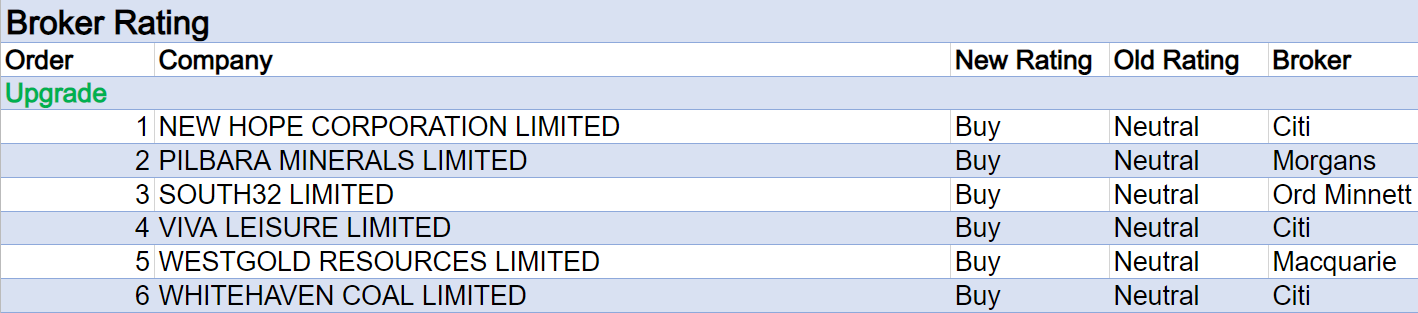

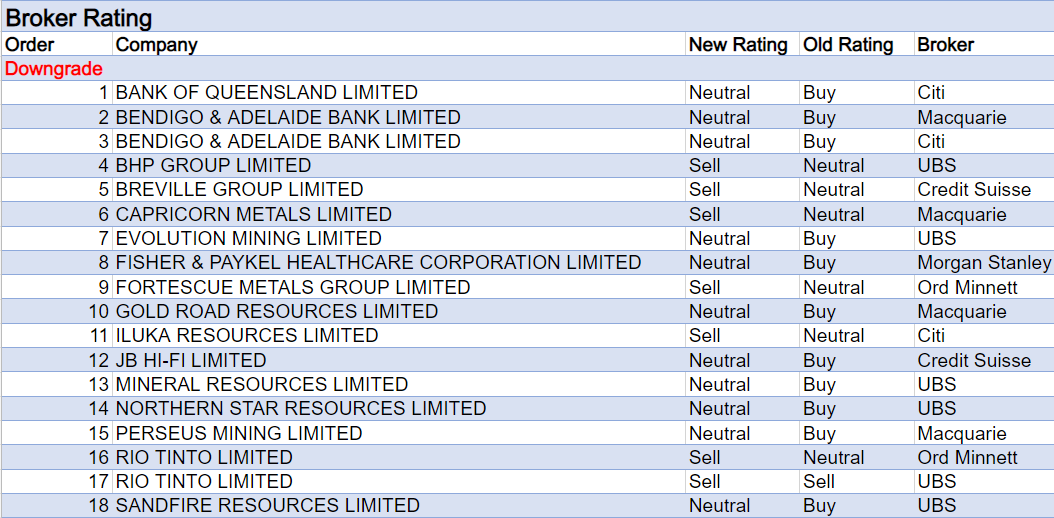

For the week ending Friday December 16 there were six upgrades and twenty downgrades (eleven resource companies) to ASX-listed companies covered by brokers in the FNArena database.

An update from Bendigo & Adelaide Bank for the first five months of FY23 revealed stronger net interest margin trends than brokers had anticipated, highlighting significant leverage to higher interest rates and favourable deposit pricing, according to Morgan Stanley.

Macquarie downgraded its rating to Neutral from Outperform, believing upside earnings risk is now better reflected in expectations, and deposit margins likely past their peak. Citi also downgraded to Neutral from Buy after recent share price gains.

This broker felt the bank is close to posting peak net interest margins and observed loan volumes are slowing (the balance sheet is contracting), headwinds are building for asset quality, and costs are rising, all of which should dampen further gains.

Another to receive two ratings downgrades from separate brokers last week was Rio Tinto. UBS felt the share price had climbed too far during a rally by iron ore miners in recent weeks and downgraded its rating to Sell from Neutral.

Ord Minnett agreed with UBS on overvaluation and downgraded its own rating to Lighten from Hold. While Rio is currently benefiting from the China reopening theme, the analyst believed fatigue on the trade for miners may be imminent, given strong recent share performances and 2023 recession concerns.

While the commodity team at Citi expects 2023 to be a challenging year given slowdowns in China, the EU and the US, higher-for-longer thermal coal prices are still anticipated. As a result, the broker’s ratings for both Whitehaven Coal and New Hope were raised to Buy from Neutral.

