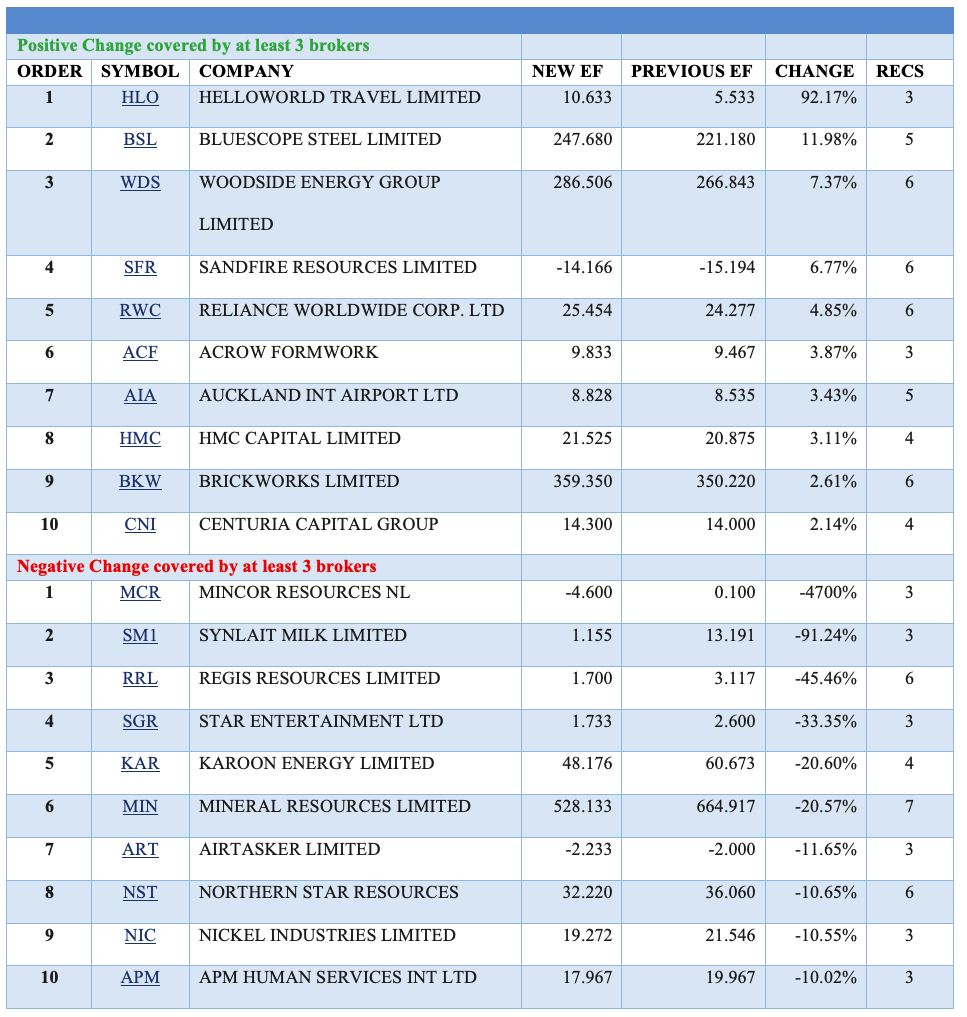

The number of companies receiving material downgrades to forecast earnings far outweighed significant upgrades.

Twelve-month average target prices also suffered to a greater extent, led by a -25% fall for Synlait Milk’s target in the wake of a downgrade to profit guidance.

Management is now expecting FY23 profit in the range of -$5m to $5m, down from the $15-25m range set on March 17 when another material downgrade occurred. Management attributed the current downgrade to lesser demand for Advanced Nutrition, as well as additional financing and supply chain costs.

While Bell Potter observed the stock is now in a three-year earnings downgrade cycle and not without risk, material operating leverage beyond FY23 is achievable.

The broker noted such leverage would require delivery of acceptable returns on the new Pokeno nutritionals customer, a successful navigation by a2Milk Co of the new registration process for China label infant milk formula products, and the addition of new base powder customers.

Operating risks and debt remain high, likely limiting short-term gains, though UBS highlighted the company’s long-run pre-tax return on investment capital of more than 12%, and retained its Buy rating, while also lowering its target to NZ$3.95 from NZ$4.30.

Brokers also reduced the average target price for Airtasker after a third quarter trading update missed expectations. Morgan Stanley noted the company remains unprofitable and free cash flow-negative and doesn’t expect a turnaround for these metrics until the end of FY25.

