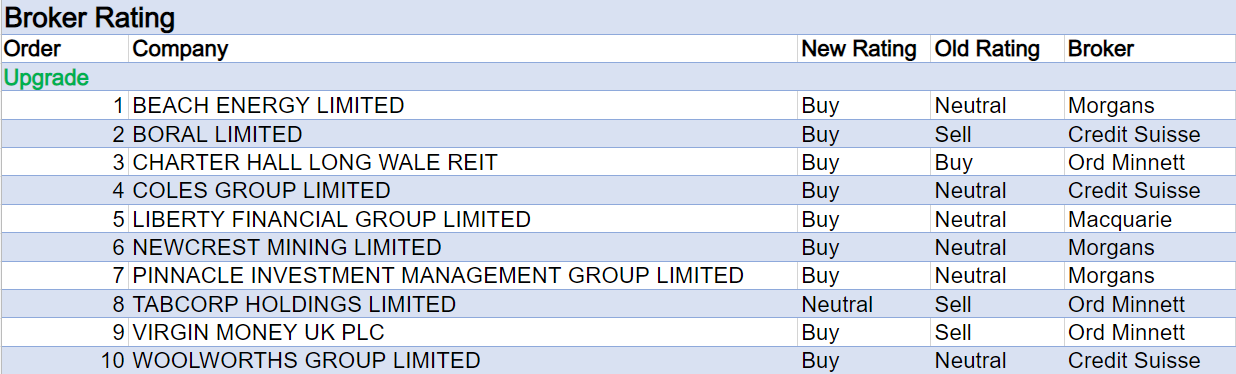

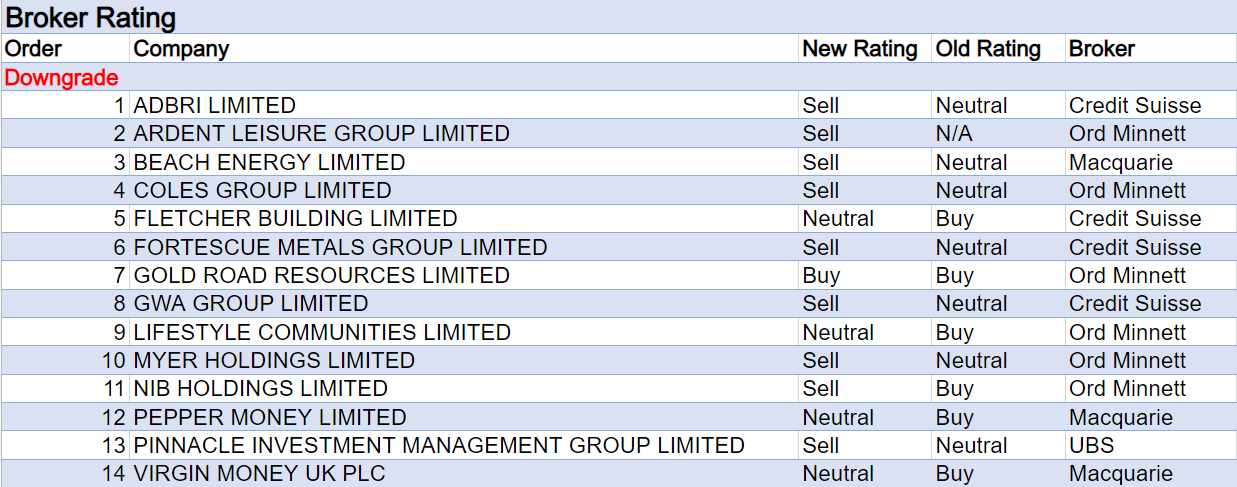

For the week ending Friday February 3 there were a relatively even number of ratings upgrades and downgrades (10: 14) for ASX-listed companies covered by brokers in the FNArena database.

The total number of ratings changes for the week were boosted by Ord Minnett’s transition to new whitelabeled research by Morningstar (from JP Morgan). For five companies, a fresh view by a Morningstar analyst resulted in a change of recommendation.

The even number of ratings changes was partly attributable to four sets of upgrades and downgrades by different brokers for the same companies, namely Pinnacle Investment Management, Virgin Money Uk, Coles Group, and Beach Energy.

Morgans upgraded Pinnacle to Add from Hold as medium-term earnings (FY25) are expected to step-up, while UBS (Sell from Neutral) focused on the shorter-term, predicting the company’s second half results are likely to disappoint on higher costs, weaker fund flows and a softer outlook.

