The average target price for Flight Centre Travel in the database increased by over 10% to $21.06 from $19.00 last week.

Morgans not only raised its target by around 37% to $26.25, but also upgraded its rating for Flight Centre to Add from Hold after the company slightly raised FY23 underlying earnings guidance to a level above the consensus estimate. It’s felt the guidance is conservative and the company is on the verge of an earnings upgrade cycle that may continue for the next few years.

Volumes continue to recover strongly, observed the analyst, with March delivering record post-covid total transaction value. Also, the group’s cost margin is now at an historic low, partly reflecting permanent and structural cost base changes, explained Morgans.

Citi also upgraded its target by around 10% and noted the operating environment is on the improve and international air travel is now 82% of pre-pandemic levels in Australia.

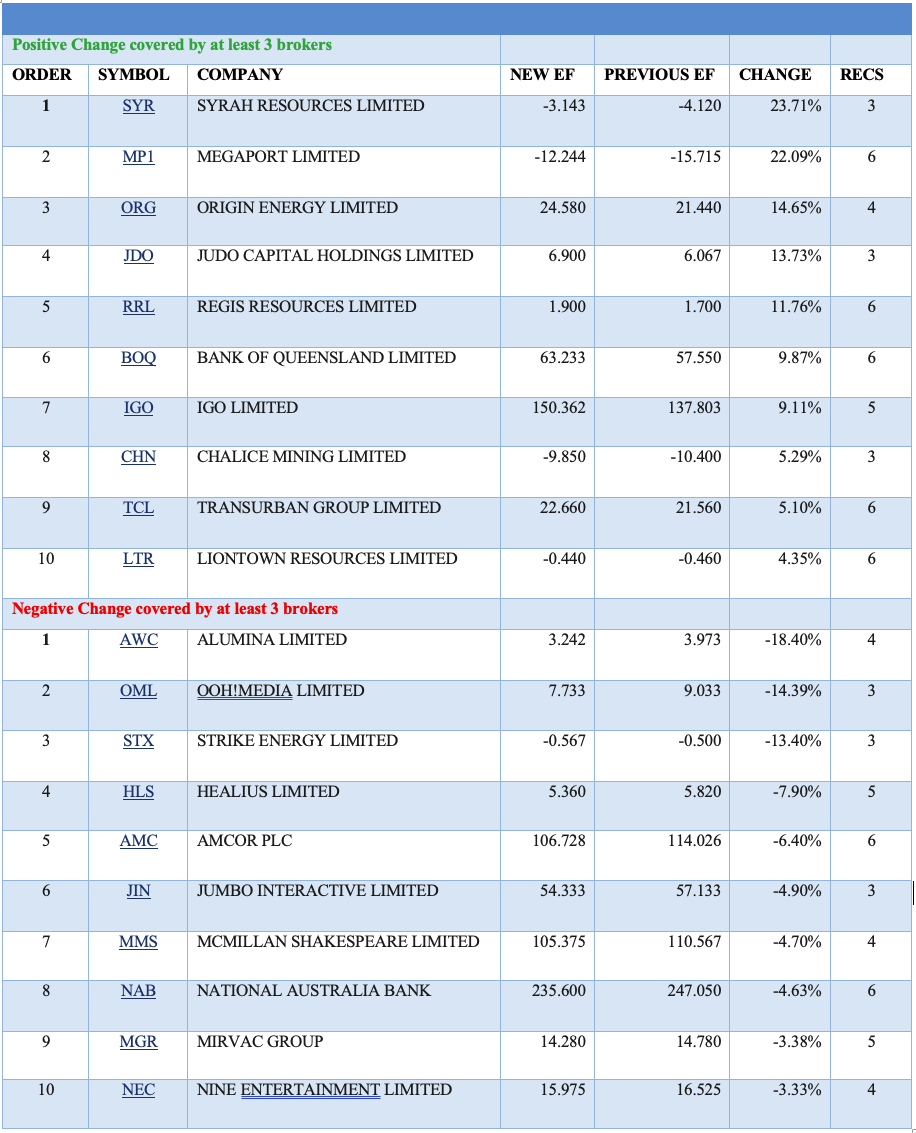

On the flipside, oOh!media received the only material fall in average target price in FNArena’s database following first quarter results, falling by around -12% to $1.83. Ord Minnett noted good value on offer and upgraded its rating to Accumulate from Hold.