Because Citi also raised its target for New Hope to $6.70 from $4.50, the stock registered the only material change to average target price in the FNArena database last week. The average target of four brokers rose to $6.95 from $6.40.

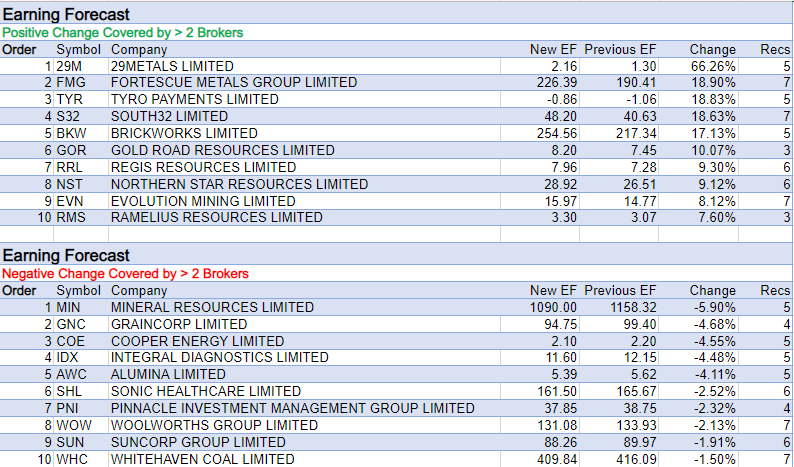

The only material changes for average forecast earnings in the database last week were positive, and several of those related to resources stocks following sector updates by both Citi, Macquarie, UBS and Ord Minnett.

29Metals headed the upgrade table below after Macquarie raised its short-term nickel forecasts, which also benefited forecast nickel earnings for peers Panoramic Resources and Mincor Resources.

Next on the table is Fortescue Metals, on higher near-term iron ore price expectations by Citi, Macquarie and UBS.

As noted above for Rio Tinto, Ord Minnett was more cautious on the recent China reopening rally, and noted shares this year of BHP Group, Rio Tinto and Fortescue have risen by 25%, 14% and 5%, respectively, outperforming iron ore which has fallen by -8%. The broker’s rating for Fortescue was downgraded to Lighten from Hold.

South32 also appeared in the earnings upgrade table. Ord Minnett raised its rating to Buy from Hold, as the company’s share price has been a been a laggard in recent weeks by comparison to the rally of the big, diversified miners.

Tyro Payments received an earnings upgrade by Buy-rated Ord Minnett last week, after a period of research restriction.

Management has now ceased takeover discussions with Westpac and Potentia.

While the broker suggested some caution in the current macroeconomic backdrop, given the company’s exposure to discretionary expenditure, underlying momentum heading into 2023 was highlighted.

In reaction to the current macro backdrop, the analyst points out Tyro is adapting by shifting to a more profitable growth model.

Ord Minnett was also behind an earnings upgrade for Brickworks, following the release of a first half trading update which came in ahead of consensus expectations.

The company has benefited from several one-offs, according to the broker, including the sale of Oakdale East Stage 2 for $301m and from revaluation profits of $112m in the half.

Near-term, the analyst expects underlying property earnings will continue to grow, only to be offset by slowing housing activity in late FY23 and FY24.

Ord Minnett’s Buy rating was retained and its target price increased to $32.00 from $29.90.

Total Buy recommendations comprise 54.42% of the total, versus 37.10% on Neutral/Hold, while Sell ratings account for the remaining 8.48%.

In the good books

NEW HOPE CORPORATION LIMITED (NHC) was upgraded to Buy from Neutral by Citi, B/H/S: 4/0/0

Citi’s global commodity team has increased forecast FY23 prices for copper, iron ore and nickel and expects higher-for-longer thermal coal prices. For aluminium, the broker has turned more bearish in the medium term. On a 12-month view to the 4Q of 2023, Citi forecasts rise by 3-12% for iron ore, aluminium and manganese prices, but a pull-back is expected from today’s nickel/thermal coal prices of -25% and -23%, respectively. The overall more bullish view on coal leads to material forecast upgrades for New Hope and the rating is upgraded to Buy from Neutral. The target rises to $6.70 from $4.50.

PILBARA MINERALS LIMITED (PLS) was upgraded to Add from Hold by Morgans, B/H/S: 2/1/3

Pilbara Minerals has announced a December BMX auction price for spodumene, which represents a -3% decline on November’s price. As a result of this announcement, the company’s share price fell by -9% and the broader Lithium sector also declined. Morgans feels this was a significant over-reaction and takes the opportunity to upgrade its rating for Pilbara to Add from Hold, having just initiated coverage yesterday. While very short-term sentiment towards the sector could weaken further, the analyst believes investors may be convinced by strong 2Q cash flows and the potential for capital management. The $4.70 target is unchanged.