After a solid first quarter report by Virgin Money UK, Ord Minnett now expects lower operating costs and more business customers in the greater London market. Ord Minnett upgraded to Accumulate from Hold, while Macquarie downgraded to Neutral from Outperform on valuation.

Credit Suisse upgraded Coles to Outperform from Neutral due to robust industry growth, margin benefits from food inflation and an absence of covid-related costs, while Ord Minnett downgraded to Sell from Hold as a result of the new whitelabeled research.

A further four ratings changes last week resulted from a review of the Australian Building Materials sector by Credit Suisse.

On the one hand extraordinary rainfall is now normalising and spot energy costs have peaked, according to the broker. On the other hand approvals/prices are falling for housing, along with additions and alterations (A&A), and further deterioration is expected.

Taking these factors into account, Credit Suisse analysts now prefer stocks involved in the areas of infrastructure and non-residential over exposures to residential, new construction and the repair and remodel (R&R) space.

Boral benefited most from these new preferences relative to other stocks in the sector, and Credit Suisse upgraded its rating to Outperform from Neutral.

On the flipside, the ratings for Adbri and GWA Group were lowered to Underperform from Neutral, while the broker also reduced Fletcher Building’s recommendation to Neutral from Outperform. In all cases no changes were made to forecasts or 12-month target prices.

APM Human Services International received the only material adjustment to target price by brokers in the FNArena database last week. The average target fell by -13% to $3.41 simply because two new brokers with targets below the existing average ($3.92) were entered into the database.

Morgan Stanley initiated coverage on the global human services business with an Overweight rating and $3.00 target, while new white labeled research adopted by Ord Minnett was an effective ‘initiation of coverage’ at Hold and $2.80.

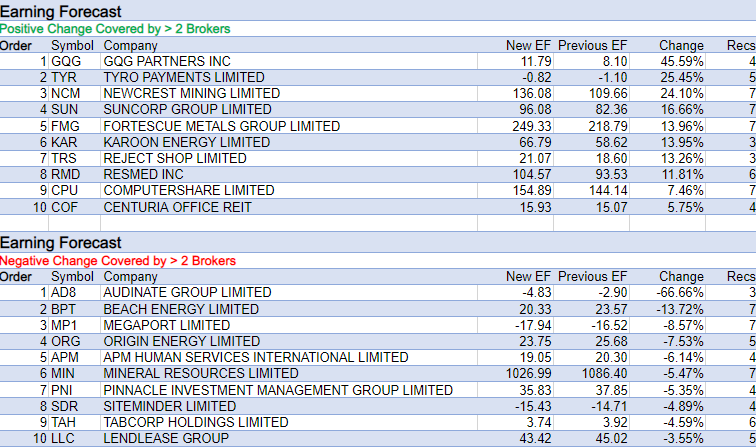

In term of earnings forecasts by brokers, Audinate Group received the greatest percentage decrease last week. While Macquarie retained its Outperform rating, cost forecasts also rose due to increasing logistics costs, headcount and higher travel expenses.

However, it should be noted the percentage decrease was exaggerated by the relatively small earnings forecast numbers (still in the negative too). The target fell to $10 from $11.

Beach Energy was equally in the picture. As noted previously, the company received a downgrade and an upgrade last week, in reaction to second quarter production results.

Macquarie downgraded Beach to Underperform from Neutral on news of disappointing drilling at Waitsia, rising capital expenditure and a delay caused by the need to reselect a contractor when currently attractive LNG prices may not persist.

Morgans (Add from Hold) was far more forgiving. It was felt lower reserves at Waitsia won’t impact delivery of commitments to customers over the next five years. Also, the analyst attributed lower production at Otway and Kupe to plant outages and lower customer demand, rather than poor operational performance.

Tyro Payments assumed the top position on the earnings upgrade table below (after a data glitch rendered GQG Partners’ top position ineligible).

The company’s pre-reported first half profit met Macquarie’s forecast and FY23 guidance was upgraded to reflect strong turnover, banking yields and other income, offset partly by higher expenses. The Neutral rating was retained due to the uncertain economic backdrop.

Next up was Newcrest. Following a second quarter production result with a solid performance by Cadia in particular, Morgans’ lower capex forecasts and higher gold price assumptions resulted in higher earnings forecasts and a new $25.70 target, up from $20.60, along with an increase in rating to Add from Hold.

