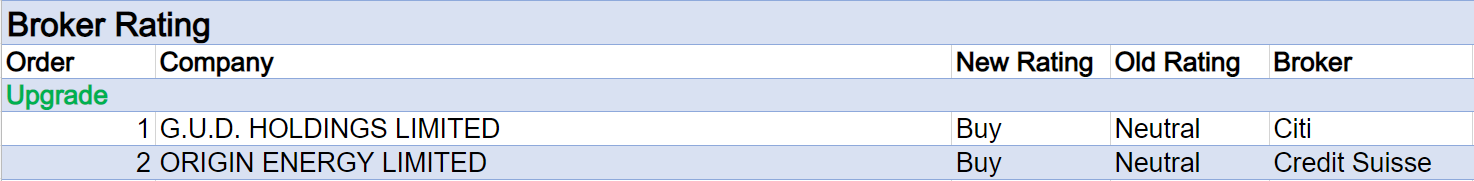

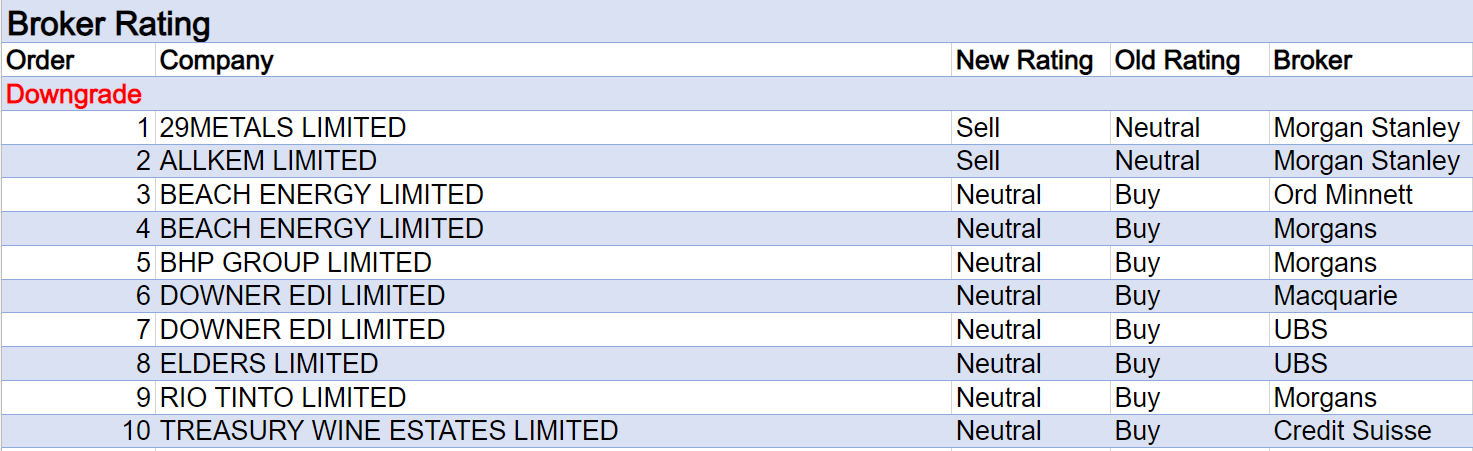

For the week ending Friday December 9 there were two upgrades and ten downgrades to ASX-listed companies covered by brokers in the FNArena database.

There were two downgrades to Beach Energy by separate brokers last week.

Clough, the company’s contractor for the Waitsa project, is experiencing financial difficulties and Hancock Energy has increased its bid for Warrego Energy to 28cps, ahead of the 20cps pitched by Beach nearly a month ago.

After Morgans allowed for these two events, as well as recent share price strength, the broker’s rating was downgraded to Hold from Add.

Ord Minnett also lowered its rating to Hold from Accumulate on valuation concerns after shares had rallied and on the increased competition for Warrego Energy from both Hancock Energy and Strike Energy. Further, threats over government intervention to lower gas prices have been growing in recent weeks.

Downer EDI also suffered two ratings downgrades, the largest percentage downgrade to target price by brokers, as well as the second largest percentage downgrade to forecast earnings.

Not only was guidance lowered by -15% due to wet weather and labour shortages but also, more worryingly, management announced accounting irregularities relating to a single contract in the Utilities business.

UBS downgraded its rating to Neutral from Buy and noted the overstatement of historical earnings highlights an internal control weakness, and while the amount is immaterial, investors will be seeking reassurances the incident is not indicative of a more widespread issue.

The broker also pointed out the company’s renewed infrastructure services and maintenance operating model has proven susceptible to challenging weather and post-covid related operating conditions, which has resulted in ongoing earnings volatility and project write-downs.

For broadly similar reasons, Macquarie also downgraded its rating to Neutral from Outperform and reduced its target price to 4.05 from $5.61, while the average target price of four covering brokers in the FNArena database also fell to $4.39 from $5.85.