The analyst pointed out June quarter growth may still end up being positive, but the main concern is renewal risk for concessions, as about 32% of revenue for the group is attached to concessions that are set to expire this year.

Macquarie retained its Outperform rating for oOh!media given the outdoor advertising industry is well-positioned to gain share from other media formats, and the share price movement had already reflected a negative earnings outcome. It was noted the company is one of the cheapest globally of the listed operators in this space.

Citi expects it will be a tough year for Alumina Ltd and downgraded its rating to Sell from Neutral. An earnings loss of -US$42m is now expected in 2023 due to production/grade issues, rising costs and lower alumina pricing. The broker’s target was lowered to $1.50 from $1.55.

Alcoa, which released first quarter results back on April 20, is anticipating impacts from lower bauxite quality into 2024. On 15 March, Alcoa announced the Portland smelter would be curtailed to 75% of capacity from 95% given operational instability.

Looking at earnings upgrades, Syrah Resources had the greatest percentage lift in the FNArena database last week after Shaw and Partners decided to initiate coverage with higher earnings forecasts than the existing average from Macquarie and Morgan Stanley in the database.

Outside of China, Syrah Resources is the only vertically integrated, natural graphite, active anode material producer of scale, points out the broker. The company has Tesla as a foundation customer.

A large active anode material facility in Louisiana is currently under construction. At the end of March Syrah had cash of US$84m and will be drawing on a US Department of Energy loan and grant, supplied under the US Clean Energy Inflation Reduction Act, to fund the capital required.

The broker begins with a Buy recommendation and 12-month price target of $1.40, with the shares closing out last week at $1.015.

Megaport was next after five brokers reviewed soft March quarter results from the prior week, but management upgraded earnings guidance to nearly double consensus forecasts.

Morgans noted achievement of guidance should be within management’s control, as it’s primarily based on lower operating costs. It’s thought the business will become free cash flow positive in FY24.

Morgan Stanley felt new guidance de-risks investor concerns around management changes and ongoing cash burn, while Macquarie was impressed the business was able to weather a softer sales period without raising capital.

At the beginning of last week, Origin Energy upgraded its FY23 Energy Markets earnings outlook by over 60%, with stronger earnings from Octopus Energy a key driver, according to UBS.

The company is also a beneficiary from the $125/t coal price cap imposed by the NSW government, with the broker forecasting additional earnings of $155m from government compensation for coal bought at prices above the cap from December 23 last year.

UBS is currently under a rating restriction for Origin but raised its earnings forecasts materially to reflect a re-rate to Octopus Energy and cheaper coal prices.

Earnings forecasts by brokers in the FNArena database also rose last week for Judo Capital. Profit before tax in the third quarter exceeded Overweight-rated Morgan Stanley’s forecast by more than 30%, and management guidance for the second half underlying margin was upgraded by 20 basis points.

However, longer-term margin guidance was unchanged due to “significant” deposit competition and higher costs for new term deposits, explained the broker.

Macquarie (Outperform) remained concerned that large swings in the margin and significant volume growth are required to meet cost targets and reduced its target to $1.60 from $1.70. Despite the headwinds to interest margins and asset quality through FY24, Citi suggested the stock is inexpensive and retained its Buy rating and $1.65 target.

Regis Resources also received a more than 11% lift to its average earnings forecast by brokers in the database following third quarter production results. All-in sustaining costs were 8% better than Macquarie had expected.

A strong performance at Duketon South offset softer results at Duketon North (bad weather) and Tropicana, explained the analyst. Tropicana was impacted by fleet availability and productivity issues, which have now been rectified.

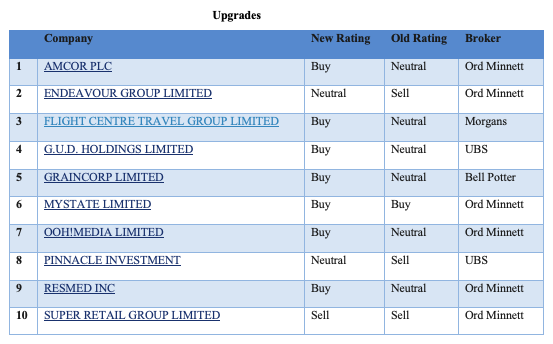

In the good books

AMCOR PLC ((AMC)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 1/4/1

Ord Minnett reduces FY23 earnings forecast by -10% for Amcor following the March quarter update. The update was materially weaker than expected as softer consumer demand affected volumes.

