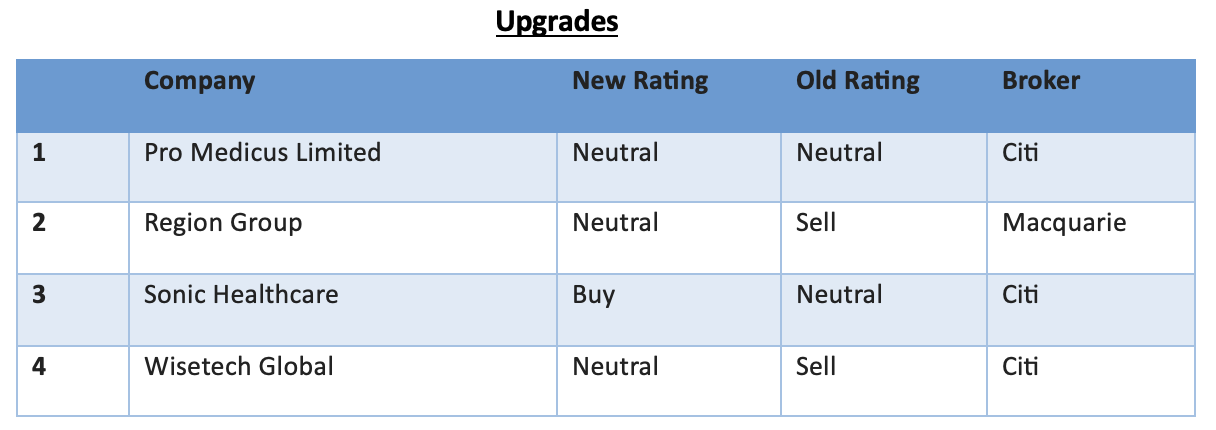

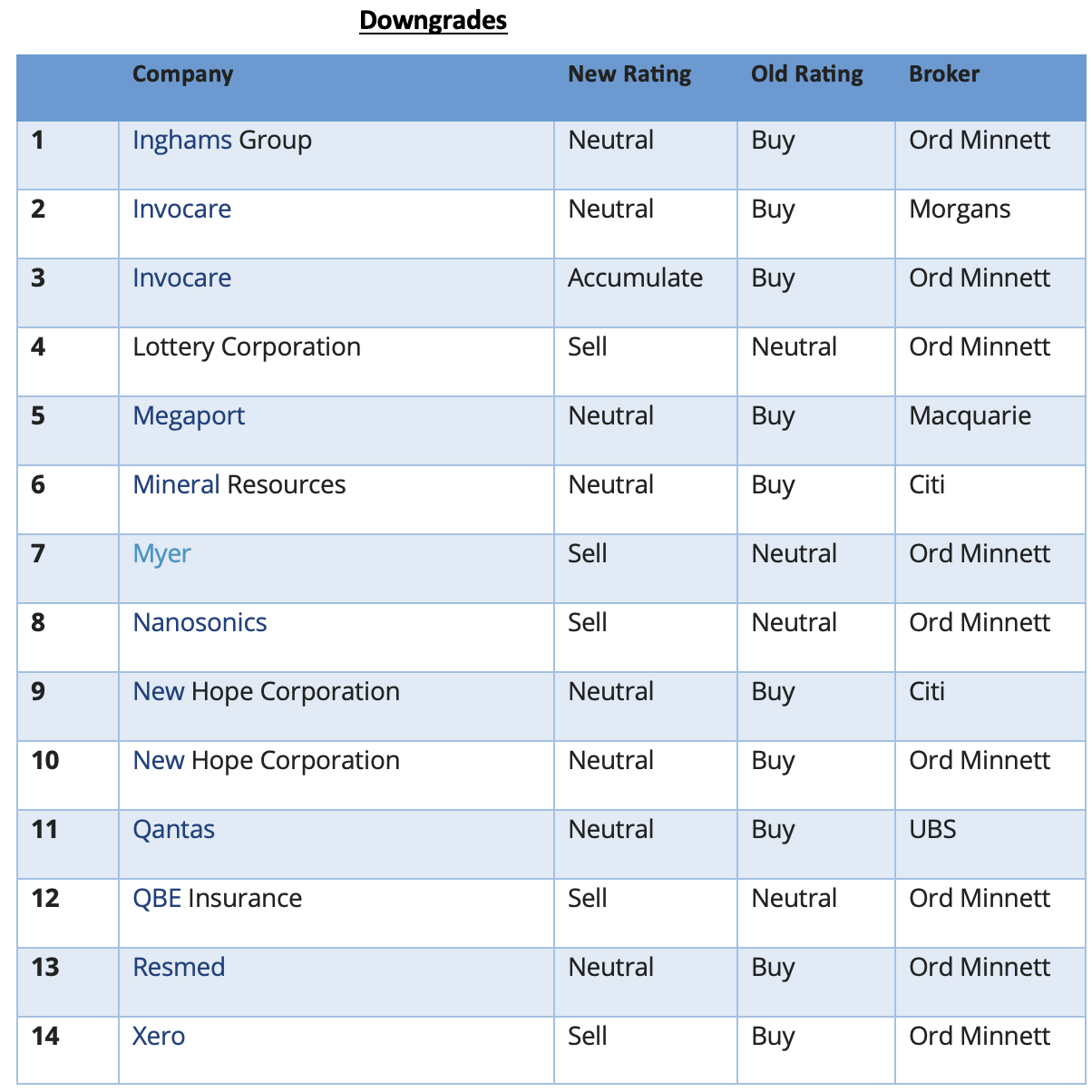

For the week ending Friday March 10 there were four upgrades and fourteen downgrades for ASX-listed companies as brokers in the FNArena reduced their research output following the conclusion of the February reporting season.

Of those fourteen downgrades, eight were reactions to perceived overvaluation by Ord Minnett following recent share price rallies. No changes were made to the broker’s forecasts for those companies. Ord Minnett (Morningstar) follows a model of automatic ratings changes triggered by relative movements in share price to target price.

Citi agreed with Ord Minnett that New Hope Corp was overvalued and downgraded its rating to Neutral from Buy, but also slashed its FY24 earnings forecast by -47% on lower forecast coal prices and lowered its target to $4.90 from $6.15.

The analysts pointed out Newcastle thermal coal price has retraced by -58% from the peak attained last September, and with Asian utility coal restocking expected in June, Whitehaven Coal remains the preferred exposure.

Compared to New Hope shares, the Whitehaven share price has underperformed by -20% over the last three months.

Ord Minnett’s downgrade of InvoCare to Accumulate from Buy on valuation was matched by Morgans downgrade to Hold from Add for the same reason.

Having previously accumulated a near 18% interest in InvoCare, TPG Global has launched an indicative bid to acquire the remainder of the company for $12.65/share, a 41% premium to the previous closing price.

Morgans raised its target to $12.19 from $11.10 in response, and noted the offer price is well above InvoCare’s peer median FY23 enterprise value multiple of 11.1x.

The offer is at pitched at 15.2x, which is above the company’s average over the past ten years of 13.9x and shy of the highest point of 16.6x in December 2017.

The analyst assigned a 70% probability the transaction will be successful.

