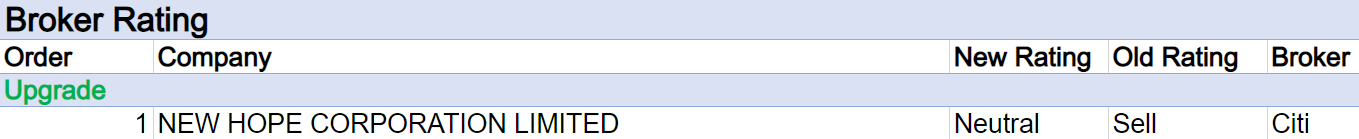

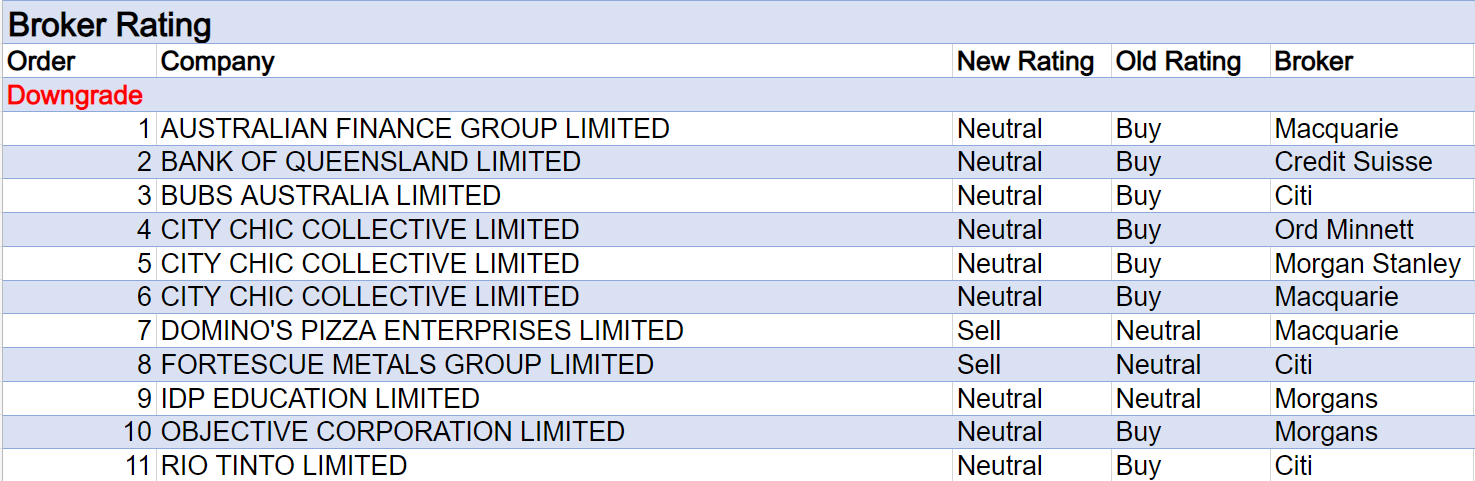

For the week ending Friday December 2 there was one upgrade and eleven downgrades to ASX-listed companies covered by brokers in the FNArena database.

It was a disappointing week for City Chic Collective with ratings downgrades by three separate brokers after the company reported a -2.0% fall in sales across the first 20 weeks of FY23, compared to the previous corresponding period.

Ord Minnett doesn’t expect margin contraction from weaker demand (particularly in the northern hemisphere) to abate anytime soon and downgraded its rating to Hold from Buy. The broker noted the impact on operating margins from elevated fulfillment costs, and falling gross profit margins.

Macquarie, which downgraded its rating to Neutral from Outperform, observed growing macroeconomic pressure and online competition, while higher product returns and promotional spend also hit margins. Even though the A&NZ region proved more resilient than Morgan Stanley had anticipated, results from North America and the EMEA region dragged on performance, resulting in a downgrade to Equal-weight from Overweight.

Five brokers’ new outlooks combined to lower the company’s average FNArena database target price to $1.23 from $2.45, which was the largest (and only material) percentage adjustment for the week across all companies.

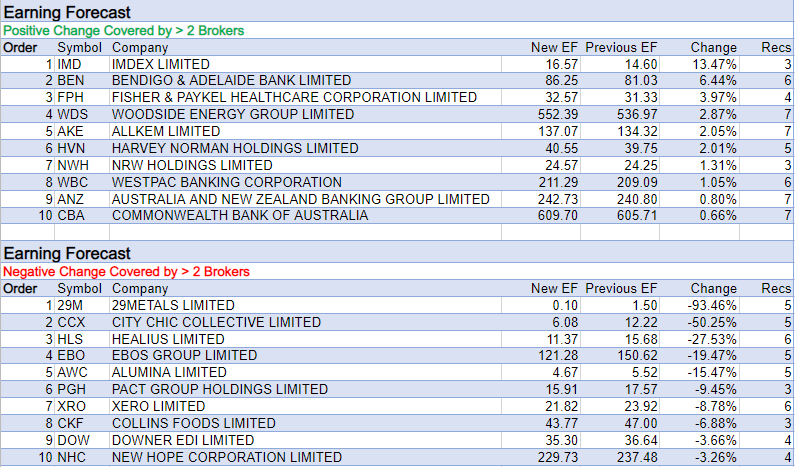

City Chic also received the second largest percentage downgrade to forecast earnings in the database, behind 29Metals.