The main concern for the broker entering FY24 is the impact of continued volume weakness without a corresponding decline in raw material costs.

Accordingly, margin assumptions are revised lower for FY24 and FY25 for flexibles and rigids. Rating is upgraded to Accumulate from Hold because of the share price fall. Target is reduced to $16 from $17.

ENDEAVOUR GROUP LIMITED ((EDV)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 2/2/1

The share price of Endeavour Group has moved through the trigger level and Ord Minnett upgrades to Hold from Lighten. Target is $6.40.

FLIGHT CENTRE TRAVEL GROUP LIMITED ((FLT)) was upgraded to Add from Hold by Morgans. B/H/S: 2/2/0

Flight Centre Travel has slightly lifted FY23 underlying earnings (EBITDA) guidance to a level above the consensus estimate. Morgans upgrades its rating to Add from Hold and raises its target to $26.25 from $19.11.

The broker feels guidance is conservative and believes an earnings upgrade cycle is imminent, and may continue for the next few years.

Volumes continue to recover strongly, observes the analyst, with March delivering record post-covid total transaction value (TTV). Also, the group cost margin is now at an historic low, partly reflecting permanent and structural cost base changes.

Management is now targeting a 2% profit margin for FY25, yet the consensus forecast is for 1.5%, notes Morgans.

GRAINCORP LIMITED ((GNC)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 3/2/0

Bell Potter points out the GrainCorp share price has lost -35% over the last year (as El Nino rears its head) and feels the current level ignores upcoming likely cash releases.

The broker’s rating is upgraded to Buy from Hold, despite the prospect El Nino events can undermine near term earnings (i.e., FY24), and the $8.00 target is unchanged.

G.U.D. HOLDINGS LIMITED ((GUD)) was upgraded to Buy from Neutral by UBS. B/H/S: 4/0/0

UBS upgrades to G.U.D. Holdings to Buy from Neutral and raises the target price to $10.50 from $8.80, believing risks to earnings are subsiding, while also observing strength in the company’s listed peers.

UBS says industry feedback suggests core demand remains strong and margins have held; order books remain elevated; and gearing is improving.

The broker considers gearing to be the key to a re-rate with peers, and expects easing costs should offset any potential weakness in volumes.

EPS forecasts are steady in FY23; and rise 2% in FY24; and 3% in FY25.

MYSTATE LIMITED ((MYS)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 1/0/0

As the share price for Mystate has moved through Ord Minnett’s trigger level the rating is upgraded to Buy from Accumulate. Target is $5.20.

OOH!MEDIA LIMITED ((OML)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 2/1/0

As oOh!media has moved through Ord Minnett’s trigger level the rating is upgraded to Accumulate from Hold. Target is $1.50.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED ((PNI)) was upgraded to Neutral from Sell by UBS. B/H/S: 2/2/0

Pinnacle Investment Management’s March-quarter trading update outpaced UBS funds-under-management (FUM) forecast by 4%, thanks to strong share markets and improved net flows.

Net inflows rose $1.9bn, compared with UBS’s forecast $0.5bn; a figure struck on lower average fee margins.

The company’s Metrics business will assume Pinnacle’s 35% associate share in Payright (and the latter’s losses), which is likely to weigh on an otherwise good result, says UBS.

EPS forecasts rise 5% in FY23; and 6% in FY24 to reflect strong March-quarter FUM and flows, and an expectation of higher performance fees.

Rating upgraded to Neutral from Sell, after the company’s sharp -20% share-price retreat and the solid March quarter result. Target price rises to $8.80 from $8.60.

RESMED INC ((RMD)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 4/1/0

A key driver of Resmed’s strong March Q sales was an improving supply environment, Ord Minnett suggests. The company was able to provide unrestrained access to its cloud-connected device in North America, and improved access globally.

This led to ResMed recording its highest quarter of new patient set-ups. The clear negative in the result was a contraction in gross margin from the prior quarter.

This was mainly due to the sales-mix shifting towards lower margin devices and higher component costs offset by higher prices, the broker notes. But management has called the bottom for margins.

Upgrade to Accumulate from Hold, fair value rises to $39 from $35.