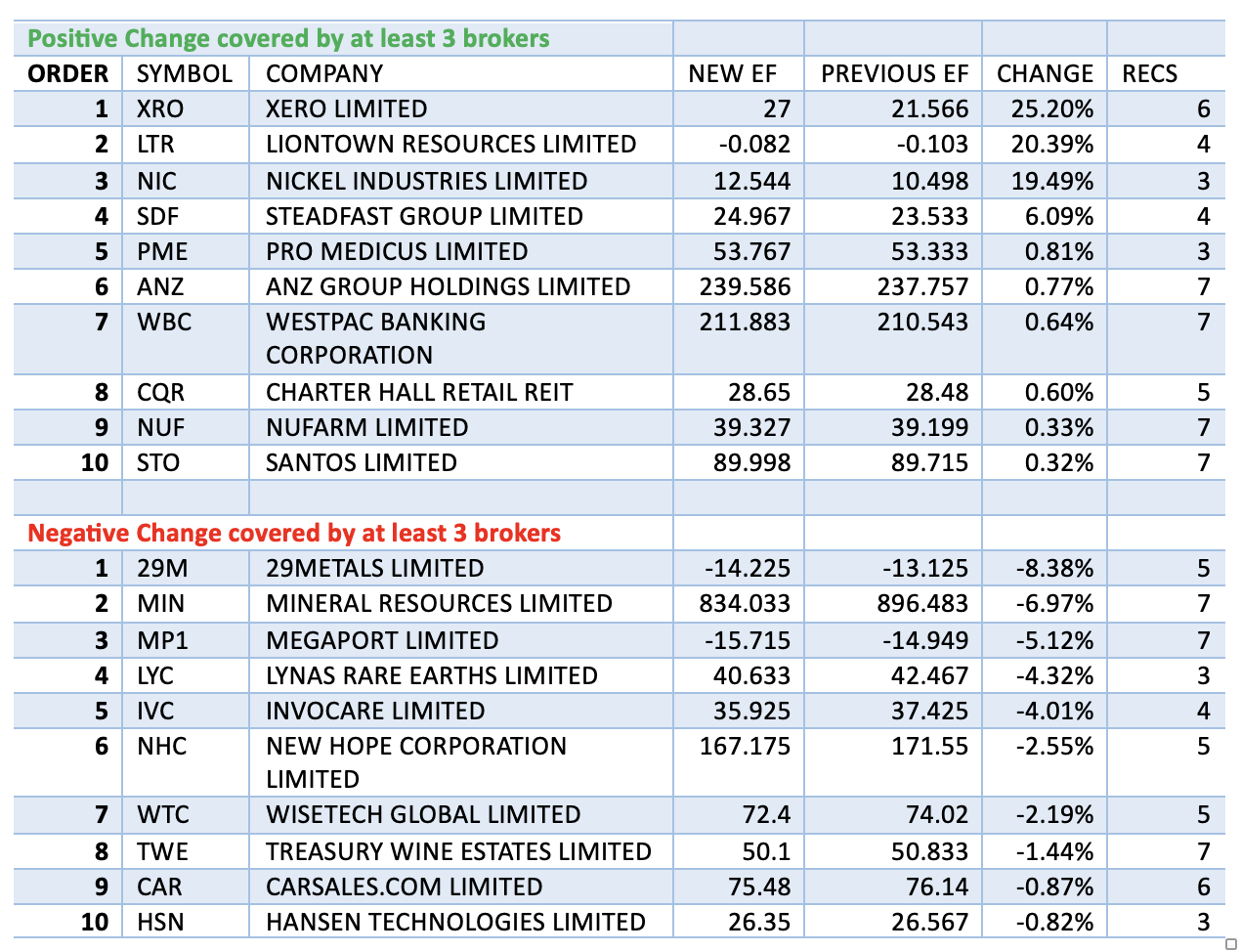

There were no material target price changes nor any significantly negative forecast earnings downgrades made by brokers in the FNArena database last week.

There were, however, some sizeable upgrades to forecast earnings with Xero heading up the table below. The company’s shares rallied hard toward the end of the week, prompting Ord Minnett to downgrade its rating to Sell from Lighten on valuation.

Shares rallied in response to the new aim by incoming CEO Sukhinder Singh Cassidy to target profitable growth, which according to Morgans, should result in higher free cashflow and profits in FY24 and beyond.

The company announced an intention to reduce its workforce by -15%, or around 700-800 roles, in an attempt to balance growth and productivity ahead of uncertain macroeconomic conditions.

UBS raised its earnings forecasts by an average of 17% through to FY25, after also incorporating a redesign of the company’s technology function, which is expected to result in improved efficiencies.

Liontown Resources was next on the table though very small forecast numbers rendered exaggerated percentage changes irrelevant. Across the lithium sector, Citi downgraded the ratings of a number of companies under its coverage, as lithium prices are likely to remain under near-term pressure.

Also, several of these companies had experienced a significant share price rally prior to the broker’s report, including Liontown (Neutral from Buy), whose shares had risen by around 30% in a week after presenting at the BMO Capital Markets conference in the US. The $1.80 target price was unchanged.

Other lithium stocks downgraded by Citi were Mineral Resources (Neutral from Buy) and Core Lithium to Sell from Neutral. The analysts are hoping to achieve lower entry prices, especially as lithium prices may gain once restocking occurs along the battery supply chain over March to April.

Citi’s preferred exposure in the sector is Pilbara Minerals given it has the simplest operational model.