Management announced a cost-out program, which includes a -20% reduction in headcount, along with the future exit of non-core businesses acquired as part of the OneFlare transaction.

While Buy-rated Morgans assessed a resilient third quarter performance by Airtasker in the current macroeconomic backdrop, core gross marketplace volume was weaker than expected. The broker’s target fell to 60c from 80c partly owing to the use of a lower multiple by the analyst due to the ongoing de-rating of peers and the sector.

While previewing third quarter results for News Corp, Macquarie slashed its target to $23 from $34, thereby dragging down the average target in the FNArena database by just over -11%, to $28.67.

The company experienced a softer advertising market performance in the second quarter, which the analyst now expects will worsen. It’s anticipated advertising market facing businesses across Dow Jones, News Media and subscription video services will record ad revenue declines of between -10-15% year-on-year.

While a breakup scenario could be a positive for the company, the broker felt earnings will continue to negatively weigh on the share price in the near term.

Both Synlait Milk (second) and Airtasker (seventh) also appeared on the list of companies that experienced the largest percentage falls in forecast earnings by brokers last week.

First position was attained by Mincor Resources with a very large percentage fall in forecast earnings, somewhat exaggerated by the small numbers involved.

Nickel production in the March quarter was below Bell Potter’s forecast as a result of previously flagged off-specification ore production and lower metallurgical recoveries.

The board has unanimously recommended shareholders accept the takeover offer by Wyloo Metals ((WYL)) in the absence of a superior proposal, in response to risks from ongoing ramp-up issues. A competing offer appears increasingly unlikely to the broker given Wyloo has acquired a controlling interest (51.2%) as of April 21.

Earnings forecasts were also lowered by brokers for Regis Resources. While group production and lower guidance were pre-released, third quarter results provided details on the operational issues which impacted all sites.

Morgan Stanley noted production suffered during the quarter amid challenges from the weather, as well as limited fleet availability and productivity problems.

However, the company’s average target price actually rose, and Morgans even raised its rating to Add from Hold for a number of reasons including a positive outlook for production in the fourth quarter. There’s also thought to be potential for large cap gold miner takeovers/consolidation.

Star Entertainment was next after a surprise downgrade to FY23 earnings guidance. This came after a deterioration in the revenue environment which has created balance sheet risks, causing Macquarie to downgrade its rating to Neutral from Outperform and lower its target to $1.35 from $1.65.

Management outlined cost cutting initiatives along with a strategic review of Star Sydney and the balance sheet. Macquarie feels the company should be able to negotiate debt covenant relief, which likely only relates to interest coverage.

Karoon Energy and Mineral Resources also feature in the earnings downgrade table below. Please refer to the Broker Call Report (or Stock Analysis) on the FNArena website for further details.

On the flipside, Helloworld Travel was the outstanding winner last week, measured by percentage increase in both average target price and forecast earnings, after releasing third quarter results.

BlueScope Steel received the second largest percentage increase in forecast earnings last week, after a 43% upgrade to earnings guidance.

According to Ord Minnett, new guidance is mainly being driven by improved steel prices and hot rolled coil spreads in the US, where the company’s North Star mini mill operates.

BlueScope’s second half should also benefit, according to the broker, from improved realised margins in the North American steel coated products businesses, and stronger realised prices in the Australian Steel Products business.

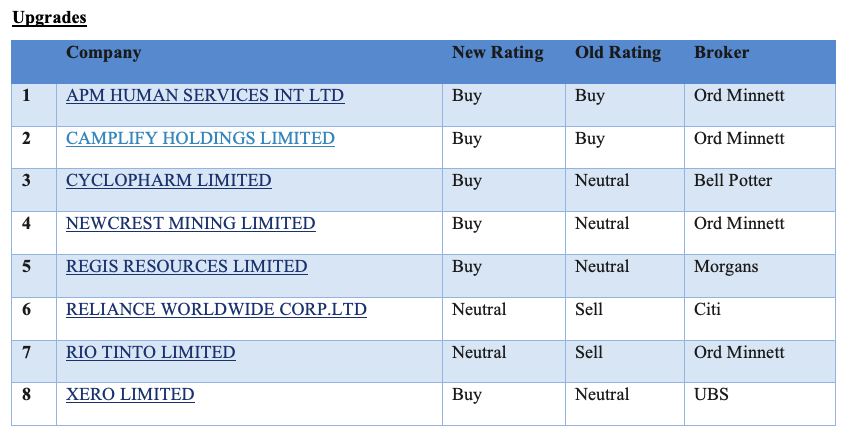

In the good books

APM HUMAN SERVICES INTERNATIONAL LIMITED ((APM)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 3/0/0

Ord Minnett upgrades its rating for APM Human Services International on valuation after a steady recent share price decline.