VIVA LEISURE LIMITED (VVA) was upgraded to Buy from Neutral by Citi, B/H/S: 1/0/0

Citi upgrades Viva Leisure to Buy from Neutral, reflecting stronger than expected momentum in the company’s core business combined with a weaker share price. While Viva’s greenfield rollout has been slower than expected, and there is medium term risk around the company’s higher priced gym offerings potentially underperforming in a weaker consumer environment, the broker sees current valuation as undemanding given long-term growth prospects. Target rises to $1.46 from $1.39.

WESTGOLD RESOURCES LIMITED ((WGX)) Upgrade to Outperform from Neutral by Macquarie, B/H/S: 1/0/0

Despite retaining a fairly bearish outlook for gold Macquarie’s commodities team has made minor upgrades to its near-term outlook, and updated its sector coverage accordingly. Within its small cap gold stocks, Ramelius Resources ((RMS)) sees the largest earnings per share increase at 111% for FY23, followed by Regis Resources ((RRL)) at 42%, Westgold Resources at 27% and Silver Lake Resources ((SLR)) at 24%. The rating is upgraded to Outperform from Neutral and the target price of $0.90 is retained.

WHITEHAVEN COAL LIMITED (WHC) was upgraded to Buy from Neutral by Citi, B/H/S: 7/0/0

Citi’s global commodity team has increased forecast FY23 prices for copper, iron ore and nickel and expects higher-for-longer thermal coal prices. For aluminium, the broker has turned more bearish in the medium term. On a 12-month view to the 4Q of 2023, Citi forecasts rise by 3-12% for iron ore, aluminium and manganese prices, but a pull-back is expected from today’s nickel/thermal coal prices of -25% and -23%, respectively. The overall more bullish view on coal leads to material forecast upgrades for Whitehaven Coal and the rating is upgraded to Buy from Neutral. The target rises to $11.10 from $8.00.

In the not-so-good books

BANK OF QUEENSLAND LIMITED (BOQ) was downgraded to Neutral from Buy by Citi, B/H/S: 0/6/0

Citi suspects Bank of Queensland’s CEO resigned ahead of very little profit growth apparent for the bank after the RBA cash rate hits a high next year, given sharply rising deposit rates, slowing lending growth and further risk & compliance-led cost growth. The broker has cut earnings forecasts on the assumption of weaker margins, and the path to returns above the cost of capital look less and less likely. Downgrade to Neutral from Buy. Target falls to $7.30 from $8.75.

BREVILLE GROUP LIMITED (BRG) was downgraded to Underperform from Neutral by Credit Suisse, B/H/S: 4/1/1

Credit Suisse anticipates consensus downgrades for retailers exposed to Australian household goods due to a worsening outlook for FY23 earnings. It’s felt interest rate increases, falling house prices and increasing promotional intensity will weigh. The broker downgrades its rating for Breville Group to Underperform from Neutral. Small appliance sales are expected to decline, with competitors already having reported declining sales in almost all global regions. The target is reduced to $18.61 from $22.28.

CAPRICORN METALS LIMITED (CMM) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 0/0/1

Despite retaining a fairly bearish outlook for gold Macquarie’s commodities team has made minor upgrades to its near-term outlook, and updated its sector coverage accordingly. Among those within its small cap gold stocks to be downgraded are Perseus Mining ((PRU)), Gold Road Resources ((GOR)) and Capricorn Metals, with all downgrades reflecting recent share price movement. The rating is downgraded to Underperform from Neutral and the target price increases to $4.20 from $4.00.

GOLD ROAD RESOURCES LIMITED (GOR) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/1/0

See Capricorn Metals above. The rating is downgraded to Neutral from Outperform and the target price increases to $1.70 from $1.50.

ILUKA RESOURCES LIMITED (ILU) was downgraded to Sell from Neutral by Citi, B/H/S: 3/2/1

See Whitehaven Coal above.. The rating for Iluka Resources is downgraded to Sell from Neutral given an around 10% share price rally over the last month, despite ongoing weakness in China property completions. The $9.50 target price is unchanged.

JB HI-FI LIMITED (JBH) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 2/4/1

See Breville Group above. The analyst expects sales for the electrical retail space will fall below trend in the first and second quarters of 2023. For JB Hi-Fi, the broker feels a reduction in entertainment-related product and average selling price will hurt sales. It’s felt there may be a better entry point for shares during the 1H of 2023 and the rating is downgraded to Neutral from Outperform. The target falls to $45.73 from $55.11.

PERSEUS MINING LIMITED (PRU) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/1/0

See Capricorn Metals above. The rating is downgraded to Neutral from Outperform and the target price increases to $2.20 from $1.90.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.