The analyst sees an emerging value proposition for Newcrest thanks to the company’s diversification, solid margins and long-life reserves. All this happened before news got out that a merger with prior US parent Newmont may yet again be on the cards.

Suncorp Group was fourth on the table below for the largest percentage upgrade in forecast earnings by brokers in the FNArena database last week.

At the underlying level, UBS is anticipating an improved first half result on February 8, driven by tight claims control and positive underwriting jaws.

Meanwhile, Overweight-rated Morgan Stanley expressed the view Suncorp will outperform Insurance Australia Group (Equal-weight) over the next two years, on cost savings, CAT costs and retentions.

In addition, Suncorp has renewed its reinsurance and its quota share agreement on more favourable terms.

Total Buy recommendations comprise 53.46% of the total, versus 36.43% on Neutral/Hold, while Sell ratings account for the remaining 10.11%.

In the good books

LIBERTY FINANCIAL GROUP LIMITED (LFG) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/1/0

Macquarie’s investment thesis is based on Liberty Financial’s ability to deliver a more defensive result in the elevated rate environment, with structurally lower credit growth aspirations. With a lower churn rate, the broker sees Liberty as well placed to manage margins, and with a lower exposure to the non-prime mortgage segment, sees Liberty as a lower risk exposure and higher quality book than Pepper Money. With a more defensive bent than Pepper Money in the non-bank lender segment, Liberty is Macquarie’s preferred exposure in the sector, given stronger defensive quality and stability in pricing strategy, which should engender improved customer loyalty in the longer term. Upgrade to Outperform. Target unchanged at $4.25.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED (PNI) was upgraded to Add from Hold by Morgans, B/H/S: 2/1/1

Second quarter net flows for Pinnacle Investment Management showed some improvement on the first quarter. While flows remain uncertain, upcoming leverage is expected after investment by several affiliates in longer-term initiatives. The broker upgrades its rating to Add from Hold, while the target slips to $10.75 from $10.95. Medium-term earnings (FY25) are expected to step-up on improving flows and performance fees, as well as operating leverage on improved funds under management (FUM). The investment management firm reported profit for the 2Q of $30.5m, missing the $32.9m expected by the analyst. While group funds FUM closed flat over six months, it’s thought the composition improved.

See also PNI downgrade.

VIRGIN MONEY UK PLC (VUK) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 1/1/0

Ord Minnett assesses a solid 1Q (September year end) and believes management at Virgin Money UK will reduce operating costs and add business customers in the greater London market. The broker’s rating is increased to Accumulate from Hold, while the target falls by -2.5% to $3.80. The 1Q revealed a 3bps improvement to 1.89% in net interest margin (NIM) thanks to the higher interest rate environment and the analyst expects 1.90% will be achieved for FY23. Management is guiding to a range of 1.85-1.90%.

See also VUK downgrade.

In the not-so-good books

REGIS RESOURCES LIMITED (RRL) Initiation of coverage with Neutral by UBS, B/H/S: 2/2/2

UBS initiates coverage of Regis Resources with a Neutral rating and provides commentary on the West Australian-based projects Duketon and Tropicana. A 12-month target price of $1.80 is set. The broker’ current valuation of Tropicana suggests a slight overpayment for the company’s -$903m purchase (30% interest), though it remains a quality cornerstone asset. It’s thought mine life extension, most likely from the underground operations, will provide upside. Also, underground extensions will help Duketon maintain rates of 350kozpa for longer and 500kozpa for the company, forecasts the broker.

PEPPER MONEY LIMITED (PPM) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/2/0

After listing in 2021, Pepper Money has delivered better than expected cash earnings, driven by higher margins and accelerating credit growth in a low-rate environment. However, Macquarie sees increasing headwinds in the medium term as rates rise. Pepper Money is unable to offset this through deposit margins on current accounts, and now unable to compete with major banks as they utilise deposit margin benefits to compete aggressively in the prime mortgage segment, the broker notes. Downgrade to Neutral from Outperform. Target unchanged at $1.70.

VIRGIN MONEY UK PLC (VUK) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/1/0

Virgin Money UK’s underlying performance improved in the Dec quarter, Macquarie notes, underpinned by stable margins and improved growth in key segments. Virgin Money remains fundamentally cheap relative to the theoretical valuation, the broker suggests, but with a challenging economic backdrop its multiple is no longer materially different to larger UK peers. Following a 30% share price rally, the stock no longer looks overly cheap versus peers. Downgrade to Neutral from Outperform, target falls to $3.60 from $4.20.

See also VUK upgrade above

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.