The broker leaves its forecasts unchanged and retains its $2.80 target price.

CAMPLIFY HOLDINGS LIMITED ((CHL)) was upgraded to Buy from Accumulate by Ord Minnett. B/H/S: 2/0/0

Camplify Holdings’ March-quarter revenue sharply outpaced Ord Minnett’s forecasts after rising 204% thanks to strong average booking values.

The broker sheets this back to strong category growth post covid, market dominance, and a rising preference for cost-effective holidays.

The broker says the company is building a strong presence in the peer-to-peer RV rental segment, and appreciates the company’s positive cash flow and strong balance sheet. EPS forecasts rise across the board.

Rating rises to Buy from Accumulate. Target price rises to $2.60 from $2.11.

CYCLOPHARM LIMITED ((CYC)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/0/0

The US Federal Drug Administration (FDA) has advised Cyclopharm that its response is complete and that the company will be eligible for review; and has set a potential approval date of September 29, 2023.

Bell Potter estimates the market for Cyclopharm’s Technegas at US$180m. The broker sounds miffed about the last approval delay, which the FDA claimed was based on a lack of safety and efficacy data, while Cyclopharm pointed out that the Complete Response Letter did not relate to such, not to mention the tens of thousands of doses already being delivered to patients outside the US each year, says the broker.

Meanwhile, Bell Potter claims the nuclear medicine community in the US is champing at the bit to get started and observes the company is well capitalised to start the launch.

Rating upgraded to Buy from Hold. Target price rises to $2.80 from $1.70.

NEWCREST MINING LIMITED ((NCM)) was upgraded to Accumulate from Hold by Ord Minnett. B/H/S: 2/4/0

Ord Minnett notes commodity prices have generally been less volatile so far in 2023. In line with a higher indicative offer for Newcrest Mining from Newmont, the broker raises its target price to $33 and as a result upgrades to Accumulate from Hold.

See also NCM downgrade.

RIO TINTO LIMITED ((RIO)) was upgraded to Hold from Lighten by Ord Minnett. B/H/S: 1/4/1

Rio Tinto’s March-quarter result appears to have pleased Ord Minnett, thanks to strong iron-ore shipments. The broker observes that the company’s share of Pilbara iron ore shipments grew 16% on the previous March quarter thanks to higher production and inventory drawdowns.

Ord Minnett now suspects its forecasts may be a tad conservative should production remain elevated but holds its ground for now, expecting a decline in 2023 copper production and awaiting further signs on iron-ore demand.

Meanwhile, aluminium, alumina and bauxite production missed the broker’s forecasts. Rating upgraded to Hold from Lighten. Target price is steady at $107.

REGIS RESOURCES LIMITED ((RRL)) was upgraded to Add from Hold by Morgans. B/H/S: 3/2/1

Despite a soft 3Q for Regis Resources with production and costs missing Morgans forecasts, the broker raises its rating to Add from hold and increases its target to $2.51 from $1.91.

These changes are due to a positive outlook for 4Q production, approval at the McPhillamys Gold project and the potential for large cap gold miner takeovers/consolidation, explains the analyst.

The McPhillamys project is risked to 40% from 20% by the broker as a result of regulatory approval by NSW’s Independent Planning Commission.

Management revised FY23 guidance with production expected between 450koz-470koz at an all-in sustaining cost (AISC) of $1,795/oz – $1,845/oz.

RELIANCE WORLDWIDE CORP. LIMITED ((RWC)) was upgraded to Neutral from Sell by Citi. B/H/S: 3/3/0

On Citi’s calculations, Reliance Worldwide’s March quarter is tracking over 10% higher than consensus second half expectations.

Growth above the market took market share to record levels and the broker was surprised at the muted share price response to the update.

After a period of underperformance, Citi upgrades to Neutral from Sell. Near term the broker sees a strong combination of sales momentum and declining input costs.

But Citi is cautious in capitalising these historically high levels of above market growth, as there is currently limited clarity on drivers or sustainability. Target rises to $4.10 from $3.00.

XERO LIMITED ((XRO)) was upgraded to Buy from Neutral by UBS. B/H/S: 4/1/1

UBS envisages scope for cash flow to surprise over the medium term.