SUPER RETAIL GROUP LIMITED ((SUL)) was upgraded to Lighten from Sell by Ord Minnett. B/H/S: 2/2/0

Super Retail sales growth slowed to the low single digits in the second half of April, Ord Minnett observes. Momentum is expected to continue easing while competition intensifies in the short term.

In the outdoor category, which accounts for around 20% of estimated group earnings, competition remains high and price cutting is affecting profits.

At current prices, the shares screen significantly overvalued and Ord Minnett believes the market under appreciates the risks, especially monetary policy tightening that is designed to curtail consumption.

The broker raises the rating to Lighten from Sell because of the share price movement and retains a $9.50 target.

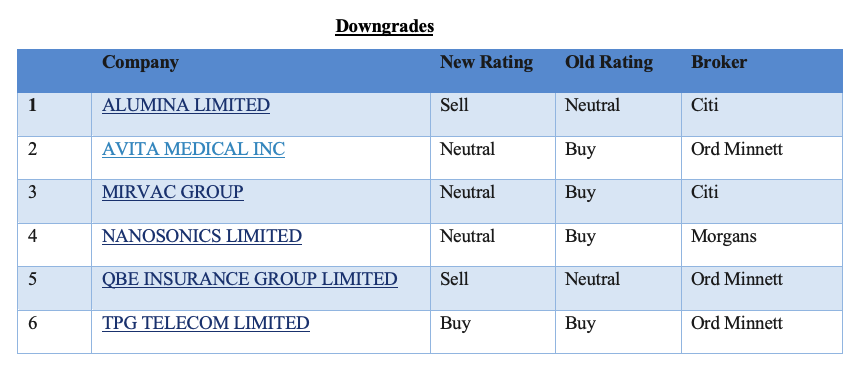

In the not so good books

AVITA MEDICAL INC ((AVH)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 2/1/0

Ord Minnett downgrades Avita Medical to Hold from Accumulate, after the share price rose above the broker’s trigger level. Target price is steady at $5.60.

The broker expects the company to be free cash flow positive by FY26.

ALUMINA LIMITED ((AWC)) was downgraded to Sell from Neutral by Citi. B/H/S: 1/0/2

Citi now expects Alumina Ltd will deliver a loss in 2023 of -US$42m because of production/grade issues, rising costs and lower prices.

The broker downgrades to Sell from Neutral and lowers the target to $1.50 from $1.55. The alumina price forecasts for 2023 is reduced to US$353/t from US$360/t.

MIRVAC GROUP ((MGR)) was downgraded to Neutral from Buy by Citi. B/H/S: 2/3/0

Mirvac Group has unexpectedly downgraded FY23 earnings guidance by -5% driven by lower residential settlements and delayed recognition of industrial development profits (now in FY24).

On the positive side, Citi notes, residential enquiries are rising, Mirvac has made good progress on capital partnering and asset sales with almost all assets identified for sale at the beginning of FY23 now close to being sold.

Looking ahead, the lower earnings base puts Mirvac in a better position to grow earnings in FY24, the broker suggests, and proceeds from asset sales will help fund the development pipeline. However, Mirvac has a large office portfolio, which may cap upside.

Downgrade to Neutral from Buy. Target rises to $2.50 from $2.40.

NANOSONICS LIMITED ((NAN)) was downgraded to Hold from Add by Morgans. B/H/S: 0/1/2

For the sixth time in around six months, Morgans oscillates its rating between Hold and Buy for Nanosonics.

In that time, the share price has trended upwards from around $4.00 to yesterday’s close of $5.47, with periodic pullbacks in price.

The analyst has, on his own assessment, been timing these pullbacks very well and now downgrades to Hold from Add. The aim is to await a share price closer to $5.00 before reversing the rating again.

The broker’s forecasts and $5.24 target price are unchanged.

QBE INSURANCE GROUP LIMITED ((QBE)) was downgraded to Lighten from Hold by Ord Minnett. B/H/S: 5/0/0

As the share price of QBE Insurance has moved through the trigger level Ord Minnett downgrades to Lighten from Hold. Target is $13.

The broker expects higher interest rates will benefit the business in the medium term although the competitive landscape means some of the upside will be eroded through competition.

TPG TELECOM LIMITED ((TPG)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 4/1/0

As the share price of TPG Telecom has moved through the trigger level Ord Minnett downgrades to Accumulate from Buy. Target is $7.40.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.