The average earnings forecast in the FNArena database also rose for Nickel Industries after Macquarie reacted to revised terms for the Dawn high-pressure acid leach (HPAL) project in Indonesia, which includes higher nameplate production capacity and lower capital expenditure.

In the good books

PRO MEDICUS LIMITED ((PME)) was upgraded to Neutral from Sell by Citi .B/H/S: 0/2/1

Citi views Pro Medicus’ business model as attractive, given a real competitive advantage in the Picture Archiving & Communication Systems space, but a valuation of some 70x PE on FY25 forecasts is keeping the broker on the sideline.

Citi does not yet explicitly forecast any contribution from Cardiology or AI, awaiting more details on the new products, nor any significant revenue contribution from Europe. These could be sources of upside over the medium to longer term, but difficult to quantify at this stage, the broker notes.

But following an -8% share price decline post-result, the broker upgrades to Neutral from Sell. Target unchanged at $61.

REGION GROUP ((RGN)) was upgraded to Neutral from Underperform by Macquarie .B/H/S: 1/5/0

Highlighting that Region Group has underperformed the ASX200 A-REIT index by -6% since releasing its first half result, Macquarie notes it remains cautious on the company’s earnings trajectory, particularly heading into FY24.

The broker does remain positive on the company’s defensive topline, with Region Group’s tenant base performing strongly in the first half and leasing spreads improving to 4.4% from 3.3% partially as a result of the company delaying lease negotiations during covid-impacted periods.

The rating is upgraded to Neutral from Underperform and the target price of $2.52 is retained.

SONIC HEALTHCARE LIMITED ((SHL)) was upgraded to Buy from Neutral by Citi .B/H/S: 4/1/1

Citi has upgraded its earnings forecasts for Sonic Healthcare after adjusting for the AUD/USD, and rolled forward its valuation. The result is a target increase to $36.00 from $34.50 and an upgrade to Buy from Neutral.

The broker notes ample balance sheet capacity for acquisitions/new contracts or share buybacks and further upgrades its FY23-25 forecasts on higher margin expectations.

WISETECH GLOBAL LIMITED ((WTC)) was upgraded to Neutral from Sell by Citi .B/H/S: 3/2/0

While wary of WiseTech Global’s high valuation, Citi decides to upgrade its rating to Neutral from Sell on growth potential, new business opportunities and a strong balance sheet/profitability.

In the face of declining freight volumes, the analysts admire the company’s impressive growth and see new growth emerging from global customs and landside logistics.

A highlight from 1H results, according to the broker, was the global customs roll-out with Kuehne & Nagel the largest global third party logistics (3PL) company with a reputation for developing its own software.

The target rises to $64.10 from $53.65.

In the not so good books

INGHAMS GROUP LIMITED ((ING)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 2/3/0

Ord Minnett downgrades its rating for Inghams Group to Hold from Accumulate after a recent share price rally.

Forecasts are unchanged and the $3.50 target retained.

INVOCARE LIMITED ((IVC)) was downgraded to Hold from Add by Morgans and to Accumulate from Buy by Ord Minnett .B/H/S: 1/3/0

Having previously accumulated a near 18% interest in InvoCare, TPG global has launched an indicative bid to acquire the remainder of the company for $12.65/share, a 41% premium to the previous closing price.

Morgans notes the offer price is well above InvoCare’s peer median FY23 EV/EBITDA multiple of 11.1x. The offer is at 15.2x, which is above the company’s average over the past ten years of 13.9x and shy of the highest point of 16.6x in December 2017.

The analyst assigns a 70% probability the transaction proceeds.

The broker raises its target to $12.19 from $11.10 and lowers its rating to Hold from Add on valuation.

Ord Minnett lowers its rating for InvoCare to Accumulate from Buy on valuation after a recent share price rally.

The $14.50 target is unchanged.

MINERAL RESOURCES LIMITED ((MIN)) was downgraded to Neutral from Buy by Citi .B/H/S: 3/3/0

Citi downgrades the ratings for a number of lithium equities under its coverage as lithium prices will likely remain under near-term pressure and some share prices have rallied hard.

The broker is hoping to achieve lower entry prices, especially as lithium prices may gain once restocking occurs along the battery supply chain in March-April.

Citi lowers its rating for Mineral Resources to Neutral from Buy, largely because shares have rallied 12% over the last week. The $94 target is unchanged.