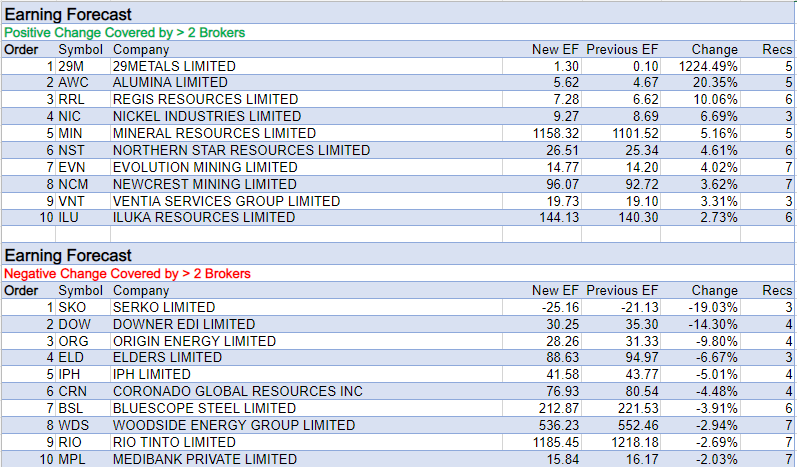

29Metals received the largest percentage increase in forecast earnings, after Morgan Stanley updated across its materials coverage to account for spot commodity prices and currency rates. Valuations were also adjusted for new base, bear and bull case scenarios.

The broker downgraded its rating for 29Metals to Underweight from Equal-weight on account of valuation and the potential for higher costs in 2023, though the target increased to $2.00 from $1.85 on a more positive bull and bear case.

Alumina and Regis Resources also appear on the table below for a positive change in earnings forecast following Morgan Stanley’s updated commodity and currency forecasts. The 12-month target price for Alumina fell to $1.70 from $1.80, while the Regis target increased to $1.80 from $1.70.

In the good books

ORIGIN ENERGY LIMITED (ORG) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/2/0

Consistent with the indicative bid price from Brookfield/EIG, Credit Suisse raises its target price for Origin Energy to $9.00 from $6.20 and upgrades is rating to Outperform from Neutral. It feels that the bid will ultimately be successful. The broker increases its FY23 and FY24 earnings (EBITDA) forecasts for both Energy Markets and Integrated Gas, which factors in the massive $350-550m guidance range (on October 31) for a LNG trading gain. After conducting a scenario analysis, Credit Suisse estimates AGL Energy (AGL) would be less impacted by government imposed price caps than Origin Energy (ORG) This is because AGL has less net output exposed to high price NSW/SA after Aluminium smelter contracts and the Liddell closure.

In the not-so-good books

29METALS LIMITED (29M) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 2/1/2

Morgan Stanley lowers its rating for 29Metals to Underweight from Equal-weight on valuation and the potential for higher costs in 2023. The broker increases its 2022-24 gold price forecasts. The 2022-23 copper price estimates also increase and then slightly decrease in 2024. Despite a fall in earnings forecasts for the analyst’s base case, the valuation technique also incorporates a more positive bear and bull case, resulting in a $2.00 target, up from $1.85.

ALLKEM LIMITED (AKE) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 5/0/2

Morgan Stanley makes updates across its materials coverage to account for spot commodity prices and currency changes. Lithium demand headwinds causes the broker to downgrade its rating for Allkem to Underweight from Equal-weight and the target falls to $12.40 from $15.85.

BHP GROUP LIMITED (BHP) was downgraded to Hold from Add by Morgans, B/H/S: 1/5/0

Despite stable fundamentals in the iron ore market, Morgans sees reduced value upside for the major Australian miners as the market appears to have prematurely priced in a China growth recovery. Market sentiment towards China has been rising over the last month on signals for an easing in covid restrictions and stimulus measures for the property market, explains the analyst. The broker also increases its risk free rate to 3.6% from 3.0% for the iron ore miners under its coverage. As a result of these changes, Morgans rating for BHP Group is downgraded to Hold from Add and its target falls to $44.80 from $47.00.

DOWNER EDI LIMITED (DOW) was downgraded to Neutral from Outperform by Macquarie and to Neutral from Buy by UBS, B/H/S: 2/2/0

While Macquarie had anticipated wet weather may jeopardise FY23 guidance for Downer EDI, the extent was greater than expected. Higher costs also weighed. News of accounting irregularities was considered of greater concern. The irregularities occurred in a maintenance contract at the Australian utilities business and resulted in a historical overstatement of pre-tax earnings of around $30-40m. Investigations are ongoing and the analyst notes the risk they may uncover similar issues. Guidance for FY23 was downgraded to $210-230m profit (NPATA) compared to the broker’s $249m forecast.

The rating is downgraded to Neutral from Outperform and the broker sets a $4.05 target, down from $5.61. Downer EDI’s renewed infrastructure services and maintenance operating model has proven susceptible to challenging weather and post-covid related operating conditions that have resulted in ongoing earnings volatility and project write-downs, UBS notes. The weather had led to a -15% guidance downgrade. The overstatement of historical earnings highlights internal control weaknesses, UBS suggests. While the amount is immaterial, investors will be seeking reassurances that this control deficiency is not indicative of a more widespread issue. Downgrade to Neutral from Buy. Target falls to $4.00 from $6.15.

RIO TINTO LIMITED (RIO) was downgraded to Hold from Add by Morgans, B/H/S: 2/5/0

Despite stable fundamentals in the iron ore market, Morgans sees reduced value upside for the major Australian miners as the market appears to have prematurely priced in a China growth recovery. Market sentiment towards China has been rising over the last month on signals for an easing in covid restrictions and stimulus measures for the property market, explains the analyst. The broker also increases its risk free rate to 3.6% from 3.0% for the iron ore miners under its coverage. As a result of these changes, Morgans rating for Rio Tinto is downgraded to Hold from Add and the target falls to $107 from $108.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.