Brokers lowered earnings forecasts after 29Metals announced its latest results for a feasibility study performed at Gossan Valley, as well as a pre-feasibility study for Cervantes. These two parts comprise one greater extension for the company’s Golden Grove project.

In the Healthcare sector, brokers also lowered earnings forecasts for Healius and Ebos Group last week.

Morgans assessed a poor performance from a trading update by Healius for the financial year up to the end of October, largely due to an -85% decline in covid testing. Credit Suisse also noted fewer patients entering at the GP level is the biggest issue facing the company, combined with GP shortages and a decline in bulk billing rates.

Citi attributed what will likely be a significant first half earnings margin miss (versus consensus) to wider operating de-leverage faced by the pathology industry from lower covid revenues, as well as a delay in recovery of business-as-usual volumes.

Regarding Ebos Group, Outperform-rated Macquarie reviewed industry data for October and observed mixed trends, with neurosurgical and plastics/reconstructive turnover outpacing orthopaedic (below trend) and spinal business.

Industry surgical trends suggest to the broker an uplift for the group’s Institutional Healthcare division and a medium term catch-up for orthopaedic volumes will act as a medium-term tailwind, as the surgical waitlist normalises.

On the flipside, Imdex received the largest percentage increase in forecast earnings. The company provides products and services to drilling contractors and resource companies globally.

While UBS and Macquarie already research the company, it was an initiation of coverage by Citi last week which raised the average earnings expectations in the database.

This broker foresees a continuation in strong commodity prices and expects the company will be able to grow revenue without increasing its work force. This is expected to cushion the company against labour shortages, given its operations are less labour-intensive than many peers.

The analysts observed the company’s extensive offering relative to peers and commenced coverage with a Buy rating and $2.70 target price.

Total Buy recommendations comprise 55.18% of the total, versus 37.22% on Neutral/Hold, while Sell ratings account for the remaining 7.60%.

In the good books

NEW HOPE CORPORATION LIMITED (NHC) was upgraded to Neutral from Sell by Citi, B/H/S: 3/1/0

Following a -19% share price fall in the last month, Citi upgrades its rating for New Hope to Neutral from Sell. October quarter run-of-mine (ROM) and saleable coal production fell by -10% and -15%, respectively, on inclement weather impacts. Management expects Qld coal production will be close to 5mtpa of saleable coal in FY25. An on market buy-back of ordinary shares for up to $300m was announced on November 3 to commence on or after 17 November this year. After the broker incorporates into its forecasts the New Acland Stage 3 (assumed capex of -$400m) and the 12-month $300m buyback, along with FY23 guidance, the target falls to $4.50 from $4.60.

In the not-so-good books

BUBS AUSTRALIA LIMITED (BUB) was downgraded to Neutral from Buy by Citi, B/H/S: 0/1/0

While remaining supportive of Bubs Australia’s journey to become a more diversified and sustainable business, and despite recent momentum improvement in key markets, Citi has downgraded on the stock following a weaker than anticipated first half. The broker attributed first half performance to slower-than-expected US consumer offtake and a new model in China. The broker lowers its full year net profit forecast to -$8.3m from $2.7m, factoring in first half performance as well as expected increased costs. The rating is downgraded to Neutral from buy and the target price decreases to $0.32 from $0.68.

DOMINO’S PIZZA ENTERPRISES LIMITED (DMP) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 4/2/1

Collins Food’s ((CKF)) December-half result revealed continued rising costs for restaurant operators and Macquarie observes menu price rises are not outpacing cost inflation. While the broker observes Domino’s Pizza Enterprises with its franchise model is better positioned to manage inflation, falling franchisee profitability will affect store expansions, one of the company’s main profit drivers. EPS forecasts are cut -9% for FY23; -3% for FY24; and -3% for FY25. Rating downgraded to Underperform from Neutral. Target price falls to $60 from $61.90.

IDP EDUCATION LIMITED (IEL) was downgraded to Hold from Add by Morgans, B/H/S: 4/1/0

Following September quarter student visa approvals data, Morgans awaits a pullback in the IDP Education share price to provide another buying opportunity. For the moment the rating is downgraded to Hold from Add on valuation. Approvals were strong, according to the analyst, across the company’s markets of Australia, the UK and Canada. The analyst notes International study demand from India remains strong for all destinations. A slight tempering of Canadian demand is expected with that country’s immigration introducing a new English proficiency test provider to its panel. The target price falls to $30.75 from $31.10.

RIO TINTO LIMITED (RIO) was downgraded to Neutral from Buy by Citi, B/H/S: 3/4/0

While Rio Tinto’s full year Pilbara iron ore production guidance of 320-335m tonnes per annum was marginally lower than Citi had expected, the broker notes the company has reinstated its mid-term production target of 345-360m tonnes per annum. Citi highlights ramp up at Rio Tinto’s Gudai Darri asset, alongside completion of a number of mine developments in coming years, is crucial to the company meeting its target. The rating is downgraded to Neutral and the target price of $115.00 is retained.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.