The broker suspects the market is being too conservative and forecasts underlying free cash flow growing to $339m by FY26. Options should emerge in North America from the targeted strategy and open banking catalysts.

Growth in the core business is expected to continue, despite efficiency initiatives. UBS upgrades Australasian net subscriber additions from an average of 89,000 per annum to 246,000 over FY23-26.

Rating is upgraded to Buy from Neutral and the target raised to $109.00 from $90.85.

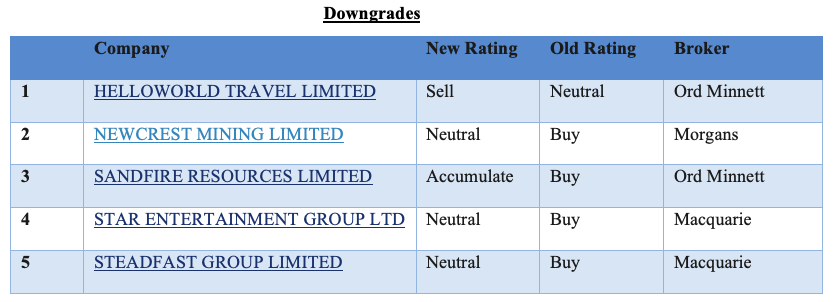

In the not so good books

HELLOWORLD TRAVEL LIMITED ((HLO)) was downgraded to Lighten from Hold by Ord Minnett. B/H/S: 2/0/0

Ord Minnett highlights a 3Q revenue margin of 7.7% and an earnings (EBITDA) margin of 30.4%, which are the highest achieved by Helloworld Travel, to the best of the broker’s knowledge.

What’s more, the earnings margin is the highest the analyst has seen globally for a mainly business-to-consumer bricks and mortar travel agency business.

Management has, again, upgraded FY23 earnings guidance to $38-42m from $28-32m.

Ord Minnett raises its target to $2.62 from $2.08 and lowers its rating to Lighten from Hold after a 58% share price rally in the last three months.

NEWCREST MINING LIMITED ((NCM)) was downgraded to Hold from Add by Morgans. B/H/S: 2/4/0

Morgans assesses Newcrest Mining is on-track to deliver FY23 guidance after posting steady gold and copper production during the 3Q.

The broker believes the Newcrest share price will continue to trade at a discount to the Newmont takeover price to reflect significant time to implementation.

The rating falls to Hold from Add on valuation, while the target rises to $25.80 from $25.70.

See also NCM upgrade.

STEADFAST GROUP LIMITED ((SDF)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 1/2/0

Key findings by Macquarie in an analysis of the Australian broker M&A market are the doubling of resourcing for insurance brokers over the last three years, while three new competitors have also entered the local market.

The broker undertook this analysis as the M&A pipeline has been a major contributor to EPS growth for Australian listed insurance brokers over recent years. It was concluded there is minimal accretion for the brokers with acquisition multiples at current levels.

Given lower returns, the analyst finds having public targets for the Trapped Capital initiative may not be in Steadfast Group’s best interest over the medium term.

The initiative provides the company’s network brokers the opportunity to unlock trapped capital by partial sale to Steadfast.

The rating for Steadfast Group is downgraded to Neutral from Outperform and the target falls to $6.30 from $6.50.

SANDFIRE RESOURCES LIMITED ((SFR)) was downgraded to Accumulate from Buy by Ord Minnett. B/H/S: 3/3/0

Stronger third quarter production and costs at DeGrussa offset lower production and higher costs at the Matsa operations, explains Ord Minnett, which raises its target price for Sandfire Resources to $7.50 from $7.45.

Management increased FY23 guidance for zinc by 7%, while CI costs and sustaining capital spend guidance was adjusted by 3% and -6%, respectively.

The broker’s rating falls to Accumulate from Buy after a significant share price rally since March 10, and due to standard commissioning risk at Motheo. Despite this downgrade, the analyst still sees upside on exploration upside at both Matsa and Motheo.

STAR ENTERTAINMENT GROUP LIMITED ((SGR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 2/1/0

A deterioration in Star Entertainment’s revenue has caused Macquarie to re-evaluate its numbers. The broker remains comfortable with the leverage ratios and expects the company can negotiate covenant relief.

The company has provided a trading update and outlined cost cutting initiatives along with a strategic review of Star Sydney and the balance sheet.

The “ultimate debate”, in the broker’s view, is around the asset value of the integrated resorts. Macquarie does not envisage enough margin of safety and downgrades to Neutral from Outperform. Target is lowered to $1.35 from $1.65.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.