MEGAPORT LIMITED ((MP1)) was downgraded to Neutral from Outperform by Macquarie .B/H/S: 4/3/0

Macquarie reviews the Telecom, Media and Technology sectors and tinkers with most earnings estimates. Having observed reporting season outcomes, the broker advises investors stick to defensive stocks over those offering structural growth.

Coverage of Megaport is transferred to Darren Leung from Wei Sim.

The broker downgrades Megaport to Neutral from Outperform to reflect near-term macro pressures and strategic uncertainty given the recent change of management (CEO Vincent English has resigned, which follows movements in the Chief Revenue Officer position). The broker assesses the company’s top-line growth remains elusive.

EPS forecasts fall -11% in FY23; -41% in FY24; and -23% in FY25. Target price falls -36% to $5 from $7.80.

MYER HOLDINGS LIMITED ((MYR)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 0/0/0

Ord Minnett has a dimmer view on the outlook for consumer demand than the general market and believes current demand for apparel and homewares is unsustainable.

The broker feels Myer’s jump in share price after pre-released 1H results yesterday was a reaction to the company’s solid balance sheet, which allowed an interim and special dividend of 4cps each.

The analyst also points out sales momentum slowed over January and February and should progressively worsen. The rating is lowered to Lighten from Hold, while the 75c target is maintained.

NANOSONICS LIMITED ((NAN)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 1/0/1

Ord Minnett downgrades its rating for Nanosonics to Lighten from Hold on valuation post a share price rally.

Forecasts are unchanged and the $4.00 target retained.

NEW HOPE CORPORATION LIMITED ((NHC)) was downgraded to Neutral from Buy by Citi and to Hold from Accumulate by Ord Minnett .B/H/S: 3/2/0

Citi downgrades its rating for New Hope to Neutral from Buy on valuation and earnings downgrades. FY24 earnings forecasts are slashed by -47% on lower forecast coal prices. The target falls to $4.90 from $6.15.

The analysts point out the NEWC600 thermal coal price has retraced by -58% from the peak attained last September.

With Asian utility coal restocking expected in June, the broker prefers Whitehaven Coal ((WHC)) for thermal coal exposure as its share price has underperformed by -20% over the last three months compared to New Hope shares.

Following New Hope’s recent share price rally, Ord Minnett pulls-back its rating to Hold from Accumulate on valuation.

No changes are made to forecasts and the broker’s $6.50 target is maintained.

QANTAS AIRWAYS LIMITED ((QAN)) was downgraded to Neutral from Buy by UBS .B/H/S: 4/2/0

While continuing to see upside to its valuation of Qantas Airways, UBS highlights the stock is less than compelling following a 40-50% lift over the last year. The broker expects earnings to prove resilient into the next fiscal year, and feels balance sheet strength is sufficient to support a return of dividends.

The broker does anticipate record capital expenditure is ahead for the airline, following a number of years of below-average investment. It expects Qantas Airways will be looking to replace aircrafts reaching retirement age, alongside growing capacity at a rate of 3.3% per annum, and that the scale of this spend may surprise the market.

The rating is downgraded to Neutral and the target price decreases to $7.60 from $7.75.

QBE INSURANCE GROUP LIMITED ((QBE)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 6/0/0

Ord Minnett downgrades its rating for QBE Insurance to Lighten from Hold on valuation after a recent share price increase.

The $13.00 target is unchanged.

RESMED INC ((RMD)) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 4/2/0

Ord Minnett lowers its rating for ResMed to Hold from Accumulate on valuation after a recent share price rally.

The $35 target is unchanged.

LOTTERY CORPORATION LIMITED ((TLC)) was downgraded to Lighten from Hold by Ord Minnett .B/H/S: 4/1/0

Ord Minnett lowers its rating for Lottery Corp on valuation after a recent share price rise.

Forecasts are unchanged and the broker’s $4.70 target is maintained.

XERO LIMITED ((XRO)) was downgraded to Sell from Lighten by Ord Minnett .B/H/S: 3/2/1

Ord Minnett downgraded its rating for Xero to Sell from Lighten on valuation after yesterday’s strong share price rise.

Forecasts are unchanged and the broker’s $54 target is retained.

Note: the downgrade looks more dramatic in the FNArena database as Ord Minnett formerly sourced research from JP Morgan, which previously had an Accumulate rating.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.