal-weight from Overweight by Morgan Stanley. B/H/S: 1/4/0

Morgan Stanley estimates asset level expense for a typical mall will escalate by around 8% next year, due to big increases for insurance, energy, and statutory charges. Administration, security, cleaning, and repairs could also experience 4-5% cost escalation.

The analyst points out landlords generally pass through 30-50% of mall operating expenses to the occupiers.

While the likes of Scentre Group ((SCG)) and Vicinity Centres ((VCX)) recover around 50% of costs from occupiers, the broker notes Region Group only recovers around 30%.

Anchor tenants, who dominate Region’s neighbourhood centres, don’t pay cost recoveries, explains Morgan Stanley. The rating is downgraded to Equal-weight from Overweight and the target falls to $2.70 from $2.95.

TPG TELECOM LIMITED ((TPG)) was downgraded to Equal-weight from Overweight by Morgan Stanley. B/H/S: 3/2/0

Morgan Stanley questions whether the market is under-estimating the displacement of legacy telco revenue by cloud-based software.

The broker suspects a shift in wallet share is occurring towards software vendors from large telcos, especially in fixed-line enterprise products, and as a result envisages earnings headwinds for TPG Telecom.

The broker makes reductions to EBITDA estimates of -2-7% for 2023-24. Rating is downgraded to Equal-weight from Overweight and the target lowered to $5.60 from $7.70.

UNITED MALT GROUP LIMITED ((UMG)) was downgraded to Neutral from Buy by UBS. B/H/S: 0/4/0

United Malt’s first half earnings were slightly ahead of recently downgraded guidance while FY23 guidance was reaffirmed. This was underpinned by improved demand and margins, although UBS is conservative and forecasts the lower end of the EBITDA range of $140-160m.

A strong recovery is expected in FY24. The broker downgrades to Neutral from Buy after lifting the target to Malteries Soufflet’s indicative bid price of $5.00, from $3.80.

XERO LIMITED ((XRO)) was downgraded to Hold from Add by Morgans. B/H/S: 3/2/1

Morgans assesses Xero displayed financial resilience over FY23 and expects this to continue into FY24. A “good” FY23 result revealed year-on-year revenue and subscriber growth of 28% and 14%, respectively, and 8% higher average revenue per user (ARPU).

A highlight for the analyst was an impressive rise in free cash flow to around NZ$102m.

Management didn’t provide any subscriber growth targets though expects to deliver revenue growth from a combination of subscriber and ARPU growth.

After an around 20% share price rally in the last few months, Morgans lowers its rating to Hold from Add, while the target rises to $101 from $97.

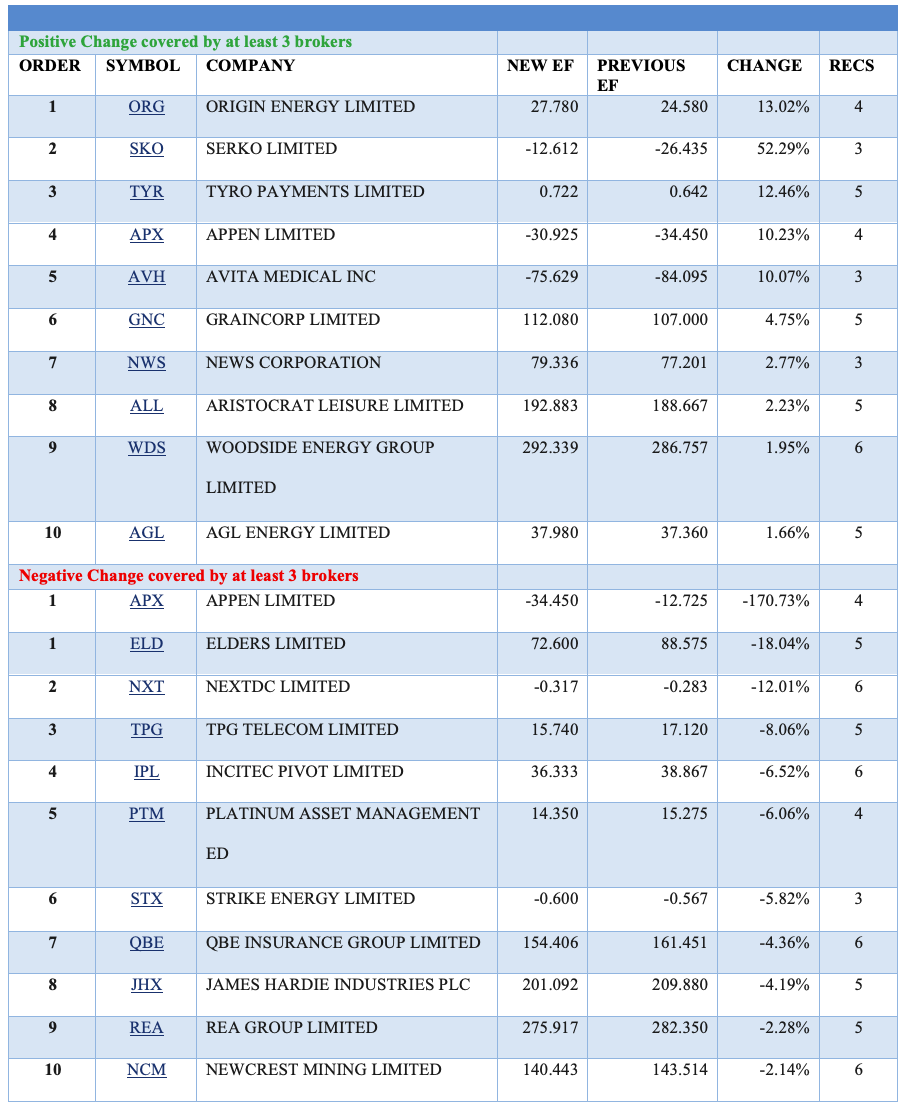

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.